Medicare As Your Primary Health Care Coverage

Once you become eligible to receive health care coverage through Medicare, you may be required to enroll in Medicare. program or under locally provided insurance , and on whether your municipality has accepted the provisions of M.G.L. c. 32B, § 18. Please check with your local benefits coordinator or the Group Insurance Commission to see if you are required to switch to Medicare upon becoming eligible.)

If you enroll in Medicare, you may want to obtain Medigap insurance to supplement Medicares coverage. If, prior to enrolling in Medicare, you were covered under:

- the local municipalitys program, you should make arrangements with your local insurance coordinator to continue coverage through your group insurance program. The local insurance program will then serve as a supplement to Medicare. You should contact your local benefits coordinator for Medigap options.

- the RMT program, you will be required to enroll in Medicare, if eligible you should then apply for Medigap coverage through the Group Insurance Commission. For your Medigap options, contact the Group Insurance Commission .

Why Is Fehb So Expensive

There are a couple of reasons why having FEHB is so rare and valuable. ⦠It is difficult for many companies to compete with the sheer size and cost savings of the FEHB program, not to mention the fact that federal employees only have to cover about 28% of the premium with the government picking up the rest.

Recommended Reading: Empower Retirement Special Tax Notice

Applying For The Health Insurance Credit

If VRS is deducting your health insurance premium from your benefit, you do not need to apply for the health insurance credit. If VRS is not deducting your health insurance premium or you have eligible health insurance coverage in addition to your employer-sponsored coverage, register or log into your myVRS account to manage your health insurance credit online, or complete and send the Request for Health Insurance Credit VRS-45 to VRS. The credit will be added to your monthly retirement benefit. If you do not receive a monthly benefit, you will receive a check from VRS for the reimbursable amount.

Watch the Presentation

Completing the VRS-45: A Tutorial

Get step-by-step instructions on how to complete your request for the health insurance credit.

If you are on long-term disability through the Virginia Sickness and Disability Program , obtain the form from Reed Group, the VSDP third-party administrator. The credit will be added to your long-term disability benefit.

Also Check: Is Eye Surgery Covered By Health Insurance

Federal Employee Retirement Health Benefits And Medicare

There are a lot of factors when trying navigate FEHB, Medicare, and Medicare Advantage .

As someone decades away from being about to apply for Medicare, I havent studied them deeply and do not feel qualified to discuss this in great detail. To get more information on the topic, I interviewed Brian Sigwart. Brian is a certified financial planner with Cummins and Associates Financial Group. He has been providing financial wellness classes for over a decade at over 25 federal agencies in the DELMARVA area.

What Insurance Do Postal Employees Get

Newly hired postal employees are covered under Social Security and Medicare. The Postal Service offers coverage through the Federal Employees Group Life Insurance Program. The cost of Basic coverage is fully paid by the Postal Service, with the option to purchase additional coverage through payroll deductions.

Also Check: How Much Will I Need To Retire At 62

Don’t Miss: Will The Irs Penalize For No Health Insurance

How Much Does Health Insurance Cost For Early Retirees

Your health insurance costs will depend on your age when you retire, what level of plan you choose, and whether you’re eligible for premium subsidies. The Kaiser Family Foundation reported the average monthly cost for a 40-year-old on a mid-tier plan in 2022 was $438. That number would likely be higher for older people.

Opening A Health Savings Account Tied To A High

As you shop around, you could consider purchasing a high-deductible health plan and opening a health savings account . The high-deductible health plan will likely have lower premiums than others youâre considering, and the money you invest in an HSA, only available to those who purchase a high-deductible plan, can be used to pay for qualified medical expenses not covered by your insurance. Contributions are tax-deductible, and any interest or other earnings are tax-free. Withdrawals are also tax-free, as long as theyâre used to pay for qualified medical expenses. Any unused balances remain in the account, potentially gaining in value. No other type of tax-advantaged savings account offers all of these features.

âOnce youâre eligible for Medicare and enroll, you can no longer contribute to an HSA, although you can draw on your HSA funds to pay certain Medicare premiums and out-of-pocket medical expenses,â says Storey. Thereâs also no limit on when you can request HSA reimbursements, he adds. âYou can tap your account any time you need the money.â

Read Also: Who Accepts Ambetter Health Insurance

Public Service Loan Forgiveness Program

Through the Public Service Loan Forgiveness Program, the government forgives the remaining balance on eligible student loans for people who have worked in a public service job for at least 10 years.

