Types Of Health Coverage

There are multiple types of health insurance plans. Understanding the difference between each plan type can help you select the best provider depending on your needs. Lets take a look at 4 of the most common types of health insurance plans.

Keep in mind that not every health insurance provider offers every type of plan. Some providers only offer 1 plan type, while others offer all 4. Make sure you consult with your plan provider and understand the plans structure before you lock yourself into health insurance.

Private Health Insurance On The New York Marketplace

Health insurance plans in the private market in New York are available in different metal tier options, including:

In some cases, your income level may make you eligible for even cheaper plans or more coverage benefits than the ones listed in MoneyGeeks analysis.

New York residents with an income level that is between 100% and 400% of the federal poverty level are eligible for premium tax credits. In a two-person household, this means with an income level of between $17,420 to $69,680, you can get tax credits on your health insurance premiums.

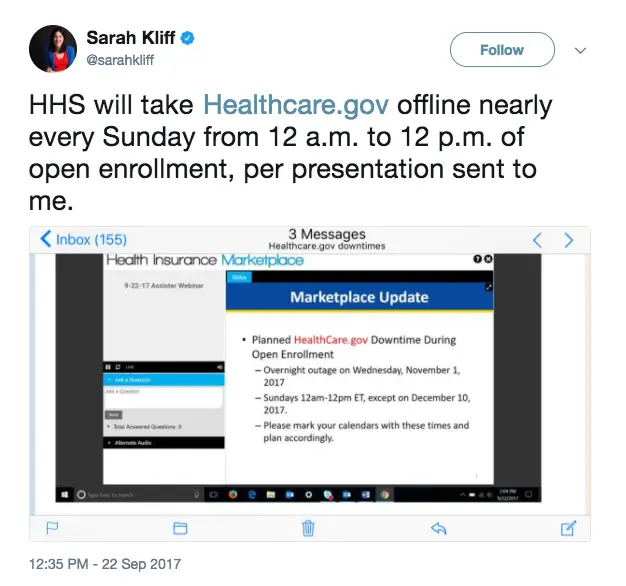

When you want to enroll in a new healthcare plan or renew your existing one from the New York Insurance Marketplace, you have to do it during a specific period referred to as the open enrollment period. Before the COVID-19 pandemic, the open enrollment period was between November and December. However, due to the pandemic, the enrollment period has been extended.

In New York, if your income is 138% to 250% of the federal poverty or between $24,040 to $43,550, you qualify for cost-sharing reductions if you buy a Silver health insurance plan. With the reductions, your out-of-pocket maxes and coinsurance payments will be lower, and you can even get a Gold plan at the same rates as a Silver plan.

Premium Tax Credits: Best For Marketplace Savings

Depending on family size and income, you may be eligible for premium tax credits. When you apply for health insurance through the Marketplace, you are expected to estimate your annual income for that term year. You may qualify for a premium tax credit toward your monthly health insurance premium based on your income information. If you have used more than your credit allowed by the end of the year, you will have to pay back that difference, but if you used less, you would receive that difference.

Also Check: Which Health Insurance Company Is The Best For Medicaid

Individual New York Health Insurance

Individual New York health insurance plans are for persons:

- That are between the ages of 19 and 64 or

- That are dependents between the ages of 0 to 26

- Who dont have a health insurance plan at their work,

- OR, who dont qualify for their health insurance plan at work because they are part-time or recently hired and havent completed the waiting period

- Who are dependents age 26 or under, n an individual health insurance plan

- OR are dependents age 26 or under, of a person who doesnt qualify for their health insurance plan at work because they are part-time or recently hired and havent completed the waiting period

- BE ADVISED that if you purchase a plan from the New York State exchange and the plan is canceled mid-year, you cannot go back onto a plan until the next Open Enrollment or unless you have a qualifying event. However, you may be able to join an Association and get an Off-Exchange plan, that usually has a larger network of providers.

