How Much Does Average Health Insurance Cost In The Usa

Health insurance means different things to people across the world the USAs system is known for several distinguishing features, including a high relative cost to the individual and a lack of universal coverage.

You may be wondering why the cost of healthcare insurance seems to be rising and how the picture compares to other nations. In a country that spends nearly $4 trillion on healthcare yet finds coverage varies widely, theres a lot to weigh up. How much does health insurance cost? is one of the most important questions to Americans.

Across the United States, Americans pay wildly different premiums monthly for health insurance. The average annual cost of health insurance in the USA is $7,470 for an individual and $21,342 for a family as of July 2020, according to the Kaiser Family Foundation a bill employers typically fund roughly three quarters of.The cost to each person can vary a lot, however, based on factors such as age, geography, employer size and the type of plan theyre enrolled in. While these premiums are not determined by gender or pre-existing health conditions, thanks to the Affordable Care Act, a number of other factors impact what you pay.

Of course, not all companies offer health benefits to employees 44% of firms did not offer insurance to staff in 2020.

Insurance costs are rising globally.

Find out what’s driving up prices

How Much Does Health Insurance Cost

In 2022, the average cost of health insurance is $541 a month for a silver plan. However, costs will vary by location. Insurance is expensive in West Virginia and South Dakota, averaging more than $800 a month. States with cheaper health insurance include Georgia, New Hampshire and Maryland, averaging less than $375 a month.

How Much Is Needed For Health Care Costs In Retirement

According to the Fidelity Retiree Health Care Cost Estimate, an average retired couple age 65 in 2021 may need approximately $300,000 saved to cover health care expenses in retirement.

Of course, the amount youll need will depend on when and where you retire, how healthy you are, and how long you live. The amount you need will also depend on which accounts you use to pay for health caree.g., 401, HSA, IRA, or taxable accounts your tax rates in retirement and potentially even your gross income.2

Tip: If youre still working and your employer offers an HSA-eligible health plan, consider enrolling and contributing to a health savings account . An HSA can help you save tax-efficiently for health care costs in retirement. You can save pretax dollars , which have the potential to grow and be withdrawn tax-free for federal and state tax purposes if used for qualified medical expenses.3

Also Check: Starbucks Insurance For Part Time Employees

Who Will Pay For Your Health Care In Retirement

Who will pay for your health care expenses in retirement? This is a good question, whether retirement is just around the corner oreven if it is still far off in the future. Maybe your answer is Medicare will pay for it. And thats partly true, with emphasis on partly. Medicare, the nations federal health insurance program for people over the age of 65, pays benefits if you are eligible for Social Security. If youve noticed the term FICA on your pay stub that stands for Federal Insurance Contributions Act youve been paying into Medicare.

But heres the rub: Medicare covers some medical expenses, but not everything. And it isnt free you pay Medicare premiums in retirement,and these premiums can increase as the years go by, as can your out-of-pocket expenses. Thats why you need to be thinking about having a plan to cover your health care costs beyond Medicare.

Read Also: Can You Buy Dental Insurance Anytime

Health Insurance Coverage For Multiple Years

TriTerm Medical Insurance,2 underwritten by Golden Rule Insurance Company, is short term health insurance that offers coverage for preventive care, doctor office visits, and prescriptions.

- Apply once for insurance coverage terms that equal one day less than 3 years.

- $2 million lifetime maximum benefit per covered person on most plans.

- Eligible expenses for preexisting conditions are covered after 12 months on the plan.

You May Like: Starbucks Dental Insurance

Read Also: Starbucks Open Enrollment 2020

Does Affordable Care Act Apply To Expats

Unfortunately, not anymore. Today, the US Government does not require anyone to subscribe to an ACA-compliant health insurance policy. However, a handful of states still impose a penalty on people who do not comply with the ACA. These are:

- California

- Massachusetts

- New Jersey

Other states are also currently processing legislation that will make health insurance compulsory, so before you move to the USA, check your new states laws.

