What Happens If You Dont Renew Your Insurance

If you miss a payment or dont renew your policy on time, youll receive a notice from your car insurance company before they drop your coverage. Typically, youll have whats called a grace periodoften between 10 and 20 days, depending on your stateto make your payment without your policy being canceled.

Getting Help With Your Health Insurance Renewal

Not sure whether you should renew your health insurance or look elsewhere? At HealthPartners, we help people in Minnesota and western Wisconsin find the right plan with the right coverage.

We specialize in making things simple so you can choose a health insurance plan that makes sense for you and your family. That way, everyone can start the new year on the right foot.

Do Not Renew Your Health Cover Blindly

- It is advisable to check the options in the market before renewal

- A review must be done to ensure that your current policy offers enough coverage as compared to the new options

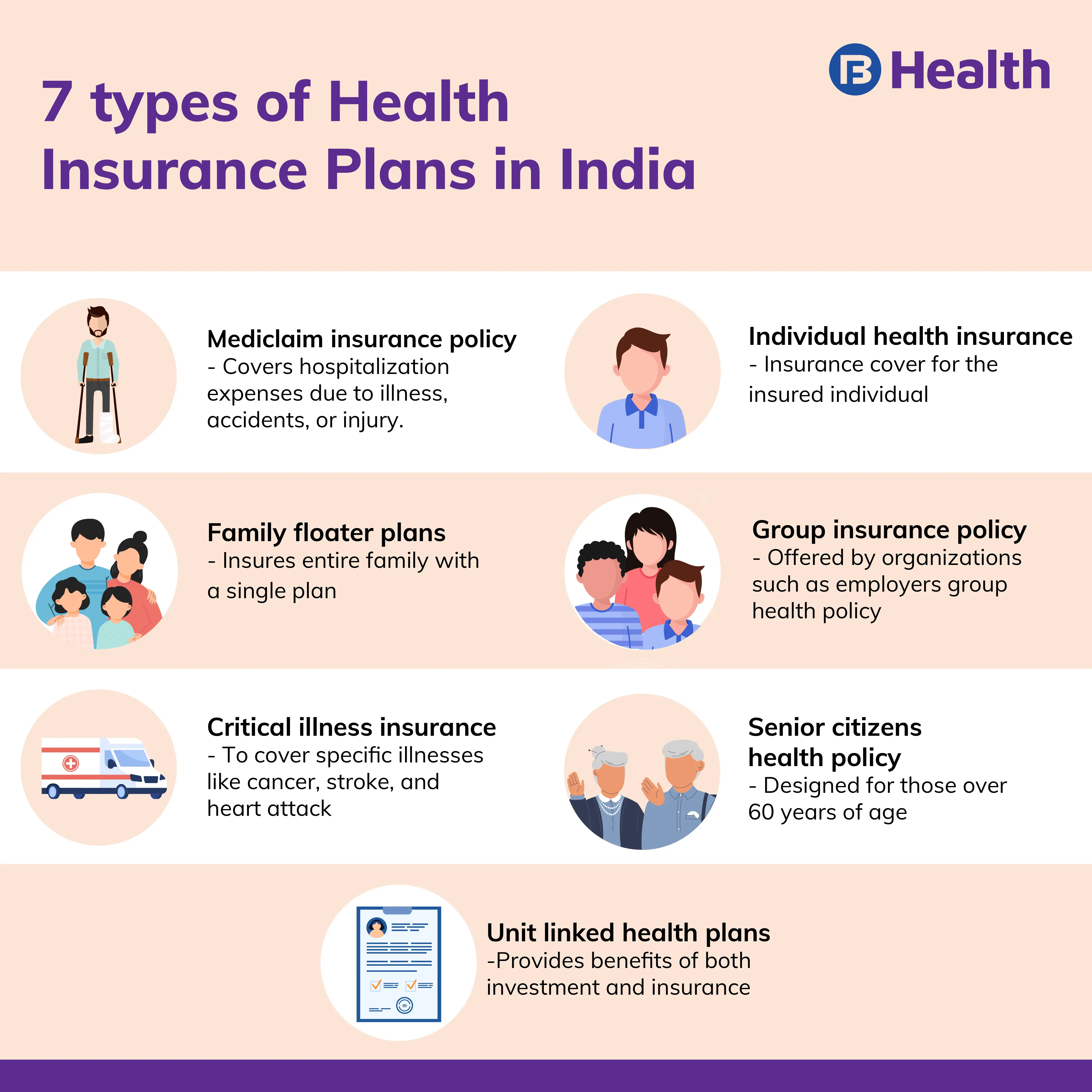

Generally, health insurance is offered as one-year contracts, which require a renewal every year on a specified date. At the same time, there is a lot of competition going on in the health insurance sector because of which every insurer keeps on updating and enhancing their policies every year.

