Health Insurance Age 62 To 65

Some states offer no medical examination of health insurance for under 65 for home businesses. It is best to speak with an insurance broker or agent in your state so that they can provide you with detailed information about personal insurance policies.

One way to make your health insurance age 62 to 65 policy affordable is to join a business organization or association in your state, as this makes the purchase as a group. It is best to assess your needs and ability to pay before obtaining individual insurance coverage.

Do your research before choosing inexpensive health insurance for individual or family health insurance for under 65 plan. And read all the information available.

This way, you will understand processes such as types of coverage and filing procedures. Knowing this information will help you choose the right health plan for you or your family.

Complaints Are Few A Good Sign

Complaint ratios for insurance companies can be found on the National Association of Insurance Commissioners site. The median complaint ratio from the NAIC is always 1.00. This means half of the insurers have a complaint ratio of under 1.00 and half have a ratio above. Basically, numbers lower than 1.00 are better with fewer complaints than the median and a number higher than 1.00 has more complaints than the median.

For Medicare supplement insurance, UnitedHealthcare had a complaint ratio of 0.39 for 2019, which is good news. For all Medicare Supplement coverage, they received 56 complaints, which Medicare Advantage received only seven. It comes as no surprise the main reason for a complaint is denial of claim and then unsatisfactory settlement or offer, as these tend to be the main complaints that come in for health insurance providers. In our survey, UnitedHealthcare actually received its best score, 84.92, in claims handling. With our older surveyed policyholders, those 55 and older, the scores were even better for claims, with a score of 88.91.

Sampling of feedback from those that said they had Medicare Advantage with UHC in our consumer review survey:

Medical Insurance For Retirees Under 65 Quote

The following choice is COBRA. It will be the Combined Omnibus Price range Obtaining back together Act.

COBRA enables former workers and their children to proceed their companys team protection for up to 18 months. The best factor about COBRA is it is assured. Your former companys health insurance for seniors under 65 providers cant convert you lower. Even if you have a serious Aetna healthcare problem.

Recommended Reading: Does Insurance Cover Chiropractic

Cheap Health Insurance For Seniors Under 65

3. Some individuals themselves in a position where they are not certified for State health programs. Also have excellent difficulty paying for traditional health insurance for seniors. If you are one of such, then you can reduce your budget for health good care by getting healthcare plans.

A lower price healthcare cards makes you allowed to take benefits of a system of healthcare companies. Who have decided to give cards providers healthcare solutions at a more affordable amount. Such cards are not given by any health insurance for elderly parents quotes provider.

If you have been disqualified from frequent health insurance for seniors over 62 to 65 due to a pre-existing situation or think your rates are too costly then you can bring down your invest by using this kind of cards. One benefits of a price reduction healthcare cards is that everybody is welcome.

All you have to do is pay a inexpensive per month fee and you will benefit from the assistance of a system of healthcare companies at a low cost.

4. Being on the same plan will reduce a lot if youre wedded. Even though this is true, its not absolutely the situation. So consider your health insurance for seniors age 62 to 65 options to be sure which is in your attention.

This is because in a variety of circumstances. its smart more to be on different health insurance for seniors age 62 to 65 plans and in other circumstances its more successful to be on the same strategy.

Best For Supplementing Medicare: Humana

Humana

Humana offers excellent Medigap coverage with a user-friendly website and multiple plan options to choose from. It is our choice as the best Medigap provider for its customizable coverage options and the ability to keep the healthcare providers you trust.

-

Multiple plans to choose from

-

You can choose any healthcare provider.

-

Majority of your Medicare costs covered

-

Monthly premiums can be high.

If youre 65 or older, you may not think you need additional coverage since you qualify for Medicare. However, a 65-year-old couple that retired in 2021 can expect to pay $300,000 in healthcare and medical expenses during their retirement.

A Medigap policy can help cover your health costs, such as your Medicare deductibles, coinsurance, or copayments.

Medigap policies dont include prescription drug coverage, and your monthly premium may be expensive. Humana is licensed to offer Medigap policies in most states, but check to see if plans are available where you live.