Find Cheap Health Insurance Quotes In Your Area

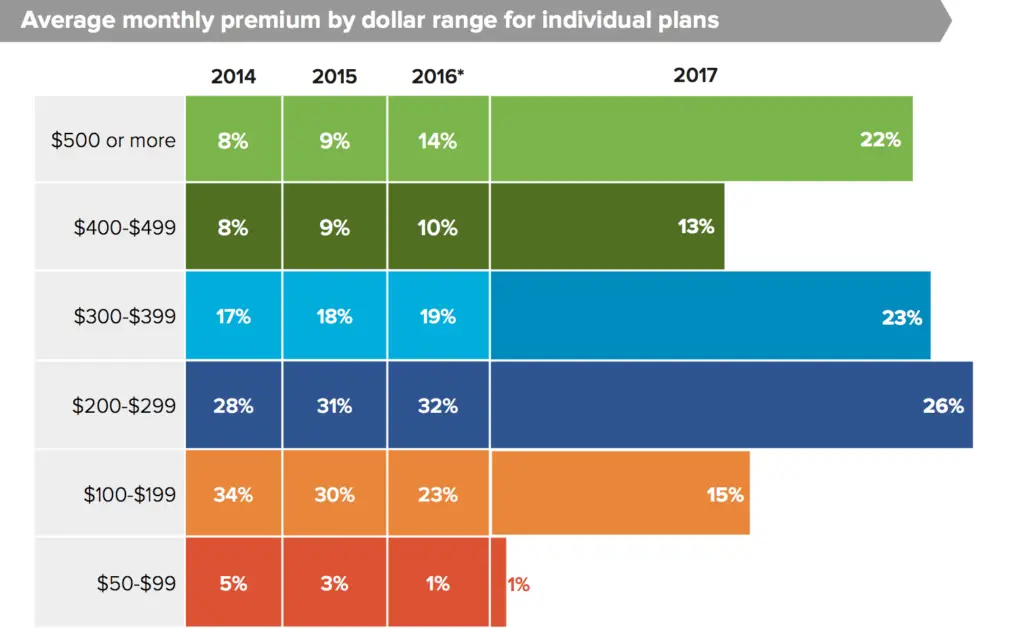

Health insurance premiums have risen dramatically over the past decade. In previous years, insurers would price your health insurance based on a multitude of factors. However, the number of variables have decreased significantly with the Affordable Care Act.

In 2022, the average cost of individual health insurance for a 40-year-old on a silver plan is $541. This represents an increase of nearly 1% from the 2021 plan year.

You May Like: How Long Do I Have Insurance After I Quit

What Is The Cost Of Family Planning Without Insurance

If you require pre-natal care, the average cost of a doctor’s visit is between $100 and $2,000+. This adds up to a big total throughout even a single pregnancy. Should you go into labor and need assistance delivering your baby, this will cost anything from $2,700 up to and over $40,100.

Surgery in the form of a cesarean section costs between $10,600 and $50,500+. A postpartum check-up costs between $100 and $3,100+. If you have any birth complications, this tends to cost $3,000+ per day. And the average length of stay in the NICU is 20 days, meaning that you could potentially face a $60,000+ bill at the end of all your troubles.

How Do I Find Affordable Health Insurance

Group plans are generally cheaper than individual plans. So if you are eligible for onethrough your employer, your union, or some other associationthat’s your best bet, in terms of coverage for the money. If that’s not an option, the public health marketplaces established by the Affordable Care Act offer affordable health insurance for individuals. In most of the U.S., you can sign up for a plan offered through the federal government via the HealthCare.gov site. However, 12 states run their own marketplaces, and residents sign up via their sites.

Don’t Miss: Does Uber Have Health Insurance

Florida Health Insurance Overview

If youre looking for individual or family health insurance in Florida under the Affordable Care Act also known as Obamacare, youll probably have a good chance of getting government subsidies to lower your costs. You can also get low-cost or free Florida health insurance through public programs like Medicaid and the Childrens Health Insurance Program .

Health insurance through Medicare is also a big deal in Florida. So if youre at least 65 years old , Medicare may be a cheaper option for you.

You can review the sections below to learn different aspects of buying health insurance in Florida, such as how to enroll, average health insurance costs, and income requirements to qualify for subsidies.

How To Get Health Insurance Quotes In Canada

There are several ways to get health insurance quotes in Canada. You can use a broker, shop for yourself, or use an internet comparator.

A private health insurance broker can help you find the best policy for you. This option can be more expensive, since you may be charged a commission- typically around 10% of the premium. Because the broker represents specific insurers and plans, shop around for quotes from several sources before making a decision.

You can also request quotes through each company to find a health insurance plan for you, but this is time-consuming.

The internet is a great resource for asking questions, comparing policies and making a selection. You can use our comparison tool to quickly and conveniently compare quotes and find the best one for your situation.

Start saving today!

What is the best way to find a cheap health insurance plan?

The first step in finding affordable health insurance in Canada is to understand exactly what your plan covers and how it works. Compare the benefits offered and what, if any, exclusions or limitations may apply.

