The Impact Of The Coronavirus Pandemic On The Uninsured Population In 2020 And Beyond

Since the end of 2019, the spread of the novel coronavirus has resulted in increases in unemployment, substantial changes in household income, and increasing strains on the health care delivery system. Recent legislation in response to the pandemic has included federal funding for testing for COVID-19 , treatment for uninsured people, and tax credits for employers that continue contributing to the health insurance premiums of furloughed employees it has also required health insurance plans to cover COVID-19 testing with no cost sharing.

Against the backdrop of those changes, in the Congressional Budget Offices estimation, the number of people without health insurance will increase to about 31 million in 2020.1 That uninsured population in 2020 will include most of the approximately 30 million people who would have been uninsured in the absence of the coronavirus pandemic, plus additional people who lose health insurance coverage on account of the pandemic and do not obtain alternative coverage. Therefore, understanding the people who lacked insurance before the pandemic remains relevant even in a rapidly changing economy.

1. For further discussion of CBOs estimates of the number of uninsured people in 2020, see Congressional Budget Office, Federal Subsidies for Health Insurance Coverage for People Under 65: 2020 to 2030 , www.cbo.gov/publication/56571.

Characteristics And Coverage Options Of The Uninsured Population In 2019

Many of the estimates in this report are drawn from the CBOs health insurance simulation model, HISIM2, which CBO uses to estimate the major sources of health insurance coverage and associated premiums for noninstitutionalized U.S. residents under age 65.1 Most of the data in HISIM2 come from the Annual Social and Economic Supplement of the Current Population Survey . Those data provide reliable, timely, and detailed information on many of the key variables needed to model health insurance coverageincluding income, employment, and self-reported health status.

To improve the accuracy of the CPS data, CBO adjusts variables that are likely to be reported with some error, such as the number of people enrolled in Medicaid and the amount of income reported on tax returns, so that the distributions of characteristics of people in the HISIM2 sample match those found in administrative data.

The Impact Of Trumps Efforts To Abolish The Aca

First off, we must point out the fact that a study carried out in 2017 concluded that 49% of US citizens were sure that the abolishment of the Affordable Care Act, would likely lead to losing their health insurance coverage.

The market had to deal with the recent changes pushed by the Trump Administration that introduced several policies meant to limit private insurance policies on the marketplaces created by Obamacare. Similarly, enrollment has now been limited once again to Medicaid. Therefore, Americans now need to respect different criteria to be eligible for enrollment with an insurance provider, thus influencing the uninsured rate. The luckiest individuals, in this case, are those who receive health insurance as part of their employment.

An important aspect worth considering is that any policy change , is bound to affect the popularity of the respective policy, judging how most people have a hard time adapting to change. Over the last couple of years, numerous policy changes have been introduced to the US healthcare market, creating unnecessary public confusion and making it more difficult for people to make the right choice.

You May Like: How To Apply For Health Insurance As A College Student

Immigrant Status And Nativity

Most uninsured people are U.S. citizens by birth . The relatively small proportion of the general population comprised of naturalized citizens and noncitizens is significantly more likely than U.S.-born residents to be uninsured, although immigrants’ uninsured rates decline with increasing length of residency in the United States.

Residency status, family income, and length of residency in the United States are important influences on the likelihood that a person will lack insurance coverage . Foreign-born residents of the United States are almost three times as likely as U.S.-born residents to be uninsured, and among the foreign-born, noncitizens are more than twice as likely as citizens to be uninsured . Foreign-born residents are a relatively small proportion, about 10 percent, of the general population under age 65. The declining uninsurance rate for immigrants with longer residence in the United States means that they contribute a relatively modest number and proportion to the overall growth in the uninsured population .

Hispanics

American Indians and Alaska Natives

African Americans

Asian Americans and Pacific Islanders

Million In The Medicaid Gap

Set aside the 7 million noncitizen immigrants, most of whom were never meant to be covered by the ACA, and 26 million uninsured remain. Of those, nearly 4 million were meant to qualify for insurance under the federal law but were later blocked from coverage. They fell into whats known as the Medicaid gap, with incomes that were too high for Medicaid eligibility and too low to receive subsidies on the new health care exchanges.4

When the Affordable Care Act was written, it expanded the existing Medicaid program to cover everyone living below the poverty line, including childless adults who had previously been mostly excluded from the program. It also offered subsidies to people earning 100 percent to 400 percent of the poverty line to buy private insurance on the exchanges. A Supreme Court decision left Medicaid expansion up to individual states, and about half chose not to expand the program. That left millions of low-income people ineligible for Medicaid but, counterintuitively, unable to qualify for subsidies on the insurance marketplaces because they earned too little.

