Consider The Services You Need The Most

Suppose youre one of the 3 in 5 U.S. adults with a chronic health condition. If so, you likely visit one or more doctors frequently and take prescription drugs. As a result, you want to become more fit to improve your health and reduce your symptoms.

Additionally, lets say you do a lot of domestic and international travel. In this case, you may be at a higher risk of travel-related illnesses.

Using the example above, the health insurance plan you need should:

- Provide coverage for your needed prescription drugs

- Offer exercise, fitness, or gym membership programs

- Provide free or discounted vaccines for travel safety

- Include domestic and international emergency coverage

Once you find plans that meet your needs, check their insurance terms and conditions. They should indicate the level of coverage provided and which services are free. They must also be clear on requirements and exclusions .

How To Choose The Right Health Insurance Plan For You

Choosing the right health insurance plan for you can be a difficult and confusing task. There are many different factors to consider when choosing a health insurance plan, such as cost, coverage, network, and more. It is important to do your research and compare different plans before making a decision.There are a few things to keep in mind when choosing a health insurance plan:1. Cost: Health insurance plans can vary greatly in cost. It is important to find a plan that fits your budget. Consider how much you are willing to pay per month for premiums, deductibles, and copayments/coinsurance.2. Coverage: Make sure the plan you choose covers the services you need. Each health insurance plan has different coverage levels, so it is important to understand what is covered under each one.3. Network: Most health insurance plans have networks of doctors and hospitals that they work with. If you have a preferred doctor or hospital, make sure they are in the network for the plan you choose.4. Plan type: There are different types of health insurance plans available, such as HMOs, PPOs, and POS plans. Do your research to understand the differences between each type of plan before making a decision.

Will This Health Insurance Plan Make It Easy To Get Care If Im Well

Remember: health care is health care. To make the most of your plan, youll want to investigate what kind of benefits it has not only when youre sick but also when youre already well.

With a better sense of how your health insurance plan will help you keep feeling your best, you can save a few trips to the doctors office .

Related questions to ask:

- Are there free services to keep me healthy? Which ones are important to me and my family?

- Will I pay anything for regular checkups, annual OB-GYN visits or routine tests?

- Will I pay anything for regular immunizations, like a flu shot?

Read Also: Does Allied Universal Offer Health Insurance

Consider A Health Savings Account

One way to potentially save yourself health care dollars is to consider signing up for a Health Saving Account An HSA is a tax-advantaged medical savings account that you can contribute to and withdraw money from for medical-related expenses on a tax-free basis. These accounts can be used to pay for a variety of health care-related expenses including out-of-pocket doctor and hospital bills, as well as dental and vision care costs. They cant, however, be used to pay monthly insurance premiums. Many high deductible plans are HSA compatible and make a great way to offset a high deductible.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: How Much Is Health Insurance Annually

When Can I Start Using My Insurance

Once you’ve signed up for a plan and paid the first month’s premium, you or your child can start using the insurance. The insurance company should send you and everyone covered by your policy insurance cards with your policy number and other information. If you or your child need to see a doctor or go to a hospital before you receive your card, call your insurance company first to make sure your family has been entered into their system.

You should also make sure that any doctor you choose for you or your child is in your insurance plan’s network. A network is made up of doctors, specialists, and other health care providers who have agreed to work with your insurance company when it comes to payments and services. If you take your child to a doctor who isn’t in your plan’s network, you may have to pay full price for some services.

Ask around and learn what you can about the primary care physicians in your plan’s network, and then choose a doctor you like. Once you’ve done that, schedule checkups and use your insurance to help keep your family healthy.

Is It Easy To Get Support And Advice With This Plan

Health care can be complicated, so its not unusual to have questions about using your insurance or getting care.

Whether its when youre signing up, searching for clinics near your vacation rental or wondering if you need to get care at 3 a.m., its vital to find a plan that makes member support easy and straightforward.

Related questions to ask:

- Can I call a 24/7 nurse line whenever I have a health question?

- Who will I call if I have a question about my insurance? When are they available?

- Are there people available to help me and my family pick the right plan?

- Will I know how to get in touch with the right people when I need to?

Recommended Reading: Who Accepts Bright Health Insurance

Thats How To Pick Health Insurance Companies

Always remember that in the U.S., nurses, doctors, and hospitals charge more than in other countries. Even medicines cost far more here, nearly four times more than in other developed nations. Thats why health insurance, which helps cover some of those costs, is vital to Americans.

So now that you know how to pick health insurance companies, its time to find and choose the one that suits you the most.

For more informative health, wellness, and lifestyle guides, check out more of our blog!

