Pos Plans: The Basics

A point of service healthcare plan combines some of the features of HMO plans and PPO plans. Much like an HMO health plan, POS plans require their members to choose a doctor within their network to serve as their primary care physician . Under both POS and HMO plans, youll need to ask your PCP for a referral when you want to see a specialist or doctor within your network of healthcare professionals.

Like PPO plans, POS plans provide some sort of insurance coverage to people who visit healthcare providers outside of their network. So its possible to receive a mixture of medical care from in-network and out-of-network doctors under a POS plan.

Example Of A Pos Vs Ppo Plan

Heres a real example of a POS and a PPO plan side-by-side for a family of four.

If youre shocked by the sticker price, this is how much Gold health insurance plans can cost if you have to pay for one 100% on your own with no employer or government subsidy. The Average Cost Of Family Health Insurance is outrageously high in the US.

Keep in mind this is just one example. There are dozens and dozens of nuances from one POS and PPO plan to the next. However, this comparison table can give you a general sense of how a POS and PPO plan can stack up against each other.

How A Pos Is Like An Hmo

A point-of-service plan has some characteristics of a health maintenance organization, or HMO. Most HMOs require their members to select a primary care physician, who is then responsible for managing the member’s health care, making recommendations as far as courses of treatment, specialist visits, medications, and more. The primary care physician also provides referrals for any other necessary services within the network. Most HMOs will only cover specialist care if the patient’s primary care doctor has provided a referral, although this is not always the casesome modern HMOs allow members to self-refer to specialists within the network.

But HMOs do tend to be fairly strict about only covering in-network care, unless it’s an emergency situation .

If you have HMO coverage and decide to visit a doctor or healthcare facility outside of your health plans network , you will most likely have to pay all of the cost for that care, as it will not be covered by the HMO.

HMOs have historically had lower out-of-pocket costs than PPOs. But this is no longer always the case, especially in the individual market . It’s common to see HMOs in the individual market with multi-thousand dollar deductibles and out-of-pocket limits. In the employer-sponsored market, there are still plenty of HMOs with low out-of-pocket costs, although deductibles and out-of-pocket exposure have been increasing on all types of plans over the years.

Also Check: How To Keep Insurance Between Jobs

Comparing Costs Between Ppo And Pos

When it comes to the costs for PPO vs. POS plans, how do they stack up?

- Deductibles: PPO plans usually come with a deductible. This means you pay for care and services until the deductible is met. Then your plan starts sharing costs. POS plans typically do not have a deductible as long as you choose a Primary Care Provider, or PCP, within your plan’s network and get referrals to other providers, if needed.

- Copays: Both PPO and POS plans may require copays. This is a fee you pay to a doctor at the time of a visit or for a prescription medication.

- Coinsurance: You may be required to share some of the costs for your care with both a PPO and POS plan. For a PPO plan your coinsurance kicks in once you’ve met your deductible. With a POS plan coinsurance costs could kick in if you need out-of-network care or fail to get referrals to see other providers.

- Premiums: This is what you pay monthly for your plan. Typically you will have a higher premium with a PPO because it offers more options. The POS plans usually have lower premiums because they offer fewer options.

What Are The Downsides Of Having A Pos Plan

Like all insurance plans, there are also downsides to having this type of plan. Here are a few to keep in mind:

- Varying rates by provider and referral status. With different rates per provider insurance status and whether you have a referral, it can be confusing to understand what youll actually end up paying.

- Paperwork implications. If you see a provider out-of-network, there might be a lengthy paperwork process in order to receive any of the coverage to which youre entitled.

Recommended Reading: Does Starbucks Provide Health Insurance

What Is A Medicare Advantage Pos Plan

Some Medicare health maintenance organization plans offer a point-of-service option. These plans are sometimes called HMO-POS plans. They combine lower costs associated with HMO plans along with some out-of-network flexibility associated with preferred provider organization plans.

The term point-of-service refers to where or from which doctor or other health care provider you receive medical services.

Basics of Medicare POS Plans

- You must choose a primary care physician to coordinate all your medical care.

- You may not need your PCPs referral to see a specialist, but it may speed things up.

- Youll need prior authorization from your PCP or your specialist for some services or they wont be covered.

- You will have separate deductibles for the HMO and POS portions of your plan.

Having two different deductibles in a POS plan may make a difference in your out-of-pocket costs. You will have one deductible for services you receive in your HMO network. Youll have to meet a separate deductible for out-of-network services you receive as part of your POS option in the plan.

