Use The Aca Health Insurance Marketplace

The ACA marketplace is a service offering insurance plans for individuals, families and small businesses.

The platform is designed to match you with the best insurance plan for your situation based on several factors, such as income and recent life events. You can view plans that are available for your ZIP code.

Each plan lists all relevant details, such as the deductible, copayments, estimated monthly premiums and the health services covered under the plan. The ACA marketplace can be a way to find affordable health insurance coverage if you qualify for premium tax credits and subsidies. Note that you can only sign-up for a plan during the open enrollment period . You will otherwise need to qualify for a special enrollment period, available due to change in circumstance or life event, such as getting married, having a child and moving out of state.

How The Aca Affects Health Care Costs

Health care costs have been rising for decades, and some people continue to pay more for insurance and costs. But the ACA helps reduce health care costs for many people by:

- Providing preventive care, such as screening mammograms and colonoscopies, at no cost to patients

- Not allowing yearly and lifetime dollar limits on the amount of coverage a health plan will pay for

- Limiting out-of-pocket costs that an individual or family will pay every year

- Encouraging more competition among health plans and empowering consumers to choose the best one for them

- Helping low- and middle-income people afford health coverage in the health insurance marketplaces

- Helping to make sure health plans don’t charge you more just because you have a pre-existing condition

- Not allowing plan to charge women more than men

Using Other Health Insurance

If you have any health insurance other than TRICARE, it is called “other health insuranceHealth insurance you have in addition to TRICARE, such as Medicare or an employer-sponsored health insurance. TRICARE supplements dont qualify as “other health insurance.”.” It can be through your employer or a private insurance program. By law, TRICARE pays after all other health insurance, except for:

- State Victims of Crime Compensation Programs

- Other Federal Government Programs identified by the Director, Defense Health Agency

This means your other health insurance processes your claim first. Then, you or your doctor files your claim with TRICARE.

Are you on active duty?

- You can’t use other health insurance.

- TRICARE is your only coverage.

Do you have Medicare?

- Medicare is a federal entitlement

- TRICARE pays last after Medicare and your other health insurance

- Visit the Medicare website to see which planMedicare or your other health insurancepays first

Also Check: Does Any Health Insurance Cover Cosmetic Surgery

Eligibility: How Am I Evaluated By Health Insurance Companies

Each private health insurance company has the flexibility to create their own rules regarding which applicants will be accepted for an individual health insurance policy in Texas. Additionally, an applicant can be turned down by in insurance provider for any reason. The only exception to this is for newborns who are required to be covered under their parents policy for the first 30 days and disabled, dependent children whose parents have a policy that covers dependents. Although private insurance in the state is not guarantee issue, to comply with HIPAA Group-to-Individual Portability Coverage regulations, the state does guarantee acceptance into the Texas Health Insurance Risk Pool , for those who are HIPAA eligible but have been unable to obtain coverage through a private insurer.

You Can Keep Your Plan Longer With State Continuation

Texas law requires some group plans to continue your coverage for six months after COBRA coverage ends. Your plan must be subject to Texas insurance laws. State continuation doesnt apply to self-funded plans since the state doesnt regulate them.

State continuation lets you keep your coverage even if you cant get COBRA. If you arent eligible for COBRA, you can continue your coverage with state continuation for nine months after your job ends. To get state continuation, you must have had coverage for the three months before your job ended.

You usually cant get state continuation if you were fired.

Also Check: What Is A Premium Tax Credit For Health Insurance

Buy Health Insurance Directly From The Insurance Company

Private health insurance doesnt always have to be expensive: since you typically choose a plan based on what services you think youll need, if you only need basic coverage, it may end up being a cheaper option than even the health insurance marketplace. While looking into private health insurance can be time-consuming, it is often worth the effort, especially if you are not eligible for any of the other types of health insurance listed above.

Your Parents Plan Might Not Be Cheaper

Adult children have a couple of options for finding their own insurance. They can continue coverage with COBRA, join their own companys health insurance plan if they are employed and one is offered, or shop for their own individual plan in their states marketplace.

There are a few things that adult children should consider when deciding between staying on a parents plan and having their own. The first is the potential cost. It might not be cheaper to stay on a parents plan, and if it is, you might be sacrificing coverage, said Norris.

All you need is one broken arm or one really bad case of the flu and it becomes painfully clear why you shouldve had coverage.Kim Buckeyvice president of client services at DirectPath

Its common for employers to cover a lot for the employee but less for the kid, said Norris from Healthinsurance.org. Especially if youre over the age when insurance plans start charging the adult rate, your parents might be paying quite a bit to cover you, Norris said.

