Are Your Providers In Network

Check the health plans network to make sure it has a good selection of hospitals, doctors and specialists. Look for your providers in the plans network.

This is especially true if you get an HMO. HMOs have a restricted network and wont pay for the care you receive outside of the network.

If you get a PPO, youll likely be able to get out-of-network care, but it can come at a higher price tag.

Understand And Compare How Health Plans Are Structured

Know the differences between a health maintenance organization , preferred provider organization , exclusive provider organization , point of service plan and high-deductible health plan with a health savings account.

Dig into the details of what the health plans cover. For instance, how will the plan cover the prescription drugs you take? Make sure the healthcare providers you want to use are in the plans network. Otherwise you will pay more out of pocket or may not have coverage to see them.

In addition to reviewing the premium youll pay for the plan, estimate how much youll pay out of pocket for the amount of healthcare you expect to use in the next year.

If you rarely need medical care, it probably makes more sense to choose a plan with a higher deductible and lower premium than to pay a high premium for a plan with a low deductible. However, if you have a family and expect will need at least some health care services, a lower deductible could be the best choice.

Do You Need Workers Compensation

Almost every business in the country of Canada needs workers compensation insurance. However, you must remember that the workers compensation rules tend to vary from one location to the next. In many provinces, youll be required to carry this type of coverage. This is definitely the case, if you have employees. Workers compensation will protect your workers in the event that theyre injured on the job. The insurance will also reimburse these individuals, if theyre unable to work. It is truly in your best interest to obtain workers compensation insurance!

Other frequently asked questions before buying insurance:.

You May Like: How To Maintain Health Insurance Between Jobs

Helping Wny Get And Stay Healthy

As your local health plan, for over 40 years we have remained dedicated to improving the health and well-being for all of Western New York. Its a commitment that we deliver through the RedShirt® Treatment our promise of exceptional customer service. Its who we are. As associates and as a company, and what we bring to our members, employer groups, brokers, provider partners and the entire community.

