Commissions Relative To Other Opportunities

In my experience talking with former Assurance IQ agents, commission levels are lower relative to other insurance sales opportunities.

The main reason is Assurance provides warm leads to its agents and expects them to focus on closing new policies, not figuring out how to generate leads.

As they say, there is no such thing as a free lunch!

And with the marketing side of things figured out, commission levels are understandably lower, as you are not carrying the risk of losing your money on bad leads.

If you are more entrepreneurially minded, you may find being an independent agent where you control your lead flow to be a better business model.

This is what I do and teach my agents to do. We have access to multiple lead vendors that makes it simpler to find quality prospects.

Yes, we have to invest in leads out of our own pocket, but our insurance commission rates are sometimes triple what other organizations are that pay for the leads.

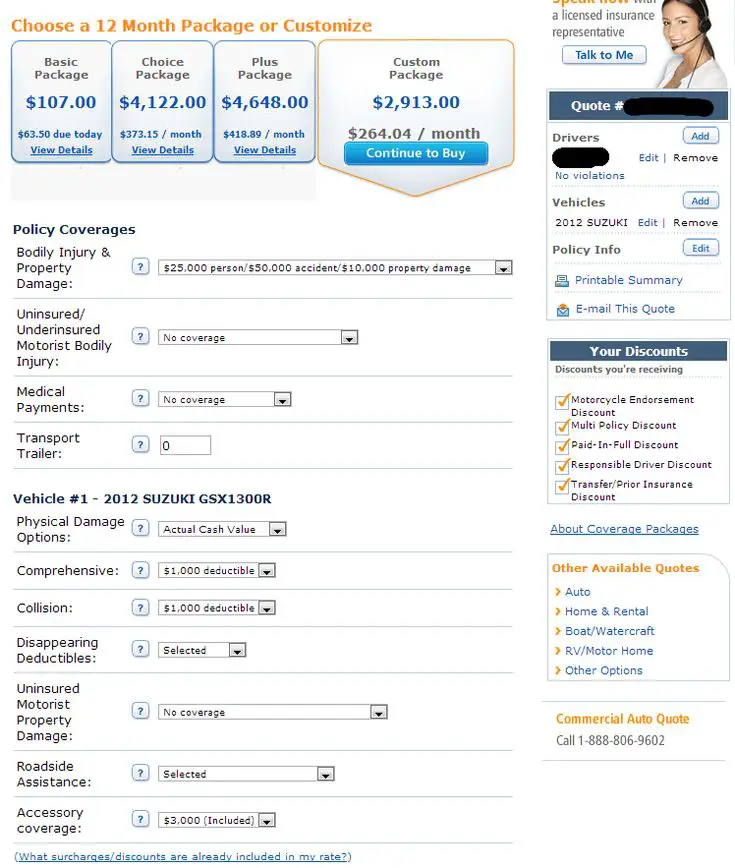

Comparing Assurant Health Insurance Quotes Online

If you arent sure if Assurant Health Insurance Company is for you, use the comparison tool on the top right side of this page to compare rates and quotes from top companies. Seeing quotes side by side can help you make the right decision.If you still have questions, you can contact an independent agent who can answer any questions and give you the additional information you need.Assurant offers many options to meet the needs a wide variety of customers. Dont go without insurance because you cant find the affordable plan you need. Compare Assurant and other top companies with the free comparison tool above, today. Get started comparing health insurance providers today!

How You Find Prospects

Assurance IQ provides you with free insurance leads, offering a steady stream of qualified, inbound shoppers who are qualified.

Assurance takes care of lead generation via marketing that costs the company more than $10 million each month.

This marketing strategy allows for a constant stream of calls.

Additionally, all of the callers that you receive as an agent have been pre-qualified by an Assurance Guide. These guides transfer the calls to agents.

You May Like: Is Health Insurance Really Worth It

What To Know About Assuranceamerica

Founded in 1998, AssuranceAmerica is a privately held company that provides property and casualty insurance to the non-standard private automobile segment.

AssuranceAmerica is headquartered in Atlanta, GA, and also operates in Birmingham, AL, Tampa, FL, and Dallas and McAllen, TX, through its subsidiaries AssuranceAmerica Insurance Company, AssuranceAmerica Managing General Agency, and InsureMax Insurance Company.

