How Pet Insurance Works In New Jersey

Most pet insurance in New Jersey reimburses you after submitting a claim, and because the insurance company pays you back – instead of paying the veterinarian directly – you dont have to worry about being in-network. In New Jersey, your pet insurance will work at any licensed veterinarian.

Heres an example of how the claim process works:

- You pay for the vet treatment your pet needs.

- You submit a claim to your pet insurance company.

- The pet insurance company reimburses you 70%, 80%, 90%, or even 100% of the covered costs .

Group Coverage Also Known As Employer

Companies that provide health insurance to employees as a benefit provide an insurance type known as group insurance. The cost of this type of health plan is based on total premiums paid to the insurance company. Premiums include payments from both employers and employees. Premiums do not include payments for services such as deductibles, co-pays or other out-of-pocket costs. Group coverage includes: Health Maintenance Organizations , Preferred Provider Organizations , Point-of-Service Plans and High-Deductible Health Plans.

When Do I Need To Enroll

Those needing to purchase health coverage through the state marketplace can compare available 2022 health and dental plans, then choose a plan by Dec. 31 for coverage beginning Jan. 1, 2022.

Otherwise, consumers can enroll by Jan. 31, 2022 for coverage beginning Feb. 1, 2022.

The COVID-related enrollment period has overlapped with the start of open enrollment for 2022 coverage.

A total of 53,554 people had already signed up for coverage seven months into the Special Enrollment Period between February to Aug. 1, opened by the state due to COVID-19.

You May Like: How Much Does Blue Cross Health Insurance Cost

Your Situation Can Help You Determine The Right Plan

Our health insurance plans are as different as the people they protect, so its important to understand what kind of plan best fits your needs. We offer a variety of family and individual health plans so whatever your situation, AmeriHealth New Jersey can meet your needs. To learn about and compare AmeriHealths individual health insurance plans, you can go straight to Individual health insurance plans explained.

To start, tell us a little bit about yourself, and we can help you pinpoint the things you should pay attention to when picking a health plan.

Is Pet Insurance Worth The Cost In New Jersey

The number of insured pets is increasing nearly 20% every year – and with good reason. After surveying more than 20,000 pet owners, we found thatcould not afford to pay for an unexpected $5,000 veterinary bill without pet insurance.

Of more than 20,000 pet owners,Considering 47.40% of New Jersey households are pet owners, pet insurance is a great tool to hedge financial risk. Like auto-insurance, its something you have but hope not to use – but if an unexpected tragedy does strike youll be reimbursed 70% to 90% of the costs . Getting pet insurance in New Jersey can help ensure that your dog or cat will get the care they need. It allows you to focus on doing the right thing, rather than costs.

Here are the metro areas across New Jersey with the most interest in pet insurance:

Read Also: Are Daca Recipients Eligible For Health Insurance

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

How Much Is Health Insurance

The average American spent $3,667 on health insurance in 2020, according to the Bureau of Labor Statistics. And per to the Kaiser Family Foundation, the average persons monthly premium for plans made available through the Affordable Care Act during open enrollment for 2019 was $612, before subsidies. Thats 1.5% less than 2018 but about 29% more than 2017 .