Hence, the health policy you purchased today may not be the best policy for you tomorrow. Also, over time, the insurance product may not be suitable for you because of the age factor. Keeping such scenarios in mind, you shouldnt blindly renew the same health policy every year.

In todays piece, we take a look at important things that you may miss out on if you blindly renew it.

Every year, the insurer sends you a renewal notice through SMS informing you about the expiry of the policy. However, the important thing that the insurer, insurance broker or insurance sales agent dont tell the policyholder is the updates in the health insurance sector. They dont tell a policyholder whether he/she should continue with the existing policy or move to another one, getting added benefits at the same cost.

KYC mandatory for buying health, auto, and other insura …

Any change in details on dependents can only be done at the time of renewing your policy.

Read Also: Where To Buy Private Health Insurance

Health Plans Are Typically Offered As One Year Contracts And Require A Renewal Every Year Some Insurers May Send A Renewal Notice

no-claim bonusRenewal requestinsurance30 daysHealth updatePremium paymentsGrace periodrenewal premiumPortabilityPoints to note 1. 2. 3. The content on this page is courtesy Centre for Investment Education and Learning . Contributions by Girija Gadre, Arti Bhargava and Labdhi Mehta.

Dont miss out on ET Prime stories! Get your daily dose of business updates on WhatsApp.

How Much Did Benchmark Premiums Drop In 2020

And for 2020, benchmark premiums dropped by about4 percent in states that use HealthCare.gov. But nationwide, overall average premiums were essentially flat .] If the amount of your subsidy is dropping and your own plans premium is either increasing or dropping by a smaller amount that the reduction in the benchmark premium, …

Recommended Reading: How To Find Health Insurance

When Do You Update Your Marketplace Application

No matter what plan you want to enroll in, we strongly recommend that startingyou update your Marketplace application with your expected income and household information and compare your current plan to whats available for 2022. Select a plan by December 15, 2021 for coverage that starts January 1, 2022.

How To Renew Your Plan

You must renew Medicaid Managed Care once a year. When the COVID-19 Public Health Emergency ends, youll need to actively renew your plan to keep your coverage.

What to expect:NYSOH will mail you a letter when its time to renew. Healthfirst will also reach out by mail, email, text message, or phone to help you keep your coverage.

You must renew your Essential Plan once a year. When the COVID-19 Public Health Emergency ends, youll need to actively renew your plan to keep your coverage.

What to expect:NYSOH will mail you a letter when its time to renew. Healthfirst will also reach out by mail, email, text message, or phone to help you keep your coverage.

You must renew your Personal Wellness Plan once a year. When the COVID-19 Public Health Emergency ends, youll need to actively renew your plan to keep your coverage.

What to expect:NYSOH will mail you a letter when its time to renew. Healthfirst will also reach out by mail, email, text message, or phone to help you keep your coverage.

You must renew Child Health Plus plans once a year. When the COVID-19 Public Health Emergency ends, youll need to actively renew your childs plan to keep their coverage.

What to expect:NYSOH will mail you a letter when its time to renew. Healthfirst will also reach out by mail, email, text message, or phone to help you keep your coverage.

Coverage is provided by Healthfirst PHSP, Inc.

.

Also Check: How Do Small Business Owners Get Health Insurance

How Do You Sign Up For Medicare

Before you need to worry about a renewal, you need to apply for Medicare in the first place!

Luckily, this is relatively easy: for Original Medicare , residents of the United States and its territories are automatically enrolled upon becoming eligible, provided theyre receiving Social Security benefits. If youre not receiving Social Security, youll need to sign up manually by contacting the Social Security Administration.

For Insurance Quotes By Phone Tty 711 Mon

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

MedicareInsurance.com, DBA of Health Insurance Associates LLC, is privately owned and operated. MedicareInsurance.com is a non-government asset for people on Medicare, providing resources in easy to understand format. The government Medicare site is www.medicare.gov.

This website and its contents are for informational purposes only and should not be a substitute for experienced medical advice. We recommend consulting with your medical provider regarding diagnosis or treatment, including choices about changes to medication, treatments, diets, daily routines, or exercise.

This communications purpose is insurance solicitation. A licensed insurance agent/producer or insurance company will contact you. Medicare Supplement insurance plans are not linked with or sanctioned by the U.S. government or the federal Medicare program.