AssuranceAmerica has not been rated by AM Best or any other major financial ratings agency.

The History Of Health Shield Insurance

If youre like many people, you may be wondering if health shield insurance is actually a legit business. Well, the short answer is yes health shield insurance is a legitimate business. In fact, the history of health shield insurance is pretty interesting.The origins of health shield insurance can be traced back to the early 1900s. Back then, many people were worried about getting sick and not being able to afford to pay for medical bills. As a result, they started buying health insurance policies that would cover them in the event that they became ill.Over time, health shield insurance expanded beyond just medical coverage. Today, it also includes coverage for things like car accidents and property damage. And, of course, it also includes life insurance coverage.So whats the verdict? Is health shield insurance legit? The answer is yes its a legitimate business.

Recommended Reading: How To Register For Health Insurance

Pros & Cons To Assurance Life Insurance

Every company has a set of pros and cons. Assurance is no exception.

Below is a table that outlines most of their good and bad elements.

| High coverage limits for term and traditional whole life | When there is a waiting period, it’s three years long |

| Can usually purchase all online without having to speak with an agent | May require an exam for higher coverage options |

| The website has helpful educational life insurance content | The cost of their life insurance is higher than many other life insurance companies |

How Much Does National Family Life Insurance Cost

The price you pay for coverage with Assurance is based on which product you buy, the coverage, gender, tobacco usage, and health.

Your payment could be as low as $10 per month or as much as $500, depending on the abovementioned factors.

That said, below is a table that outlines some sample monthly National Family final expense insurance costs.

Most of their final expense is underwritten by Lumico Life Insurance Company.

Its worth noting that many customers who are looking for final expense insurance wont get immediately effective burial insurance from Lumico.

You May Like: How To Get Health Insurance In Michigan

It Looks Like Olhi May Be Able To Review Your Complaint

Of course, we still need more information from you so that we can assess whether we can in fact become involved. Before proceeding we require that you read and sign our agreement to receive Dispute Resolution Services.

After you read and sign the authorization form, we will collect information about your complaint.

Our authorization form must be completely filled out, electronically signed and dated by the person who owns the insurance policy or the person who is a member of the insurance plan through a job or association. The lines entitled Insurance Company and Insurance Company representative signature must be left blank. OLHI will have this information completed by the insurance company. If you are not the owner or member, refer to Representatives for more instructions.

To review the authorization form BEFORE signing it and submitting your complaint, .

Votre Abonnement A Bien T Pris En Compte

Vous serez alerté par email dès qu’un article sera publié par la rédaction sur :Social, santé

Vous pouvez à tout moment supprimer votre abonnement dans votre compte .

Choisissez vos sujets d’actualité préférés dans .

Être alerté en cas de changement

Ce sujet vous intéresse ?Connectez-vous à votre compte et recevez une alerte par email dès qu’un article sera publié par la rédaction sur :Social, santé

Recommended Reading: What Is The Best Health Insurance For College Students

Monthly Healthcare Insurance Blog Articles

Assurance offers targeted, expert advice through our Healthcare Blog. This gives our clients a competitive advantage for minimizing risk and lowering insurance premiums. Each month, we provide industry specific pieces designed to control and decrease loss costs throughout the entire gamut of healthcare. We educate on everything from coverage options to risk management programs and the Affordable Care Act.

National Family Assurance Life Insurance Reviews & Complaints

Although the BBB accredits them, they still have an unusually high amount of complaints.

Since they operate under two brand names, there are two BBB profiles to consider:

- National Family: As of 7/7/2022, the BBB review score is 1.04/5, with 110 complaints over the prior 36 months. On Trustpilot, their review score is 2.8/5 with a total of four reviews.

- Assurance: As of 7/7/2022, the BBB review score is 1.39/5, with 405 complaints over the prior 36 months. On Trustpilot, their review score is much better at 4.2/5 with a total of 840 reviews.

The primary criticism policyholders and would-be customers seem to levy are nagging phone calls that dont stop.

Below is a screen capture from the BBB website illustrating such a complaint.

