Can I Claim Home Insurance Premiums On Rental Properties That I Own And Rent Out

Yes, you may be able to claim property insurance premiums paid towards coverage on your rental property for the current year. If you are renting out a separate property you can claim the full amount. If you are renting out only a part of your principal residence, then you can only claim a portion. Refer to the CRA website for more information.

Private Health Insurance Benefits For Self

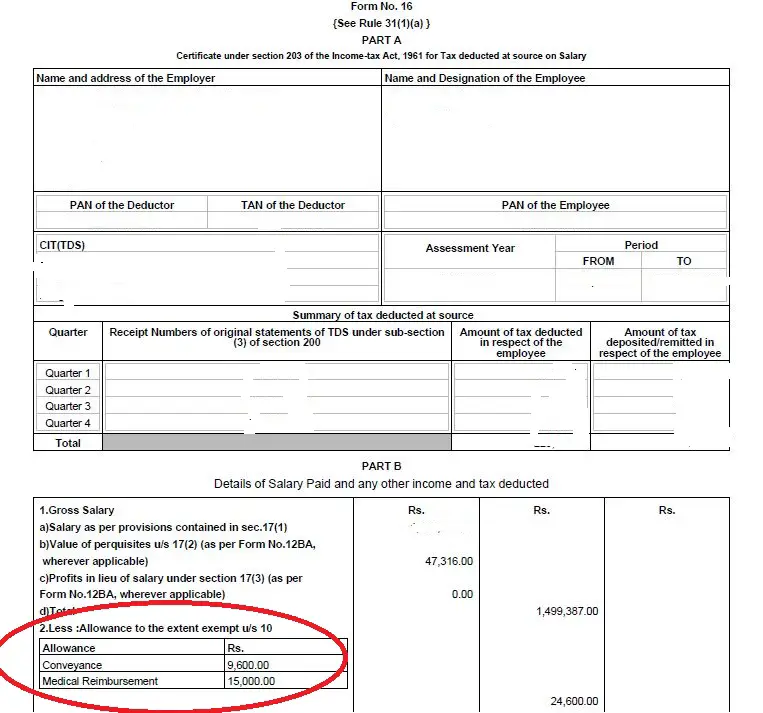

Private health insurance is an important consideration for the self-employed. As a self-employed individual, you do not have a health plan through an employer, and you are limited to the medical coverage you receive through OHIP. Rather than paying out of pocket, consider private health insurance to provide you with the coverage and peace of mind you are looking for.

As outlined on TaxTips.ca, If a person is self-employed, the premiums paid for a private health services plan can be deducted from self-employment income, instead of being claimed as a medical expense. This would result in greater tax savings, and is a way to provide a tax-free benefit to employees of a small business.

How Do I Know If I Qualify For A Tax Credit

When you apply for coverage through a health insurance marketplace, also called an exchange, the system will determine your eligibility for tax credits based on your income and household size.

If your income is below the federal poverty level threshold, you may be eligible to enroll in Medicaid. Most states have now expanded Medicaid eligibility to incomes at or below 138% of the federal poverty level , providing more health insurance choices for those with low incomes.

Those with income between 100% and 400% of the federal poverty level qualify for premium tax credits. And if you earn more than 400% of the federal poverty level, you may still qualify for health insurance discounts.

The so-called “subsidy cliff” at 400% of the federal poverty level was eliminated in 2021 as a part of the American Rescue Plan Act. Those earning more than the 400% threshold gained access to subsidies that limited health insurance costs to 8.5% of their income.

This benefit was extended through the end of 2025 as a part of a wide-reaching federal law called the Inflation Reduction Act.

You can preview your tax credit eligibility by using our Affordable Care Act subsidy calculator. If you qualify, the monthly premium cap shows how much you would spend for the second-cheapest Silver plan on the marketplace.

Also Check: How Much Is Farm Bureau Health Insurance

What Is Tax Form 8962

If you purchased health insurance from the Healthcare.gov site or your state healthcare marketplace if you live in a state that maintains one you’ll need to use Tax Form 8962. This form has two parts you’ll need to fill out:

Form 8962 is also used to reconcile the premium tax credit you might be eligible for with any advanced premium tax credit payments youve already received.

The first part of the form determines your annual and monthly contribution amount based on your family income and tax family size. Your tax family generally includes you and your spouse if filing a joint return and your dependents. You must include all of your family’s or household’s income.

After filling in this information and determining your applicable federal poverty level, you can figure out the amount of credit you can claim. You have two choices for how to claim it:

- A credit to reduce your monthly payments on your health insurance premiums

- A credit to reduce your taxes on your return

If you choose the monthly payments, the government pays your insurer over the course of the year, which lowers your monthly premium costs.

