Id Doctor Visits Per Person Per Year By Insurance Type

This type of care includes visits to doctors in which the patient was not in an institution such as a hospital.

The frequency of doctor visits among people covered with group insurance visit doctors nearly 20% more than the national average. People insured with individual insurance are slightly below the national average for seeing doctors. Medicare Advantage enrollees are approximately 20% below the national average for visiting doctors. Idaho does not have a Medicaid managed care program. For that reason there are no numbers in the Medicaid section of the chart above.

Do You Get Free Medicare When You Turn 65

Medicare is not completely free insurance coverage. If you paid Medicare taxes for 40 quarters of work , you will receive Medicare Part A premium-free. Medicare Part B or medical coverage requires you to pay a monthly premium, which Medicare sets each year.

Even if you choose a Medicare Advantage plan in Idaho, you will continue to pay a monthly Part B premium, plus a premium to your Medicare Advantage plan. Some plans offer premium-free coverage.

In addition to Medicare premiums, you will have co-payments and deductibles to pay with Medicare. However, Medicare negotiates with healthcare providers to keep these costs as low and consistent as possible.

How Do I Enroll In Idahos Health Insurance Marketplace

Idaho has a state health insurance marketplace: Your Health Idaho. However, Your Health Idaho is more than just a marketplace for individual plans. Its a hub that allows you to review many of your affordable health insurance options in Idaho, including on-exchange and off-exchange plans. You can speak to enrollment counselors if youre interested in purchasing an ACA plan or to an insurance broker or an insurance agent if you want an off-exchange insurance plan.

If you are interested in an ACA plan, Your Health Idaho will ask questions to determine whether or not you are eligible for any special tax credits or CSRs. These include questions about your household size, your tobacco use, and the ages of people in your household. Once youve gone through the registration process, youll be able to browse plans until you find one that suits both your family and your budget.

Five companies offer ACA plans on Your Health Idaho:

- Blue Cross of Idaho

- Individual vs. family deductibles

Recommended Reading: Starbucks Health Insurance Benefits

Sample 2019 Iowa Individual Affordable Care Act

Sample premium information for individual ACA-compliant health insurance plans available to Iowans for 2019 based on age, rating area and metal level. These are premiums for individuals, not families. Please note that not every plan ID is available in every county. Please go to https://www.healthcare.gov/ to determine if your plan is available in the county you reside in.

How Do I Enroll In Idaho Health Insurance

You can enroll in ACA health coverage directly through the Idaho Health Insurance Marketplace at YourHealthIdaho.org.

Your Health Idaho offers metal plans in bronze, silver, and gold as well as catastrophic health insurance. All Idaho metal plans include essential health benefits, but Idaho catastrophic plans arent required to include them.4

You May Like: Does Insurance Cover Chiropractic

What Is The Extended Cobra Health Insurance Benefit For A Qualified Disabled Beneficiary

When the qualified beneficiary has been certified by the Social Security Administration by the 60th day of COBRA coverage, an additional 11-month extension is added. This only applies to people who are only eligible for 18 months of COBRA coverage.

The employer must offer COBRA coverage for a minimum of 18 months .

One drawback when extending coverage is that when an individual elects COBRA continuation coverage, they become responsible for the full cost of the policy. Employers are allowed to charge an additional 2% administration fee, bringing the total cost of the policy to 102% of the actual premium.

But this amount may be increased to 50% making the total COBRA cost 150% of the policy premium during the additional 11 months when COBRA coverage is provided due to a former workers disability.