MULTIPLAN_GHHK5LLEN_2023

Recommended Reading: Does National Guard Have Health Insurance

What Is The Grace Period Allowed For Policy Renewal

Most insurance companies will provide a grace period of 7-30 days after your policy has expired. While you will not have health insurance coverage during this period, it provides you with a window of opportunity to renew your policy and keep its continuity benefits such as cumulative bonus, and waiting periods.

Most insurance companies will provide a grace period of 7-30 days after your policy has expired. While you will not have health insurance coverage during this period, it provides you with a window of opportunity to renew your policy and keep its continuity benefits such as cumulative bonus, and waiting periods.

Please try one more time!

Is There A Penalty For Cancelling Health Insurance

Yes, usually you can cancel your health insurance without a penalty. However, if you reside in a state that has its own coverage mandate, you may face a tax penalty. Your cancellation may take effect beginning the day you cancel, or you may set a date in the future, such as when your new coverage will start.

Read Also: What Is Public Health Insurance

Things To Remember About Medigap Renewal

Remember: although Medigap plans will be available for renewal, the plan may cost more or other plans may become available to you. Even if you do intend to renew your plan, you should always look at the plan details each year to see if anything has changed. You can always talk to an independent insurance agent for help getting quotes.

Its also a good idea to look at the overall structure of Medigap plans and to get some quotes every year to see if any new plan options are available that works better for you. But, when it comes to renewal, they will always be easily available.

Do I Need To Renew Medicare Every Year

Original Medicare coverage is automatically renewable each year you are eligible. Thus, you do not need to renew your Medicare parts each year.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Supplement plans work the same way, once you are accepted, the plan is automatically renewable as long as you continue to pay the monthly premium.

Medicare Advantage plans work similarly. However, you have the option to change your plan each year if you do not like the benefits of your current plan.

Read Also: Do I Qualify For Health Insurance Subsidy

Do You Have To Renew Medicare Advantage

You will be automatically re-enrolled in your Medicare Advantage plan annually unless the company that provides your plan stops offering it. Then youll get a chance to buy a different one during the annual Open Enrollment Period from October 15 to December 7. There is also a Medicare Advantage Open Enrollment Period from January 1 to March 31. During both those periods, youll also be able to switch Medicare Advantage plans even if its just because you dont like the Advantage plan you have, or you are looking for more benefits or lower cost. Once you enroll in a new plan, you will be automatically disenrolled from the old one.4

Why Pay Attention To Automatic Enrollment

Health insurance sold under the Affordable Care Act only lasts for a maximum of one year. When you first picked a health plan, you may have chosen to automatically renew your healthcare plan for as long as five years. Initially, this was designed to be harmless for consumers however, health insurance companies routinely change their offerings from one year to the next, leaving consumers with a different policy than the one they initially chose.

Here are reasons why automatic health insurance renewal can affect consumers:

1. No More Chance to Cancel

In the early years of ACA implementation, auto-renewals took place with weeks of the annual signup period left to spare. Now open enrollment ends in mid-January in most states. Once your current plan has been auto-renewed or subbed with a different plan if your previous plan isnt available you cant switch to something else.

2. Auto-Renewal Can Hurt You

You might assume that if your current plan is no longer being sold, or if it drastically changes, that an auto-enrollment alarm would go off. This isnt the case. Health insurance renewal keeps chugging along .

Your current health insurance provider can choose which plan to auto-enroll you in, and its required to pick something as close as possible to what you previously had. But it might not be the plan you wouldve picked for yourself.

3. You Can Be Switched to a Different Policy, Company, or Metal Level

4. Cost Changes to Current Plans

5. New Options Are Very Competitive

Don’t Miss: How Much Is Supplemental Health Insurance For Seniors

Its Important To Look At The Numbers In Your Health Insurance Renewal

Your renewal notice has information about how your plan will work for the upcoming year. In many respects, your plan may work the same. But there may also be places where its different than what youre used to.

Take the time to read over and check everything so youre not surprised when you go in for care. Especially review common health insurance terms like:

In addition, if you enrolled in your plan through the health insurance marketplace, youll want to review your tax credit information to see if youre still eligible or if your credit has changed.

Medicare Advantage Open Enrollment Period

If you already have a Medicare Advantage plan, the Medicare Advantage Open Enrollment Period is when you can enroll in another Medicare Advantage plan or go back to Original Medicare. Enrollment is from Jan. 1March 31. However, you can only make 1 change within the period, and other rules apply as well.

To learn more, go to our .

Read Also: What Is The Best Private Health Insurance

Financial Help And Next Year Eligibility

Note: Information about tax credits and tax filing is in the section, including frequently asked questions about .

- Your household income

Your eligibility for is updated annually by MNsure. Your eligibility is based on the most recent information that you reported to MNsure.