Don’t Miss: Which Health Insurance Is Most Widely Accepted

I Was Harassed By This Company After

I was harassed by this company after explaining to 5 different people that I was not the person they were looking for and to put my number on the do not call list. I am filing a complaint with FCC today and the BBB. I had no less than 30 calls to my phone in 1 day. Absolutely ridiculous. Do not use this company for anything they do.

Date of experience:April 12, 2022

Reply from Assurance

Thank you for your comments. We’re sorry to hear about your experience. As a company, we’re committed to the success of our agents, associates, and customers, which is why we truly appreciate your feedback so we can continue to improve.

This Was Probably The Easiest Thing To

This was probably the easiest thing to do. My agent Gay Glenn was phenomenal with helping me to understand what I am purchasing. And the application process is simple. Highly recommend Prudential.

Date of experience:August 10, 2022

Reply from Assurance

Thank you for your feedback! We’re glad to hear that you had such a wonderful experience.

Also Check: Can I Use Health Insurance For Dental

Best Online Insurance Company

This is a wonderful place to buy a health insurance policy conveniently. My purchase of a Care Health Insurance Plan was very easy and convenient. Thanks to the amazing customer service for making my purchasing experience terrific. I advise all my family and friends to buy a health insurance policy with InsuranceDekho. Just like me all of you can get protected in the comfort of your home.

They Call Claiming To Be From The Government

If the US Government needs to get in touch with you, they will either send you a certified letter via mail, or theyll show up at your door. They will never call you directly and threaten you with any type of action, and will never ask for your personal information, like your social security number or your bank information, over the phone.

Also Check: How To Get Low Health Insurance

How Does Health Shield Insurance Work

Health Shield Insurance is a type of health insurance that provides coverage for medical expenses not covered by other insurance plans. It is based on the premise that all individuals should have access to affordable, quality health care. Health Shield Insurance policies are designed to cover expenses for qualifying healthcare services, including doctors appointments, hospital stays, surgeries, and medications.

Health Shield Insurance policies are available in several different forms, including individual and family policies. Individual Health Shield Insurance policies provide coverage for one person only. Family Health Shield Insurance policies provide coverage for up to four people within a family unit.

To be eligible for Health Shield Insurance coverage, you must have medical expenses that exceed your regular insurance premiums. You must also meet certain eligibility requirements, such as having a valid health insurance policy or being covered by another healthcare plan that does not cover your qualifying healthcare expenses.

Health Shield Insurance is an affordable way to get quality healthcare coverage without having to worry about high out-of-pocket costs. If you are in need of coverage for your qualifying healthcare expenses, consider getting a Health Shield Insurance policy.

Assurant Health Insurance Company

UPDATE: Since June 15, 2015, Assurant Health has not accepted new business submissions of its major medical and Assurant Health Access insurance products after its parent company announced it was exiting the health insurance marketplace. In October 2015, Assurant announced that National General Holdings Corp. had acquired Assurant Healths supplemental and small group self-funded product lines. These products remain available under National General.Assurant Health Insurance Company offers a variety of health care options that allow customers to have the flexibility they need. Knowing a little bit about Assurant can help you decide if this company would be a good fit for you.There are many choices available when it comes to choosing a quality health insurance company. Each company offers different options, rates, coverage, or claims service.Read through our review of Assurant Health Insurance, read through Assurant reviews from customers of Assurant at the bottom of the page, and then be sure and compare health insurance quotes from Assurant and other top health insurance providers by using our free quote comparison tool in the sidebar of this page.

Read Also: How Much Is Health Insurance Out Of Pocket

Is Cigna Good Insurance

Cigna has good rates overall but below-average customer satisfaction scores. And Cigna individual health and Medicare Advantage plans are not widely available. By comparison, UnitedHealthcare and Humana sell cheap, well-rated Medicare Advantage plans throughout the U.S. For low-cost individual insurance with top ratings, consider Kaiser Permanente if plans are available where you live, or a Blue Cross Blue Shield plan with medium-range rates and good customer satisfaction scores.

Face To Face Versus Phone Sales

With Assurance IQ, your entire sales efforts are done telephonically. There is no opportunity to sell insurance face-to-face with your prospects.

