Affordable Health Insurance Plans

Shopping for your own coverage? Open Enrollment is here and runs until Jan. 15. Cigna’s plans come with $0 preventive care, $0 virtual care , personalized digital tools, and 24/7/365 service and support. Lets find a plan that works for you.

See if plans are available in your state. See availability

Shop and compare Medical plans now

Find in-network doctors and covered prescriptions, too.

Or, call us at for a quote, MonFri, 8 am10 pm ET.

Make Your Selection And Enroll

After you compare health insurance plans and evaluate quotes, your agent can assist you with enrolling in a plan. For those joining a Marketplace plan, the Open Enrollment Period is currently active, running from November 1st until January 15th. Once you enroll, your coverage will specify a start date, and youll soon receive your insurance cards digitally or by mail. Youll also typically be able to set up an online account with your provider, where you can track your claims, deductible, and more.

Can I Cancel My Health Insurance Plan If Yes Then How Can I Get My Premium Back

Yes, you can cancel your Health Insurance. A free look period of 15 days from the date of policy receipt is available to the policyholder to review the terms and conditions of the policy. If the policyholder is not satisfied he may seek a cancellation of the policy. In such cases the Health Insurance Company allows the refund of the premium after adjusting the cost of pre-acceptance medical screening and underwriting cost.

Recommended Reading: Does Target Offer Health Insurance

Key Factors To Consider Before Buying Health Insurance Plans

Before shortlisting an insurance policy, consider the following factors to make the best purchasing decision:

Claim Process – Before buying a health plan always consider the number of claims settled by the medical insurance company. The entire purpose of buying an insurance plan is to get secured financially against unexpected critical illnesses. If the claim settlement process is smooth then it is advantageous for the insured. Additionally, you must look for great customer service.

Family Members to be Covered – You must consider the family members whom you want to cover under the insurance benefits. Under family floater health insurance plans, you can seek cover for yourself, your legally wedded spouse, children, parents, and grandparents. Moreover, age, present ailments, and family medical history are important factors that you should keep in mind. Also, you must inform your insurance company in case any of your family members have a pre-existing disease.

Sum Insured – The sum insured should be carefully chosen because it covers you and your loved ones for medical expenses incurred during the policy term. You should consider your income as well as your age when deciding on the sum insured for your medical insurance policy. Make certain that the sum insured is not insufficient and that the premium is not excessively high.

Get Supplemental Health Insurance From Aflac

Now that you know a bit more about how to compare health insurance plans, you may better understand where you need more coverage. Aflacs supplemental insurance plans can work with your health insurance plan to help provide a more enhanced coverage and better financial support. Discover our diverse range of insurance products today.

Still have questions?

1 & 4 Investopedia HMO. Updated July 22, 2022. . Accessed Aug 16, 2022.

2 Investopedia POS. Updated Mar 10, 2022. . Updated Aug 16, 2022.

3 Investopedia PPO. Updated May 9, 2022. . Accessed Aug 16, 2022.

Critical Illness Lump Sum Critical Illness In Arkansas, Policies A73100AR & A7310HAR. In Idaho, Policies A73100ID & A7310HID. In New York, Policy NY72100. In Oklahoma, Policies A73100OK & A7310HOK. In Oregon, Policies A73100OR & A7310HOR. In Pennsylvania, Policy A73100PA & A7310HPA. In Texas, Policies A73100TX & A7310HTX. In Virginia, Policy A73100VA. Lump Sum Critical Illness In Arkansas, Policies B71100AR & B7110HAR. In Oklahoma, Policies B71100OK & B7110HOK. In Oregon, Policies B71100OR & B7110HOR. In Pennsylvania, Policies B71100PA & B7110HPA. In Texas, Policies B71100TX & B7110HTX.

Z2201103

You May Like: How Long Is Open Enrollment For Health Insurance

Putting It All Together

Heres a summary of the tips offered above:

- See if youre eligible for a subsidy, so you can determine what your premiums will be and so youll know where you need to shop.

- Review your current plan to understand how it does or does not meet your needs, and keep this in mind as you review your options.

- Understand the different types of insurance plans to understand how your choices will impact your costs and your satisfaction with your plan.

- Get claims and treatment cost data from your current insurers member portal to understand past and potential future medical costs. Use this information to estimate out-of-pocket costs for the other plans youre considering.

- Research the networks for the plans you are considering to see if your preferred doctors and hospitals are included.

