What Documents Can I Use To Prove A Qualifying Life Event

Who is this for?

If you need to buy health insurance or make changes to your coverage during special enrollment, this explains what you’ll need.

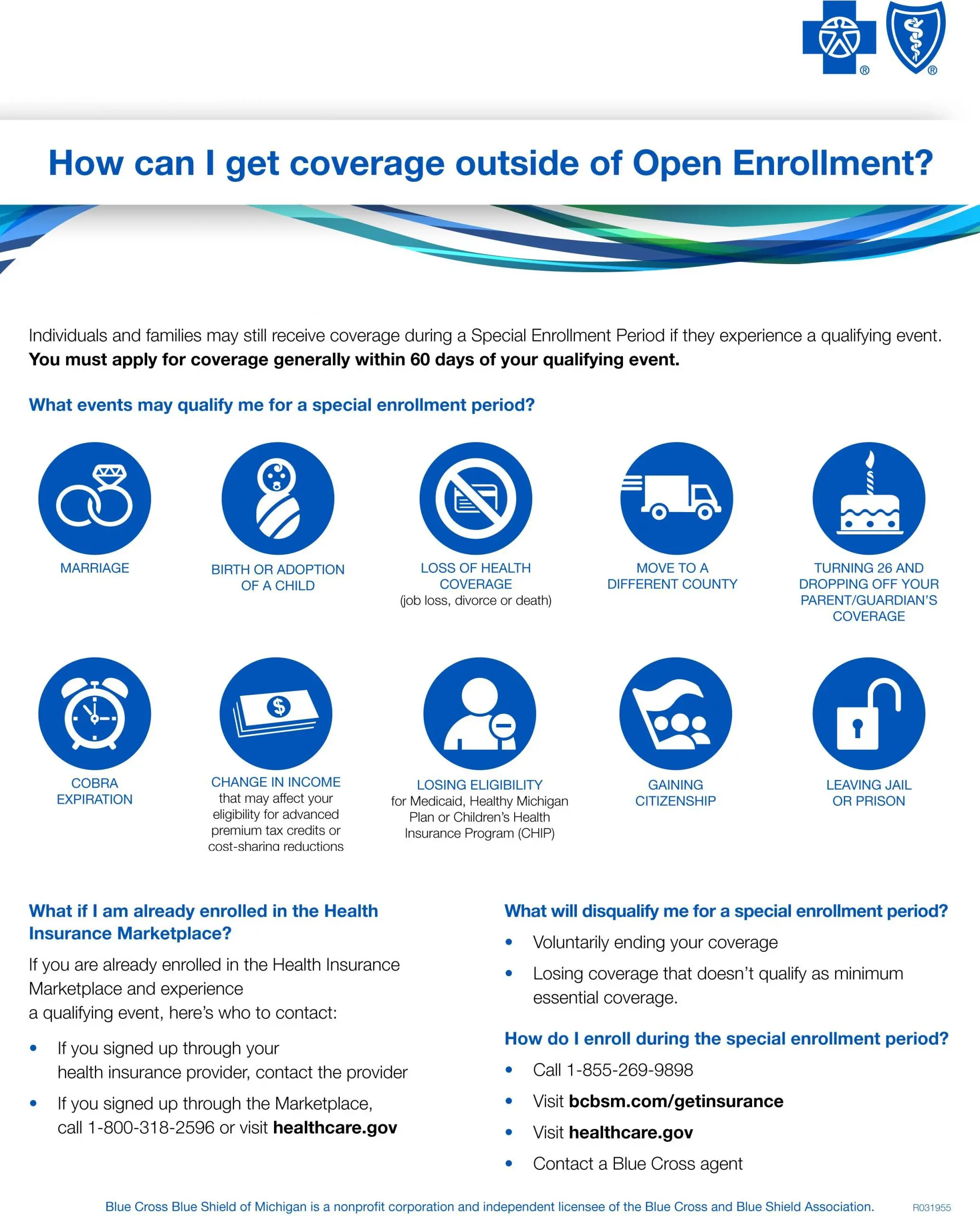

Everyone can enroll in an individual health insurance plan during open enrollment. But sometimes events like a birth or marriage mean you’ll need to change your coverage at another time of the year. These are called qualifying life events. After a qualifying life event, you have a period of 60 days to change your plan or enroll in a new plan. You also may be able to select a plan up to 60 days in advance of some qualifying life events. This can be during open enrollment or after open enrollment has ended.

You can use any of the following qualifying life events to enroll in one of our plans during a special enrollment period. For any of these events, please be sure to provide us with one of the documents listed below. Some events may require more than one document.