Selecting a suitable plan can be an ordeal. Useour online health insurance comparison tool to save money. Quickly shop the best quotes in your province, compare details and get reliable information.

Don’t Miss: Insusiance

The Costs Of Individual Vs Family Plans

The Affordable Care Act offers some subsidies to make health insurance more affordable, but not everyone qualifies.

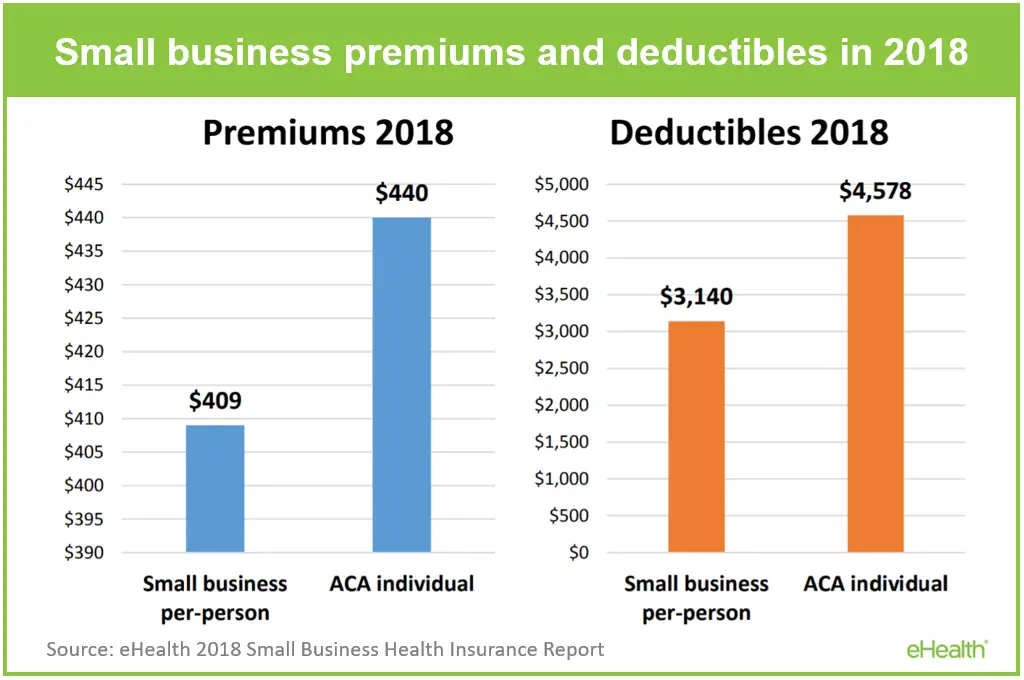

In 2021, health insurance premiums for unsubsidized individual customers were $645 per month on average, while family premiums averaged $1,852 per month. The average individual deductible is individuals was $4,490 the family deductible averaged $8,620.

Over the course of a year, the average health spending for a family of four in the U.S. was $22,221 in 2021. This figure includes spending on monthly premiums. It also includes meeting the deductible.

The Best Way To Save For Healthcare In Retirement

When it comes to covering healthcare costs later in life, you have options. You could pad your IRA or 401 plan so youre better equipped to pay your future medical bills, or you could dedicate funds to healthcare in a health savings account, or HSA.

The latter route is worth exploring if youre enrolled in a high-deductible health insurance plan and are therefore eligible to fund an HSA. Thats because HSAs offer more tax benefits than IRAs and 401s.

- The money you contribute goes in tax-free

- Investment gains in your account are tax-free

- Withdrawals from your account are tax-free, provided theyre used to cover qualified healthcare expenses

Meanwhile, HSA limits change from year to year, but this year, you can contribute up to $3,650 if you have self-only coverage, or up to $7,300 if you have family level coverage. If youre 55 or older, you can make catch-up contributions in your HSA, adding $1,000 to whichever limit applies to you.

Next year, those limits are increasing. For self-only coverage, youll get to contribute $3,850 to your HSA. For family level coverage, youll get to contribute $7,750. And that $1,000 catch-up will still be in play.

GAS PRICES HIT RECORD HIGHS, AGAIN:Average cost per gallon over $4 nationwide

Also Check: Uber Driver Health Insurance

Average Health Insurance Cost By Plan

Less surprising, though, is how the cost will differ based on the plan you use. After all, different plans offer different services, and those with more services and flexibility come at the price of a higher premium.