You are also not allowed to combine the two deductibles and you have to reach each one separately. You may also have to pay a higher copayment or coinsurance for out-of-network services with a POS plan.

Medicare POS plans are a type of Medicare Advantage plan sold by private companies that contract with Medicare.

Don’t Leave Your Health to Chance

What Is Better An Hmo Pos Or Ppo

It depends on what you want from your health plan in terms of network, premiums, flexibility, and coverage.

The main choice would be the network, says Hope. Individuals should always research if their providers are in the network.

Before choosing a plan, make a list of the doctors that are important for your family whether its a particular cardiologist, pediatrician, ob-gyn, dermatologist or others. Then, find out which plan networks they participate in when comparing your plan options during open enrollment. If they arent included in the plans network, find out how much youd have to pay to continue to see them.

Also, see what hospitals are in the plans network.

Nearby hospitals should also be a consideration if you have an ongoing health condition that requires treatment or surgery, says Hope. Other considerations include treatment away from home and the availability of network providers in those areas.

If your doctors are all in the plans network, or you dont mind choosing some new doctors, you may want to save money in premiums with an HMO. If you dont mind having a primary care physician coordinate your care and control referrals to specialists, you may be interested in an HMO or a POS plan. If you dont mind paying more for the ability to use doctors and facilities that arent in the plans network, you may want a POS or a PPO plan.

Also Check: Insusiance

Definition Of A Point

A point-of-service plan is a managed care plan that lets you pay less if you use in-network hospitals, doctors, and health care providers. This plan also gives you the flexibility to see an out-of-network provider at a higher cost or reduced benefit level.

- Alternate names: Open-ended plan, HMO/PPO hybrid

- Acronym: POS

A POS plan combines the characteristics of a preferred provider organization plan and health maintenance organization .

What Is Pos Insurance Coverage

POS insurance coverage routes care through your primary care physician like an HMO, with in-network cost benefits like a PPO. You are required to select an in-network primary care physician who acts as the coordinator of your care with a POS. Your PCP provides primary and preventive care services and referrals to in-network specialists as needed.

Unlike HMO plans , you can do so without a referral if you seek care outside of the network. But the coverage will not be as robust. You will need to pay more for out-of-network care than if you had chosen to remain in-network. The amount of coverage provided by the insurance company will depend upon whether the point of service is in-network or out-of-network.

POS plans have higher premiums than HMO plans but cost less than PPO plans. This somewhere-in-the-middle pricing makes sense, as this type of plan combines the best of the two options.

Each POS plan is unique and has its terms. In most cases, you will be responsible for filling out and filing claims and other paperwork for out-of-network medical care, and copayments required for out-of-network service will be higher than that owed for in-network care. There is usually a deductible to be met before out-of-network coverage begins, while in-network care does not require meeting a deductible.

Also Check: Starbucks Insurance Benefits

Differences Between Pos Health Insurance Networks And Other Networks

The main differences between POS policies and other types of health insurance plans are costs, where you receive care and if you need a PCP.

What follows are brief descriptions of different network plans:

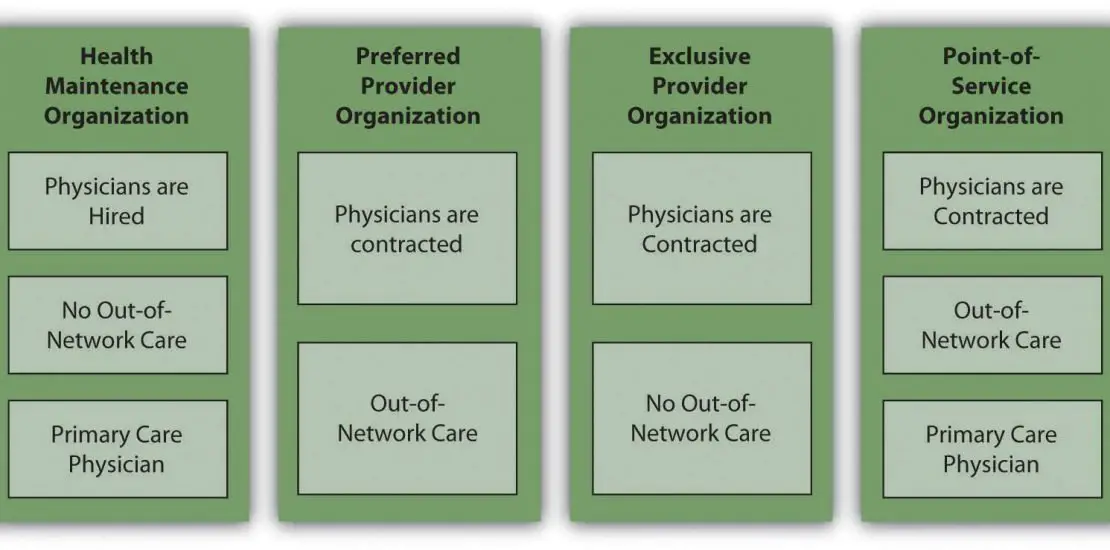

- Preferred provider organization : A type of health insurance plan where you pay less for using in-network providers. You can also go outside of the network for care and see specialists without having to obtain a referral. These plans provide more flexibility than the other plans, but they are more expensive.

- Health maintenance organization : A type of health insurance plan that only pays for care provided by the plans network of physicians and providers except in emergencies. With some HMOs, beneficiaries have to live or work within the HMOs geographic area to receive care. Beneficiaries are required to select a primary care physician as a regular source of care. The PCP has to approve referrals to specialists.

- Exclusive provider organization : EPOs, like HMOs, only pay for in-network care except in emergencies. Unlike with HMOs, you dont need to designate a PCP to manage your care, and you dont need a referral or prior authorization to see in-network specialists.

| Key plan characteristics |

|---|

| Not required |

Ppo: The Plan With The Most Freedom

A Preferred Provider Organization has pricier premiums than an HMO or POS. But this plan allows you to see specialists and out-of-network doctors without a referral. Copays and coinsurance for in-network doctors are low. If you know youll need more health care in the coming year and you can afford higher premiums, a PPO is a good choice.

Jenelle, 38, of Jacksonville, FL, has been married for five years. The couple is having difficulty conceiving and has seen a number of fertility specialists. When her employer offered three choices for health plans, Jenelle picked the PPO. She pays more for one fertility doctor whos out of network, but she doesnt mind: Her mission is to get pregnant.

Recommended Reading: Starbucks Open Enrollment

Point Of Service Plan

A point of service plan is a type of managed carehealth insurance plan in the United States. It combines characteristics of the health maintenance organization and the preferred provider organization .

The POS is based on a managed care foundationlower medical costs in exchange for more limited choice. But POS health insurance does differ from other managed care plans.

Enrollees in a POS plan are required to choose a primary care physician from within the health care network this PCP becomes their “point of service”. The PCP may make referrals outside the network, but with lesser compensation offered by the patient’s health insurance company. For medical visits within the health care network, paperwork is usually completed for the patient. If the patient chooses to go outside the network, it is the patient’s responsibility to fill out forms, send bills in for payment, and keep an accurate account of health care receipts.

Ppo Vs Pos: What Are The Main Differences

When you’re comparing health plans it’s important to understand what sets them apart from one another. This way you can make a decision based on your needs. Here are some main features that you can compare to find out what makes a PPO different from a POS:

- Costs

- Primary Care Provider requirement

- In-network requirement

- Referrals to other providers

You May Like: Kroger Associate Discounts

How Do Point Of Service Plans Work

Like an HMO, you start by selecting a Primary Care Provider to help coordinate and manage your health care needs. Your costs for care will be lower if you see in-network providers. Like a PPO, you have choices about where to receive care. Your PCP may refer you to in-network specialists, if your particular plan requires it. You are also free to see out-of-network specialists, without a referral, but you could pay more for that flexibility.

A Pos Plan May Be Right For You If:

- You’re willing to play by the rules and possibly coordinate your care through a primary care physician

- Your favorite doctor already participates in the network

*Definitions may vary by plan provider. Please read the provider’s Summary of Benefits.

Don’t Miss: How Long After Quitting Job Health Insurance

Is There Any Reason Not To Sign Up For A Pos Insurance Plan

A POS insurance plan is more beneficial than most state or federally sponsored health insurance plans. Individuals and families get complete coverage with a POS insurance plan, and while the coverage through state plans might be limited.

For example, state and federal plans do not offer comprehensive prescription medicine coverage, and certain benefits might be limited including hospital stays and elected surgeries. In most cases, if you have the ability to be part of a POS plan, it is a good choice.