Situations That Are Not Qualifying Life Events For Health Insurance

Although qualifying life events seem self-explanatory, there are times when such situations would not qualify you to enroll in a health insurance plan during the special enrollment period. For instance, while divorce typically is a situation that is considered a qualifying life event for health insurance, it is only such if it results in a loss of health insurance coverage. If theres no change in your coverage, then this is not considered a qualifying life event, and you cannot enroll in a health insurance plan. Dropping your existing insurance willingly or having your insurance canceled because of failure to pay the health insurance premium will not allow you to seek new insurance during the year. Youd need to wait for Open Enrollment again which is November 1st through December 15th .

Change In Family Status With Your Health Insurance

If youve gotten married, divorced , your household size has changed because youve had a baby, or a household member has moved out, then youll most likely be able to change your health insurance. This would be considered a qualifying life event. Court-ordered dependent changes are also considered a qualifying life event for health insurance.

Read Also: How Much Does Starbucks Health Insurance Cost

What Is Considered A Qualifying Life Event

Qualifying life events are those situations that cause a change in your life that has an effect on your health insurance options or requirements. The IRS states that a qualifying event must have an impact on your insurance needs or change what health insurance plans that you qualify for. In either case, the qualifying life event would trigger a special enrollment period that would make you eligible to select a new individual insurance policy through the state marketplace.

| Category | Examples of qualifying life events |

|---|---|

| Loss of health care coverage |

|

| Changes in household |

|

| Changes in residence |

|

| Other qualifying events |

|

Qualifying events are evaluated on a case-by-case basis by an underwriter. You can view a complete list of qualifying life events on HealthCare.gov.

Special Enrollment Period Examples:

-

Having been kept from enrolling during Open Enrollment due to a serious medical condition or a natural disaster

-

If someone working in an official capacity prevented enrollment, made a mistake in enrollment, gave wrong information, etc.

-

If a technical error occurred or if wrong policy data was displayed on the Exchange

-

Applying for Medicaid or CHIP during open enrollment but being deemed ineligible after open enrollment ended

-

Gaining a new dependent or becoming dependent on someone else due to a court order

-

Surviving domestic abuse or spousal abandonment and enrolling in a new, personal health policy

-

Filing and winning an appeal after an incorrect eligibility determination

Don’t Miss: Starbucks Health Care Benefits

Should I Use Cobra Insurance

If you were fired from your job or decided to quit, then you would trigger a qualifying life event. In this case, a special enrollment period would be activated in which you would have two options: purchase a new health insurance policy or extend your current coverage under COBRA.

The Consolidated Omnibus Budget Reconciliation Act is an insurance law that temporarily extends job-based insurance coverage offered by employers. This law allows employees to keep their group health insurance plans when normally they would lose coverage after being fired. However, selecting COBRA can be expensive because your employer no longer will contribute to premium payments.

You can voluntarily drop your COBRA coverage or stop paying premiums on a COBRA policy, but it is important to know that this would not be considered a qualifying life event. Therefore, you would not be eligible for a special enrollment period if you wanted to purchase individual health insurance. For this reason, if you were recently fired or quit, we recommend evaluating the costs of ACA health plans and COBRA plans before choosing one as your policy.

Major Life Events And Planning For Health Insurance

Sometimes you know ahead of time that a major event will happen in your life. Examples might include getting married or divorced, changing jobs or having a baby. Other times, such as at a death, you may not have advance warning. Either way, youll have a lot to think about. One thing to keep in mind is your health insurance. How can you make sure you stay covered? How can you get the best coverage for you and your family?

This article discusses the kinds of life events that may give you a chance to make changes in your health insurance. It notes how you may need to document those events. And it describes the kinds of choices you may make when those events happen or are about to happen.

You May Like: Can You Buy Dental Insurance Anytime

Loss Of Health Coverage

Losing coverage and losing eligibility may include if you no longer have access to health coverage through a job or an insurance policy you bought on your own, you become ineligible for Medicare, Medicaid, or the Childrens Health Insurance Program or you lose coverage through a family member. For example, children turning 26 and can no longer be covered by your parents health plan or if your spouse loses a job and you no longer have health coverage.

There are also other situations in which you may qualify for a special enrollment period see Healthcare.govs Special enrollment periods for complex issues page for more information.

The qualifying life events may be slightly different for employer coverage.

Can You Drop Health Insurance Without A Qualifying Event

It depends. You’re allowed to cancel an individual health insurance policy at any point during the year, even if you didn’t experience a qualifying life event. However, you must have experienced a qualifying life event to cancel group health insurance through your employer — unless you leave the job.