The four types of plans you may be able to get for your health insurance are a health maintenance organization , point-of-service , preferred provider organization and exclusive provider organization . Per ValuePenguin, the average monthly rate for a 21-year-old on each plan is:

- HMO: $230

Is Employer Coverage Cheaper

Many people assume that employer coverage is the best or cheapest option. In 2020 an estimated 157 million people opted for their employer-based health care plan.4

But is it? Should you always choose your employers health coverage or should you opt for individual health insurance?

Employer plans can sometimes be less expensive since the company chips in part of the costs. Your employer can also sometimes get a better rate because theyre buying a large block of insurance packages. But not always. It can sometimes be cheaper to get health insurance on your own. While it might take a little more work on your end, if youre looking to save money on your health insurance costs, you might want to pass on the employer coverage and shop for an individual plan.

Also Check: How To Get Insurance Between Jobs

What Are Average Health Insurance Costs

In the U.S., 55% of people receive health insurance through their employer, and 20% receive insurance coverage through government assistanceeither through Medicaid or Medicare according to the U.S. Census Bureau. Some peoplesuch as those who are self-employedchoose to purchase insurance privately, says Peter Kongstvedt, M.D., a health care expert and author based in Virginia. There are also 8% of people in the U.S. with no health insurance coverage at all.

The average health insurance cost for a single person who received health insurance through their employer in 2020 was $7,040 a year, according to data compiled by the Kaiser Family Foundation. The average cost of health insurance for a family in 2020 was $21,342 a year. These numbers represent what someone pays for a health care premium. A premium is the amount you pay each month to the health insurance provider, Dr. Kongstvedt says.

A premium is different from a deductible. A premium is what you pay up front , regardless of if you get health care or not. A deductible is something you pay in plans if you actually receive health care, Dr. Handel explains. For example, if the deductible for your health insurance plan is $1,000 a year, youll need to cover the other medical bills beyond that amount, he adds.

Average Should Start By Browsing Silver Plans

Unless you are extremely healthy or know you will have medical expenses, we advise that you begin your buying process by looking at the Silver metal tiered health insurance policies. These are the plans that the exchange offerings are typically benchmarked off of, and they occupy a good middle ground between premiums you are guaranteed to pay and cost-sharing obligations that you will incur if you have any medical costs.

In such a case, these plans can essentially provide more benefits than higher-priced Gold and Platinum plans but at a much lower premium.

You May Like: Does Starbucks Give Health Insurance

Also Check: Starbucks Benefits Part Time

The Average Cost Of Health Insurance By Plan Types And Metal Tier

The type of health plan and the level of coverage you choose impact how much youll pay for health insurance.

For example, you might be willing to pay more for easier access to a broader range of providers, such as through a Preferred Provider Organization or Point of Service plan. Or, you may opt for less flexibility with a Health Maintenance Organization or Exclusive Provider Organization plan but score lower-than-average premiums.

Another thing to consider is how much of the cost of care your insurance covers. Different metallic tiers dictate how much of your health care expenses your plan will cover compared to what youll pay in premiums. As youd expect, the more a plan covers, the higher your premiums will typically be.

What Health Insurance Plan Is Best For International Students

International students attending a university in Canada are not always eligible for the countrys public health care. They are instead required to get a private health care insurer. Each province is different. In provinces where students are not eligible for public health care insurance, the universities themselves often provide a health insurance plan for their international students. It may even be mandatory and included in the tuition fees.

If you can not continue your semester due to illness, many insurance plans for international students will reimburse your tuition fees!

Don’t Miss: Starbucks Health Coverage

Canadian Costs Versus The World

So where does this leave our average family of four? In their 2015 report, the Canadian Institute of Health Information noted that Canadians were among the highest health care spenders in the world. They estimated the average spend at $5,782 per person.

That put the personal spending above the average but nowhere near the biggest spenders. As it has for years, the average American spent twice as much as $11,916. An average family in Sweden spent slightly more at $6,601 and the same family in the UK spent $5,170.

Florida Health Insurance Enrollment In The Marketplace

Florida uses the federal exchange at Healthcare.gov for Obamacare open enrollment that takes place from .

Despite opposition to the federal healthcare law by state legislators, Florida has had the highest number of sign-ups for individual Obamacare plans since 2015.

