What Is An Out

An out-of-pocket maximum is the maximum amount youd be required to pay for covered health services during the year. The amount is defined by your health insurance plan.

This figure is made up of your deductible, your coinsurance responsibility and your copays. If you reach this out-of-pocket maximum, then your insurance company pays 100% of your remaining covered medical costs for that year.

Remember: Insurance companies love their fine print, so its good to check which health services they actually cover and which ones they dont!

Why Do I Have More Than One Deductible

Health insurance plans may have multiple deductibles. For example, your policy may have both individual and family deductible limits. Most plans also have a separate deductible if you use medical providers who are outside the plans provider network. Your deductible will generally be higher if you use an out-of-network provider. Your plan may also have separate deductibles for medical and prescription drug benefits.

If you switch plans part way through the year, youll generally have to start over with a new deductible on your new plan. This is common, for example, if you leave a job where you had employer-sponsored health coverage, and switch to an individual market plan or a new employers health plan mid-year.

Can Adjusting Your Health Insurance Deductibles Save You Money

The answer is yes! Adjusting health insurance deductibles can have benefits when it comes to how much youre paying in monthly premiums and how much youre paying out of pocket.

First, you should track how many times youve needed to see a doctor or buy prescription drugs in the past few years. If youre in a family plan, this also goes for each member of your family.

How much health care do you need on average each year? Could you cover the cost of a higher deductible if you were faced with a large medical bill at any time?

You May Like: Can I Cancel My Health Insurance Without A Qualifying Event

What Is Unsubsidized Health Insurance

Unsubsidized health insurance is any type of health coverage that the policyholder is responsible for paying the entire cost of the insurance plan. This means the individual pays the full premium cost and the full cost-share attributed to the policyholder according to the plan benefits. These out-of-pocket expenses include deductibles, copayments, and coinsurance for covered services and all expenses for non-covered services. Neither government assistance in such forms as tax credits and financial help programs nor employer cost-share contribution is available to reduce the individuals health insurance cost.