Open Enrollment In New York

Open enrollment in New York is from Nov. 16 to Jan. 31 each year. This is a few weeks later than the open enrollment period in most other states, which goes from Nov. 1 through Jan. 15.

In New York, if you buy a health plan before Dec. 15, then the plan will begin on Jan. 1. Enrolling before Jan. 15 will give you coverage that starts on Feb. 1. And if you sign up during the last few weeks of January, your plan will begin on March 1.

Recommended Reading: How Much Does Health Insurance Cost An Employer

Medicaid Cancer Treatment Program

This is a New York health insurance Medicaid program for qualified beneficiaries who need treatment for breast, cervical, colorectal, or prostate cancer. It cannot be extended to include family members or dependents. Read More

To be enrolled in the MCTP in New York, you need to complete an application with a New York State Department of Health Cancer Services Program trained designee and/or be referred to the program by a Designated Qualified Entity , who is a person trained by the New York State Department of Health to assist individuals to complete the MCTP application.

Full Medicaid benefits are provided for those enrolled in the MCTP for an initial period which is determined by the type of cancer or precancerous condition of the person receiving treatment.

To be eligible for the MCTP, you must:

- Be under the age of 65

- Have an income at or below 250% of the Federal Poverty Level

- Not be covered under any creditable insurance

- Be ineligible for Medicaid under other eligibility groups

- Be a resident of New York state and a U.S. citizen or eligible alien

- Have been screened by a NY State licensed health care provider or by another states National Breast & Cervical Cancer Early Detection Program.

For Additional Information be sure to call TEL: 866-442-2262

What Is The Best Health Insurance Plan In Nyc And Brooklyn

Healthfirst has the best deal on high-quality plans in New York City, with Silver-tier coverage costing $735 per month. For a well-rated plan with a wider network of doctors, choose Empire Blue Cross. And the cheapest plans in NYC are from Fidelis Care and MetroPlusHealth, which could save you about $75 per month but have lower ratings of three out of five stars.

You May Like: Is There Private Health Insurance In The Uk

Small Business As Owners

If you are a small business owner in New York and would like to offer health insurance to your employees, there are many benefits to doing so.

You may qualify for the Small Business Health Care Tax Credit that would cover up to 50% of the cost the employer pays for their employees insurance premiums. The eligibility requirements are:

- Your business has 25 or fewer full-time or full-time equivalent employees.

- Your business pays an average annual salary of less than $53,000 a year per worker .

- Your business is contributing at a minimum of 50 percent toward the cost of employee premiums.

- Your business offers a Small Business Health Options Program plan coverage for all full-time employees.

It should be noted that eligibility is based on the number of full-time employees, rather than the number of total employees businesses with part-time workers may also qualify for the credit even if more than 25 workers are under their employ. Further information on this can be found in New York Small Business Health Insurance.

If you are a NY small business owner with fewer than 10 full-time employers with an average annual salary of $25,000 or less, you may still be entitled to the full tax credit. For those companies with a higher number of full-time workers and higher salaries, the amount of credit is reduced.

Is Private Health Insurance Better Than Nhs

The NHS is an excellent option for those who want quality care at a low cost but it has significant issues in terms of funding and oversubscription. Private treatment, on the other hand, is a great choice if you are looking for excellent facilities, short waiting times and a more personalised service.

Recommended Reading: How To Get Massachusetts Health Insurance

Medicare Advantage In New York

Medicare Advantage plans are another option. These bundled plans must cover everything in original Medicare, and they often include prescription drug coverage, too. Depending on the plan, you could also get other types of coverage, such as dental care, vision care, or even gym memberships.

When you start shopping for Medicare plans in New York, youll notice there are plenty of options. Here are some of the insurance companies that sell Medicare Advantage plans in New York for 2022:

In total, you have 12 different types of Medigap plans that are available to choose from this year if you live in New York.

In New York State, youre eligible for Medicare if you fall into one of the programs eligibility groups:

- youre age 65 or older

- youre under age 65 and have received Social Security Disability Insurance for 24 months

- you have end stage renal disease or amyotrophic lateral sclerosis

If you qualify for Medicare based on your age, your first chance to apply is during your initial enrollment period. This period starts 3 months before the month you turn 65 and ends 3 months after your birthday month. You can sign up for Medicare at any time during this 7-month period.

