What Is The Best Medical Insurance For Self

The best medical insurance plan is the one that offers the right coverage for you. Our brokers scour the ends of the earth, AKA search through all the national and regional carriers in the individual market, both on and off the Marketplace to make sure they find the very best medical insurance for you.

Best For Convenience: Cigna

Cigna is our top pick for self-employed individuals looking for convenience because of its virtual care options and prescription home delivery.

-

Virtual services and prescription delivery

-

Expansive provider network

-

Not available in all states

-

Mixed customer satisfaction reviews

Cigna is the oldest health insurance company on our list, with a history dating back to 1792. The company has earned an A rating from AM Best and rankings of 2.5 to 4.0 from NCQA. Cigna also earned high marks, including four regional first places, in the J.D. Power 2022 U.S. Commercial Member Health Plan Study. However, it did receive low scores in some other regions.

Cigna offers global coverage to 180 million customers in 30 countries, which includes 1.5 million providers and facilities. In the United States, the company works with over 67,000 pharmacies, more than 500 hospitals, and over 175,000 mental and behavioral health providers, growing 70% since 2016.

Cigna offers individual plans in 13 states: Arizona, Colorado, Florida, Georgia, Illinois, Kansas, Mississippi, Missouri, North Carolina, Pennsylvania, Tennessee, Utah, and Virginia. Depending on where you live, you may have access to Cignas other products like Medicare, Medicare supplemental plans, dental insurance, vision insurance, or international health insurance.

Interest And Bank Charges

You can deduct interest incurred on money borrowed for business purposes or to acquire property for business purposes. However, there are limits on:

- The interest you can deduct on money you borrow to buy a passenger vehicle or a zero-emission passenger vehicle. For more information, go to Motor vehicle expenses.

- The amount of interest you can deduct for vacant land. Usually, you can only deduct interest up to the amount of income from the land that remains after you deduct all other expenses. You cannot use any remaining amounts of interest to create or increase a loss, and you cannot deduct them from other sources of income.

- The interest you paid on any real estate mortgage you had to earn fishing income. You can deduct the interest, but you cannot deduct the principal part of loan or mortgage payments. Do not deduct interest on money you borrowed for personal purposes or to pay overdue income taxes.

Don’t Miss: Does Oregon Have Free Health Insurance

Buying Group Health Insurance With Employees

If you have at least one employee , you can buy group health insurance through an agent, directly from an insurance company, or through the public exchange. Basically, you have more options for how you can buy a group health policy when youre a self-employed business owner with employees.

Anther option is a stand-alone health reimbursement account . This is an employer-funded account from which you can be reimbursed tax-free for qualified medical expenses. There are several types of HRS, including the Individual Coverage HRA available to businesses of any size, and the Qualified Small Employer HRA , available to business with up to 49 employees.8,9 These two types of HRAs are considered an alternative to job-based health coverage, and require enrollment in a health plan for the money to be used.10

For a QSEHRA, the business owner sets an allowance for the QSEHRA, then employees maintain minimum essential health coverage and submit their medical expenses for tax-free reimbursement. Employees can be reimbursed up to $5,300 per year for individuals and up to $10,700 per year for families.11

Read Also: Will Health Insurance Pay For Liposuction

Changes In The Affordable Care Act Insurance Quotes

Under the ACA, Americans are required to carry clinical insurance that meets federal minimum requirements or face the cost of tax liability, but Congress removed that fee in December 2017. A Supreme Court decision in 2012 overturned an ACA arrangement that required setting to expand Medicaid qualifications. as the problem of receiving government Medicaid financing, and various specifications decided to reduce growth. Since 2021, some 31 million people have health and wellness coverage through the Affordable Care Act Insurance Quotes.

2 public health and welfare insurance plans, Medicare and the Child Health and Welfare Insurance Program , target parents and children who need assistance with health and wellness insurance. Medicare, which is available to those 65 years of age or older, also offers individuals with certain disorders. The CHIP plan has an income limit and includes infants and children up to 18 years of age.

