Consider All Of Your Options

Like with most major decisions, it makes sense to compare all of your potential options before you make a decision.

Each type of insurance listed below can vary greatly in price in each persons individual situation. The levels of coverage can vary greatly depending on which plan you pick, too. Make sure you completely understand the health insurance plans youre considering before you make a decision.

What To Do If Your Request Is Denied

Don’t give up even if your request is denied. Call your health insurance company to find out why. Sometimes, requests are denied for a simple reason such as:

- The insurer was unable to contact the out-of-network providers office.

- The insurer thinks there are in-network providers capable of providing the same service.

- The insurer doesnt have your correct address and thus thinks you live closer to in-network providers than you do.

All of these mistakes can be cleared up. Once you understand why the request was denied, you can either appeal that decision or submit a brand new request that includes additional information to bolster your request.

Is Short Term Insurance For Me

Short term insurance may be for you if you’re:

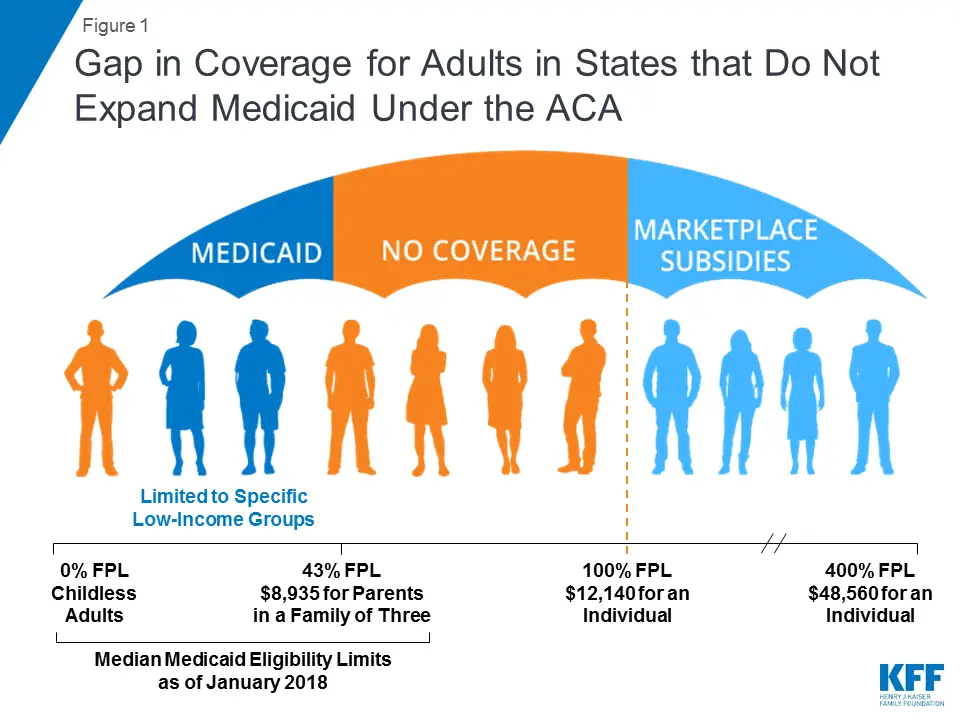

- Unable to apply for Affordable Care Act , also called Obamacare, coverage because you missed Open Enrollment and you don’t qualify for Special Enrollment

- Waiting for your ACA coverage to start

- Looking for coverage to bridge you to Medicare

- Turning 26 and coming off your parent’s insurance

- Between jobs or waiting for benefits to begin at your new job

- Healthy and under 65

For these situations and many others, Short term health insurance, also called temporary health insurance or term health insurance, might be right for you. It can fill that gap in coverage until you can choose a longer term solution.