Recommended Reading: Starbucks Part Time Insurance

Recommended Reading: How To Get Prescriptions Without Health Insurance

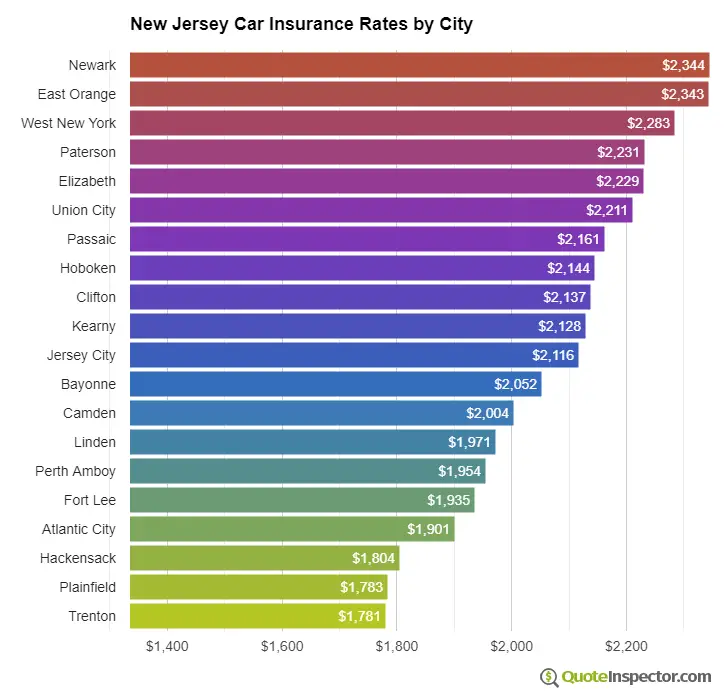

New Jersey Car Insurance Rates By Insurance Company

Every auto insurance company in New Jersey has its own rating system, meaning that the premiums offered for the same coverage will typically be different. If you are shopping for auto insurance coverage, it may be a good idea to get quotes from several different providers. However, price isnt the only factor to consider. Even if you are looking for the cheapest car insurance in New Jersey, you may still want to think about a companys financial strength scores, customer satisfaction scores, coverage options, discounts and policy features.

| Car insurance company |

|---|

Coverage.com, LLC is a licensed insurance producer . Coverage.com services are only available in states where it is licensed. Coverage.com may not offer insurance coverage in all states or scenarios. All insurance products are governed by the terms in the applicable insurance policy, and all related decisions and policy obligations are the sole responsibility of the underwriting insurer. The information on this site does not modify any insurance policy terms in any way.

How Much Is Car Insurance In New Jersey By Age

A drivers age is one of the major factors that determine the cost of auto insurance. Younger drivers are viewed as inexperienced and have a higher risk of getting into accidents, which can increase their premiums significantly.

Getting added to a parents policy can make teen auto insurance more affordable. The average annual cost of a policy for a 16-year-old is $4,172, in contrast to $1,674 for a 40-year-old driver holding the same policy.

In New Jersey, auto insurance rates for first-time drivers are similar to those of teen drivers as both groups are viewed as risky.

Average Costs of Full Coverage Car Insurance in New Jersey – By Age

Scroll for more

Recommended Reading: How To Pass The Life And Health Insurance Exam

Average Health Insurance Rates By Plan Type

Another distinction between plans that can change the rates you pay is the type of network the plan uses.

Depending on whether the plan is a preferred provider organization , health maintenance organization , exclusive provider organization or point of service , access to health care providers will be managed in different ways.

HMOs tend to be the most restrictive about which doctors you can see and what you need to do in order to see them. This usually means that the insurers save on your cost of care and thereby provide lower premiums.

| Type |

|---|

Policy premiums are for a 40-year-old applicant.

Change In Average Health Insurance Cost For 2022

From 2021 to 2022, health insurance rates across the nation increased by less than 1%. South Dakota saw the largest year-over-year jump in health insurance costs for a 40-year old on a silver plan increasing just over 23%. Including South Dakota, 27 states had their rates increase on average from 2021 to 2022.

Year-over-year rates decreased the most in Georgia, South Carolina and Nebraska, which all fell by more than 10% . Overall, 21 states experienced a decrease in health insurance premiums. Two states Idaho and Virginia saw no year-over-year change.

| State |

|---|

Recommended Reading: Does Aarp Have Health Insurance Plans For Under 65

What Is The Average Cost Of Health Insurance

Maybe youre wondering, How much does individual health insurance cost? Heres what you can expect. The average individual in America pays $452 per month for marketplace health insurance in 2021.2 The average family pays $1,779 per month.3

But the cost of health insurance varies widely based on a bunch of factors. Some things are in your control, some arent. Things like your age, how many people are on your plan, how much coverage you need, where you live and who your employer is all play a role in the price of your coverage.

Heres a breakdown showing the average costs depending on your state:

Kaiser Family Foundation, 2021.

New Jersey Health Insurance: Find Affordable Plans

See how you can get cheap health insurance in NJ, including marketplace plans, Medicare, and Medicaid.

New Jersey residents have access to several types of health insurance. You can enroll in employer-sponsored coverage through your job, buy a private plan, or even sign up for Medicare or Medicaid.

This guide explains your New Jersey affordable health insurance options in detail.