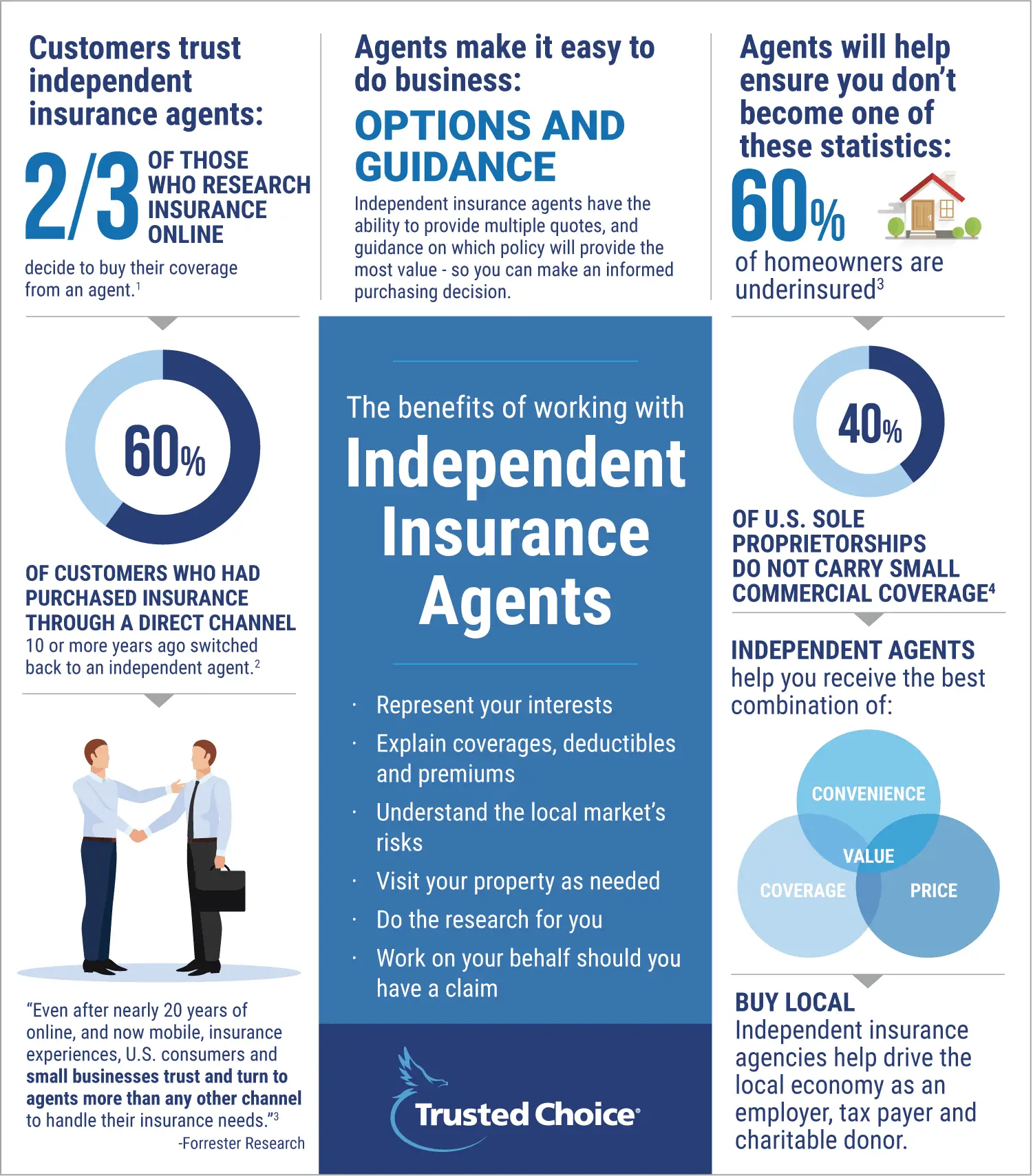

Definition Of An Independent Insurance Agent

An independent insurance agent represents multiple insurance carriers, typically offering consumers a choice of insurers, policies, and pricing.

In general, independent insurance agents sell:

- Property insurance

- Life and health insurance

- Small business insurance and employee benefit plans

- Retirement products

- Non-standard auto insurance such as non-owner policies

Recommended Reading: How Long Can Your Kid Stay On Your Health Insurance

Who Needs Individual Health Insurance

Individual health insurance is for anyone who doesnt have access to employer-sponsored or government-run health coverage. This includes people who are employed by a small business that doesnt provide health benefits, people who are self-employed, and people who retire before theyre eligible for Medicare and have to get their own personal health coverage until they reach age 65.

Tax Results Of A Dependent

Covering a dependent under your health insurance plan can affect your taxes. Sometimes, states mandate that employers cover dependents after the age of 26 which demonstrates. This is not the case for every state, but some states do have such mandates and require that employers follow them.

If the child is not considered a dependent under tax laws, then the situation is somewhat different. Covering them cannot be paid before taxes and oftentimes the policyholder must pay extra for covering such a person, even if the child is eligible for the health insurance plan.

Also Check: Is Health Insurance Cheaper When Married

Complaints Against Independent Health And Other Insurance Carriers By Consumers

Insurance complaints are one of the most important methods that consumers can use when considering a health insurance plan. The NYS Department of Financial Services receives and compiles complaints from consumers against their health insurance providers. Most of those complaints involve issues like payment, medical and hospital care reimbursements, issues regarding coverage, network problems, plan benefits not being covered, rates, and premium issues matters. This is the most recent yearly complaint table. This information in this table was sourced from the New York Consumer Guide to Health Insurers

| Carrier |

|---|

Employer Vs Individual Health Insurance Plans

In the past, most people had employer health insurance. Their company did all of the research, chose the insurance company and picked plan options for employees. This is also called group coverage or group insurance. But, a lot has changed in recent years.

- Challenging economic times have forced many employers to cut costs.

- Rising healthcare costs have made it difficult for companies to pay for health insurance.

- New and more expensive technologies, treatments and drugs have emerged, adding costs.

Due to these factors and others, a growing trend is for individuals to either partially or fully pay for their own health insurance. Even if employer-based group health insurance is still an option for you, you may wonder if you should purchase health insurance on your own, buying what is called Individual Health Insurance, or Personal Health Insurance.

To help you understand your options, well look at both individual and employer-sponsored plans, explaining and comparing them.

Recommended Reading: Can I Buy Health Insurance For Myself

Why Buy From Us

We provide one-stop shopping. We are a licensed, independent insurance agency, with no allegiance to any one insurance company. We offer a broad selection of health insurance companies and plans, which allows you to find the plan that fits your needs.

We treat you like you want to be treated. Whether you are just looking, buy a $60 or a $10,000 policy, you will be treated as our best customer. We are available to answer questions any time you need us, not just while you are buying a policy.

Best Prices. Health insurance rates are filed with your states Department of Insurance. Whether you buy from us, another agency, or directly from a health insurance company, you will pay the same monthly premium for the same plan. Were competing on service, not price, so were here for you.