Don’t Miss: Why Is Us Health Insurance So Expensive

What Is Gap Health Insurance

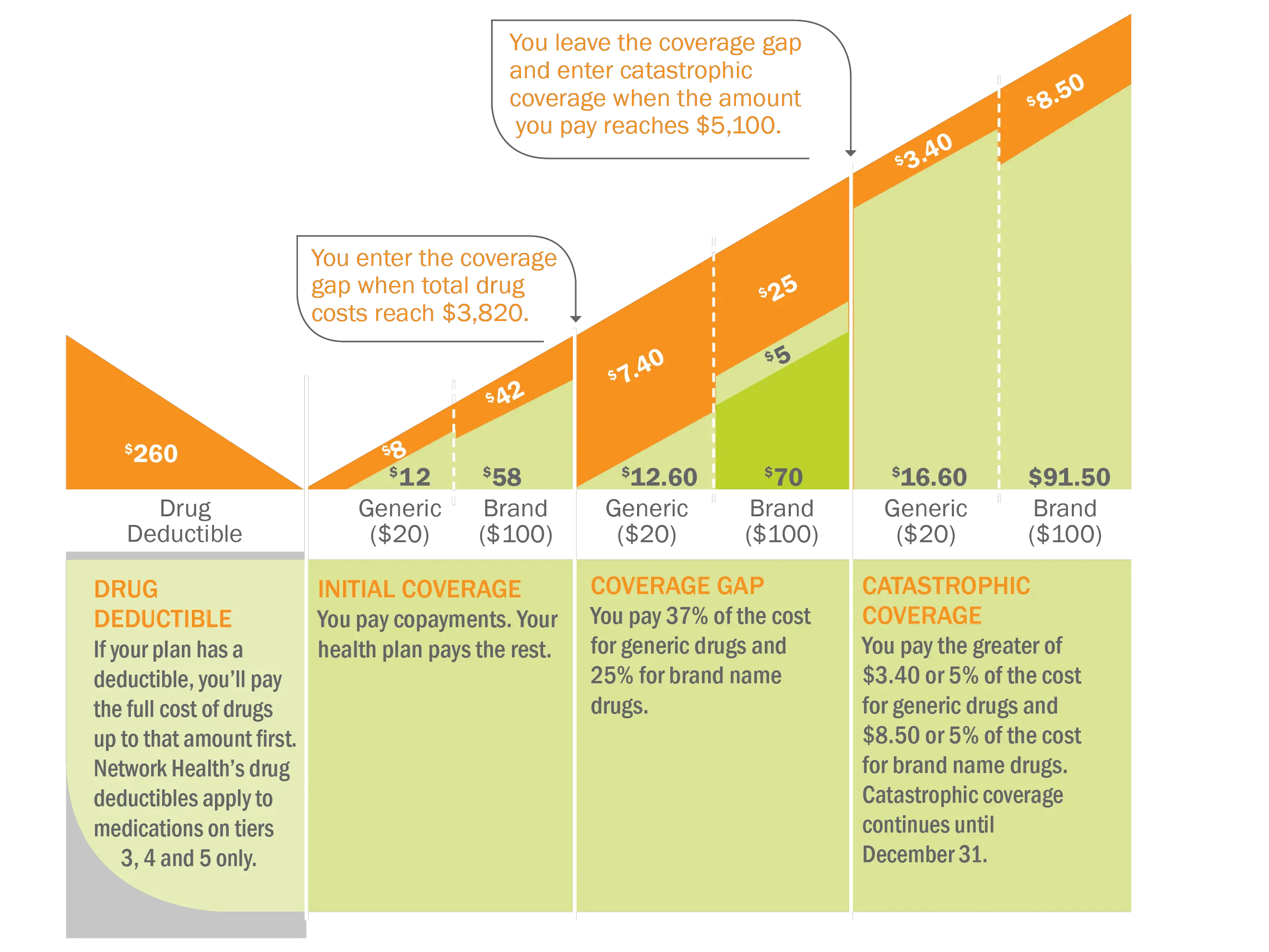

Gap Health Insurance is a group supplemental health plan that works along with a high-deductible major medical plan. The IRS defines a High Deductible Health Plan as a plan having a deductible of at least $1,300 for an individual, and $2,600 for a family. As the name implies, gap insurance helps pay for medical costs that occur before reaching the deductible, which has led to people calling it insurance on insurance.