This 3.8 million was a very poor group overall, but nearly half, 1.7 million people, lived in families whose incomes were less than 50 percent of the poverty line. Because Medicaid historically tended to cover just families with children, the bulk of those falling into the gap were working-age adults without children nonetheless, about 800,000 parents with children living at home fell into the gap.

Read Also: How Much Does Usps Health Insurance Cost

Understanding Trumps Initiative To Abolish The Affordable Care Act And Its Overall Impact On American Health Insurance

One of Trumps first moves as President of the United States was to sign an executive order which instructed officials to do all thats in their power to waive, delay, and defer the implementation of instructions outlined in the ACA. It is believed that this initiative is a direct reason why the rates of uninsured Americans have increased over the last couple of years.

So far, President Trump has not managed to stop the program in its entirety, yet several changes have already been implemented. These include, but are not limited to:

7. The elimination of the individual mandate

Obamacare necessitates that all US residents must have some form of health insurance failure to do so would lead to a penalty. The purpose of this policy was to get as few uninsured Americans as possible to help keep insurance premiums low since more people actively contributed to the health insurance fund.

8. Sponsoring a law that would allow states to implement work requirements

The ACA was designed to be all-inclusive for US citizens, yet if approved, this policy change would make it obligatory for residents of certain states to prove that they are an employee, or in school. This makes access less inclusive and theoretically goes against the original ACA uninsured definition.

9. Cost reduction subsidies are no longer given to insurers as a form of incentive for participating in the ACA program

10. The administration also cut funding to several other programs including HealthCare.gov

Top Uninsured American Statistics:

- 30 million people in the United States do not have health insurance. Millions of other Americans are underinsured.

- 9 million children are uninsured in the United States.

- 73.7% of uninsured adults say that the cost of coverage is the reason they don’t have a policy.

- 50% of people in America who don’t have health insurance have not seen a doctor or healthcare professional in the last 12 months.

- The majority of the market, or 67.3%, is made up of private health insurance.

- 34.4% of the market is public health insurance

Read Also: Does Golden Rule Insurance Cover Mental Health

Why Some People Dont Buy Health Insurance

Whether its a matter of principle or a matter of money, some Americans choose not to buy health insurance, opting to pay the fine instead. One young couple explains why.

For one 30-something Florida couple, going without health insurance is a mixed bag of budget and principle.

Bill, Lisa, and their teenage son were covered on an individual policy through 2014. When their plan was cancelled at the end of last year, they found their options limited.

Lisa told Healthline premiums for the family of three would have more than doubled.

We feel its unfair to have paid years of insurance and then be cut off and forced into higher premiums and less coverage, she said.

So, they decided to dump their insurance, fork over the tax penalty, and pay their own medical costs as they go.

What Are The Financial Implications Of Being Uninsured

The uninsured often face unaffordable medical bills when they do seek care. These bills can quickly translate into medical debt since most of the uninsured have low or moderate incomes and have little, if any, savings.26,27

Key Details:

- Those without insurance for an entire calendar year pay for nearly half of their care out-of-pocket.28 In addition, hospitals frequently charge uninsured patients much higher rates than those paid by private health insurers and public programs.29,30,31

- Uninsured nonelderly adults are much more likely than their insured counterparts to lack confidence in their ability to afford usual medical costs and major medical expenses or emergencies. More than three quarters of uninsured nonelderly adults say they are very or somewhat worried about paying medical bills if they get sick or have an accident, compared to 47.6% of adults with Medicaid/other public insurance and 46.1% of privately insured adults .

- Medical bills can put great strain on the uninsured and threaten their financial well-being. In 2019, nonelderly uninsured adults were nearly twice as likely as those with private insurance to have problems paying medical bills .32 Uninsured adults are also more likely to face negative consequences due to medical bills, such as using up savings, having difficulty paying for necessities, borrowing money, or having medical bills sent to collections resulting in medical debt.33

Figure 10: Problems Paying Medical Bills by Insurance Status, 2019

You May Like: How To Retire Early And Afford Health Insurance

Helping You Get Insured Affordably

The risks of being an uninsured person are high. Without an insurance plan, both your health and your bank account are put in jeopardy. But by protecting yourself, you can make sure that an unexpected accident wont derail your life.

If youre self-employed and wondering about the costs associated with health insurance, check out this article: How much is health insurance for the self-employed?

KFF. Key Facts about the Uninsured Population.

Healthcare.gov. Read the Affordable Care Act.