Health Spending Nears $6000 Per Person Among People With Large Employer Coverage

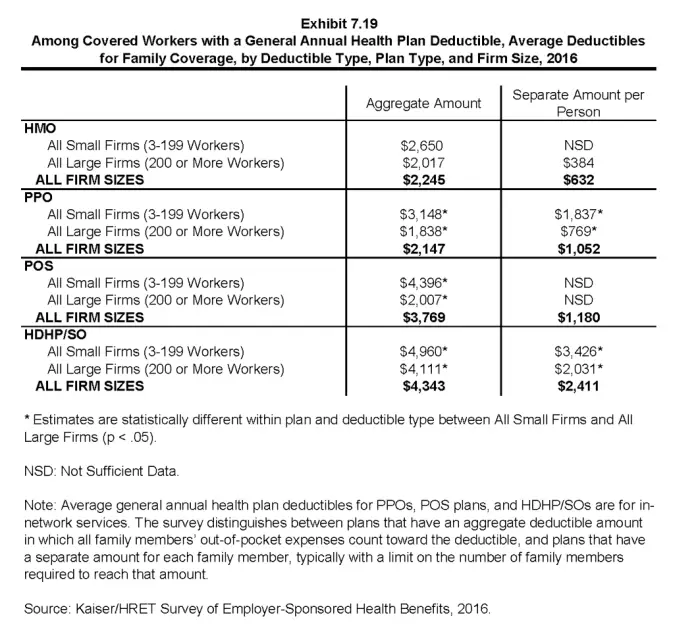

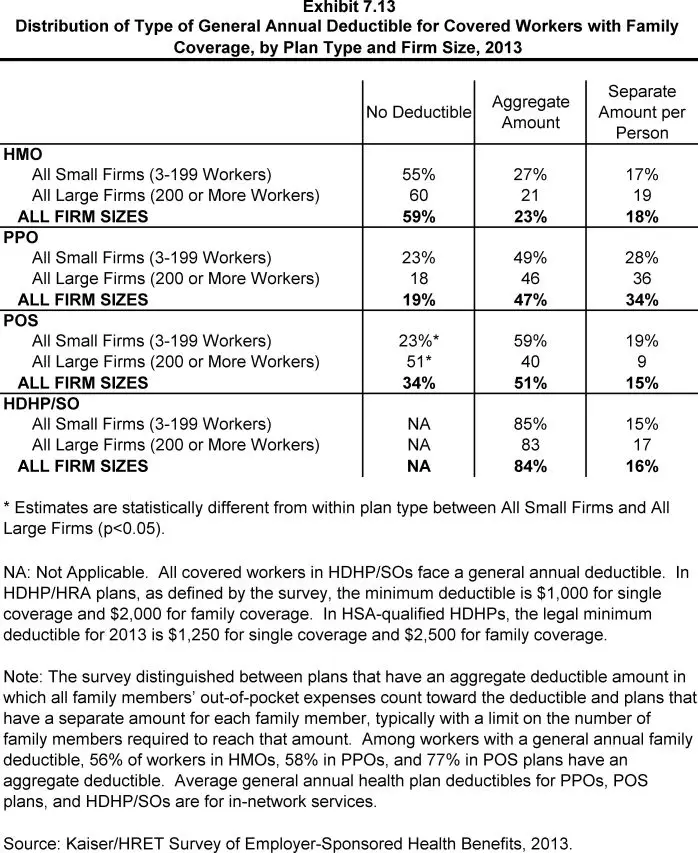

General annual deductibles are the amount enrollees must pay out-of-pocket before most services are covered by a health plan. Plans are required to cover some services, such as preventative care, before the deductible and in some cases plans elect not to apply the deductible to services, such as prescription drugs or physician office visits. After enrollees have met their deductibles, most must also pay a copayment and/or coinsurance at the point of healthcare service.

Over time, there has been a significant increase in both the of workers with a general annual deductible and the average deductible for those who have one. Analysis of claims data allows us to look beyond changes in the plan designs and focus on the out-of-pocket liability that plan enrollees are incurring.

Also Check: Does Health Insurance Cover Plan B

How Does A High Deductible Health Plan Work

In general, your health plan begins paying for covered medical expenses once youve met your deductible, which is the amount you pay out of pocket. This also applies to conventional plans.

Your deductible is the amount you must pay out of your own pocket before your health insurance company begins paying a portion of your medical expenses. The amount of your deductible is determined by the plan you select. If you pick a plan with a higher deductible, you may have to pay higher out-of-pocket in order to reach your deductible.

Do I Have To Pay My Deductible Before I Go To The Doctor

The cost of your deductible might be daunting, but it should not prevent you from going to the doctor. Since 2014, the Affordable Care Act has required that all plans cover preventive care services for free. That means, you wont be charged for services like blood pressure screenings or vaccinations, even if you havent met your deductible.

Some plans created before 2014 are known as grandfathered plans and dont have to meet this requirement. So you could still be charged for preventive care if your health plan is in this category. If youre concerned this might be the case, you can always call your insurance company and ask.

Dont Miss: How To Enroll In Starbucks Health Insurance

Read Also: How Much Does Marketplace Health Insurance Cost

Are Hdhps Leading To Lower Health Costs

A key tenet of an HDHP is that it can reduce health care costs both for employers and employees. However, our Insure.com survey found that the vast majority of people with a high deductible plan havent seen lower health care costs.

In fact, 49% said health plan costs are about the same with a high-deductible plan and 40% said health costs have actually increased. Only 12% said health insurance costs have decreased since enrolling in a high-deductible plan.

One drawback with an HDHP is that paying more for doctor appointments and tests may make people delay care. We found that about one-third of HDHP members surveyed said theyve delayed care because they didnt want to pay the high deductible. Delaying necessary care could lead to more health problems and higher health bills later.

Tips For Finding Healthcare Coverage

With the rising costs of healthcare, how can Americans save on healthcare and the cost of insurance? Be diligent, and do your research to compare plans. That way, you can get the most comprehensive health coverage you can afford.

If your employer offers health insurance and pays for a large portion of the premium, it is a great option to think about. If not, shop the health insurance exchange for affordable coverage. Check to see whether you qualify for any subsidies to help offset the cost of health insurance. Health savings accounts can also help you pay for out-of-pocket expenses such as co-pays and deductibles.

Finally, if you have a catastrophic accident or illness, ask the hospital for help with a payment plan. Many hospitals will reduce their charges for those who are unable to obtain insurance.

You May Like: How To Switch Your Health Insurance

The Average Cost Of Health Insurance By Company

What you can expect to pay for health insurance differs by the insurance company. Some insurers want to grow, so they offer more attractive rates. Others are more cautious and will charge more to be sure they can cover their members health care costs.