By raising the deductible on the major medical plan, you will see the biggest impact. Gap Plans have been growing in popularity as a solution to reduce overall out-of-pocket costs and supply better access to healthcare. With the changes brought on by the Affordable Care Act, insurance premiums and health coverage deductibles are on the rise. It is important to note that gap health insurance is not major medical nor ACA compliant. It is a supplemental policy.

Is It Worth It To Purchase A Gap Health Insurance Policy

Choosing to purchase a GAP health insurance policy is not a decision to take on lightly. While a GAP policy combined with regular health care premiums typically costs less than a health insurance policy with a low deductible, you must still consider whether or not its a solution that meets your needs.

If your health insurance plan is high-deductible and you have extensive or ongoing medical needs, you may benefit a great deal from a GAP health insurance policy. On the other hand, if youre relatively healthy with no planned medical expenses, you wont save much money, if any at all, by adding a GAP health insurance policy to your plan. However, medical emergencies happen, so its probably worth paying for a GAP policy simply for peace of mind.

Some people opt to stow emergency funds for medical issues away in a savings account. If you do not have a savings account, or any funds at all to help you cover a large medical bill, a GAP policy can help you avoid financial distress.

When youre scheduling medical procedures or services, its important to look into whether or not the service will be covered by your GAP health insurance policy before attempting to use it. Since GAP policies vary greatly based on elective and non-elective services, its up to you to determine whether or not a particular procedure or service is covered by your GAP policy.

Recommended Reading: How Much Does Health Insurance Cost In Wisconsin

What Is Needed To Sell Gap Medical Products

These insurance products are designed to be offered in conjunction with an employer-sponsored major medical plan. There is no need to develop or use existing provider networks, as any A& H insurance company can enter this market. Claims generally are adjudicated based on the insureds Explanation of Benefits of covered services and a claim form. However, as the sophistication of this product evolves , administration will become more complex.

S To Cover The Gap In Your Health Insurance

Modified date: Mar. 4, 2021

Life hardly ever goes according to plan. While itd be nice if we were all able to take the easy path and get the best results, that usually isnt the case.

One particularly frustrating area of life is health insurance. Health insurance is important because an unexpected health emergency could easily bankrupt someone without health insurance. At the same time, sometimes its hard to stay covered.

For example, lets say youre changing jobs. You had health insurance at your old job. Youll also have health insurance at your new job. But maybe youre taking a three-month break between jobs or the new job has a waiting period before you can start using benefits, including health insurance.

What can do you do cover a gap in your health insurance? Thankfully, you have a few options.

Whats Ahead:

Read Also: Have No Health Insurance What Should I Do

Why Do People Need Gap Insurance In Canada

There are a number of situations/factors when drivers should consider purchasing it :

- New automobile: New cars lose value as soon as you take ownership. This often creates a negative gap between the vehicle value and how much you owe .

- Depreciation :Depreciation can cause the value to be less than what you owe on your loan.

- Long auto loans : Long auto loans are popular today. Many people have loan that are 60 months or longer. This also means many drivers carry a balance on their loan for a longer period of time. This potentially creates a financial difference between finance costs and vehicle value.

What Does Gap Insurance Cover

If your car is stolen or totaled, gap insurance will pay the difference between the ACV of the vehicle and the current outstanding balance on your loan or lease. Sometimes it will also pay your regular insurance deductible.

Car owners often assume that if their car is totaled, it will be replaced at the amount they paid, or at least the amount they owe. This is not so. That is why many car insurance companies offer gap insurance as an optional coverage.

You must also have comprehensive and collision coverage to buy gap coverage, but if you lease or finance your car, those are typically required.

You May Like: Can I Opt Out Of Employer Health Insurance

Gap Insurance In Canada Is Overlooked Coverage By Many Drivers

Gap insurance is an often overlooked and misunderstood form of insurance for your car.

When you are looking to upgrade your vehicle or buying your first one, you may have been asked if you want to include gap protection. Many drivers are not even sure if they have the coverage or it’s worth adding to their car insurance quote.

Here we will outline how it works and answer some of the most frequently asked questions to help you decide if you should include it or not.

Find Out When Your Coverage Actually Ends

The first thing you need to do is figure out when your current health insurance coverage ends. Depending on how you get your insurance, your coverage may not end when you think it does.