Best Online Therapy With Insurance Of 2023

- Best for Live Chat: Talkspace

- Best for Medication Management: MDLIVE

- Best for BIPOC: Inclusive Therapists

- Most Insurance Plans Accepted: Amwell

- Best Online Directory: Headway

- Best for Multiple Disorders: Lifestance Health

- Best for Psychiatry: Talkiatry

- Types of Therapy: Individual, couples, medication management

Read Also: Can My Son Put Me On His Health Insurance

Advantages Of Deductibles In Health Plans

Some of the major advantages of deductibles in health plans include:

-

Aids in the reduction of health plan premiums. Moreover, if the concerned insured chooses voluntary deductibles, depending on the terms and policies of the insurance company it may offer special discounts too.

-

The option of deductibles discourages the insured individual from raising minor claims, aiding to retain the No Claim Bonus amount undisturbed, thus enhancing the primary health plan coverage.

-

Despite the deductibles applicability, the insured individual can easily access health coverage during unprecedented medical contingencies.

Why Would My Health Insurance Claim Be Denied

There are a few reasons that explain why your health claim can be denied. Below mentioned are some of those reasons:

You May Like: How Much Does Health Insurance Usually Cost

Is There Any Add Cover/rider With Health Plan

Best Health Insurance in India offers additional benefits or Riders along with the base policy. Riders are additional benefits attached to your base policy which will offer you boosted benefits apart from your base policy. Add-on covers attached to your health insurance policy help you enhance the protection level. Listed below are the options:

1. Critical Illness Cover

Critical Illness refers to illness, disease, or sickness which even after the treatment, drastically affects the lifestyle of the patient. For example, Cancer, even after the treatment, needs extreme care and may not make an individuals life as normal as he/she was before. With Critical Illness add-on the cover, the insured is provided with an immediate fixed amount plus the rider cover expenses incurred during the medical procedure as well. By having critical illness covered, you are covered for a wide range of critical illnesses. Critical Illness can also be taken as a standalone policy. Many insurers have separate Critical Illness plans under their health portfolio.

2. Hospital Cash Cover

Hospital cash rider provides for the daily cash that you may need for compensating the medical expenses during the stay in the hospital. Typically, you can claim benefits an amount depending on the nature of your stay. You can also claim a higher payout in case you are admitted to ICU. You will be eligible for the rider payout in case you are hospitalized for a minimum of 24 hours.

3. Room Rent Waiver

Do All Online Therapy Providers Accept Insurance

No. Many online therapy providers do not accept insurance, though that does seem to be changing. In private practice, often the therapists who accept insurance are early-career professionals, says therapist Hannah Owens, LMSW. “And therapists often stop accepting insurance because of the high administrative burden and low reimbursement rates, which usually do not adequately reimburse professionals with more experience. This is also because there is an abundance of patients who are used to and willing to pay out of pocket, she says.

Owens does note, however, that some therapists who work for an online therapy company that accepts insurance may have more years of experience under their belt because the company will handle all the pesky and time-consuming insurance-related administrative tasks.

Read Also: Can Unmarried Couples Be On The Same Health Insurance

Why Should You Buy Health Insurance Online

Convenience in buying and the availability of a wide variety of plans are major reasons why most people prefer to buy coverage against critical illnesses online. More reasons to buy medical insurance are listed in the section below:

Time-Saving – Unlike the traditional ways of buying a plan where you had to explain all your requirements to the insurance agents and follow the tedious process, online services save your time and let you buy the health plan conveniently.All you need to do is fill out a quote and shortlist the most relevant medical health insurance policy from the ones displayed on your screen.

Easy to Compare Different Health Insurance Plans – The online way of buying a plan has simplified the process of comparison by reducing the paperwork. With a premium calculator, it becomes easy to calculate premiums as well as compare different insurance plans.

Right Decision – The flexibility provided in choosing and buying the best plans is one of the best features of buying insurance online. An online insurance company provides access to all the information like policy quotes, coverage benefits, exclusions, and other terms and conditions to do a comparative study of the most suitable plan.

Information Available 24×7 – There are no time-boundations to buy an insurance plan on online platforms like InsuranceDekho. Hence, you can easily compare, choose, and buy the most suitable plan anytime at your convenience.

How Can I Find The Best Uk Private Health Insurance

To find the best health insurance for you, its always worth comparing a variety of policies.

You can then see which offer the features you need, at a price you can afford. Whats best for someone else might not be right for you, so youll need to consider your personal circumstances and what you want from your policy.

Recommended Reading: Can You Put Your Girlfriend On Your Health Insurance

Comparing Tata Aig Health Insurance Plans

Tata AIG offers the MediCare Health Insurance Plan with three different variants that you can choose from.