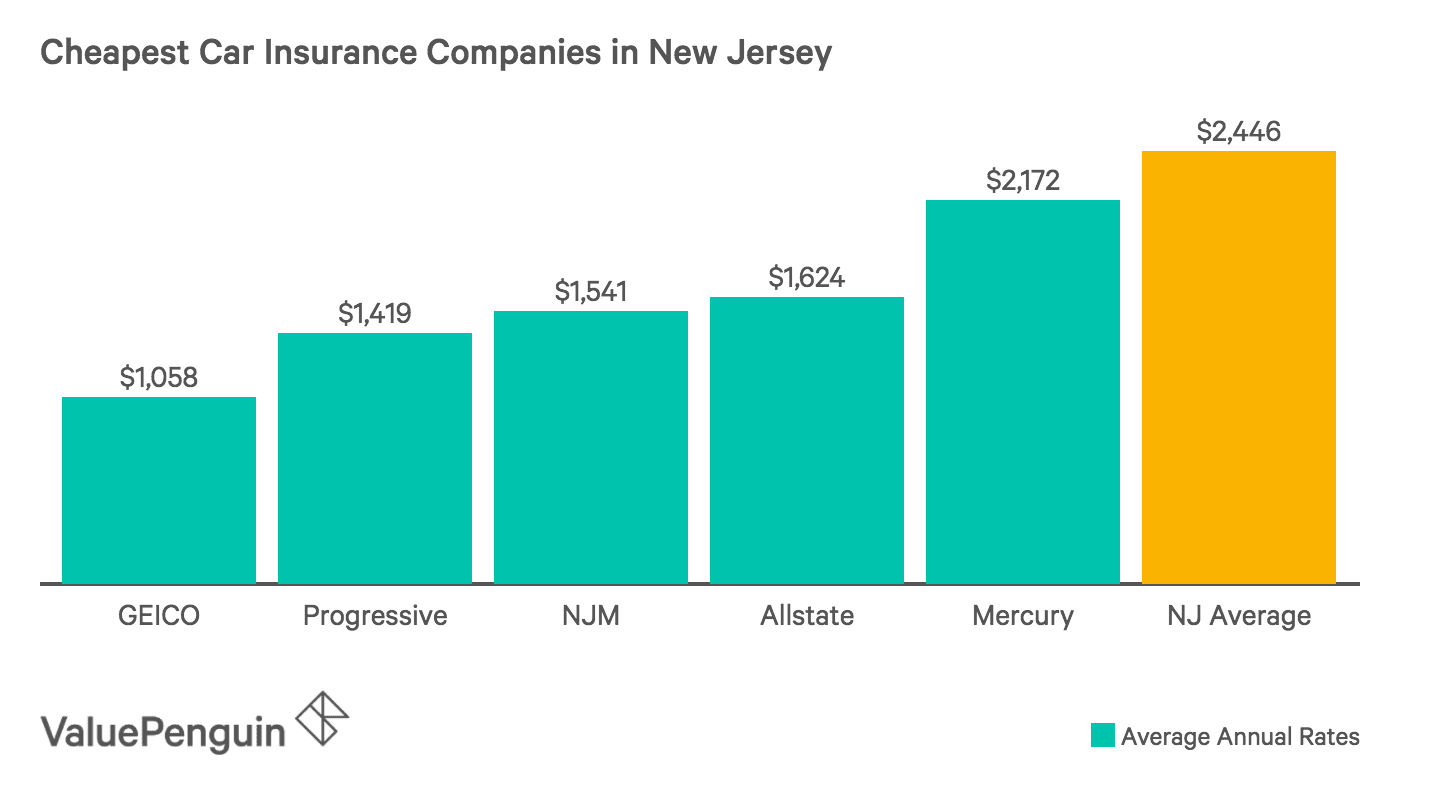

How Much Does Car Insurance Cost In Idaho

The average auto insurance premium in Idaho is $1,018 per year less than the national average by 28.7%. Car insurance premiums are affected by factors aside from geography. Car insurance rates price based on a number of factors, including ones marital status, driving history, credit rating, gender and age.