But Medicaid can help older people spend long-term care in home care, Medicare cant.

Health and wellness insurance is a contract you enter into with an insurance provider to have them cover some or all of your clinical costs for a fee. Having health and wellness insurance can prevent you from incurring medical expenses that you cant afford Insurance Quotes.

You May Like: How Important Is Health Insurance

How Much Is Health Insurance For Self Employed

Self-employed people have to cover all expenses that many people take for granted. The biggest of which is health insurance. So how much is self-employed health insurance?

Health insurance depends on many different things and the cost can be different from person to person. But the biggest factors on self-employed health insurance costs are who you buy it from and what level of coverage youâre looking for. In this article, weâll walk through everything that makes up the total price you pay for insurance before getting into some of the most popular plans out there for self-employed workers.

Health insurance is one of the biggest expenses that you will face as a self-employed worker. The prices will vary drastically from person to person, but an average self-employed person can expect to pay anywhere from $335/month up to $1,618/month depending on the company and the level of coverage.

All the information in this article comes directly from myself searching for self-employed health insurance. During my search, I learned about everything that goes into the cost for insurance, which is more than just the monthly premium! The plan details and costs that you find here come directly from the companies themselves.

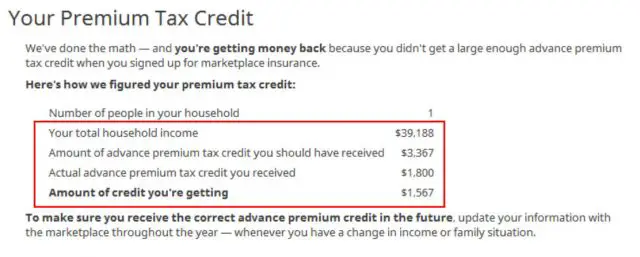

Aca Tax Credits Mean More Savings For The Self

How else can you lower your health insurance costs when self-employed? The Affordable Care Act introduced premium tax credits , which are refundable credits that help qualifying Americans pay their premiums for health insurance coverage purchased through the Marketplace.

- Not be eligible for affordable coverage through an employer-sponsored plan.

- Not be eligible to enroll in a government plan like Medicare, TRICARE, or Medicaid.

- Have paid your health insurance premiums by the original due date of your tax return.

- Not file your tax return with the status married filing separately.

- Not be a dependent.

- Have household income thats at least 100% and no more than 400% of the federal poverty line for your household size.

To get a PTC, enroll in health insurance coverage through the Marketplace and request financial assistance. The PTC amount you qualify for will be estimated based on your family size, household income, and eligibility for non-Marketplace coverage. Your estimated credit, if you qualify for one, will be paid in advance directly to your insurance company on your behalf, lowering your out-of-pocket monthly expenses.

Don’t Miss: Does Mcdonald’s Have Health Insurance

What Is An Annual Deductible

The term annual deductible is the amount of money you pay each plan year before your insurance company starts paying its share of the costs. For example, if your annual deductible is $2,500, then you would be responsible for paying the first $2,500 of your medical expenses each year, and then the insurance company would start paying its agreed upon share.

How Much Is Self Employed Health Insurance

Health insurance prices will depend on several factors and will be different for everyone. But the two most important factors on the price of self-employed health insurance is the company you buy it from and the level of coverage you desire. Letâs take a look at some of the different plans offered by a couple of the biggest names in self-employed health insurance.

For the sake of this comparison, we will be looking at the average cost for a reasonably healthy self-employed adult looking to purchase individual health insurance for themselves. From this, you can extrapolate as needed to get a quick estimate for what you can expect to pay based on coverage and company.

Read Also: Are We Still Required To Have Health Insurance

The Ultimate Guide To Self

Editor

As a freelance writer, you dont have an employer who offers you health insurance. That can be a frightening proposition, but not to worry there are numerous great self-employed health insurance options for freelancers!