Also Check: Starbucks Medical Insurance

Can I Cancel My Health Insurance Without A Qualifying Event

You can cancel your individual health insurance plan without a qualifying life event at any time. But it is important to remember that once you cancel your policy, you cannot enroll again until the next open enrollment period. During this time you will have no health insurance coverage, which could be costly if you happen to get injured.

On the other hand, you cannot cancel an employer-sponsored health policy at any time. If you wanted to cancel an employer plan outside of the company’s open enrollment, it would require a qualifying life event. Under Section 125 of the Internal Revenue Code, if you do decide to cancel without a QLE, then you and your employer will incur tax penalties.

What If You Don’t Have A Qualifying Life Event

You still have a few options if you need health insurance outside of the annual open enrollment period but haven’t experienced a qualifying life event.

The first option is to consider enrolling in a Medicaid plan if you meet the income requirements. Medicaid is a federally-funded health insurance program thats reserved for low-income families. There’s no open enrollment period for Medicaid, so you can purchase coverage at any time.

A similar program with no open enrollment period is the Children’s Health Insurance Program . It can help you get affordable coverage outside of open enrollment if you have kids. Some state CHIP programs are rolled into Medicaid, while others are separate programs.

If you dont qualify for Medicaid or CHIP, another option is to purchase short-term health insurance. These policies can be purchased in most states directly from private health insurance companies at any point during the year, without a qualifying life event.

These low-cost plans have limited benefits, so its wise to only keep short-term health insurance until youre eligible for a health plan with comprehensive coverage, such as an ACA or employer plan.

Read Also: Starbucks Health Insurance Eligibility

Alternatives To Qualifying Life Events

You can look into applying for Medicaid or the Children’s Health Insurance Program which always accepts applicationsif you don’t qualify for special enrollment. You might also look into membership health insurance or a temporary health plan. Membership health insurance can be obtained if you belong to an organization that provides it. If you’re a student, see whether your school offers a student health plan if you’re enrolled in a higher education program.

A short-term health plan can help in the event of a catastrophic event, but it might not be a good long-term option, because coverage is often just minimal.

Is Medicare Eligibility A Qualifying Event

Becoming eligible for Medicare isnt specifically a qualifying event, but you can drop the coverage you buy on your own from Healthcare.gov or your state insurance marketplace at any time.

Medicare generally becomes your primary coverage when you turn 65 . So, you usually want to sign up during your initial enrollment period. That period runs from three months before to three months after the month you turn age 65.

You arent required to drop marketplace coverage at that point, but most people do so because youll no longer receive a subsidy to help pay premiums after you enroll in Medicare.

If you have coverage from an employer with 20 or more employees, that coverage pays first and Medicare is secondary. You may want to delay signing up for Medicare while youre still working. If your employer has fewer than 20 employees, however, Medicare becomes your primary coverage at 65. You can keep your employer coverage, too, to supplement Medicare.

You May Like: Do Substitute Teachers Get Health Insurance

How Long Do You Have For A Qualifying Event

A special enrollment period generally lasts 60 days before or after the qualifying event and allows an individual to make plan changes or sign up for a new health insurance plan immediately.

You might also like

Join us for a panel discussion with thought leaders from BambooHR and Zane Benefits as we explore how optimizing your benefits helps you recruit and retain the best people for your organization.

Becoming A United States Citizen Or Lawfully Present Resident

This qualifying event only applies within the exchanges carriers selling coverage off-exchange are not required to offer a special enrollment period for people who gain citizenship or lawful presence in the US.

There are special rules that allow recent immigrants to qualify for premium subsidies in the exchange even with an income below the poverty level, since they arent eligible for Medicaid until theyve been in the US for at least five years.

Read Also: Starbucks Insurance Cost

What Is A Qualifying Event

Usually, an individual or a family can only purchase a health insurance plan during the Open Enrollment Period. Any life event that triggers a Special Enrollment Period during which you are freely able to enroll in a new health insurance plan is considered a qualifying event.

There are several important questions to keep in mind when talking about qualifying events. For example, what life events are considered to be worthy of an SEP? What types of health insurance plans have qualifying events? How long does one have to select a plan following a qualifying event? You can get answers to all these questions and more right here at Health Insurance Providers.