In most cases, if your renewal qualifies you for a tax credit for next year you will be automatically re-enrolled in the same plan offered through MNsure and the updated amount of tax credit will be applied to your new premium amount. If your renewal qualifies you for cost-sharing reductions for next year and you are either automatically re-enrolled in the same silver plan or you select a new silver plan offered through MNsure for the coming year, you will continue to receive cost-sharing reductions.

If you are an receiving cost-sharing reductions you do not need to be enrolled in a silver plan to continue to receive the same cost-sharing reductions in your plan.

If an advanced premium tax credit was applied to your coverage in a previous year and you have not filed a tax return for that year, you will no longer be eligible for advanced premium tax credit or cost-sharing reductions in the coming year. You should file a tax return as soon as possible.

If you did not provide consent for MNsure to use your federal tax information to renew coverage for the coming year, you will no longer be eligible for financial help.

I Want To Change My Medicare Coverage

There are a lot of reasons to think about getting a new Medicare plan. Your health care needs may have changed in the last year. Maybe you want new benefits such as a fitness membership that your current plan doesnt provide. Or maybe, you just want to explore your options and see if you can save on Medicare costs.

If you decide you want to change plans, there are three options to do so: work with the insurance provider directly, work with an insurance agent, or contact Medicare. You can read more about each option here.

Recommended Reading: What Do Expats Do For Health Insurance

What Do I Do If My Health Insurance Is Cancelled

If your health insurance is being canceled because you are leaving your job or you are losing your full-time status, you have two options. You can either buy a plan through the health insurance marketplace or you can sign up for COBRA. You can apply for marketplace insurance during the open enrollment period which ends on January 31, 2017.

What Is Coinsurance And Copay

Copays and coinsurance This is how much youll owe after you meet your plans deductibles. When you pay a copay or coinsurance,your health plan covers the rest of the cost. Copays and coinsurance can vary for different coverage areas, so take a closer look at which benefits you expect to use most often.

Read Also: Can I Be Fined For Not Having Health Insurance

Does Health Insurance Premium Increase Every Year

Do you know what happens with your insurance premium when you renew your health insurance policy? If youre wondering whether your health insurance premium increases upon renewal every year the answer is yes. Every year, your expenses like rent, fuel, food, etc. increase due to inflation and so does your health insurance premium.

It may be surprising for you to know that inflation in the healthcare industry is much higher than in other industries, and therefore, a direct impact on your health insurance is obvious. However, inflation is not the only reason why your health insurance premium increases every year. There are certainly more reasons behind this increase in the insurance premium.

There Are Two Types Of Medicare:

- Original Medicare includes Part A and Part B. For drug coverage, you join a Medicare prescription drug plan . To pay additional costs, which can mount up quickly, most people buy a Medicare Supplement plan .

- Medicare Advantage, otherwise known as Medicare Part C, is an all-in Medicare health plan operated by private companies that contract with Medicare to provide Part A and Part B benefits and usually, but not always, prescription drug coverage.

Which plan you choose affects many things going forward, including how your Medicare works, what it pays for, and how easy or hard it is to switch things around.

One of the best places to learn about Medicare is Medicare.gov, the governments information site. In order to get accurate information, you must create an account. Once youve done that, you can tailor your results. The site doesnt give you help making a decision about what is best for you, but it does offer plenty of personalized details to guide your decision making.

Recommended Reading: Why Do I Need Health Insurance

Who Is Eligible For Medicare

First of all, lets set out exactly who Medicare policies are for, as well as who they are not for.

Original Medicare covers inpatient hospital care plus outpatient and physician services for anyone who is aged 65 or over and has been a U.S citizen or legal resident for at least 5 continuous years.

Those aged under 65 but who have certain disabilities can also be eligible. If you have been in receipt of Social Security Disability Insurance for 24 months, you will be automatically enrolled in Medicare regardless of your age.

Other disabilities that may make you eligible include end-stage renal disease, amyotrophic lateral sclerosis , cancer, mental health disorders, or musculoskeletal system and connective tissue disorders.

If you are unsure whether you are eligible for Medicare, you can use the medicare.gov eligibility tool to find out more.

With Medicare, its always better to sign up as soon as possible. When you become eligible, an Initial Enrollment Period will begin. The initial enrollment period is a 7-month window where you are guaranteed to be exempt from penalty fees for late sign-up and your medical history is not a consideration.

It also pays to be prepared. You dont have to wait until retirement to sign up. Having to suddenly pay out of pocket for medical care while you wait for the sign-up process to go through can be costly and stressful. Something we all want to avoid!

Donât Miss: Does Medicare Part B Cover Freestyle Libre Sensors