Keep this in mind if youre a dyed in the wool traditional sales rep that likes meeting your clients in person.

For some, phone sales isnt an issue. For others, its a grind being chained to your desk all day making phone calls.

Read Also: How Long Can My Son Stay On My Health Insurance

They Ask For Personal Information

Never give your personal information to anyone who calls you out of the blue or shows up on your doorstep. If someone calls to talk to you about personal information and you arent sure if theyre legitimate, hang up and call them back using a number you trust, which can be found on the back of billing statements, insurance cards, or on the companys website.

Save Your Dollar: Car Rental Insurance Fees

Save a Dollar: Car Rental Insurance Fees Fraud How It Works Renting a car seems to be more popular by the day. It is mostly because the prices went down over time, while the quality of the vehicles has increased proportionally. However, there are many rental companies that use deceiving practices in order to Save Your Dollar: Car Rental Insurance Fees Read More »

Also Check: Can I Add My Undocumented Wife To My Health Insurance

What Is Health Shield Insurance

Health Shield is a health insurance company that specializes in providing coverage for high-cost medical procedures. Health Shield is separate from other health insurance companies and operates as an independent nonprofit organization. The company offers health insurance coverage for people who live in the United States, Canada, and the United Kingdom. Health Shield also offers a variety of health care benefits, such as hospital stays, surgery, and specialist visits.

The Health Shield website provides information about the companys policies and services. The website also provides information about how to enroll in Health Shield coverage and how to use the companys benefits. The website includes a FAQ section that contains answers to common questions about Health Shield coverage.

The Health Shield website provides information about the companys policies and services. The website also provides information about how to enroll in Health Shield coverage and how to use the companys benefits.

Assurant Small Business Health Insurance

Assurant also provides health insurance options for small businesses with 2-50 employees. Small business insurance plans are called Real Choices Medical Plans. This is because Assurant wants to offer business owners real choices they can pass on to their employees. Studies show that one of the major reasons for job turn over is lack of health insurance options. If employees have the options they need, they will stay at a job longer.The types of Real Choices plans offered range in their coverage and cost to give small business owners of varying levels of income choices. Major Medical is the broadest coverage option available through Real Choices. Consumer Choice Plans rely heavily on health savings accounts and reimbursement options for the insured.Another option is a Self-funded plan. This means that the employer covers all medical expenses of employees out of pocket up to a pre-determined amount. Assurant offers Stop-Loss Insurance to the employer to protect the business should a high number of claims be made during one year. In addition to this, Assurant offer Ancillary Products such as dental, life-insurance, and short-term disability.

You May Like: What Is Marketplace For Health Insurance

What To Do If Youre A Victim Of Health Insurance Fraud

If you feel youve been the victim of a health insurance scam, know that youre not alone. Youre not the first one to fall victim to their lies but with your help, you can be one of the last. In the event of a scam, take the following steps to reduce the damage as much as possible:

What Life Insurance Products Does National Family Assurance Corporation Offer

National Family Assurance has three different types of policies they offer.

Some of their plans require a medical exam, and some do not.

How much coverage you buy and the type of plan dictates whether or not you will have to undergo an exam.

Their website allows you to buy online, but many customers still need to speak with one of their agents to complete the underwriting process.

According to their website, National Family life insurance for seniors will be one of the following three types of coverage:

- Term Life Insurance: This is a level premium temporary life insurance plan that will last 10, 15, 20, or 30 years. Your age will determine how long of a term you can buy. For example, if you are 70, they will only offer you a 10-year policy. Additionally, depending on your age and health, you might be able to buy up to 1 million dollars in coverage. The coverage you buy will never decrease as time goes on. How much life insurance you can buy and how long it lasts depends on your age.

- Whole Life Insurance: This is a permanent contract with fixed premiums for the policys life. It will never expire due to age, and the coverage will never decrease in value. Depending on your age and health, they claim you can apply for up to 1 million dollars in coverage.

Like every life insurance company, all their products come with a money-back guarantee .

Assurance does not offer universal life insurance or accidental death coverage.

You May Like: How Much Does A Family Health Insurance Plan Cost