To qualify, program applicants must have already made 120 monthly payments and be employed full time in AmeriCorps, the Peace Corps or another public service organization such as:

- The federal government or a state or local government.

- A public child or family service agency.

- A 501 nonprofit organization.

- A private organization that provides public safety, public interest law services, public health, law enforcement or another a public service.

You May Like: How Much Money Will I Need To Retire At 50

Eligibility As A Temporary Employee

An individuals decision not to enroll in the FEHB program as a temporary employee eligible to enroll does not affect the individuals future eligibility to continue FEHB health insurance as a retiree. Only services for which the government contributes toward the cost of health benefits counts in determining whether the individual has met the five-years of service, or first opportunity, requirement to continue coverage as a retiree.

Donât Miss: Employees Retirement System Of Rhode Island

Recommended Reading: What Do Expats Do For Health Insurance

If You Choose An Imrf

If you enroll in an IMRF-endorsed plan after retirement, or participate in the Sav-Rx Prescription Drug Discount Card Program, Delta Dental plan, or the United Healthcare Vision Care plan, you can choose to have your insurance premiums deducted directly from your monthly benefit payments.

To request automatic premium deduction, please complete a “Health Care Program Premium Deduction Authorization for IMRF Endorsed Plans,” form and return it to Doyle Rowe LTD with your enrollment form.

Automatic premium deduction is available on all Doyle Rowe plans except for:

- Blue Cross and Blue Shield plan for retirees and family members under the age of 65

- Medicare Part D plan participants

Medicare Part D premiums cannot be deducted from your IMRF benefit payment, but you can elect to have them deducted from your Social Security payment.

Let Us Help You Make Sense Of The Retirement Health Benefits Puzzle

Planning for retirement is a busy time. Theres so much to think about you might not know your health benefit plan in retirement is different from the health benefit plan you have while working. When you retire, any extended health care and dental coverage you were receiving through your employer will stop however, you can apply for retirement health coverage.

Without a good basic knowledge of retirement health benefits, it can all seem a bit puzzling. Would you like to learn more about your retirement health benefit options? Here are some basic facts about the retirement health coverage available through BCs Public Service Pension Plan.

Green Shield Canada is your retirement health coverage provider

Green Shield Canada . Its a not-for-profit insurance carrier that provides health care benefits for groups and individuals, as well as administration services, and an app and health portal where you can track activities, read up on health tips and earn reward points.

The Public Service Pension Plan does not administer retirement health coverage however, were happy to answer questions about coverage when youre planning to retire.

For details about eligible expenses, maximum reimbursements, deductibles and coverage, read the Green Shield Canada My Benefit Plan booklet or contact GSC. Public Service Pension Plan staff does not have the information to answer questions on these topics.

You have retirement health coverage options

Dental plan coverage is not subsidized.

Don’t Miss: What To Do If You Lost Your Health Insurance

Health Insurance For 55 And Older: Real Life Questions And Answers For Health Insurance Before Medicare Eligibility

Editorial Team

Many people want to retire before they are eligible for Medicare at age 65. However, figuring out health insurance and how to afford that coverage is very difficult. Health insurance for 55 and older can be very expensive, depending on your circumstances! And, lets face facts, health factors are more prevalent and unpredictable at this age. You need answersThe very first NewRetirement Ask me Anything zoom seminar was focused on your questions about healthcare and retirement. Below we offer all of the real life questions and the expert answers about medical coverage before the age of 65. NewRetirement events.

Explore below the questions and answers about health insurance for 55 and over.

Cost And Method Of Payment For Medicare

Coverage for Medicare Part A is free to eligible retirees. There is a charge for Medicare Part B. Once you have established coverage with the Medicare program, the MTRS will withhold the monthly premium for your Medigap coverage.

Starting in 2007, the Medicare Part B premium is based on retirees income: In the past, all Medicare-eligible retirees paid the same premium for their Medicare Part B coverage. Starting in 2007, the Medicare Part B premium is higher for retirees whose income exceeds certain limits. The standard Medicare Part B premium in 2007 is $93.50/month. For retirees whose total earnings exceed $80,000 or $160,000 , the Part B premiums increase on a sliding scale, up to a maximum of $161.40/month for those retirees whose income exceeds $200,000 or $400,000 .