If you can claim the premium tax credit and your insurer received advanced payments from the government, the second part of Form 8962 compares how much credit you used and your final available credit. There are three possible scenarios:

How Does Good Recordkeeping Help At Tax Time

Filing taxes is easier when you keep good records. Remember that your health insurer will send you the information needed to complete your Form 1095-A successfully. Additionally, you may need to reconcile your premium tax credit and properly fill out Form 8962 so that you can receive your tax refund . Thus, you can more easily understand how your specific health plan will impact your taxes at the end of the year by keeping good records.

Whether you are an individual or a small business owner purchasing health insurance, eHealths licensed insurance agents can help determine if you are eligible for any tax-advantaged marketplace plans or government-sponsored health programs. Our professionals also assist small business owners with administrative tasks related to the insurance plan that may ease some of the burden of recordkeeping. Contact us to learn more about your health insurance options, or compare the small business health insurance plans available in your area.

Thisarticle is for general information and may not be updated after publication.Consult your own tax, accounting, or legal advisor instead of relying on thisarticle as tax, accounting, or legal advice.

Recommended Reading: How Do Business Owners Get Health Insurance

Earned Income Tax Credit

Congress set up the Earned Income Tax Credit to allow lower-wage earners to hold onto more of their paychecks. Households that qualify for the credit can reduce their tax liability to zero, which means they will owe no income taxes. If your tax obligation is less than the amount of the credit, you may be eligible for a cash refund of the remaining credit amount.

To qualify for the EITC, a taxpayers earned and adjusted gross income must be below certain income limits. For the 2022 and 2023 tax years, the maximum credit that a single or married taxpayer could claim is as follows:

| EITC Income Limits for 2022 Tax Year |

|---|

| Number of Children |

| $7,430 |

What Is A Tax Credit

You may be able to use a tax credit to save money on health insurance when you enroll in a plan through a state . The tax credits help lower your insurance premium, or the payments you make each month for your health plan. You can receive the tax credit in advance by having all or part of the money sent directly to your insurance company. That will lower your monthly bill. You can also pay the full cost of your insurance premium during the year and take your credit instead at income tax time.

Read Also: Does Farmers Insurance Sell Health Insurance

What Medical Expenses Are Tax Deductible

Many people arent aware that some expenses can be deducted from your federal income taxes. Besides your health insurance premiums, other deductible medical expenses may include the following:

- Equipment needed for a medical disability

- Mental health services

- Travel and lodging expenses for medical appointments

Its important to remember that you can only deduct the cost of qualifying medical expenses if the total amount you paid exceeds 7.5% of your AGI and you choose to itemize your deductions. You cant deduct the amount paid for by a health plan or employer.

Hunsaker explains that this tax deduction can be powerful for people with disabilities or chronic illnesses or who experience major medical events. But the deduction is hard to claim for those who visit the doctor only a few times per year for basic and preventive care.

Heres why: The 2020 U.S. Census says the median household AGI is $67,521 and 7.5% of that is $5,064.

That means you can only deduct expenses after the first $5,064 and, if you meet the criteria, it makes sense for you to itemize deductions, Hunsaker says.

What Happens If I Didnt Have Any Health Insurance Last Year

So what if you didnt carry health insurance last year? How might this impact your taxes? To gain a better understanding of this situation, lets review the Affordable Care Act.

In previous years, this could be a negative situation for those without health insurance. The mandate and penalty were meant to be another way to get as many people covered as possible. However, this part of the law was unpopular.

As of 2019, there is no longer a federal tax penalty for going without health insurance. Even if you have no exemption for not having insurance, you can avoid the fee. However, at the state level, some places still impose a penalty.

So, in most states, the bottom line is that not having health insurance coverage wont mean you have to pay any extra fees come tax season.

Don’t Miss: How Us Health Insurance Works

What Should I Do If My Job Or My Income Changes

If you get a new job that makes you ineligible for the credit, tell your state’s Marketplace. Every Marketplace will have an 800 number, so call and talk with a representative. If you don’t, you may have to pay back advance payments the IRS made from the time you became ineligible.

If your income goes down, call a representative at your state’s Marketplace because you may be able to get a larger tax credit or qualify for Medicaid.

What Is The Tax Impact Of Not Having Health Insurance

If you can afford health insurance and do not fall under one of the exemptions that allows you to forego buying it, you must have health insurance that meets the requirement under the ACA, Schneider notes. If you dont, you may be subject to a penalty in 2018.

That penalty can be calculated based on a percentage of your household income or per person in your household. You can use an online calculator to determine your penalty. The Tax Cuts and Jobs Act of 2017 reduced the amount of the penalty to zero for tax years beginning after Dec. 31, 2018.