What About An Hdhp With A Health Savings Account

A high-deductible health plan, or HDHP, can be any one of the types of health insurance above HMO, PPO, EPO or POS but follows certain rules in order to be HSA-eligible. These HDHPs typically have lower premiums, but you pay higher out-of-pocket costs, especially at first. They’re the only plans that qualify you to open a health savings account, or HSA, which is a tax-advantaged account you can use to pay health care costs. If youre interested in this arrangement, be sure to learn the ins and outs of HSAs and HDHPs first.

» MORE:HSA vs. FSA: Differences and how to choose

Don’t Miss: How The Fuck Do I Get Health Insurance

What Do Our Plans Cover

You can tailor your coverage to include a range of healthcare needs, such as:

Estimate How Much Coverage You Need

While an insurer will help to confirm how much coverage you need, estimate the amount for yourself too.

For example, when purchasing your home insurance you’ll want to estimate enough to rebuild your home and replace your personal belongings. Consider any high-price items you own that may not be covered under a traditional allotment for personal belongings. Also, consider any specialty building materials that would make rebuilding your home to the same specifications more expensive.

Similarly, when buying car insurance, think about how much property damage and bodily image coverage you should really carry. Some states require only low or even no liability insurance, which is unlikely to cover medical bills in the event of a serious accident. Consider purchasing higher coverage policies when you can.

Also Check: How Do I Get A Health Insurance Card

Is A Large Network Important

If you dont have a preferred doctor, it’s probably a good idea to look for a plan with a large network so you have more choices. A larger network is especially important if you live in a rural community, since it’ll give you better odds of finding a local doctor who takes your plan.

Eliminate any plans that dont have local in-network doctors, if possible you may also want to eliminate those that have very few provider options compared with other plans.

How To Shop For Private Insurance

If youre not covered through your employer, or not eligible for financial assistance through a state-funded program, you will likely have to buy private insurance for individual or family through a private health insurance provider, such as Independence Blue Cross.

You may be able to purchase a plan on the Pennsylvania Insurance Exchange , which has replaced healthcare.gov.

Start by finding out which private health insurance carriers are available in your area. Independence Blue Cross serves the Philadelphia and southeastern Pennsylvania regions . See if private health insurance plans from Independence are available in your ZIP code.

Shopping for private health insurance is much easier when you know what questions to ask. When it comes to health coverage, everyone has different needs and preferences. We can help you figure out what type of plan you want, how to find a balance of cost and coverage, and what other benefits you should consider.

Don’t Miss: What Does Dog Health Insurance Cover

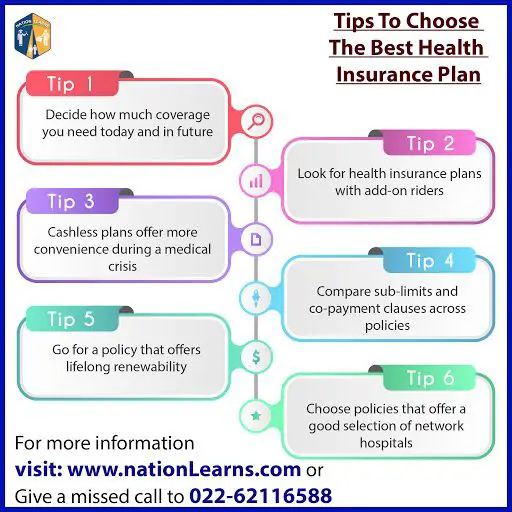

Check The Hospital Network Of The Insurance Company

Health insurance plans allow cashless hospitalisation wherein you dont have to shoulder the hospital bills. The insurance company shoulders such bills on your behalf. Cashless hospitalisation is, thus, convenient and financially liberating. However, the benefit is allowed only if you get admitted in a hospital which is tied-up with the insurance company.

Insurance companies mention the number of networked hospitals that they are tied up with. You can also find the list of hospitals in your city on the insurance companys website.

Tip: When buying a family health plan, check the list of networked hospitals. Check if the local hospital which you prefer is tied-up with the insurer or not. Also check the pan-India network strength. The stronger the better because it means that you would be able to locate a networked hospital easily, wherever you are.

How To Enroll And Get Answers To Your Questions

You can learn more about and apply for ACA health care coverage in several ways.

-

Visit HealthCare.gov to apply for benefits through the ACA Health Insurance Marketplace or you’ll be directed to your state’s health insurance marketplace website. vary by state.

-

Find a local center to apply or ask questions in person.

-

Download an application form to apply by mail

Find the answers to common ACA questions about submitting documents, getting and changing coverage, your total costs for health care, tax options, and more.

Don’t Miss: How To Get Free Health Insurance In Ny

Tips For Choosing Your Health Insurance Plan Through Work

Are you trying to choose a health insurance plan offered through your employer? Choosing a health plan for the year ahead is an important decision. And if its open enrollment time at your company, its your time to explore the available health plan options before you enroll.