Exclusive Provider Organization Plan

This plan requires you to stay within the network for your healthcare. However, there is no need to select a PCP. The limited amount of doctors lowers the cost of this plan.

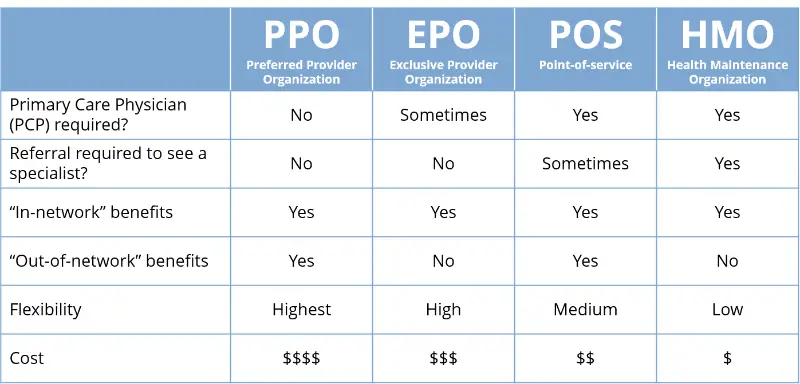

Final Thoughts on the Differences Between the Standard Types of Health Insurance Plans

We know this is a lot of information to take in, but understanding the differences between the standard types of health insurance plans will help you make the best decision for you.

Heres a table that will also help guide your decision. When choosing a health plan, balance your budget with your healthcare needs and chances are, youll arrive at the right choice for you.

| HMO |

|---|

Read Also: Starbucks Part Time Health Insurance

What Network Should You Pick

Everyone is looking for something slightly different out of their health insurance, so this is really a question you have to answer for yourself. But there are a few pointers you can keep in mind:

- Before you start looking, make note of your need to haves and want to haves in terms of your provider network and benefits. Also, list any doctors or hospitals you want access to. Keep that information at hand while you shop.

- Check the networks youre considering for doctors, hospitals and pharmacies near to you before making any decisions, especially if easy access to care is important.

- If your doctors already in-network, or youre flexible about where you get care and can easily stay in-network, then choosing an HMO or EPO may mean a lower cost for you each month.

- If you need the freedom to go outside a narrow network and still get some benefits from your coverage, then look at PPOs or a more flexible POS plan.

How Much Does A Pos Plan Cost

POS health insurance policies may be best for you if you want a plan that provides a middle ground between cost and flexibility.

POS insurance plans are not as cheap as HMO plans. They are, however, cheaper than the more flexible PPO plans in fact, POS health insurance plans can be 50% cheaper than PPO plans in some cases. With many POS plans, you do not have to meet a deductible. Deductibles are cost-sharing mechanisms, enabling insurers to defray costs while also discouraging the overutilization of services. In many instances, plans that do not charge deductibles will charge higher copays and premiums to recoup the costs of not charging deductibles.POS insurance plans also rely on primary care physicians to manage care and control costs.

POS insurance plans are not as cheap as HMO plans, but they are not as restrictive either, providing a degree of flexibility in that you can go out of network for care but at a higher price. The average monthly cost of a POS health insurance plan for a 40-year-old is $462.

| Plan type |

|---|

| $517 |

Recommended Reading: Does Insurance Cover Chiropractic

How Is A Pos Different From A Preferred Provider Organization

The two biggest differences between a Point of Service and a Preferred Provider Organization plan are flexibility and cost. The more flexibility you want, the more you have to pay. PPO plans offer the most flexibility and thus have the highest premiums. POS plans cost less than PPOs due to offering fewer choices.

But theres more than just the monthly premium cost to consider when choosing between a POS and PPO plan. Youll also want to look at the cost of the deductibles, copays, and coinsurance. Most PPO plans have deductibles, whereas many POS plans do not if you use an in-network PCP and get referrals to see other providers as needed.

Copays, however, are common with both POS and PPO plans. They tend to be similar in cost within the same metal tier. Unless you have a lot of appointments each year, the difference in copay costs may not be significant between these plan types.

Youll also typically see coinsurance on both POS and PPO plans. However, you may be able to avoid coinsurance if you stay in-network and get referrals for specialists with a POS plan.

If you go with a POS plan, youll get the best value if you have a PCP that you really like and are fine going to see for referrals. If not, a PPO plan helps you avoid referrals and needing a PCP altogether if you dont want one.