Ive heard from more than one writer whos hesitant to pursue their freelance dreams because theyre nervous and unsure of how health insurance for freelancers works. And hearing that makes me sad.

Dont let this be the issue that stops you from pursuing your freelance writing dream! This. Is. Solvable. Especially now, in the U.S., where Im thrilled that there are more options for health insurance for self-employed freelancers than ever before.

How To Save On Self

There are ways to lower your self-employed health insurance costs.

If you have a low income, you may qualify for special deductions on health insurance marketplace plans for things like your copays, deductibles, and co-insurance. Theres a personal health insurance deduction that allows self-employed individuals to deduct 100% of health insurance premiums.

Its applicable for federal, state, and local income taxes, and covers not only the policyholders but also any spouses and dependents. To qualify, you must have regular business income and no other active health insurance policy.

Another way to save on health insurance premiums is to get a high-deductible health plan . A HDHP has a deductible of at least $1,400 for single coverage and $2,800 for family coverage. You have to pay that amount out-of-pocket for health care services over a year before the health insurance begins to pay for care.

A high-deductible plan also has a health savings account or health reimbursement arrangement , which let you save tax-free for your future health care needs.

Read Also: Does Farm Bureau Have Health Insurance

Enroll In A Plan Through The Aca

You can also get insurance coverage for yourself and your family through the Affordable Care Act , sometimes called Obamacare. The ACA created the Health Insurance Marketplace where anyone can sign up for a health plan, regardless of their employment status. This may be the best health insurance option for you because it allows self-employed individuals to choose from different plans.

Through ACA, you can sign up for a plan during the open enrollment period. Federal open enrollment lasts from November 1 to December. 15, but some states open their enrollment periods sooner, or extend their deadline.

You may sign up through special enrollment if you go through a qualifying life event, such as marriage, divorce, or job loss, which impacts your insurance status. However, you must enroll within 60 days of the life event or youll risk needing to wait for the next open enrollment period.

Find additional information on how to enroll through Healthcare.gov or your states .

Are There Other Ways To Keep Health Coverage

If youre married and your spouse is covered under another employers group health insurance plan, you may be able to get family coverage thats less expensive than buying it through the individual market, depending on whether your spouses employer helps pay the premiums for dependents and spouses who are added to the plan.

If you lose your own coverage , youll have a special enrollment period during which you can be added to your spouses employer-sponsored plan, if he or she has one.

Note that if you do have access to the health insurance plan offered by your spouses employer, you wont be eligible for subsidies in the individual market as long as your spouses employer offers coverage that provides minimum value and is affordable for employee-only coverage, regardless of how much it costs to add a spouse or dependents to the plan.

Read Also: What To Do When You Lose Health Insurance

The Premium Tax Credit

Who: Those who buy through the Marketplace , below a certain income

What: Reduced health insurance costs

Where:Form 8962

One of the provisions of the Affordable Care Act was the introduction of the premium tax credit. While this isnt a deduction, these are credits, or subsidies, that make your health insurance plan more affordable. The subsidies are meant to reduce the cost of your health insurance plan according to your income. More specifically, your subsidy amount is determined by where your income falls in relation to the federal poverty level. As a general rule, the closer you are to the federal poverty level, the higher subsidy you will receive. When you call Stride Health to enroll in health insurance and we tell you that you can get a subsidy of $100 per month, effectively lowering your monthly costs by that amount, thats the premium tax credit at work!

To receive a subsidy, your income must be between 100% and 400% of the federal poverty level .