Read Also: Can You Get Supplemental Health Insurance Through Obamacare

Can You Get Cheap Health Insurance In New Jersey

New Jersey offers Medicaid coverage to residents with low income as well as the aged, blind, and disabled. Older residents may also qualify for institutional/nursing home Medicaid, which has a higher monthly income limit than the other plans. NJ FamilyCare offers coverage for certain residents who earn too much to qualify for standard Medicaid.

What Plans Are Available

GetCoveredNJ plans are organized into five categories:

- Bronze plans have the lowest monthly premiums and the highest deductibles and copays, and cover roughly 60 percent of care costs. Theyre designed to help you in case of serious illness or injury.

- Silver plans have moderate monthly premiums, deductibles and copays. They cover between 70 and 94 percent of care costs, depending on how much financial help you qualify for. Theyre the only plans eligible for cost-sharing subsidies.

- Gold plans have higher monthly premiums and lower deductibles and copays, and cover roughly 80 percent of care costs.

- Platinum plans have the highest monthly premiums and the lowest deductibles and copays, and cover roughly 90 percent of care costs. These are for people who have significant health care needs and are willing to pay the highest premiums. No platinum plans are currently offered by GetCoveredNJ.

- Catastrophic plans have low monthly premiums but a very high deductible. Theyre available to individuals under age 30 and to those who qualify for a hardship exemption. These are an affordable way for people to protect themselves from the costs of a serious illness or injury, but people with these plans pay most routine medical expenses themselves.

Use the states Shop and Compare Tool to compare plans and costs based on your income, household size and county of residence.

Recommended Reading: What Is 0 Deductible Health Insurance

Is There Any Other Financial Assistance Available

Yes. If you qualify for a premium tax credit, you may also qualify for a cost-sharing reduction that would help you pay for such out-of-pocket expenses as deductibles and copays. You must enroll in a Silver-level plan to get this assistance. The state is also offering a subsidy, called New Jersey Health Plan Savings , that helps lower your premiums. New Jersey residents qualify for these savings based on income. In 2023, an individual earning up to $81,540 and a family of four earning up to $166,500 are eligible. Those who qualify can see their lower premium using GetCoveredNJs Shop and Compare Tool or after filling out an application.

Nj Public Workers Face Big Increase In Health Insurance Rates In Coming Year

Hundreds of thousands of public workers, early retireesm and school employees in New Jersey are facing potential rate increases of as much as 24% for health benefits under proposals being considered by the State Health Benefits Commission.

Rate increases being considered include a 24% increase for medical and a 3.7% increase for pharmacy benefits for active public workers, as well as a 15.6% increase in medical and a 26.1% increase in pharmacy benefits for public workers who retired before the age of 65, according to an email sent to county administrators from New Jersey Association of Counties Executive Director John Donnadio.

Donnadio said in the email that the figures, which havent been made public, were shared by an insurance and benefits broker.

StateTreasury spokeswoman Jennifer Sciortino acknowledged rate increases were being considered and added that rates for active members and early retirees would likely increase between 12-20% across the various plans for the upcoming year.

A vote to approve the rate increases was scheduled for Monday, but the state health benefits board and the Division of Pension and Benefits postponed the vote after acknowledging during a public meeting on July 13 that more time would be needed to address questions and concerns, Sciortino said.

Horizon administers health care plans for state and local government employees and retirees in New Jersey.

Recommended Reading: Will Health Insurance Pay For Liposuction

How Do I Enroll In New Jersey’s Health Insurance Marketplace

To enroll in New Jerseys health insurance marketplace, visit the GetCoveredNJ website. If its your first time visiting the site, follow the instructions to create an account. Youll need to provide some basic details, such as your name and contact information. If you already have an account, log in with your username and password.

If youre applying during open enrollment, you can simply fill out the application, compare plans, and sign up for the plan that best meets your needs. Youll also have an opportunity to see if you qualify for help paying your health insurance premiums. If youre applying outside of open enrollment, youll need to select a qualifying life event from the list provided. Qualifying events include marriage, loss of coverage, and loss of eligibility for Medicaid or NJ FamilyCare.

To compare plans, enter your ZIP code, your date of birth, and your annual household income. If other people in your household need coverage, enter their dates of birth. Youll be able to review available plans, check their monthly premiums, and explore the services each plan covers.