There are some caveats. If you have younger siblings on a family plan, your continuing on the plan might not change the cost. Experts say the best course of action is to talk with your parents and encourage them to ask human resources or the insurer the details of the plan.

More from Personal Finance

Recommended Reading: Can A Married Dependent Be On Health Insurance

The Affordable Care Act Explained

The Affordable Care Act was created in 2010 with the goal of ensuring that everyone could access affordable health insurance. Prior to the introduction of the act, individuals with pre-existing medical conditions often struggled to access affordable care.

In addition, some who were diagnosed with serious or complex health conditions that required expensive treatment would find their policies would be cancelled or that there was a cap on the amount the insurance provider would spend on their health care per year or even during the lifetime of the policy.

The Affordable Care Act changed that, requiring insurance companies to provide coverage to all and preventing them from charging extra for pre-existing conditions or discriminating against those who needed more expensive care.

Under the first iteration of the Affordable Care Act, individuals were required to have a health insurance policy that met certain standards. Those who did not sign up for a policy would be penalized when they filed their tax returns.

Everyone was required to sign up for health coverage during an open enrollment period every year. If they missed that open enrollment window, they would either have to pay the penalty or register for health insurance during a special enrollment period.

Who Goes Without Health Insurance

A snapshot of the uninsured population gives us a portrait that reflects the relative size of population groups within the general population under age 65. More than 80 percent of uninsured persons are wage earners or members of working families, and two-thirds are members of lower-income families . Three-quarters of the uninsured are adults between the ages of 18 and 64, with one-half between the ages of 18 and 34 and one-quarter under the age of 18. Almost 80 percent are U.S.-born citizens, and half are non-Hispanic whites. Most are residents of the South and West, and three-quarters live in urban areas.

Read Also: When Health Insurance Open Enrollment

Why Is It Considered Illegal

In the beginning, the Affordable Care Act required that people have minimum essential coverage in order to be able to get medical insurance that meets certain requirements. This is known as the specific requirement for medical insurance.

This meant that, even though you werent considered a criminal act for not having medical insurance, you may have had to pay a tax penalty if you didnt have minimum important protection.

In 2017, both houses of Congress voted to repeal the 2019 shared duty charge. This was part of the tax reconciliation act.

In 2015, the federal government was required to pay the ACAs shared-duty tax charge in 2018. In 2018, the Open Registration was when people bought medical insurance to cover themselves for 2019. This was the first time in a long time that you didnt have to worry about getting an ACA-compliant strategy with little protection or dealing with a tax cost the following year.

Keep in mind, however, that not all states have the same medical insurance tax rates. If their state requires them to have medical insurance, those who live in these states might be subject to a tax.

You Need Some Coverage

It might be tempting for young adults to skip health insurance. They might think that theyre invincible, or that they can save money by not paying for coverage and not paying a penalty.

While the Trump administration did do away with the penalty for not having health insurance coverage, that wont go into effect until after 2018, meaning that the first time people filing their taxes won’t have the penalty is 2020, said Louise Norris, a writer for Healthinsurance.org and Verywell.

Regardless of the penalty, going without health insurance is never a good idea, according to Buckey from DirectPath. Attempting to skirt the cost could lead to astronomical medical bills if you do have an emergency.

All you need is one broken arm or one really bad case of the flu, Buckey said. and it becomes painfully clear why you shouldve had coverage.

You May Like: When Does A Company Have To Offer Health Insurance

The Fee For Not Having Health Insurance In 2023

There is no penalty for not having ACA mandated coverage in 2023 unless you live in a state like New Jersey or Massachusetts where it is mandated by the state. Because of this, short-term medical plans will be extremely popular in 2023 because they provide access to larger PPO networks at lower prices than ACA Bronze plans.

If You Leave Your Job

You can usually continue your coverage temporarily under COBRA .

Learn more: Need health insurance? How to find a new health plan now.

What is COBRA?

COBRA is a federal law that lets employees continue their health coverage for a period of time after they leave their job. It applies to coverage from employers with 20 or more employees. It doesnt apply to plans offered by the federal government or some church-related groups.

You can get COBRA coverage if:

- You leave your job for any reason other than gross misconduct. Gross misconduct usually means doing something harmful to others, reckless, or illegal.

- You lose your coverage at work because you switch from working full-time to part-time.