Humana is one of the top Medigap providers, offering a user-friendly website that allows you to search through the companys Medigap plans easily. With a Humana Medigap policy, you can see any healthcare provider that accepts Medicare. Depending on which plan you choose, the majority of your Medicare costs may be covered. Humana has an A- rating from AM Best.

Don’t Miss: Evolve Health Insurance Company

Coverage Including Exclusions Or Limits

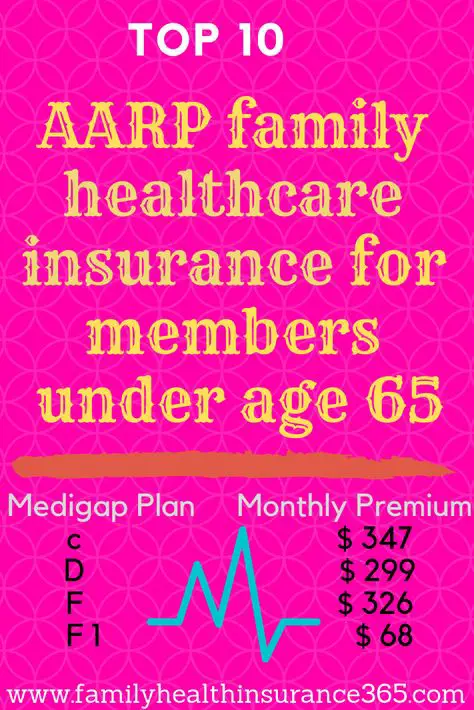

For an individual to qualify for a Medigap plan with the AARP, they must become a member. AARP membership $12 the first year, and then $16 annually.

When someone has an AARP Medigap plan, they can use any Medicare-approved doctor or healthcare provider across the U.S.

Medicare standardizes the coverage for each Medigap plan. The table below shows some of the benefits covered through the AARP Medigap plans. A person can check the complete coverage details for all AARP plans online.

| Benefit |

|---|

| 50%Plan K |

Plans K and L have annual limits that a person must reach before the insurer begins to pay. In 2021, Plan Kâs out-of-pocket limit is $6,220, and the out-of-pocket limit for Plan L is $3,110.

Pa Health Insurance Marketplace Prices Compare And Enroll

The Pennsylvania Health Insurance Exchange Authority offers affordable individual and family medical plans and generous tax subsidies. Many Pennsylvania consumers now pay less for their coverage than before the Affordable Care Act was created. But there are still a few surprises along the way. We highlighted most of the major examples, so you wont be caught off guard when you notice them, and can easily and quickly preview 2021 plans. We enroll you through the new Pennie website.

This Federally-Facilitated Marketplace allows you to purchase low-cost plans at affordable prices through our website. Our assistance is always free, and advice is unbiased. For consumers that choose NOT to participate in the Exchange, there are many options for Off-Marketplace plans that have large networks and premiums that fit within your budget. Open Enrollment for non-Medicare applicants, begins on November 1st for coverage. The last day is typically January 15th, although year-round enrollment is available with an SEP exception. In 2021, a special COVID OE period was added.

Pa Senior Medicare products are also available, but not through the Pennie Exchange. A separate Open Enrollment period applies allows consumers to switch, join, or drop plans. An ANOC is sent in the Fall and provides information regarding changes in rate, coverage, or the service area for the upcoming year. Upon review, consumers should determine if they will keep the plan, or apply for different coverage.

Don’t Miss: Does Medical Insurance Cover Chiropractic

Have A Question Or Need Help With Your Health Plan Account

If you get your UnitedHealthcare plan through your employer or former employer, or have an AARP Medicare plan or UnitedHealthcare® Medicare plan, were here to help.

This page is intended to provide employers with information about supplemental group retiree health insurance. If you are an individual interested in AARP Medicare Supplement Insurance Plans insured by UnitedHealthcare Insurance Company, you can find information here.

Where Do I Get Started

We know that it can be stressful to navigate the insurance coverage process, but we strive to make it as smooth as possible.

We accept a variety of plans from insurance companies at all of our locations. To verify if your insurance plan is accepted for services across our health system, please review our list of accepted insurance companies below.