You can use this checklist and watch our open enrollment video series to help you weigh the options and decide which health plan may be best for you. Lets get started.

Check To See Which Providers Are In Network

Finding a doctor or clinic that is in network may help keep costs lower. In fact, many plans will only cover network providers. When you’re reviewing your health plan options, consider taking these steps:

- Check to see if your primary doctor, provider or clinic is in network for the plan you are considering

- Check to see if your mental health providers, dentists and specialty providers are in network

- Find out if there is partial coverage for out-of-network providers

Knowing which providers are in network may help you narrow your choices for health plans. For example, if you have a specific doctor you prefer to see, you’ll likely want to be sure they’re in network for the plan you choose. If you’re considering a UnitedHealthcare plan, you can search for network providers and clinics using our Provider Search Tool

Don’t Miss: How Do I Apply For Husky Health Insurance

Make Sure Your Medications Are Covered

Create a list of your medications, and note whether you take name brand prescription drugs or generic. Name brand or patented drugs can be pricey, so finding a policy that covers them is essential. Generic drugs are generally lower in cost, so if your prescriptions are primarily generic, you may be able to cast a wider net or be more comfortable paying out of pocket.4

Health insurance isnât the only type of insurance you should review every year. Read our annual insurance review checklist to learn more.

How Do I Make It Legal

You put their name in a form called a âhealth care power of attorney.â You might also hear it called:

- Appointment of a health care agent

- Durable power of attorney for health care

- Health care proxy

You donât need a lawyer to create this. You can get them online, from your local or state government, and possibly at your doctorâs office or hospital. Normally, you also need two witnesses — people not related to you who watch you sign and date the forms.

Keep in mind that various states have different laws governing this.

If you live in two states — one in the summer and one in the winter, for example — youâll need to make sure your health care power of attorney works in both places. This could mean you need to fill out forms for each state. If youâre not sure what to do, a lawyer can help.

Finally, keep your finished form in your files but not in a safe deposit box. You want to make sure people can access it.

Give a copy of your health care power of attorney to your doctors, your agent, your backup agent, and your family and friends.

Show Sources

Recommended Reading: Can You Use Goodrx With Health Insurance

Where Can I Get Health Insurance

You may be able to sign up for a policy with an employer-sponsored group health insurance plan if you or a family member has one. Unfortunately, many small businesses don’t offer health insurance.

You can sign up for an individual health insurance plan yourself directly through a health insurance company’s website or on the Health Insurance Marketplace if you work for a company that doesn’t offer health insurance, or if you’re unemployed and not eligible for coverage through anyone else’s plan.

Other ways you may be able to get health insurance include Medicare, Medicaid, or the Children’s Health Insurance Program , or through membership in a labor union, professional association, club, or other organization that offers health insurance to its members.

Are My Doctors Covered By This Plan

Health insurance companies work with different doctors and clinics to help you get the best deals on your care.

Getting care from a person or place your plan covers saves you money. On the other hand, getting care somewhere else may mean your health plan pays less, leaving you with bigger bills. Thats why youll want to check that the doctors and clinics you expect to visit will be covered by the health insurance plan youre considering.

Related questions to ask:

- How big is the plans coverage network? What kind of network is it?

- Is my current doctor covered by this plan ?

- How much will I pay if I see a doctor who isnt covered by this plan ?

- Do I plan to get out-of-network care? Am I willing to switch doctors or locations if the ones I want arent in-network?

You May Like: Is Platinum Health Insurance Worth It

There Are 4 Health Care Plan Categories In The Health Insurance Marketplace

Health care plans are divided up into different categories. Bronze plans have the highest deductible and cost sharing. This means that if you go with this type of plan, you will be spending more money out of pocket. Silver plans have lower cost sharing than bronze and gold plans are even lower than silver. If you choose a platinum plan, you will end up with the smallest deductible and far cheaper copays. As a general rule of thumb, the more you pay in monthly premiums, the less your cost sharing will be.

Opt For Coverage Riders

Health insurance plans allow optional coverage benefits. These benefits are called riders and they are available at an additional premium. Riders are optional in nature and can be chosen when you buy or renew your policy.

Riders provide additional coverage at a very low amount of premium. They enhance the scope of coverage of the health insurance policy and are recommended. Some common riders include the following

- Personal accident cover

- Hospital daily cash benefit rider

- Maternity and newborn baby cover

Tip:Riders are usually a cheap way to increase the coverage. When buying a health plan for your family, check the available riders. Opt for riders which are relevant to your coverage needs and which would allow you to avail an all-inclusive coverage from your health insurance plan.

You May Like: Does Cigna Health Insurance Cover International Travel