If your family was on your health plan, you can continue their coverage under COBRA. Your spouse and children also can continue their coverage if you go on Medicare, you and your spouse divorce, or you die. They must have been on your plan for one year or be younger than 1 year old. Their coverage will end if they get other coverage, dont pay the premiums, or your employer stops offering health insurance.

You have 60 days after you leave your job to decide whether you want COBRA. You must tell your employer in writing that you want it. If you continue your coverage under COBRA, you must pay the premiums yourself. Your employer doesnt have to pay any of your premiums.

For more information about COBRA, call the Employee Benefits Security Administration at 866-444-EBSA .

Read Also: Does My Health Insurance Cover Abortion

Does Texas Have Health Insurance Penalty

Texas healthcare prompt-pay

a commercial discipline which requires businesses to:agree fair and reasonable payment terms with their suppliersensure suppliers’ invoices are approved and paid within agreed termsallow substantial penalties when an insured fails to pay a claim timely, even if by only a single day

How The Affordable Care Act Has Changed

The Affordable Care Act has been controversial since its introduction, and it has seen some changes in the Trump Era. Most notably, in 2019 the Individual Mandate was changed significantly.

The law has not been completely repealed, however. Individuals are still required to have adequate cover either through the ACA Exchange, their employer or independent arrangements, but if someone does not have coverage for the 2019 plan period or beyond, they will not have to pay a financial penalty.

Of course, its still worth getting the best health insurance you can afford for you and your family because hospital treatment and drugs can cost more than you might expect. Health insurance gives people peace of mind that they and their loved ones will be taken care of in the event of an emergency.

Read Also: Can I Apply For Medicaid If I Have Health Insurance

Other Types Of Coverage

These types of health insurance provide only limited coverage. Companies selling them can deny you coverage or charge you more if you have a preexisting condition. They also usually limit the amount they will pay for your care.

- Specified disease policies pay only if you have the illness named in the policy. For instance, a cancer policy will pay only if you have cancer. It wont pay if you have another disease.

- Short-term policies provide coverage for only a limited time, usually six to 12 months. People sometimes buy these policies while they’re between jobs or waiting for other coverage to start.