You also need to meet a few other requirements to qualify for the premium tax credit. Youre eligible for the premium tax credit if:

-

You or a family member bought health insurance from the Marketplace

-

You cannot be claimed as a dependent by another person

-

You dont file your taxes as Married filing separately

-

You are not eligible to purchase health insurance through a spouse or employer

-

You are not eligible for Medicaid, Medicare, CHIP , or TRICARE

When you exercise the premium tax credit, you have two options:

Local Chamber Or Business Group

For several years, my city Chamber of Commerce offered an affordable group plan for members that had pretty nice coverage! Look into whether a local business or professional organization might have a plan you could join as a member. There are also some national organizations that might be able to help, such as

Don’t Miss: How Do You Get Health Insurance

Confirming If Your Contractor Is Registered And Paying Premiums

If you hire a registered contractor who is not making required payments to WorkSafeBC, you could be liable for insurance premiums relating to the work or service they provide to you. To protect your business from additional insurance premiums, always get a clearance letter before and after you receive services from a contractor to confirm whether a business, contractor, or subcontractor is registered with us and paying premiums.

Canada Pension Plan Disability Benefits

The Canada Pension Plan provides monthly payments to people who contribute to the plan during their working years.

You may be eligible for CPP disability benefits if:

- you contributed to the CPP for a certain number of years

- youre under 65 years old

- you have a severe and prolonged mental or physical disability

- your disability prevents you from working on a regular basis

The benefits include payments to children of a person with a disability.

Apply as early as possible if you think youre eligible for CPP disability benefits. Quebec residents may be eligible for a similar program called the Quebec Pension Plan . It may take several months to process your application.

If you applied for CPP or QPP disability benefits and were told that youre not eligible, you can ask to have your application reviewed or considered again.

Once you reach age 65, your CPP disability benefit will automatically change to regular CPP payments. Your regular CPP payments may be less than the CPP disability payments you got before.

If so, consider:

You May Like: Evolve Medical Insurance

Read Also: How Much Does Health Insurance Cost An Employer

How Much Is Health Insurance For The Self

You want good coveragebut also dont want to pay an arm and a leg for it. Lets take a quick look at how much you can expect to pay for health insurance if youre self-employed.

A ton of factors go into the cost of health insurance: who you need to cover , the level of coverage you need, whether you smoke, your age, where you live, and more. But if youre purchasing a health insurance plan on the marketplace, the average person will pay $438 a month.2 The average family pays about $1,779 per month.3 But, if you qualify for tax subsidies, you might not have to pay as much. Check out Healthcare.gov to see if you might qualify for help.

Insurance Policies That Cover Critical Illness

Critical illness insurance plans provide coverage for a limited number of life-threatening disorders. There may be long-term treatment or even a lifestyle modification required for some conditions. Critical Illness coverage is purchased by the consumer, rather than by the hospital, and the payment is based on that coverage rather than the actual hospital expenditures.

To use the money, you can adjust your lifestyle or take new drugs. When you are unable to work because of illness, it might supplement your income, naics workers comp codes. Rather than requiring proof of initial medical expenses, these insurance pay out depending on the diagnosis of the illness.

Recommended Reading: Starbucks Insurance Benefits

Also Check: What Is The Best Hmo Health Insurance

Should I Take Public Or Private Health Insurance

As a freelancer in Germany, you have the possibility to choose between the two, public and private health insurance. However, when it comes to which one you should purchase, the decision is entirely up to you.

In addition, you should keep in mind a few things before making your choice. If you plan on moving to Germany permanently, it would probably be best for you if you joined the public healthcare system. As you get older, the monthly premiums are likely to change in the private healthcare sector. Moreover, adding additional cover would also have its own challenges since the risk status increases with age.

Freelancers registered with private health insurance providers, on the other hand, have a few more advantages. This means, if your income is relatively low, you may choose to begin with a basic private health insurance tariff and later on switch to a more comprehensive one. You may combine the tariffs of different services according to your needs and create a health insurance package that is perfect for you.

It is not easy to suggest a health insurance plan that fits perfectly to everyone. However, DR-WALTER has numerous affordable health insurance plans you might want to check out, like DR-WALTER.

PROVISIT by DR-WALTER is suitable for foreign citizens who plan to stay in Germany for up to two years. It provides you with comprehensive coverage, consisting of:

- travel health insurance

Also Check: Can You Buy Dental Insurance Anytime