Congress.gov. Tax Cuts and Jobs Act.

HealthCareInsider. 5 States Are Restoring the Individual Mandate to Buy Health Insurance.

KHN. The Cost Of Unwarranted ER Visits: $32 Billion A Year.

Bankrate. Survey: Fewer than 4 in 10 Americans could pay a surprise $1,000 bill from savings.

NCBI. Health Consequences of Uninsurance among Adults in the United States: Recent Evidence and Implications.

Cdc Reports On Uninsured In First Six Months Of 2021

An estimated 9.6% of U.S. residents, or 31.1 million people, lacked health insurance when surveyed in the first six months of 2021, according to preliminary estimates from the National Health Interview Survey released yesterday by the Centers for Disease Control and Prevention. Thats not significantly different from the surveys uninsured rate for 2020.

Among children, 4.4% were uninsured, 44.7% had public coverage, and 53.1% had private coverage. Among adults under age 65, Hispanic adults were more likely than Black , white and Asian adults to be uninsured. The percentage of people under age 65 with exchange-based coverage increased from 3.7% in 2019 to 4.3% in the first six months of 2021.

Recommended Reading: How Much Is Health Insurance For A 60 Year Old

No More Tax Penalties

In 2018, the ACA tax penalty was $695 for adults and $347.50 for children, or 2% of one’s annual income, whichever amount was more. However, on Dec. 22, 2017, when former President Donald J. Trump signed the Tax Cuts and Jobs Act, it repealed the ACA-related tax on Americans who refuse to purchase health insurance.

As of 2019, Americans without health insurance are not taxed by the government. However, individuals and families who choose to go without health insurance do so at their own risk.

People Ineligible For Subsidized Coverage

In CBOs assessment, about one-third of the uninsured population in 2019 did not have access to any of the subsidized options above. Those people were ineligible for subsidized coverage for different reasons.

Noncitizens Who Were Not Lawfully Present.CBO estimates that 13 percent of uninsured people were noncitizens who were not lawfully present in this country and did not have access to coverage through an employer . Without legal residency, noncitizens are generally not eligible for public coverage for nonemergency care, and they cannot purchase insurance through health insurance marketplaces. Thus, if they lack access to employment-based coverage, the only way for them to obtain coverage is to purchase private, or nongroup, insurance outside of the marketplaces at full cost.6 People in this group made up a large share of uninsured people with low income and only a small share of uninsured people with high income.

Consequently, for nearly all people in this group, the only option was to purchase nongroup coverage at full cost. People in this category made up nearly one-third of uninsured people with income below 138 percent of the poverty level in 2019.

Read Also: What Does Long Term Health Care Insurance Cover

Us Health Insurance Statistics

1. Around 49% of the countrys total population receive employer-sponsored health insurance .

Health insurance coverage statistics show this to be the case and most of the group insurance may include life, health or some other type of personal insurance coverage.

The highest percentage of state residents that benefit from group insurance are currently working in the northeast and midwest regions. Utah and North Dakota top this list with more than half of their residents being covered by group insurance.

Additionally, California, Texas and New York respectively have the highest number of individuals receiving employer-sponsored health insurance in the United States. This is primarily because these are large and economically strong states, with almost half of their populations having group insurance.

2. In 2019 most US states eliminated the individual mandate penalty.

This is part of the many health care economic issues faced by the country today. People were concerned about paying penalties, which is why at the end of 2018, the penalty was reduced to $0 and will remain so throughout 2021.

There are, however, penalties in 2021 for not being insured in the states of New Jersey, California, Massachusetts, Rhode Island and the District of Columbia, unless you are eligible for an exemption. The penalties everywhere else are removed but the original individual mandate still exists.

5. Roughly 21% of Americans were insured by Medicare in 2019.

Statista

Statista

Jama Network

Coverage Trends Under President Trump

Gains in healthcare coverage under President Obama began to reverse under President Trump. The CDC reported that the number of uninsured rose from 28.2 million in 2016 to 32.8 million in 2019, an increase of 4.6 million or 16%.