Florida saw enrollments climb from about 1.7 million in 2018 to almost 1.8 million in 2019 to more than 1.9 million in the 2020 plan year.3

The vast majority of Floridians who enroll in Marketplace coverage are under age 65, which shouldnt be a surprise given that the 65-and- older age group are better suited for Florida Medicare plans. As of 2020, total ACA enrollment for the under-65 market in Florida is nearly 1.9 million compared to nearly 36,000 for those 65 and older.4

Recommended Reading: Kroger Associate Discounts

The States That Drink The Most Beer

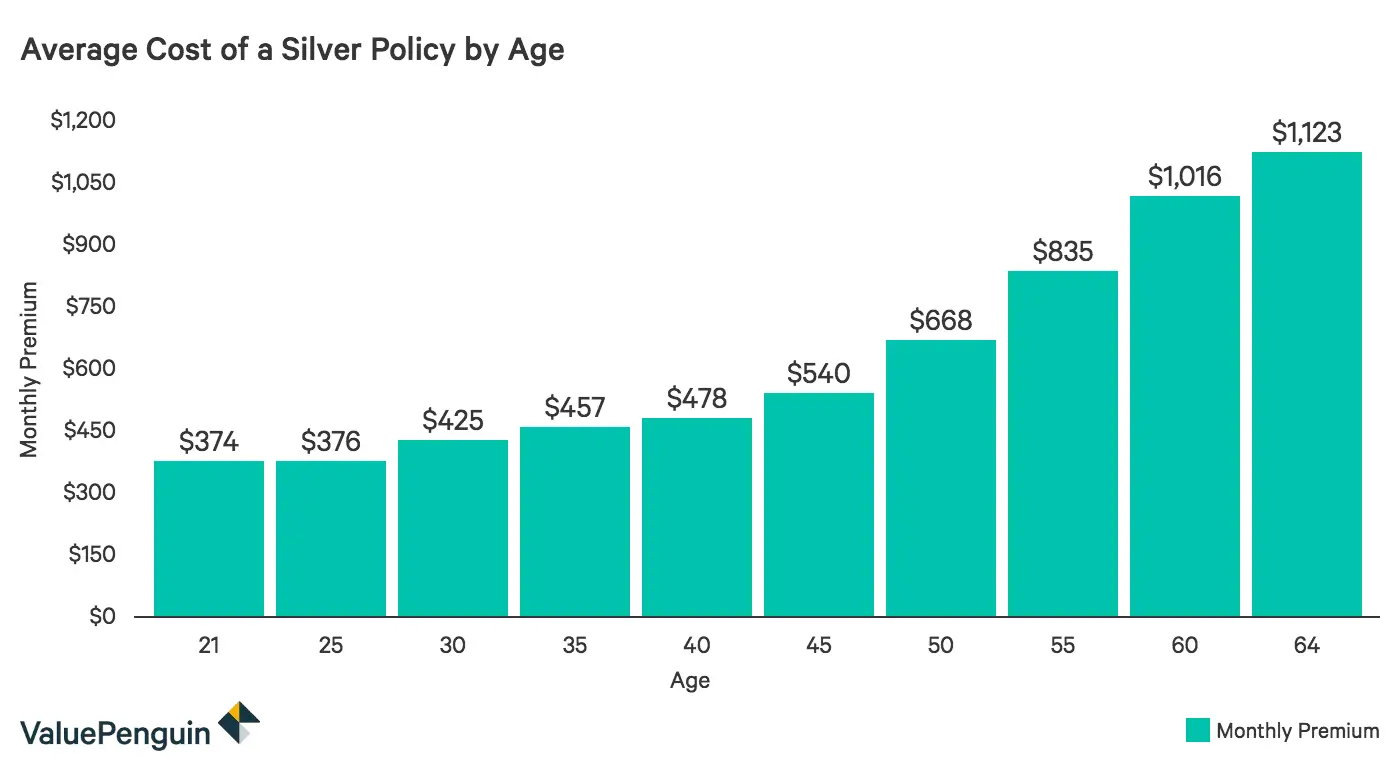

After age 50, premiums rise tremendously. At age 53 the average premium is more than double the base rate, and by 55 the average premium is $446. At age 60, the average premium is $543. If a person is 64 years old, the average health insurance premium is $600 – 3 full times what it is at 21.

It is also important to note that while this is a general guideline, prices vary dramatically from state to state. Some states, like New York, don’t factor age into premiums at all.

How Much Does Private Health Insurance Cost In Ontario

Our experts were quoted $168.26 per month with Blue Cross for a 41-year old with no pre-existing conditions for full comprehensive hospital, dental and prescription drug coverage. Cost varies depending on the level of coverage you choose.

Other factors that may affect premiums would include:

- Age

Also Check: Starbucks Health Insurance Cost