Also Check: Starbucks Insurance For Part Time Employees

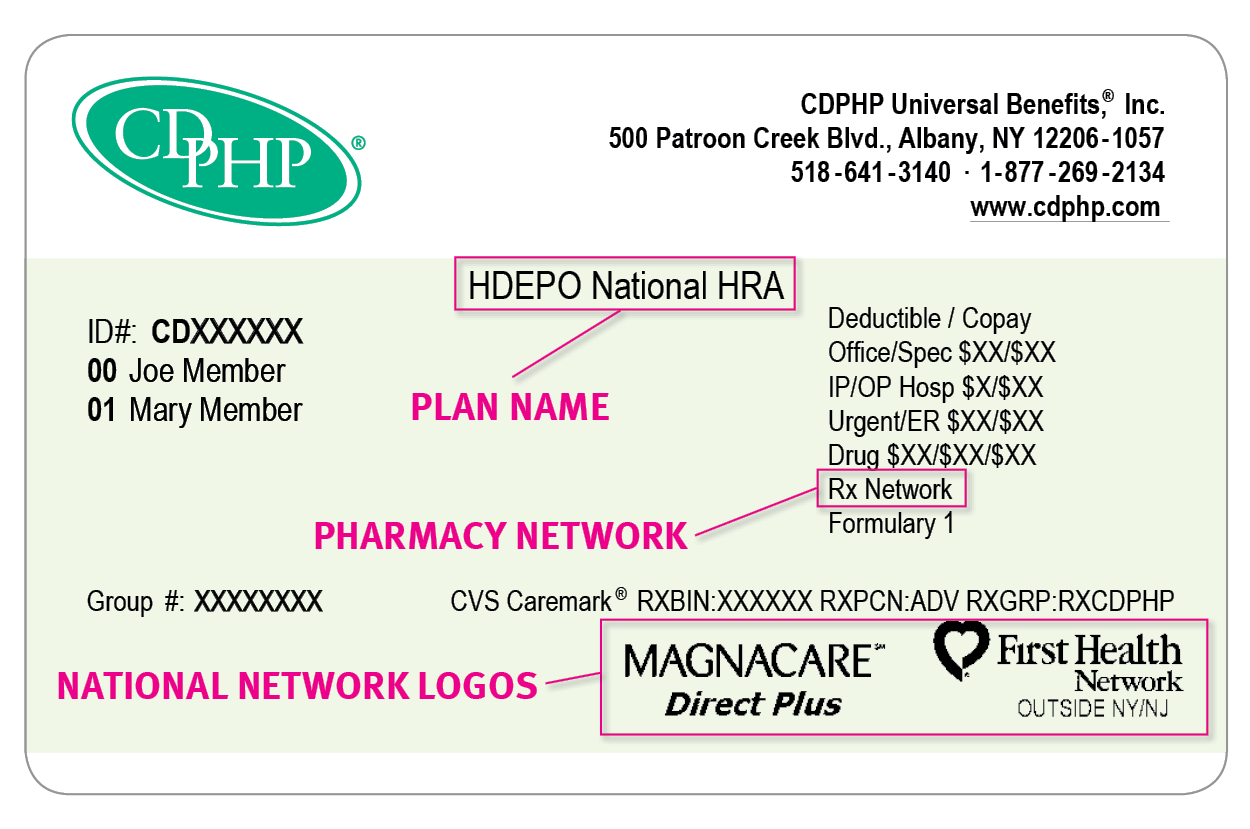

The Effect Of Insurance Deductibles On The Cost Of Health Care

ID residents insured through group, individual and medicare health plans generally have a deductible. Deductibles define the amount of the medical expenses the insured person must pay before the insurers coverage begins to pay the medical bills. The deductible amount depends on the insurance plan. Generally speaking, individual insurance has larger deductibles than other plans. Deductibles have the effect of increasing the cost of the insurance for people that file insurance claims. For example, a person on an individual plan paying the average price of $3,901 with a relatively common $6,000 deductible has an effective price of nearly $10,000, if they use their insurance.

What Are The Different Health Insurance Tiers In Idaho

According to the Affordable Care Act, there are now, also, five tiers of health insurance in Idaho. These tiers are catastrophic, bronze, silver, gold, and platinum. The more valuable the metal, the greater the coverage’s benefits and cost. We have listed them below with a brief description of each plan:

You May Like: 8448679890

The Cost Of Health Insurance In Idaho

The average cost of health insurance in the state of Idaho is $5,475 per person based on the most recently published data. For a family of four, this translates to $21,900. This is $1,507 per person below the national average for health insurance coverage. However, health insurance costs vary significantly based on the cost of care and the population insured. The chart below shows the four major insurance types available in Idaho. The dollar amounts shown on the chart are the average cost in Idaho to insure people for each type of insurance.

How Much Does Health Insurance In Idaho Cost Per Month

The average cost of individual health insurance in Idaho is $516 per month or $6,192 per year for an adult in their 40s. However, this cost will change significantly depending on the metal tier of coverage you select and your age. Like most insurance products, the older you are when you take out the policy, the more expensive it will be.

Don’t Miss: What Benefits Does Starbucks Offer Employees

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

What Are The Disadvantages Of Medicaid

Disadvantages of Medicaid

- Lower reimbursements and reduced revenue. Every medical practice needs to make a profit to stay in business, but medical practices that have a large Medicaid patient base tend to be less profitable.

- Administrative overhead.

Recommended Reading: Can You Buy One Month Of Health Insurance

Also Check: Starbucks Partner Health Insurance

How Much Is Health Insurance Per Month For One Person

Monthly premiums for ACA Marketplace plans vary by state and can be reduced by subsidies. The average national monthly health insurance cost for one person on an Affordable Care Act plan in 2019 was $612 before tax subsidies and $143 after tax subsidies are applied.

Wondering how insurance premiums are decided? The Affordable Care Act ensures that insurance companies cannot discriminate based on gender, current health status, or medical history. Here are factors that determine health insurance premiums.

What Are My Idaho Coverage Options If I Have Low Income

Before 2021, if you earned between 100% to 400% of the federal poverty level , you qualified for subsidies to help you pay for any metal plan.