Among national carriers, rates can vary widely. For example, the average Silver plan premium for Kaiser Permanente plans is $427 per month. Anthem charges an average of $481, while UnitedHealthcares average rate is $641. Newer plans, such as Bright Health and Oscar, fall somewhere in the middle, with average monthly premiums of $488 and $492, respectively.

Premiums are not the only factor when choosing a health plan. Some of the most affordable plans can have coverage that falls short of your needs. The best health insurance companies can cost a bit more, but are surprisingly affordable and give you the best value for your money.

Consider the plan’s total cost by looking at things like deductibles, coinsurance and out-of-pocket maximums. Check that your preferred doctors and facilities are in-network to save money and hassle. Be sure to also review quality and customer satisfaction ratings available on the Marketplace to make sure youre not going to encounter more annoyances than a plan’s potential premium savings are worth.

Average Health Insurance Premiums by Company

Scroll for more

Comparing Health Insurance Deductibles

As you can see, there’s a substantial difference in the monthly premiums of high-deductible versus low deductible healthcare plans. However, the real out-of-pocket costs of any plan include the premium, the deductible, and copayments along with coinsurance.

Your out-of-pocket expenses under a health plan will depend on your health profile.

Read Also: What Does Coinsurance Mean In Health Insurance

The Average Cost Of Health Insurance By Metal Tier

Plans offered on the Health Insurance Marketplace are categorized into metallic tiers: Bronze, Silver, Gold and Platinum.

The tier corresponds to the value of the coverage, or how health plans and members split the costs. For example, in Bronze plans, the health insurer pays approximately 60% of the costs of care, and the individual typically pays 40%. The provider typically pays 90% in Platinum plans, and the individual pays 10%. These ratios are set by tier and based on expected spending for a typical health plan member.

In MoneyGeeks analysis, the lowest average premiums were $383 per month for Bronze plans. The average Platinum plan, by contrast, costs $782 per month.

Average Health Insurance Premiums by Metal Tier

Scroll for more

Should I Have A High Or Low Deductible For Health Care

![Average Health Insurance Premiums [INFOGRAPHIC] Average Health Insurance Premiums [INFOGRAPHIC]](https://www.healthinsurancedigest.com/wp-content/uploads/average-health-insurance-premiums-infographic.jpeg)

To find the best deductible for you, consider your current and future medical care. If you expect to have pricey procedures or require frequent care, a no deductible or even a low-deductible health insurance plan could become a more affordable health insurance option for you over the long run.

If you rarely see a doctor and dont expect to have many medical expenses over the next year, a high-deductible health plan might be a better choice.

You May Like: Does Starbucks Provide Health Insurance For Part Time Employees

You May Like: How Much Is Low Cost Health Insurance

What Does No Charge After Deductible Mean

Once you have paid your deductible for the year, your insurance benefits will kick in, and the plan pays 100% of covered medical costs for the rest of the year. After youve reached this limit, you will not have copayments, coinsurance, or other out-of-pocket costs .

In most health insurance plans, the health insurance carrier usually only pays 100% of covered medical costs once youve reached your out-of-pocket maximum. This threshold is a similar idea to your deductible, except usually higher meaning you have to spend more money on covered medical costs before reaching it.

What Is The Aca Health Insurance Marketplace

Established by the Affordable Care Act , the Health Insurance Marketplace is a platform that offers medical insurance plans to individuals, families, and small businesses. Fourteen states and the District of Columbia offer their own marketplaces, also known as exchanges, while the federal government manages a marketplace open to residents of other states. Marketplace plans are divided into four categories that range in cost and coverage. Though offered by private companies, all must meet certain criteria established by the state or federal government.

Recommended Reading: How Can I Get Low Income Health Insurance

On Average Families Cover About A Third Of Total Health Spending Including Their Premium Contribution And Out

In comparison to cost-sharing, premium contributions are less visible to families and more consistent, usually coming in the form of regular payroll deductions, rather than a payment when a family member needs services. Over the last decade , the average premium for families with large employer health coverage has increased 55%, and average cost-sharing for a family increased 70%.

Looking specifically at the total cost for the family, both through higher average premium contributions and higher average cost-sharing, families contribute 67% more to their health benefits than they did a decade ago, while employers contribute 51% more in premium contributions. Meanwhile, wages have increased 26%.

Is It Better To Have A Higher Or Lower Deductible

A higher-deductible plan will be better for those who are healthy, rarely seek medical care for an injury, have the budget to pay higher deductibles, and want to use HSA to save or invest money.