Best Large Provider Network: Blue Cross Blue Shield

Blue Cross Blue Shield

BCBS members have access to plans through health maintenance organizations , exclusive provider organizations , and preferred provider organizations .

BCBS health care organizations offer nationwide coverage, and six of its companies were included in the top 15 best health insurers by Insure.com. Of those six, the ones that have AM Best ratings for financial strength received an A or better.

-

No matter where you live, there is a health care facility provider who accepts BCBS in your state.

-

There are many policy options and there is a plan available no matter how much coverage you may want.

-

Customers have rated various BCBS companies less than 3.5 stars on Consumer Affairs. The complaints include difficulty in getting medical procedures approved, coverage denials, and limited PPO choices.

The Blue Cross Blue Shield Association offers private health insurance coverage in the United States and over 170 countries. Over 110 million Americans have their health insurance through a BCBS organization. There are 35 BCBS independent health insurance companies in the U.S., and most have an AM Best financial strength rating of A .

The HMO plans offer the most comprehensive plans at the greatest savings but limit doctor choices to those inside the HMO. The EPO plan uses select provider networks and incorporates policies that promote and manage member health care. On the other hand, the PPO plans offer more flexibility with a great number of participating doctors.

Don’t Miss: How Can You Buy Health Insurance

Why It Is Needed

Truly, you never know what is going to happen in the future. While you might feel pretty good at this point in time, you might become injured on the worksite. Or, you might be diagnosed with a dangerous disease. Failing to obtain health insurance for independent contractors is risky! Do you really want to gamble with your life especially if you are performing high risks exposure tasks like a sidewalk construction company does? The answer is likely no. This is why you should get covered! You can purchase products such as life insurance, disability insurance, health and dental insurance from the same insurance companies that you apply to work for as an approved contractor. Do not go another day without having an adequate amount of health insurance.

What Is Individual Health Insurance

While many people get their health insurance through a group plan sponsored by their employer or union, others buy it themselves. If you are buying your own health insurance, you are purchasing an individual plan, even if you include family members on the plan. If this sounds like what you need, let eHealth show you all of your individual and family health insurance options, and use our free quote comparison tool to find an affordable plan that meets your needs.

Asa result of the Affordable Care Act , people can purchase individualhealth insurance through a government exchange or marketplace , or they can buy health insurance from privateinsurers. You may be restricted to purchasing health insurance through agovernment exchange to certain times of the year. Usually you can purchasehealth coverage from a private insurance company anytime.

ACAplans are a good starting place to understanding individual health insuranceoptions. ACA health plans are categorized by metals. You can learn more aboutthe metallic plans: Bronze, Silver, Gold, and Platinum.

Read Also: Do Physical Therapists Get Health Insurance

Ology For Company Ratings

We analyzed more than 180 health insurance plans to determine the best health insurance companies. Forbes Advisors ratings are based on:

- Complaints made to state insurance departments : We used 2021 complaint data from the National Association of Insurance Commissioners.

- Plan ratings from the National Committee for Quality Assurance : The National Committee for Quality Assurance is an independent, nonprofit organization that accredits health plans and produces ratings based on specific metrics.

- Plan ratings from the Affordable Care Marketplace : We used the federal governments overall quality rating for the companys plan. Where government ratings werent available, a companys Forbes Advisor rating is based on complaints and its NCQA scores.

Health insurance cost examples are from the federal health insurance marketplace.

Captive Health Insurance Agents

You may know that captive professionals work directly for an exclusive life insurance provider and cannot go beyond the products and plans of the company. For instance, if you deal with a captive agent, the professional will market and try to sell the only product they have.

However, the experts are adept at what their insurance companies offer. But, they cannot assist you if you do not need or qualify for their companys products. Also, when it comes to getting comprehensive packages and plans, you cannot get any help from them.

Read Also: Who Qualifies For A Tax Credit For Health Insurance

Sign Up To Our Free Breaking News Emails

Spaniards spent a record high amount on private health insurance last year, according to data released Wednesday, amid growing discontent with the countrys once-prized public health system.

Spending in 2022 hit a total $11.36 billion, an increase of 7% over 2021, Spains Association of Insurers said. It added that around 12 million Spaniards a quarter of the population are now covered by a private health policy.

The figure is all the more remarkable as all working Spaniards must contribute payments for public health insurance while public health care is available free of charge to the registered unemployed.

Poll data from Spains CIS public research institute late last year show that just 11% of Spaniards think the public health system generally functions well.