If your insurance company is accepted by Cleveland Clinic: Please contact your insurance company to confirm what care is covered by your plan as well as information on copayments, deductibles and coinsurance amounts. See what your out-of-pocket expenses will be using our cost estimator.

If your insurance company is not accepted by Cleveland Clinic: This means your insurance plan is considered out-of-network which can lead to greater out-of-pocket expenses for your care. Please contact your insurance company for more information about what your financial responsibility may be if you choose to receive care at Cleveland Clinic. Find more information about Cleveland Clinics out-of-network insurance process.

You May Like: Evolve Health Insurance

Different Types Of Individual Healthcare Plans

The three types of Pa individual health insurance are Catastrophic, Comprehensive, and Health Savings Accounts . Of course, the newer terminology is Metal plans that are available on the State Marketplace. Bronze, Silver, Gold, and Platinum are your new benchmark definitions for available policies. Small and large business owners also have additional alternatives through the SHOP Exchange. Tax credits for small businesses are offered. Employees can opt out of employer-provided coverage and purchase plans privately. However, a federal subsidy may not be offered if Group healthcare benefits were declined.

Aarp Reviews: How Much Do Aarp Medicare Supplement Plans Cost

AARP offers Medicare Supplement plans through UnitedHealthcare. Learn more about what these plans have to offer and if they best fit your healthcare needs.

Everyday Health may earn a portion of revenue from purchases of featured products.

AARP has joined forces with UnitedHealthcare, one of the largest insurance providers in the country. But does that mean AARP Medicare Supplement plans are right for you? Before committing to a Medicare Supplement plan, review and weigh all the facts.

Read Also: Substitute Teacher Health Insurance

Amac Health Insurance Plans For Members Under 65

Because AMAC has commitments from multiple top rated insurance companies, we are able to deliver more choices and better rates to our members.

- Doctors and hospitals from large PPO networks

- Broad range of low deductibles and great benefit options

- Plans with prescription drug coverage

Reliable partners for your future

Insurance is serious business. You need protection for years to come and you need a partner you can count on. AMAC consistently provides the best service and a broad array of insurance options to fit your needs. Youll enjoy a higher level of customer service, and exclusive access to your Personal Insurance Advisor. Whatever your insurance needs, we provide you with a reliable partner in securing your future.

No Surprises Just Great Coverage

Medicare Parts A and B only cover some of your health care costs. That’s where Medicare Supplement Insurance comes in. Medigap plans cover some of the costs not covered by Original Medicare, like coinsurance, copayments and deductibles.

96% of members surveyed are satisfied with the customer service.2

Endorsed by AARP

The only Medicare Supplement plans endorsed by AARP.

3 These offers are only available to insured members covered under an AARP Medicare Supplement Plan from UnitedHealthcare. These are additional insured member services apart from the AARP Medicare Supplement Plan benefits, are not insurance programs, are subject to geographical availability and may be discontinued at any time. None of these services should be used for emergency or urgent care needs. In an emergency, call 911 or go to the nearest emergency room. Note that certain services are provided by Affiliates of UnitedHealthcare Insurance Company or other third parties not affiliated with UnitedHealthcare.

Peace of mind, choice of my own doctors, reasonable cost.

Hugo H., AARP Medicare Supplement Planholder

Don’t Miss: Kroger Employee Discount Card

What Are Medical Supplement Insurance Plans

Original Medicare pays a proportion of covered healthcare costs. However, Medicare beneficiaries must also pay copays, coinsurance, and an annual deductible. Private insurance companies sell supplement insurance plans, known as Medigap, to fill these payment gaps.

However, Medigap policies do not cover all healthcare costs. Typically, they do not include services such as long-term care, vision or dental care, or private-duty nursing. They also may not cover hearing aids or eyeglasses.

Depending on where a person lives and when they became eligible for Medicare, they can choose from up to 10 different Medigap policies.

The Basics Of Aarp By Unitedhealthcare Medicare Supplement Insurance

As of 2018, UnitedHealthcare provides 34% of all Medicare Supplement Insurance in the U.S., making it the company with the largest share of the Medicare Supplement insurance market.