A lower or no-deductible health plan might be right for you if you are planning to have children, see a doctor frequently for a chronic medical condition or take prescribed medicines that are expensive.

You May Like: How Much Do Employers Pay For Health Insurance

Other Exceptions To Deductibles

While most cost-sharing benefits only kick in once the deductibles have been met, health plans can and do make a few exceptions where copays come into effect beforehand. For instance, all plans are required to cover preventive care at zero cost to the consumer.

Other exceptions to deductibles offered by plans include:

- Copays on a set number of visits to primary care physicians.

- Many catastrophic and high-deductible plans allow patients to pay a low copay for PCP visits even before deductibles are met.

- A number of plans offer up to three visits to the PCP for a copay.

- Generic drugs are also often excluded from the deductible requirement with an established copay applying at all times.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Heres how general deductibles varied in 2019:

- $1,655: Average general annual deductible for a single worker, employer plan

- $2,271: Average annual deductible if that single worker was employed by a small firm

- $1,412: Average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from Healthcare.gov., Plan Year 2020 |

|---|

| Bronze |

| $1,430 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

Also Check: Starbucks Dental Coverage

Don’t Miss: How To Qualify For Low Income Health Insurance

What Is The Average Cost Of Non

Despite the increases, there are still individuals andfamilies that are not eligible for subsidies and want to know how much they canexpect to pay for health insurance without the benefit of governmentassistance. The good news is health insurance premiums for individualsdecreased between 2020 and 2021 for Americans of all ages, according to themost recent eHealthIndex Report. However, families did not see the same price reduction fortheir plans.

The recent eHealth ACA Index report tracked costs and shopping trends among ACA plan enrollees who bought non-subsidized health insurance at ehealth.com during the nationwide open enrollment period for 2021 coverage.

What do you pay if you do not qualify for subsidies in 2021? The average monthly non-subsidized health insurance premium for one person on a benchmark plan was $450 per month in 2021. Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. Actual cost varies based on your age, location, and health plan selection.

Why Is Health Insurance So Expensive

The price of medical care is the single biggest factor behind U.S. healthcare costs, accounting for 90% of spending. These expenditures reflect the cost of caring for those with chronic or long-term medical conditions, an aging population and the increased cost of new medicines, procedures and technologies.

Recommended Reading: Why Should I Have Health Insurance

The Changing Cost Of Healthcare In The Us

Getty Images/stevecoleimages

U.S. healthcare spending grew annually at 9.7% in 2020, reaching a record $4.1 trillion, or $12,530 per person. As a share of the nation’s gross domestic product , health spending accounted for 19.7%. These numbers are staggering. What are Americans getting for their money?

Learn more about the factors impacting the cost of healthcare in the U.S. and the changes over recent years.

How Much Are Hdhp Deductibles

The average deductible for a employer-based plans single coverage is $1,644 in 2020 nearly identical to 2019. The average deductible for HDHPs is $2,303 for a single plan, a slight decrease from 2019, according to Kaiser Family Foundation.

Insure.com found that respondents single plan deductibles are usually between $1,701 and $4,000. Thats well above the $1,400 threshold for a plan to be considered high deductible.

Here are what the survey respondents said single coverage deductibles are:

- Between $1,701 and $2,499 33%

- $2,500-$4,000 26%

- More than $4,000 16%

- Less than $1,700 11%

Kaiser Family Foundation said the average HDHP annual deductible for family coverage is $4,552 for high-deductible employer-based plans in 2020. Our respondents said their family plan deductibles are:

- $3,001-$4,449 29%

- Less than $3,000 25%

- More than $6,000 18%

These deductibles are significantly higher than PPO and health maintenance organization plans. However, those higher costs are offset by lower premiums.

Kaiser Family Foundation said the average premiums for plans in 2020 are:

| Type of plan |

|---|

You May Like: How Many Americans Are Without Health Insurance

When You Dont Pay The Deductible

As part of the Affordable Care Act in the United States, you dont have to pay a deductible for certain preventive care services from an in-network doctor, as long as your health plan isn’t grandfathered.

A grandfathered plan is one that was in effect prior to the Affordable Care Act that’s allowed to continue without follow all of the ACA’s regulations. If your employer has a grandfathered plan, you may have costs for some preventive care.

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Also Check: How To Get Health Insurance