If you want to compare the health insurance plans, given below is a table that can help you understand the outline of the coverage offered by our plan variants. Similarly, even while selecting a plan for senior citizens or senior parents, you can compare senior citizen health insurance to understand the coverage and the benefits better.

| Benefits/Cover |

|---|

| Covered |

Top-Up Benefit for Your Tata AIG Health Insurance Plans

The above benefits and features as shown in the table above are part of the base health insurance plans that we offer. However, we also offer a super top-up plan called the Tata AIG MediCare Plus plan, which helps you with extra coverage after your initial sum insured is exhausted in case of medical emergencies.

You can add the MediCare Plus to any of your base health insurance plans to enjoy the following features and much more –

- Additional cover against the rising medical costs

- Higher sum insured with affordable premiums

- Access to better healthcare with additional cover

- Improved coverage for critical illnesses and treatments

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Also Check: Does Health Insurance Cover Counseling

Comparing Two Health Insurance Plans

Here is a graphical example of two health insurance plans. One is a Select Plus Platinum plan and the other is a Select Plus Gold plan for a family of four. Notice the significantly higher out-of-pocket max for the Gold plan.

Neither seem particularly affordable, unless your family is making ~$300,000 a year.

Of course, you could elect to get a High Deductible Health Plan to lower your monthly premiums. A HDHP would also make you eligible for a Health Savings Account with tremendous tax benefits to pay for your healthcare bills. However, it simply may not be worth it.

Review Your Current Plan Costs And Benefits

If you already have health insurance, reviewing what you like or dont like about your current plan can help form a basis for comparison with others. Two common areas of dissatisfaction are costs and provider networks.

You should be able to view your network of providers on your insurers member portal or in a network provider directory. You can also call the customer service line and speak to a representative.

To review your costs, look through your current insurance policy or visit your insurers member portal. Download your claims from the past year and see what youve been spending. How much is your deductible? How much is your monthly premium? Do you have a copay? Is your plan compatible with a Health Savings Account ?

Here are a few additional questions to consider:

- Are you happy with the doctors and facilities youve been using?

- Do you have to get a referral to see a specialist?

- Is preventive care covered?

- Are you covered if you get out-of-network care?

- Are your medications covered?

Also Check: How To Apply For Kaiser Health Insurance

How To Choose The Best Health Insurance Plan

The best health insurance plan is the one that meets all your requirements and provides adequate coverage and benefits to you and your family in case of a medical emergency. To select the best health insurance plan, be sure to compare various health insurance plans with the help of our online health insurance calculator.

Why Choose Policyxcom

Certified by IRDAI, PolicyX.com is a one-stop-shop for all your insurance-related needs.

- IRDAI Approved The Insurance Regulatory Development Authority of India is a regulatory body created to protect the policyholder’s interest. PolicyX.com follows all the guidelines and protocols approved by the IRDAI.

- Free Comparison Service With PolicyX.com, you can easily compare the best Health Plans in India without paying the extra amount.

- Compare 15 Companies in 30 SecondsWith us, you can compare up to 15 companies in just a few seconds.

- Buy Insurance withing 5 minsWith PolicyX.com, you can buy your policy online without any hassles. We offer an easy 4-step online buying process that allows you to buy your policy without any troubles.

- 24*7 Customer ServiceThe experts of PolicyX.com are always available to resolve any of your insurance-related queries.

- Free Future Claim AssistanceOur team will assist you at every step of your claim process. Be it claim intimation, documentation, or any other process, we are always there to help.

Also Check: Does Humana Offer Individual Health Insurance

What Is Pet Insurance

Pet insurance can help cover expenses related to your pet’s care. You pay a regular monthly premium, which may increase over time as your pet gets older. Some plans also have a deductible that you must pay before coverage kicks in.

Premiums may vary depending on the coverage amount, the pet’s age and the breed. Premiums are usually higher for purebred animals than mixed breeds because pure breeds have more genetic abnormalities.

For many pet owners, you must pay the vet’s bill and then submit a claim to be reimbursed by the pet insurance company. In some cases, your vet may be comfortable billing the insurance company first.

You can get a free pet insurance quote in 30 seconds now.

Major Medical Vs Supplemental Insurance

First, its crucial to understand that when we say health insurance we mean major medical plans. These may be considered more traditional or primary insurance plans. While supplemental insurance works with health insurance, its not designed to cover all your medical needs.

Supplemental insurance helps offset out-of-pocket costs missed by your primary health insurance plan. You can choose which coverage category you need better support in. Exploring Aflacs range of plans may be just what you need to round out your coverage.