If you currently have a plan outside of your job, your plan will likely end at the end of the month which you last paid for. This makes sense and is fairly easy to control. Simply pay for the plan until you dont need it anymore.

However, if youre losing coverage from a job, your health insurance end date may vary.

I personally thought Id lose my health insurance the day I left my job. Instead, my insurance extended through the end of the month that I left regardless on which day of the month I quit.

Check with your human resources or benefits department to see how your employers health insurance works. If that doesnt work, try calling your health insurance company directly.

You May Like: What Do Expats Do For Health Insurance

How We Chose The Health Insurance Companies

We looked at short-term health insurance plans through insurance companies and independent health insurance marketplaces to discover what options exist. We investigated the waiting periods, qualifications, coverage types, common exclusions, maximum limits, deductibles, and copays across the different plans. Our goal was to highlight some of the best short-term health insurance options offered through reputable insurance companies to help you compare and decide if short-term health insurance is a good idea for you.

Dental And Vision Insurance

Most standard health insurance plans dont include dental or vision benefits. If you want coverage for visits to the dentist or optometrist, consider a supplemental dental insurance or vision insurance plan.

Of all the supplemental insurance policies, dental and vision insurance are two of the most common. These policies cover preventative care , as well as other expenses, such as contact lenses or prescription glasses. Dental and vision insurance are usually relatively inexpensive and are sold by many health insurance companies.

Also Check: What Does Ppo Means In Health Insurance

Reasons To Consider Gap Insurance

There are several situations you should consider gap insurance. The first is if you made less than a 20% down payment on a vehicle. If you make less than a 20% down payment, it is likely that you do not have cash reserves to cover them in case of an emergency and that they will be upside down on the car payments.

Additionally, if an auto loan term is 60 months or longer, a person should consider gap insurance to ensure that he or she is not stuck with car payments if the vehicle is totaled.

Finally, if youre leasing a car, you should consider gap insurance. Although many contracts require it, the vehicle costs more than its worth in almost every situation when you lease.

What Is Gap Insurance And How Does It Work

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value. Gap insurance may also be called “loan/lease gap coverage.” This type of coverage is only available if you’re the original loan- or leaseholder on a new vehicle. Gap insurance helps pay the gap between the depreciated value of your car and what you still owe on the car.

Do I Need Loan or Lease Gap Coverage?

Buying a new car is a major purchase and an exciting one.

Congratulations!

Don’t forget to think about your insurance needs.

The coverage you had on your previous vehicle may not be sufficient for your new car.

New car replacement coverage is one type of optional coverage you may want to consider.

You may choose to purchase this in addition to the coverage you are required to buy.

Most lenders typically require comprehensive and collision coverage.

These coverages help pay to replace a totaled car, but they factor in depreciation.

Due to depreciation, your new car loses value as soon as you drive it off the lot.

Say you bought a new car for $25,000.

Shortly after, your car was totaled in a covered collision.

Your collision coverage would pay up to the car’s depreciated value for example, $20,000.

That wouldn’t be enough money to buy the same brand-new car that costs $25,000.

If you own a brand-new car, consider adding this optional coverage to your car insurance policy.

Don’t Miss: Can You Go To The Health Department Without Insurance

Is Supplemental Medical Health Insurance Worth It

Supplemental health insurance is worth it for some people, but it depends on your current health, existing health insurance plan, financial situation and what types of coverage you think you might need in the future.

For instance, if your health insurance plan has poor benefits with hefty out-of-pocket costs, purchasing a supplemental plan can be valuable. On the other hand, if you already have an excellent health insurance plan with good coverage and low out-of-pocket costs, you might find that a supplemental plan isnt necessary.

Is A Gap Insurance Worth It

Gap insurance keeps the amount that a person owes after buying a car from increasing in case of an emergency. Therefore, if someone does not have debt on his car, theres no need for gap insurance. Additionally, if a person owes less on his car than it is worth, theres also no need for gap insurance. Finally, if a person does owe more on a vehicle than it is worth, he may still choose to put the money that would be spent on gap insurance every month toward the principal of his auto loan.