Don’t Miss: How To Apply For Health Insurance In Indiana

How Can I Save Money

You may enjoy your retirement close to your own backyard. Or, maybe you spend your days far from home. The right health insurance plan can help you save money on out-of-pocket costs. When you visit in-network providers, you get access to the lower rates that they’ve negotiated with your health plan. When you see an out-of-network provider, your costs are typically higher. That’s why it’s important to choose a plan with in-network health care providers and hospitals in your area.

At What Age Are You Eligible For Medicare

Once you reach 65, you are generally eligible for Medicare. Some people become eligible for Medicare earlier. You may be eligible if youve received Social Security Disability Insurance for 24 months, regardless of your age, or if you have certain disabilities, such as amyotrophic lateral sclerosis , or permanent kidney failure.

Also Check: Can You Terminate Health Insurance At Any Time

Navigating Health Care Benefits In Retirement

Health care, and medical expenses in general, are a major component of your retirement cash flow strategy. Navigating which plan is right for you can be a challenge. Working with a fee-only financial planner who is versed in FEHB coverage, and other federal government employee benefits can help. If youd like to speak to our team, and review your options, reach out! Wed love to hear from you and to help you build a holistic retirement strategy that meets your needs.

How Much Does Health Insurance Cost When You Retire

The health insurance premiums remain the same both before and after retirement.

However, federal employees pay their portion of the premium on a biweekly basis. Retirees pay their portion on a monthly basis. However, if you remain on the same health plan before and after retirement, your total yearly premiums and benefits will remain the same.

It is important to note that part time federal employees typically have to pay more for their health insurance than full time employees. . However, upon retirement, part time and full time employees receive the same government contribution .

You are not allowed to participate in flexible spending accounts, also called FSAs, upon retirement. The IRS has specified that FSAs are a salary benefit and therefore cannot be used by people receiving an annuity.

Don’t Miss: Who Pays First Auto Insurance Or Health Insurance

Cancelling Your Health Insurance Coverage

You may cancel your coverage at any time after you retire by either completing the State Health Benefits Program Enrollment Form For Retirees, Survivors And LTD Participants or by sending a written request to VRS. Include your name, Social Security number and signature on the request to cancel. Once you cancel, you cannot enroll again in the State Retiree Health Benefits Program unless you return to work in a classified position in a state agency, or are the dependent of an active state employee and covered under his or her state health benefit plan. Your cancellation also cancels coverage for your covered dependents.

When Can I Keep My Health Insurance Benefits After I Retire

You may continue your health insurance coverage only if you meet the following conditions:

- Your annuity must begin within 30 days or, if you are retiring under the Minimum Retirement Age plus 10 provision of the Federal Employees Retirement System , health and life insurance coverages are suspended until your annuity begins, even if it is postponed.

- You must be covered for health insurance when you retire.

- You must have been continuously covered by the Federal Employees Health Benefits Program, TRICARE, or the Civilian Health and Medical Program for Uniformed Services :

- for five years immediately before retiring or,

- during all of your federal employment since your first opportunity to enroll or,

- continuously for full periods of service beginning with the enrollment that started before January 1, 1965, and ending with the date on which you become an annuitant, whichever is shortest.

You May Like: Can Undocumented Immigrants Get Health Insurance

How Do I Find Out If I Am Eligible For Medicare Coverage

You should contact the Social Security Administration at least 3 months before your 65th birthday to apply for benefits. The Social Security Administration will have records pertaining to your eligibility for Medicare coverage. If they don’t, and you or your employer need to get a statement of your earnings to apply for coverage, then you should write to:

General Services Administration National Personnel Records Center Civilian Personnel Records 111 Winnebago Street St. Louis, Missouri 63118

You should provide the following information in your request:

- Your name, as shown on your payroll records

- Years for which earnings are needed

- Name and location of employer for each year

- Reason for the request

- A statement that all other sources of information have been exhausted

- Your written signature

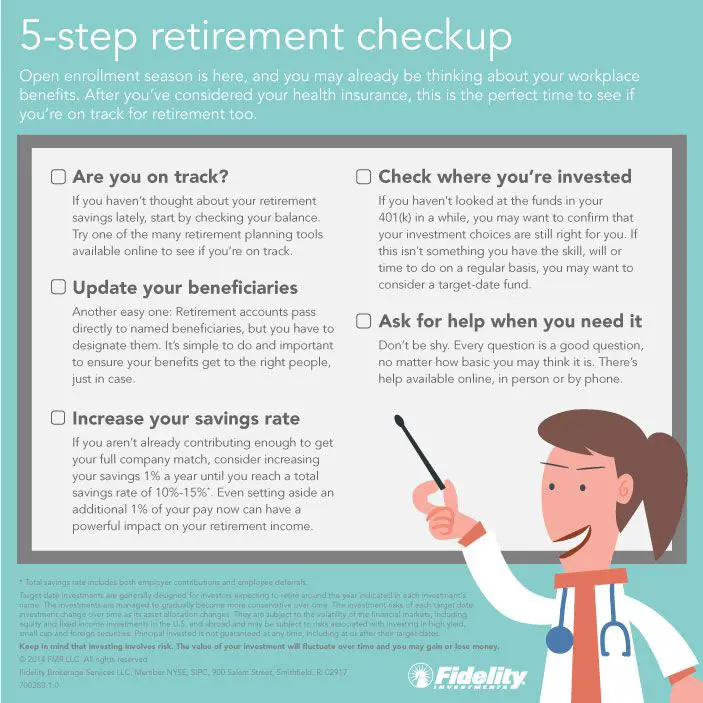

Review Plan Choices Each Year

Once you’ve secured health insurance in retirement, you should be proactive about evaluating it regardless of your age. Conduct an annual review of your coverage options during open enrollment each fall.

Benefits and costs change, and it’s possible that a new plan may offer you better coverage at a lower price. You wonât know unless you look. Once again, you may want to talk with an experienced agent or contact your state’s SHIP to ensure that your plan change will benefit you.

Also Check: Do I Need Health Insurance In California

Runner Up Best Medicare Advantage Plans: Aetna

-

Ultra-low-cost Part D plans available

-

Low premiums and deductibles on 2023 Medicare Advantage plans

-

The most MA plans with additional drug coverage in the coverage gap

-

Relatively high Medicare star ratings

-

A financial strength rating from AM Best

-

Deductibles run high on 2023 Medicare Advantage plans

-

Below average for customer satisfaction

Aetna was our runner-up for the Best Medicare Advantage Plans for a wide variety of reasons. The companys Part D plans and Medicare Advantage plans offer good value, are well-rated, and offer a wide range of benefits. Aetnas SilverScript SmartRx plan is a very low-cost prescription drug plan, with an average monthly premium of only $5.92 for 2023. Premiums and deductibles on its MA plans are well below industry averages for 2023 as well. And most MA plans include additional drug coverage in the Medicare donut hole.

But there are two reasons why Aetna isnt our top pick for retirees. Aetna ranked 6th out of nine companies in the J.D. Power 2022 U.S. Medicare Advantage Study, which indicates issues with customer satisfaction. Plus, the average out-of-pocket maximum on its Medicare Advantage plans is $5,685.48, which is about $300 higher than the average among major insurers.

Learn more in our Aetna Medicare review.

Do Federal Employees Get Medical Benefits When They Retire

After retirement, federal employees receive a monthly pension and medical coverage. To be eligible for coverage, you will need to meet minimum service requirements, including being covered as a federal employee for at least five years. Your spouse will be covered without the five-year rule.

Do federal retirees get medical benefits?

Medicare and the Federal Employee Health Benefit Program Most federal employees participate in the Federal Employee Health Benefit Program , a type of federal health insurance available to non-military employees and retirees of the United States. federal government.

Do federal employees get free healthcare for life?

Life Insurance It covers more than 4 million current and retired federal employees and their families. Unless you waive coverage, almost all full-time and part-time federal employees are automatically enrolled in a life insurance plan equal to their salary.

You May Like: Can I Buy Health Insurance Outside Of Open Enrollment

Medicaid May Be An Option

Medicaid may be another option to get health insurance in retirement.

If youre age 65 or older and meet certain income and asset limitations, you may qualify.

Unfortunately, the requirements vary from state to state.

Typically, these requirements involve a very low income and little to no assets. You will have to check your states requirements to see if you qualify.

Medicaid offers coverage for many services including doctor visits and hospital expenses. One major difference between Medicare and Medicaid is Medicaid covers long-term care costs.

These long-term care costs can include nursing homes and at-home care. That said, Medicaid does not cover prescription drugs.