Waiting times for appointments with physicians have doubled across Spain since the COVID-19 pandemic began, while almost 40% waited more than three months to see a specialist.

What Is Health Insurance For Self

Health insurance for the self-employed is any insurance plan purchased as an independent contractor or self-employed individual where you are required to cover the cost of your own employee benefits, including health insurance. You may have a couple of options for buying coverage, such as purchasing health insurance directly from a provider or through your states exchange or Heathcare.gov. You may apply during open enrollment which happens once per year every fall or after a qualifying life event.

Depending on your income, you may qualify for a discount through cost-sharing reductions, which may lower the cost of your deductible, co-payments, or co-insurance. To qualify, you must sign up for one of the Marketplace plans.

If your income is low, you may also see if you qualify for Medicaid, which could offer free or inexpensive health insurance. You may apply for Medicaid through the Marketplace or through your states Medicaid agency.

You May Like: Which Health Insurance Is Best In Nyc

What Is Health Insurance

Health insurance is a contract that requires an insurer to pay some or all of a persons medical expenses in exchange for a monthly premium. Its to prevent you from hitting financial ruin should you run into an emergency, says Molly Moore, co-founder and chief health plan officer at health insurance start-up Decent. Some people get health insurance because they know they have ongoing health care issues that need to be taken care of, and some people get health insurance because theyre scared of something that could happen that they cant plan for, she says.

Going without health insurance coverage poses a risk to both your potential to get care and an even bigger risk to your personal finances, explains Noah Lang, chief executive officer and co-founder of Stride Health, a benefits platform for independent workers. People who arent insured tend to be hesitant to get care, which can risk their health, he adds.

People who have health insurance are often more likely to go to the doctor when they need to because they know what it will cost, says Katie Roders Turner, executive director of the Family Healthcare Foundation in Tampa Bay, Florida. They tend to follow up on medical concerns their doctors flag, such as high blood pressure, before they turn into bigger problems, and theyre more likely to obtain necessary prescription drugs since theyre available at a more affordable rate.

Where Can Consumers Buy Individual Health Insurance Coverage

Individual health insurance is available via the exchange/marketplace in every state . There are 36 states that use HealthCare.gov as their marketplace in 2021, while DC and the other 14 states run their own exchange platforms .

Individual health insurance is also available outside the marketplace nationwide, with the exception of the District of Columbia . But premium subsidies and cost-sharing reductions are only available if the plan is purchased through the marketplace.

In both cases on-exchange or off-exchange individual health insurance is only available during the annual open enrollment period or during a special enrollment period triggered by a qualifying event. In most states, the annual open enrollment period runs from November 1 to December 15, with coverage effective January 1. But the majority of the states that run their own exchange platforms tend to offer extended enrollment periods, some of which continue well into January.

Plan availability and coverage options vary considerably from one area to another. Some parts of the country have only a single insurer that sells individual health insurance, while other areas have several different insurers and dozens of healthcare plans from which to choose.

You May Like: Where To Buy Private Health Insurance

Why Is Health Insurance So Expensive

The driving factor for why health insurance is so expensive is that health care is so expensive, says Louise Norris, a licensed health insurance agent based in Colorado and author of The Insiders Guide to Obamacares Open Enrollment. The price of health care in this country is really high.

According to a 2020 report from the Kaiser Family Foundation, insurers said the reasons they had to increase premium costs included the continued cost of COVID-19 testing, the rebounding of medical services that had been delayed during the pandemic and morbidities related to foregone care.

Pros And Cons Of Individual Health Insurance

For some, personal health insurance is the only way to meet ACA requirements, If you have the option of group health insurance, personal health insurance plans may still be the better option. It all comes down to which plan best meets your needs.

Individual health insurance has several benefits, such as:

- More control: Individual plans allow you to choose from a wider plan selection than just the ones your employer presents to you. You can find a more customized solution that includes what you need and excludes what you dont.

- Flexibility: Personal health insurance is not tied to your employment. This can be useful if you are concerned about job loss or changing positions. You can even use it to close a gap between an insufficient employer-provided plan and your healthcare needs.

- Choice of insurer: You can choose from more insurers with an individual plan. Some will have certain benefits, customer service offerings or pricing models that are more appealing to you.

On the other hand, individual health insurance also has some downsides:

- Higher costs: Often, a group plan is partially paid for by the employer and has lower premiums in the first place. Without these savings, individual plans can be slightly more expensive.

- Pre-existing condition coverage: Individual plans may charge additional fees or lack coverage if you have a pre-existing condition.

Read Also: How Much Is An Abortion Without Health Insurance