These Medicare Supplement policies, also sometimes called Medigap, are not paid for by Medicare, but they aredesigned to work with traditional Medicare coverage. Medigap insurancehelps seniors manage their Medicare costs since Medicare on its own leaves seniors with numerous out-of-pocket expenses, as can be seen in this article Medicare Costs at a Glance. Without supplemental insurance, the deductibles, copays, and coinsurance of traditional Medicare can be difficult to meet, particularly due to the fact that you cant really know ahead of time how much medical care and hospitalization youll require in a year.

To render Original Medicare expenses more manageable, a Medicare Supplement plan from AARP by UnitedHealthcare covers some of the copays, deductibles, and coinsurance costs that patients would otherwise have to cover on their own. It also covers some things that Medicare doesnt cover, such as blood transfusions, excess charges that occur when doctors charge more than Medicare covers, and more. Exactly how much Medicare Supplement insurance covers depends on the plan. Medicare Supplement plans are similar across all companies since they are required to meet high standards set by federal and state regulators, but slight variations in plans do exist.

Read Also: Starbucks Pet Insurance

Health Insurance For Seniors

Medicare is a best federal health insurance program for people over 65 years of age. It can also cover younger people with disabilities or serious health problems. It is divided into four different parts. Medicare Part A, also known as senior health insurance, is designed to cover hospitalization and home health care.

If you wait until after the age of 65 to enroll for Medicare, penalties may be imposed in some cases.

Many people automatically enroll in Original Medicare, Part A and Part B. Generally, when they receive benefits from the Social Security Administration or Railroad Retirement Board and turn 65, those who receive SSA or RRB disability benefits are also qualified.

If you have not paid Medicare taxes for at least 10 years that you or your spouse worked for. Or if you are not yet receiving any social security benefits. Or the Railroad Retirement Board if you qualify for Medicare. The Social Security Agency usually doesnt automatically register you with Medicare. You have to start the registration.

Medicare Supplement Plans In Pennsylvania

If you have reached age 65 and are enrolled in Medicare Part B, you are eligible to purchase a Medigap or Advantage plan. Although not required, often these types of policies can effectively lower your out-of-pocket costs for hospital confinements and other submitted claims. If you miss the six-month Open Enrollment Period , you may be able to apply for coverage, although the application will be medically-underwritten. You can also wait until the next OE period in October.

Advantage plan options are typically less expensive than Supplement plans, and often feature $0 premiums. However, it is crucial to understand the differences in policies, and to properly verify that your providers are included in the companys network. These types of policies are issued by private carriers . They have a contractual agreement with Medicare to provide Parts A and B benefits. Often, dental, vision, hearing, and prescription coverage are included in the policy. Both HMO and PPO options are offered.

Don’t Miss: What Health Insurance Does Starbucks Offer

Retired Under Age 65 Directly From Active Employment

You become eligible for health insurance on the first of the month following your 65th birthday. You must elect health insurance before the first day of the month following your 65th birthday. If your 65th birthday falls on the first day of a month, the effective date will be the first day of the following month. Evidence of insurability is not required.

Dont Miss: How Much Is Health Insurance In Indiana

How Can Someone Under 65 Get Health Insurance

Hi all. This question is really not about AARP proving plans for those of us under the age of 65 and able to retire early but, rather, how does one find out what is REALLY available in their area when it comes to private health insurance coverage? Everything I find online requires that you provide your email and phone number, tells you nothing and then you get bombarded with calls from people that are so eager to sell, they don’t pay attention to your issues. It seems like there is little in the way of private coverage in the State of Alabama but I would really like to know if that is the truth. Are there places one can call or go online and just find out the options without having to deal with the plethera of calls? I just want guidance on where to start…I don’t want offers at this point! Thanks!

I retired the middle of 2018 and I am covered under Medicare. My wife is 55 and we must cover her with private insurance…she is not covered under an employer’s plan.

My understanding is that the Affordable Care Act , sometimes called “Obamacare” is still the law of the land. There have been some changes over the past couple years but I see that 2018 Federal tax forms still require proof of health insurance coverage.

I suggest a quick study on this. You can still get on an ACA plan through mid-February if there is some “qualifying event”. Otherwise you may be restricted to short-term plans with limited coverage.

Don’t Miss: Is Umr Insurance Good