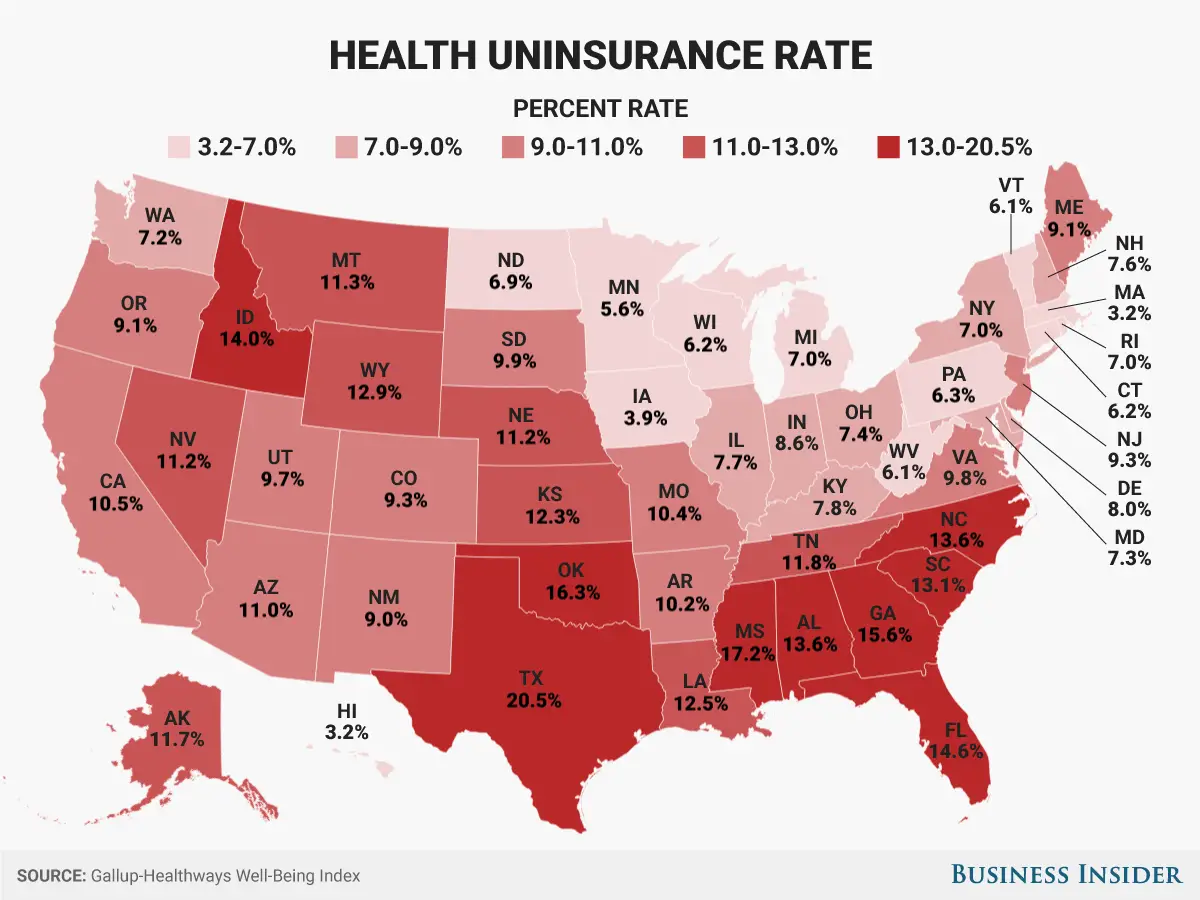

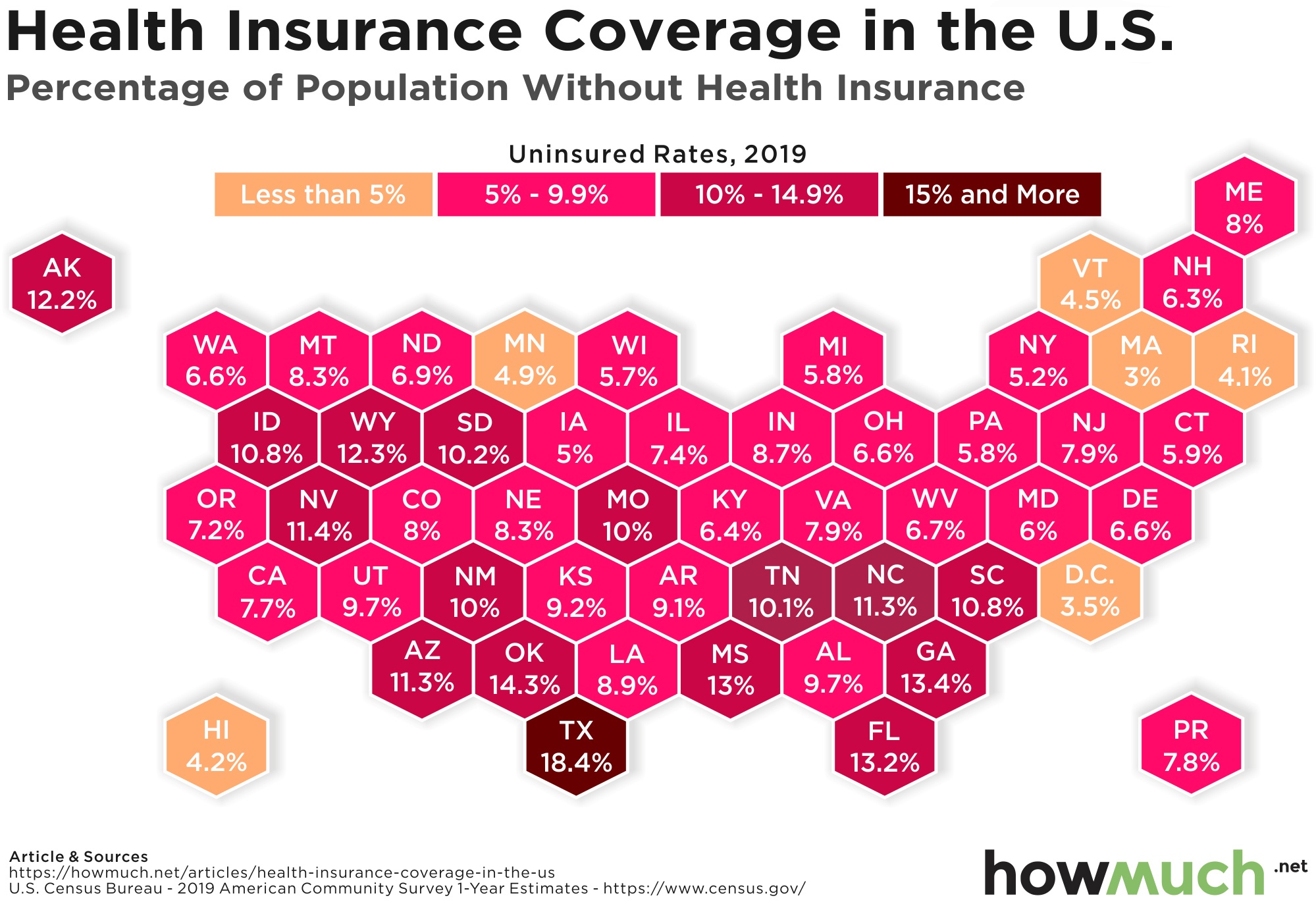

The Commonwealth Fund estimated in May 2018 that the number of uninsured increased by 4 million from early 2016 to early 2018. The rate of those uninsured increased from 12.7% in 2016 to 15.5%. This was due to two factors: 1) Not addressing specific weaknesses in the ACA and 2) Actions by the Trump administration that exacerbated those weaknesses. The impact was greater among lower-income adults, who had a higher uninsured rate than higher-income adults. Regionally, the South and West had higher uninsured rates than the North and East. Further, those 18 states that have not expanded Medicaid had a higher uninsured rate than those that did.

Approximately 5.4 million Americans lost their health insurance from February to May 2020 after losing their jobs during the COVID-19 recession.The Independent reported that Families USA report “found that the spike in uninsured Americans â adding to an estimated 84 million people who are already uninsured or underinsured â is 39 per cent higher than any previous annual increase, including the most recent surge at the height of the recession between 2008 and 2009 when nearly 4 million non-elderly Americans lost insurance.”

Also Check: Can I Have Dental Insurance Without Health Insurance

Who Are The Remaining Uninsured And Why Do They Lack Coverage

-

While the Affordable Care Act expanded health insurance to millions of Americans, an estimated 30.4 million people were uninsured in 2018. Concern about the cost of insurance is a key reason why many are uninsured.

-

Nearly half of uninsured adults may be eligible for subsidized insurance through the marketplace or their states expanded Medicaid program

-

While the Affordable Care Act expanded health insurance to millions of Americans, an estimated 30.4 million people were uninsured in 2018. Concern about the cost of insurance is a key reason why many are uninsured.

-

Nearly half of uninsured adults may be eligible for subsidized insurance through the marketplace or their states expanded Medicaid program

The Affordable Care Act brought sweeping change to the U.S. health care system, expanding comprehensive health insurance to millions of Americans and making it possible for anyone with health problems to get coverage by banning insurers from denying coverage or charging more because of preexisting conditions. In 2018 there were 18.2 million fewer uninsured people in the U.S. than when the ACA became law.1 In addition, fewer people are forgoing health care because of cost or reporting high out-of-pocket costs relative to their income.2