In 2021, the federal government expanded subsidies and removed the maximum income for premium tax credits. Instead, youre not expected to pay more than 8.5% of your annual household income for a benchmark plan . The federal government would cover the balance through subsidies.

Check our 2022 subsidy chart and calculator to see which subsidies you might qualify for.

Another way you can save money on Idaho health insurance is through cost-sharing reductions . CSRs go toward your out-of-pocket expenses for things like copays and prescription drugs, but only for silver plans. Generally, you must earn between 100% and 250% of the FPL to qualify.8

Medicaid

More than 355,000 Idahoanshave Medicaid as of February 2021.9 Idaho is one of the states that have expanded its Medicaid program to low-income residents who earn at below 138% of the FPL.7

You may qualify for Idaho Medicaid if you meet income requirements and youre either pregnant, a child under 19, the parent or caretaker of a child, 65 or older, or are blind or disabled.

CHIP

Recommended Reading: Starbucks Dental Coverage

How To Buy Health Insurance In Idaho

If you do not have coverage through your employer, you can buy health insurance in Idaho on the state exchange website. Health insurance plans are available in three different metal tiers: Bronze, Silver, and Gold.

Your premium rates depend on which tier level coverage you select and if you qualify for a subsidy.Bronze tier plans have low premiums and high deductibles, but Gold tier plans have high premiums and low deductibles. Low-income and eligible residents can obtain Medicaid coverage.

Health Insurance Deductibles: What Can You Expect

On top of premiums, everyone who carries health insurance also pays a deductible. This means you pay 100% of your health expenses out of pocket until you have paid a predetermined amount. At that point, insurance coverage kicks in and you pay a percentage of your bills, with the insurer picking up the rest. Most workers are covered by a general annual deductible, which means it applies to most or all healthcare services. Here’s how general deductibles varied in 2020:

- $1,644: average general annual deductible for a single worker, employer plan

- $2,295: average annual deductible if that single worker was employed by a small firm

- $1,418: average annual deductible if that single worker was employed by a large firm

| Median Individual Deductible, Qualifying Health Plan Without Subsidies from HealthCare.gov., Plan Year 2020 |

|---|

| Bronze |

| $95 |

Individuals who are eligible for cost-sharing reductions are responsible for deductibles as low as $115 for those with household incomes closest to the federal poverty level.

You May Like: Which Statement Is Not True Regarding Underwriting Group Health Insurance

Insurance For An Individual In Idaho

When youre buying insurance for yourself, the cost will depend on your overall health. If you dont require much health care, you should probably select a plan that offers a low monthly premium and high deductibles.

If you frequently see a doctor or a specialist and need regular prescriptions, the deductibles can add up. Your best choice might be a plan with a higher monthly premium but lower deductibles. This can help you control your out-of-pocket expenses.

There are different types of plans you can choose from:

Hmo Health Insurance Plans

HMO stands for Health Maintenance Organization. HMO plans offer a wide range of health care services through a network of providers that contract exclusively with the HMO, or who agree to provide services to members. Employees participating in HMO plans will typically need to select a primary care physician to provide most of their health care and refer them on to HMO specialists as needed.

Also Check: How Long Do Health Benefits Last After Quitting

How Much Is Health Insurance For Groups

Group insurance is a policy plan that covers an entire organization or company. A business owner usually secures it for his or her employees. The total payable premium changes depending on the number of people on the plan, so costs will fluctuate as you hire or remove employees.

The average monthly health insurance cost for single coverage employees on group policies is $574 per month. Family coverage averages $1,634 per month. On average, this is more expensive than individual health plans.

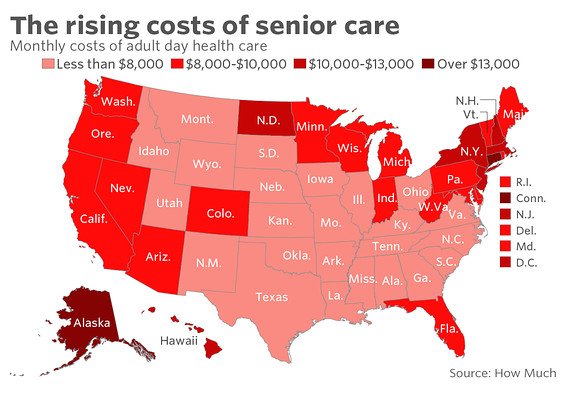

Top 10 Most Expensive States For Health Insurance

| State | |

|---|---|

| $566 | +1.85% |

Our map demonstrates the extent to which geographic location drives pricing for health insurance premiums. The most expensive state is West Virginia, where on average it costs a 40-year-old applicant $712 each month. By contrast, that same applicant would only need to pay $335 in New Hampshire, less than half as much. Not only that, but the price of insurance year-to-year varies across the country too, dropping by almost 20% in Iowa but rising almost 10% in Indiana. The states with the highest populations also tend to see the highest prices, like New York and California .