If you miss your initial enrollment period, you can sign up for Medicare during the General Enrollment Period. This runs from every year. Note that if you sign up late, you may need to pay higher monthly premiums for your coverage.

Does Premium Mean Yearly

An insurance premium is a monthly or annual payment made to an insurance company that keeps your policy active. Health insurance, life insurance, auto insurance, disability insurance, homeowners insurance, and renters insurance all require the policyholder to pay a premium to continue receiving coverage.

You May Like: How Do Business Owners Get Health Insurance

Icanconnect New York State

This New York health insurance program is managed by the Helen Keller Services for the Blind and it provides support which allows Read More

Assistance provided by iCanConnect in New York State includes:

- Computers and access to the Internet

- Possible installation and training of essential equipment

See iCanConnect New York State for further details.

Pros And Cons Of The Best Health Insurance Plans In New York

When selecting a health insurance plan, its important to consider both the pros and cons. Private health insurance plans tend to have higher premiums, but they also often provide more comprehensive coverage. Medicaid is a great option for those with limited incomes, but it may not cover all medical expenses. Medicare is generally more affordable than private insurance, but there are still some out-of-pocket costs for certain services. The ACA provides subsidies to help reduce the cost of health insurance for those who qualify.

Its also important to understand the coverage limits and cost-sharing requirements of a plan before signing up. Make sure you understand the terms and conditions of a plan before making a final decision.

You May Like: Do Any Real Estate Companies Offer Health Insurance

What Is Health Insurance

Health insurance policies are contracts that require an insurer to pay some or all of a beneficiary’s health care expenses in exchange for a premium and deductible. Plans cover preventive care and emergency medical services arising from an injury or illness. They may also offer optional coverage for dental and vision.

How Does Medicaid Coverage Work

If you apply for Medicaid in New York, you will be asked to select a health plan managed by an insurance carrier, such as UnitedHealthcare or Empire BlueCross BlueShield. These insurance companies also sell individual health insurance policies and small-business coverage, and the plans themselves operate similarly.

Each Medicaid plan will come with a network of doctors and health care providers that accept the insurance.

However, health plans offered as part of the Medicaid program may have a different network of doctors when compared to other plans offered by the same insurance carrier. If you have a physician you prefer, itâs important to make sure they are covered in the new network.

Also Check: Is Erectile Dysfunction Covered By Health Insurance

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

Child Health Plus Coverage For Children

In New York, Child Health Plus is a health insurance program for children in households that have incomes that are too high to qualify for Medicaid but are less than 400% of the federal poverty level.

The cost of the Child Health Plus plan is based on family size and household income, and the monthly cost per child ranges from $0 to $60.

Maximum monthly income per number of children to be eligible for Child Health Plus

| Cost per month |

|---|

Read Also: What Is Free Health Insurance

Average Cost Of Health Insurance In New York

In New York, it costs an average of $776 per month for health insurance, based on an individual buying a Silver health insurance plan.

Health insurance is offered at five different tier levels in New York: Catastrophic, Bronze, Silver, Gold and Platinum. Our analysis excludes Catastrophic plans because of their limited availability.

Find Cheap Health Insurance Quotes in New York

Who Qualifies For Medicaid In New York

To be able to get Medicaid in New York State, you have to meet certain requirements. The government only provides healthcare support to individuals in qualifying situations, so itâs important to analyze your situation first before attempting to apply. Medicaid healthcare is only offered to people who arenât able to pay their medical bills. Individuals who meet this criteria may be on Supplemental Security Income or be facing other circumstances that make it difficult to pay for adequate healthcare.

Medicaid is available to both children and adults, though different provider plans must be chosen based off of age group and personal healthcare requirements. Older individuals may need to choose a Managed Long-Term Care Medicaid plan, while children need a plan that specializes in covering childrenâs healthcare costs. People with mental or physical disabilities must also choose a plan specific to them to ensure the best possible coverage and care.