If a person owes more on his car than it is worth and would be financially debilitated by having to pay the remainder of his car payments if his vehicle was totaled or stolen, then gap insurance might be a saving grace.

If the extra cost of gap insurance strains your budget then consider ways to keep your vehicle insurance costs down without skipping gap insurance.

Don’t Miss: Does State Farm Sell Health Insurance

What You Should Know About Gap Health Insurance Plans

- Supplements your health coverage: Gap health insurance plans add to your existing health coverage and can pay for some out-of-pocket costs.

- Direct payments: Your gap health insurance may make payments directly to you instead of medical providers.

- Accident and death coverage: Some gap health policies cover medical expenses for covered accidents or accidental death and dismemberment.

| Health Insurance Company |

|---|

| 4.5 |

What Gap Insurance Doesnt Cover

Gap insurance is designed to be complementary, which means that it does not cover everything. Gap insurance does not cover:

- Repairs. If a car needs repairs, gap insurance will not cover them.

- Carry-over balance. If a person had a balance on a previous car loan rolled into a new car loan, gap insurance would not cover the rolled-over portion.

- Rental cars. If a totaled car is in the shop, gap insurance will not cover a rental cars cost.

- Extended warranties. If a person chose to add an extended warranty to an auto loan, gap insurance would not cover any extended warranty payments.

- Deductibles. If someone leases a car, their insurance deductibles are not usually covered by gap insurance. Some policies have a deductible option, so it is wise to check with a provider before signing a gap insurance policy.

Also Check: Can Grandparents Add Grandchildren To Health Insurance

Who Files Gap Health Insurance Policy Claims

When you use your health insurance card at a doctors office or at the hospital, the provider or facility will typically file your claim on your behalf. After the claim is submitted, youll receive an Explanation of Benefits showing how much your health insurance plan paid toward your claim and what your out-of-pocket expenses could be for the visit, including costs such as:

- Deductibles

- Coinsurance

- Co-payments

To file a GAP policy claim, you will take the EOB and submit it to your provider. Your provider should have been able to tell you where to find all necessary documents to submit your claim, including your claim form. When you fill out your claim form, you can choose to have a reimbursement check sent to the provider or directly to you. When the check is mailed directly to you, it is your responsibility to pay for any outstanding balances.

Best For Customized Coverage: Ihc Health Group

IHC Health Group

- Coverage Limit : Up to $2 million

- No. States Available: 35

The IHC Group offers low- to high-deductible options and the ability to add pre-existing condition coverage, making it the most customizable plan provider that we reviewed.

-

Some plans with routine check-ups included

-

X-rays and some other diagnostic exams included

-

Option of using your own doctor in- or out-of-network

-

Lifetime maximums up to $2 million

-

Pre-existing conditions covered on some plans up to $25,000

-

Highly customizable plans may exclude many coverages

-

High deductibles with some plans before you can access coverage

-

May be required to join Communicating for America

The IHC Group is an organization of insurance carriers operating short-term insurance plans in 35 states, including member insurers such as Independence American Insurance Company.

Your policy will be serviced by one of these companies depending on where you live, and some states require membership in Communicating for America, a national non-profit organization whose mission is to promote health and wellbeing through member benefits. AM Best gives an A- financial strength rating to the IHC Group.

AM Best has placed IHC’s financial strength and long-term issuer credit ratings under review after the company agreed to sell a 70% stake in its pet division and other assets.

Request a quote online to see what they offer in your state and how much they’d charge you.

Recommended Reading: Does Burger King Offer Health Insurance

What Should I Know Before Purchasing Gap Coverage

There are a few things to consider before you purchase GAP health insurance coverage. The first thing to remember is that GAP insurance is not the same as health insurance. GAP health insurance coverage is a limited benefit policy, meaning that the policy will only pay a predetermined amount of money toward your claim.

Some believe that GAP coverage is the same as a mini-med policy, but it isnt. Mini-med policies are standalone plans with very limited coverage, while GAP health insurance coverage acts as a sort of supplement to your regular health insurance policy. Once ACA policy reforms came into play, mini-med policies virtually stopped counting as health insurance due to the lack of coverage provided.