What explains the dramatic differences? Why does it cost so much more for health insurance in some states than others? The simplest explanation is that some Americans are healthier than average, and a major factor is location. West Virginia is widely seen as the epicenter for the opioid epidemic, and it is also the most expensive for insurance. By contrast, Colorado has one of the lowest rates of obesity in the U.S., and their health premiums only $377.

All of which is to say, it pays to shop around for health insurance. If you are in the market for coverage, a good place to start is with our health insurance cost guide.

About the article

Don’t Miss: How Long After Quitting Job Health Insurance

Mapped: Healthcare Costs In All 50 States

The average cost of health insurance for a typical 40-year-old applicant is about $495 per month, a price that has gone down over 2% from last year. However, health insurance might cost a lot more depending on where you live.

- West Virginia is the most expensive state in the country for health insurance, costing on average $712 per month.

- The cheapest place is New Hampshire, where insurance only costs about $335 per month for a typical 40-year-old applicant.

- Prices are wildly fluctuating from last year depending on where you live, declining some -19.56% in Iowa but rising +9.92% in Indiana.

- Taken together, health insurance premiums decreased over 2% from last year and cost on average $495.

We got the data for our map thanks to ValuePenguin. First we color-coded each state based on the average monthly cost of health insurance premiums for a 40-year-old applicant. The rates come from Public Use Files at the Centers for Medicare & Medicaid Services. Then, we added a circle corresponding to the percentage of change from 2020 to 2021, with green indicating a net reduction in cost, and red an increase. The result is an intuitive snapshot of the national market for health insurance.

Short Term Or Temporary Health Insurance In Idaho

Idaho has two types ofshort-term health insurance, traditional or enhanced. You can obtain coverage throughout the year from private insurers.

Conventional coverage is non-renewable and ends after a term of 6 months. Enhanced plans, available since 2020, have longer coverage terms and more comprehensive benefits.

Also Check: Umr Insurance Arizona

Idaho Affordable Healthcare Insurance

If you live in Idaho and are shopping for an individual or family plan this year, do it right by comparing prices with SmartFinancial. There are a few steps you should take before you choose a plan, and well guide you through the process. Do remember that you may only enroll in a health plan during the open enrollment, which runs through August 15, 2021 and starts back up in November. Unless you are eligible for the Special Enrollment Period due to a qualifying event, you must enroll within these time frames.

When Is Open Enrollment in Idaho?

How to Get Health Insurance in Idaho

Figuring out what ballpark your healthcare costs will fall into is a good place to start. You can estimate what your needs will be based on the previous year. Having this information will help you decide which type of coverage is right for you, and which level tier suits will be most economical. The biggest mistake people make is looking at the monthly cost alone. What about the deductible? Or the copays and prescription drug costs?

One thing you can do to ensure that youre paying the lowest price is to compare health insurance companies and health insurance quotes. After you submit a form with SmartFinancial, youll get several health insurance rates and an agent to help answer your questions about the plans youre considering.

What Types of Health Insurance Are Available in Idaho?

Does Health Insurance Cover Pre-existing Conditions?

Compare Health Insurance Plans in Idaho

Factors That Affect Health Insurance Cost

So how much is health insurance? This will always depend on your life situation. Insurance companies compute your premiums and coverage based on a myriad of variables, from your general health to your state of residence.

Here are some factors that affect your health insurance monthly cost:

Pre-Existing Conditions

However, if you have a pre-existing condition, you may opt for a higher-premium plan, which does increase your costs. These plans have higher monthly premiums because the insurance pays a more significant chunk of your ongoing medical expenses due to your condition.

Health Care Type

Your chosen health insurance category often has the most significant influence on how much your costs are.

When you buy health insurance from government exchanges as mandated by the Affordable Care Act , youll encounter four different categories. They range from Bronze to Platinum .

When you pay a higher monthly premium, youll pay fewer out-of-pocket costs because the insurance policy covers most of these. Conversely, plans with lower premiums will cost you more when you need prescriptions or doctor visits.

For example, the Platinum plan with a monthly premium of $732 covers most of your routine medical procedures, while a plan with a monthly payment of $448 might cost you more in out-of-pocket expenses.

Location by State

Read Also: Starbucks Insurance Part Time