Other Qualifying Life Events

You may become eligible for another QLE that allows you access to health coverage without having to wait for the next open enrollment period. Here is a list:

- Becoming a U.S. citizen or legal resident

- Becoming a member of a federally recognized tribe or obtaining shareholder status through the Alaska Native Claims Settlement Act

- A significant change in income that changes your qualifications

- Leaving incarceration

- Starting or ending an AmeriCorps service

Also Check: Starbucks Benefits For Part Time

What Are My Civilian Insurance Plan Options

Good news: If you lost your health coverage after returning from military service, this qualifying event opens a special enrollment period for you. In an effort to make your transition into post-military life smoother, let us help you find a health insurance plan that gives you the coverage you need.

Countdown Begins On The Day

Your Special Enrollment Period is a 60-day health insurance enrollment window. It begins on the day your qualifying life event takes place.

This means that if you get married on May 31, you must enroll in a new health insurance plan before the end of July. If you quit your job to form your own business, you have 60 days from the last day of employment to get new healthcare coverage. Once the 60-day window has passed, you have to wait until the regular Open Enrollment Period to obtain health insurance coverage or update your current coverage.

Read Also: Kroger Part Time Health Insurance

List Of Qualifying Events For Health Insurance

Qualifying events are usually connected to moving, losing health coverage, or needing to add or remove someone from your health plan.

Qualifying life events that create a special enrollment period include:

- Death of a spouse or dependent

- Job loss

Your state may offer additional rules for life events that create a special enrollment period.

How Much Time Do I Have To Take Advantage Of An Sep After Experiencing A Qualifying Event

![Do I Qualify for a Special Enrollment Period? [INFOGRAPHIC] Do I Qualify for a Special Enrollment Period? [INFOGRAPHIC]](https://www.healthinsurancedigest.com/wp-content/uploads/do-i-qualify-for-a-special-enrollment-period-infographic.png)

When you experience a qualifying event, you have 60 days to select a plan from the individual or family ACA insurance market or switch to a new plan. Depending on the qualifying event you have experienced, you may also be eligible to receive an SEP window that begins 60 days before the qualifying event and 60 days after the qualifying event occurs.

In most cases, your coverage will be effective on the first day of the following month, provided you enroll by the 15th day of the previous month, though this deadline will no longer be imposed beginning in 2022.

Keep in mind that there may be different effective dates for specific qualifying events, including marriage, birth or adoption of a child, and loss of other coverage. For Medicare, most qualifying events trigger a 2-month SEP, with a few exceptions.

If you experience a qualifying event and need to make changes to your health insurance coverage with an SEP, Health Insurance Providers can help you compare plans in your area in order to help you find better coverage for you and your loved ones. Enter your zip code in our free search box below to start comparing plans and prices today!

Also Check: When Does Health Insurance Stop After Quitting Job

Key Takeaways About Qualifying Life Events

The bottom line is, you might not need to wait for your employer or the government’s next open enrollment period to make changes to your health plan. Here’s what else you should know:

- To make changes to your health plan, you must be experiencing a qualifying life event. If youre not sure an event qualifies, visit Healthcare.gov or contact your current or future health plan sponsors for more specific information.

- Qualifying life events trigger a “special enrollment period” that typically lasts 30 to 60 days, depending on your plan, during which you can select a new plan or add a new dependent to your plan.

- To change your plan selections, notify your current or future health plan sponsor of the qualifying event in your life as soon as possible.

- Other qualifying life events include getting married, losing coverage due to divorce, losing eligibility for Medicaid, and exhausting your COBRA coverage.

- Different plans have different rules. Contact your plan administrator about any change in status that impacts your health coverage to find out your rights.

What Is Considered A Qualifying Event For Health Insurance

If you go through a qualifying event in your life, then there are high chances for you to get health insurance. The special enrollment period allows you to apply for a qualifying event health insurance. So, if you are worried that you will not get insurance, worry no more! Read on to find out what is considered to be a qualifying event for health insurance. There are four basic types of qualifying life events. These types are as follows:

Losing of health insurance

- Losing qualification for Medicare, Medicaid, or CHIP

- Turning 26 and losing inclusion through a parents arrangement

- Losing existing wellbeing inclusion, including position based, individual, and understudy plans f

Changes in household

- Having a baby or adopting a child

Moving to a different ZIP code or county

- Moving to or from a sanctuary or other momentary lodging

- A student moving to or from the place where they go to college/university

- A part timer moving to or from the spot the two of them live and work

- Other qualifying occasions

Changes in your income that impact the insurance you are eligible for

- Turning into a U.S. resident

- Picking up participation in a governmentally perceived clan or status as an Alaska Native Claims Settlement Act Corporation investor

- AmeriCorps individuals beginning or finishing their administration

- Leaving detainment

Don’t Miss: Kroger Employee Discount Card