If you need local assistance, you can use the Find Local Assistance tab in the portal to find a Certified Navigator. The following companies offer health

The following companies offer affordable health insurance in New Jersey:

- Aetna CVS Health

- WellCare Health Insurance Company of New Jersey, Inc.

Private Health Insurance On The New Jersey Marketplace

Private health insurance in the New Jersey marketplace is categorized by metal tiers. These tiers determine the split of costs between the insurer and the policyholder, along with the premiums, deductibles and out-of-pocket costs.

The state of New Jersey has three metal tiers:

- Bronze: The Bronze tier has the cheapest plans but also has the highest out-of-pocket expenses. Routine care such as checkups will have to be covered by the policyholder, which makes this best suited for individuals in good health who want some form of protection in case of a major accident.

- Silver: Silver plans offer the best balance between premiums and out-of-pocket expenses. They can also offer the most value for your money, as qualified individuals can get discounts or tax premiums on plans from this tier.

- Gold: The most expensive tier in the state is the Gold tier. It has the highest premiums and the lowest out-of-pocket expenses, which means coverage can kick in sooner. This is suited for those who frequently need medical care or have expensive prescription drugs.

If your income falls between 100% and 400% of the federal poverty level, you may be able to get even cheaper coverage than the plans listed in MoneyGeeks study. For instance, a two-person household in New Jersey making anywhere between $17,420 and $69,680 per year may qualify for discounts or better coverage. To find out how much you can save based on your income level, check out HealthCare.govs calculator.

Don’t Miss: Can You Put A Parent On Your Health Insurance

What Are The Best Individual Health Insurance Plans In New Jersey

The best individual health insurance in New Jersey depends on your health care needs. If you use insurance frequently, you may do best with a Gold plan. Gold plans have higher monthly rates but can be cheaper for frequent users because you pay less for deductibles and office visits. Bronze plans have cheaper premiums but higher deductibles and copays, so they are usually best for people who use their insurance less often.

Veterinary Costs In New Jersey

- New Jersey has some of the highest counts of tick-borne illnesses, including Lyme disease

- CNBC reports that in any given year, 1 out of 3 pets will need emergency medical treatment.

- EmergencyVetsUSA reports that the average cost of emergency vet care that requires hospitalization for 1-2 days is $600-$1700, while surgery in the pet ER can easily cost up to $5,000.

- Nearly 60% of dogs are either overweight or obese

- 80% of dogs will have some sign of dental disease by the age of two

- The Veterinary Cancer Society estimates that almost 50% of dogs over the age of 10 will develop cancer.

in New Jersey are higher than average in the U.S.This means the risk of having an expensive, unexpected vet bill is significantly higher.

* The New Jersey vet cost prediction listed above refers to the difference in health coverage premiums for a 6-month-old pet in NJ compared to the national average. We used premiums in this analysis becasue theyre heavily correlated to a locations veterinary costs.

Also Check: Can My Girlfriend Be On My Health Insurance

New Jersey Insurance Faqs

Does New Jersey require health insurance?

Yes, New Jersey requires most residents to have health insurance. This is a provision of the New Jersey Health Insurance Market Preservation Act. If you dont have minimum essential coverage or qualify for an exemption, youll have to make a shared responsibility payment when you file your annual tax return. Exemptions are only available to residents who dont have affordable coverage options, have limited incomes, are able to demonstrate some type of hardship, or only have a gap in coverage for a short amount of time.

Do I have to use the Health Insurance Marketplace in New Jersey?

New Jersey is one of 14 states operating its own health insurance exchange, GetCoveredNJ. Since New Jersey has its own exchange, you wont use HealthCare.gov to shop for marketplace plans.

What types of alternative health insurance plans are available in New Jersey?

New Jersey has several faith-based programs in which members pool their funds to share medical expenses. These plans dont meet the requirements for minimum essential coverage however, members are exempt from the shared responsibility payment as long as they belong to a cost-sharing ministry that has been sharing medical expenses continuously since .

Do I need health insurance if I have an HSA/FSA?

Do I need short-term disability coverage in New Jersey if I have health insurance?

Do I need long-term disability coverage in New Jersey if I have health insurance?

What does NJ FamilyCare cover?