Learn more: Alternative health plans

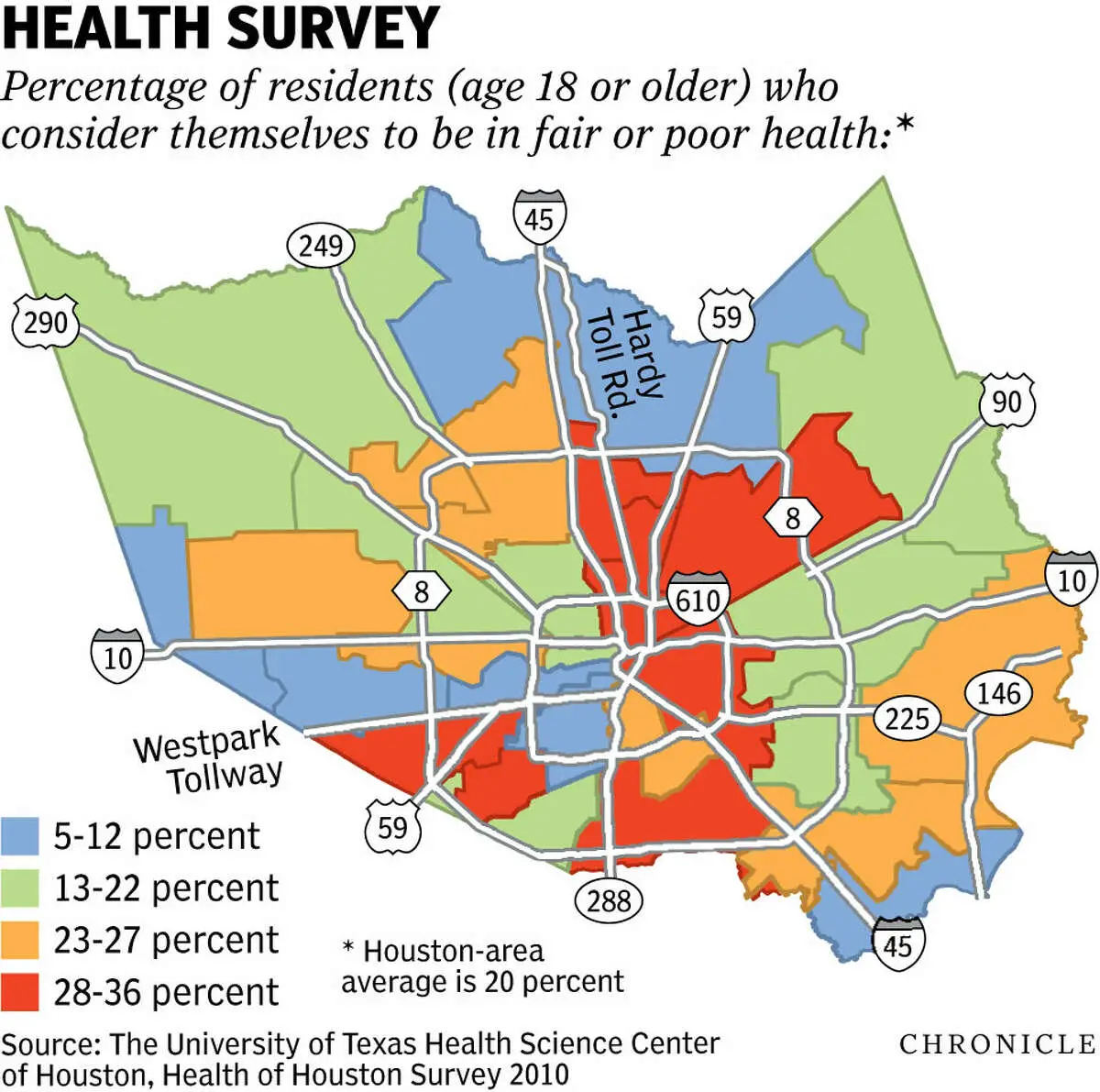

How Geographic Differences Affect Coverage

The decentralized labor and health services markets in the United States, and the distinct public policies in each state and locality, together create unique contexts for the patterns already described for individuals and population groups. Differences among states with respect to population characteristics, industrial economic base, eligibility for public insurance, and relative purchasing power of family incomes shape the geographic disparities in insurance coverage rates .

Also Check: Does Health Insurance Cover Tattoo Removal

What Influences An Uninsured Rate The Most

If all things were equal, how much of the difference between uninsured rates could be attributed solely to social or economic characteristics or to differences in immigrant status or race and ethnicity? If all states were home to populations with similar characteristics, how much variation among the states in uninsured rates can be attributed to regional and local differences in industrial economies and health services markets or to state policies for public programs?

In this report, the discussions so far have been based on two-way comparisons, for example, between income level and the likelihood of being uninsured. These comparisons give us a general picture of the dynamics of insurance coverage but do not allow us to evaluate or rank the relative importance of one factor independently of all others. By using more sophisticated statistical methods, we can look at the influence of one or more characteristics at a time on the uninsured rate and better understand their distinct influences. For example, both young adults and never married single persons have higher-than-average probabilities of being uninsured. Multivariate methods allow us to isolate the effect of youth from that of having never married.

What Are My Rights In Insurance Coverage

Federal and state law prohibits most public and private health plans from discriminating against you because you are transgender. This means, with few exceptions, that it is illegal discrimination for your health insurance plan to refuse to cover medically necessary transition-related care.

Here are some examples of illegal discrimination in insurance:

What should I do to get coverage for transition-related care?

Check out NCTEs Health Coverage Guide for more information on getting the care that you need covered by your health plan.

If you do not yet have health insurance, you can visit our friends at Out2Enroll to understand your options.

Does private health insurance cover transition-related care?

It is illegal for most private insurance plans to deny coverage for medically necessary transition-related care. Your private insurance plan should provide coverage for the care that you need. However, many transgender people continue to face discriminatory denials.

To understand how to get access to the care that you need under your private insurance plan, check out NCTEs Health Coverage Guide.

Does Medicaid cover transition-related care?

To understand how to get access to the care that you need under your Medicaid plan, check out NCTEs Navigating Insurance page.

My plan has an exclusion for transition-related care. What should I do?

If you get insurance through work or school, you can advocate with your employer to have the exclusion removed.

Don’t Miss: Does Humana Offer Individual Health Insurance

How Are Individual Health Insurance Premiums Calculated

The state allows for private health insurers to set their premiums at whatever rate they see fit, hoping that market competition will help keep them at a reasonable cost. Your insurer will take many factors into consideration when determining your rate, including age, health, and plan type. There are no laws or restrictions regarding what an individual can be charged for a policy or exclusions on the reasons for quoting a high premium. When it is time to renew your policy, your insurer also has the right to raise your premium for any reason. The good news for health insurance customers is that their provider cannot cancel their policy because they get sick, even at renewal. They can, however, raise your premium to compensate for this increased risk.