For average individuals between the ages of 19 and 65+, these are the requirements that you must meet to qualify for Medicaid in New York:

â Proof of United States citizenship Medicaid in New York is currently only offered to United States citizens. To prove your citizenship you can provide one of the following documents: a valid American passport, a birth certificate, certificate of citizenship, or a naturalization certificate.

â Marriage license

â Social security number

Don’t Miss: How To Find Health Insurance In Texas

New York Health Insurance Laws

The Affordable Care Act limits what restrictions and exclusions insurance companies can use to price your policy.

- Pre-existing conditions: Pre-existing conditions can’t be considered by insurance companies. People used to pay more for health insurance if they had a pre-existing condition, but the ACA now limits insurance companies from charging higher rates.

- Gender: According to a study by Health Services Research, women historically pay more for health care. The ACA mandates that insurance companies can’t charge men and women different prices for the same plan.

- Insurance and medical history: Before the ACA, people with previous medical problems or lapses in insurance coverage would often have to pay more for coverage. Thats no longer the case.

New York has a Family Planning Benefit Program, which requires insurance providers to offer some coverage for the following services for families:

- Pregnancy testing and counseling

- Screening and treatment for sexually transmitted infections

- HIV counseling and testing

- Most FDA approved birth control methods, devices, and supplies

- Emergency contraception services and follow-up care

- Transportation to family planning visits

Read the entire list on the New York State Department of Health website.

Cheapest Out Of Network Health Insurance Plan In New York

In New York, you can choose between two different types of plan types available. The most appropriate plan for you will depend on your specific healthcare needs and preferences. The most common type of plan in New York is Out-of-Network plan, but you can also opt for an In-Network plan.

OON plans are the most common type in New York. With this type of plan, you are not restricted to a list of providers specified by your insurer. This means that you can go to providers who do not have a contract with your insurer. However, with an OON plan, your copay costs may be higher since the provider does not have a contract with your insurer.

INN plans are different from OON in that your plan will restrict you to providers who have a contract with your insurer or in-network providers. The deductibles and coinsurance costs for INN plans are usually lower.

In New York, the cheapest Silver plans for NNO and INN plans are:

- Cheapest INN Silver plan: IND Destination 65, Silver, NS, INN, Blue Marketplace, Dep25 offered by BlueCross BlueShield of Western New York for roughly $491 per month.

- Cheapest OON Silver plan: IND POS 7000, Silver, NS, OON, Blue Marketplace, Dep 25 offered by BlueCross BlueShield of Western New York for an average of $496 monthly.

Also Check: Do You Pay Monthly For Health Insurance

How To Apply For Medicaid In New York

In the state of New York, Medicaid applicants are separated into 2 different groups: MAGI and non-MAGI applicants. The Medicaid application process is different depending on which group you fall into.

Children under the age of 19,

Relatives of parents or caregivers

Childless adults between the ages of 19 and 64 who are not pregnant and who do not have and do not qualify for Medicare, but who have a certifiable disability,

Women who are receiving fertility treatments,

FPBP beneficiaries.

Medicaid applicants who fall under the MAGI applicant category must apply through the New York State Department of Health Marketplace.

Non-MAGI applicants include people in the following groups:

AIDS Health Insurance Program

Medicaid Savings Program

Social Security Income recipients

ADC-related medical needy individuals

COBRA

People age 65+ who are not relatives of parents or caregivers

People who are blind or disabled, but who do not fall into any of the MAGI applicant categories

Medicaid Buy-In for People with Disabilities

Residents of Adult Home by LDSS, OMH Residential Care Centers/Community Residences

For non-MAGI applicants, its necessary to apply through your local Department of Social Services.

For both MAGI and non-MAGI applicants, the final Medicaid application can be submitted in the following ways:

Apply online Visit the New York State Department of Health Marketplace website to access the online Medicaid application.