Read Also: What Is Cigna Health Insurance

What Factors Affect The Premium Payable For A Health Insurance Policy

Age is the biggest factor that determines the premium payable. The older you are, the higher is your premium, as you’ll be more prone to illness. Your medical history is another factor that will go into determining the premium. If you don’t have any medical history, the premium would be naturally lower. You are also eligible for a discount on the future premium payable if you have not claimed in the previous years.

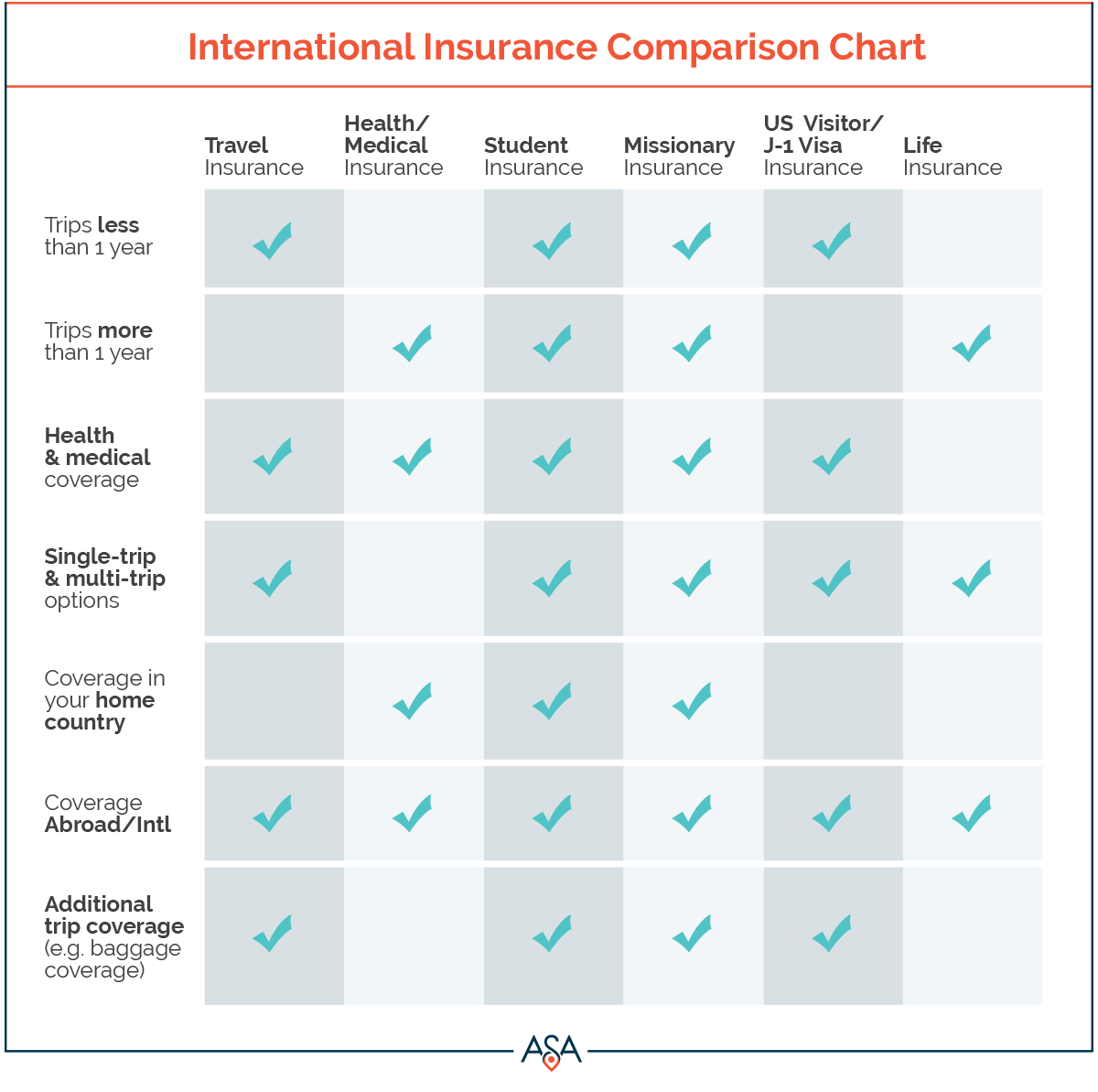

Criteria For Conducting International Health Insurance Reviews

With so much information available online, you might get confused on which areas to focus on when you are comparing international health insurance providers. But many of the perks presented in global insurance plans are simply add-ons that you can do away with. There are a few primary factors you should concentrate on because these are the most important ones that will heavily affect how much protection the policy provides.

We have listed the main areas you must focus on when comparing insurance plans:

You May Like: What Does Tax Credit Mean For Health Insurance