Also Check: Does Health Insurance Cover Plastic Surgery

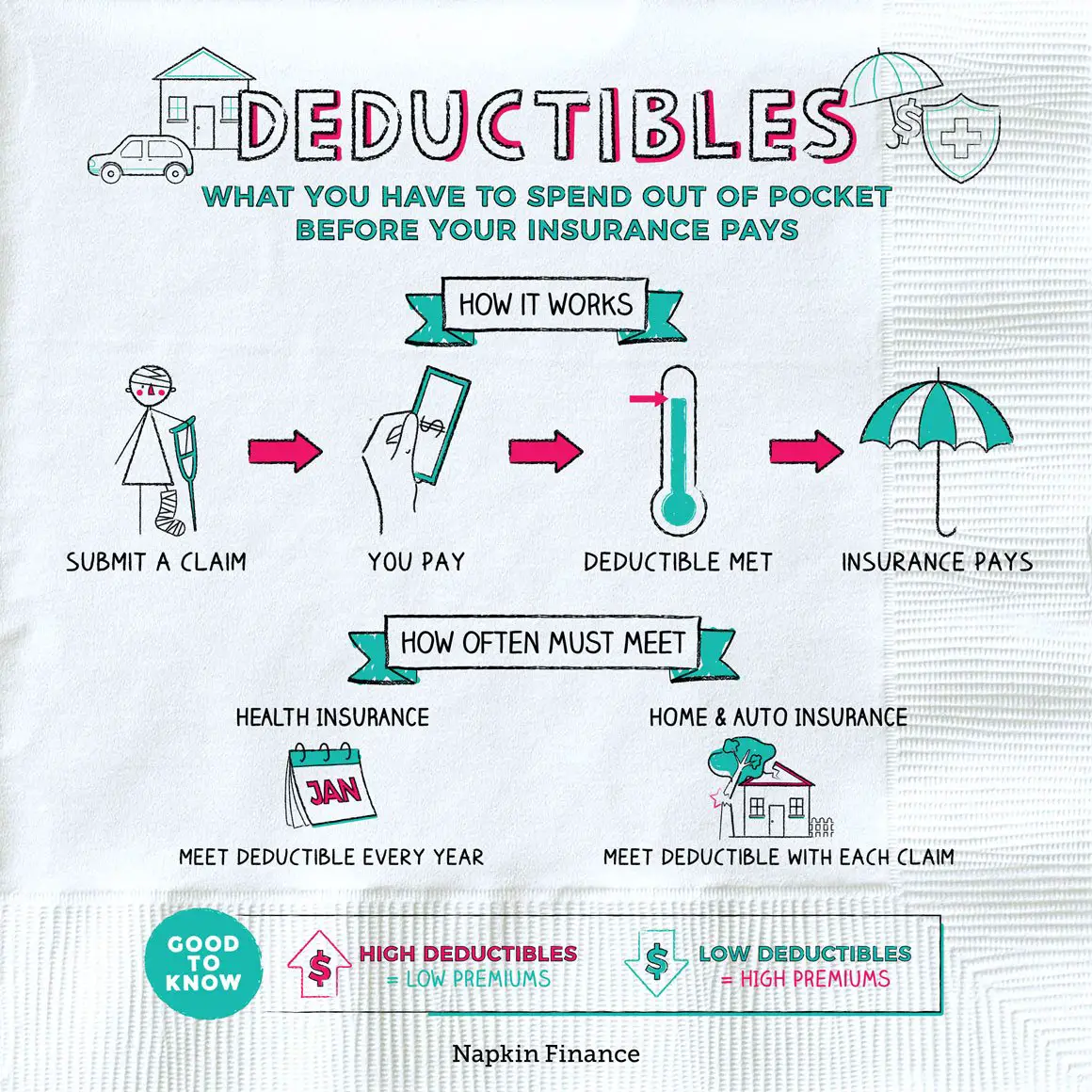

How Does It Work

Participants in the HCTC program may select either of the following credit options:

- Yearly credit: You pay 100% of your premium for the entire year and then the IRS will either issue a refund to you or a credit against your federal taxes owed for 72.5% of your premium.

- Monthly credit: You pay 27.5% of your monthly premium to the IRS. The IRS adds the remaining 72.5% of your monthly premium, and pays your health plan administrator 100% of your monthly payment. This lowers your out-of-pocket payments for your monthly premiums.

NOTE: You may be able to change health care plans to receive the HCTC benefit.

How Does The Tax Credit Work For Health Insurance

Find Cheap Health Insurance Quotes in Your Area

A premium tax credit can reduce your monthly health insurance cost. It’s only available for those who purchase insurance through a state or federal health insurance marketplace, and you must meet income and family size criteria to qualify. You’ll learn if you are eligible when you apply for a marketplace health insurance plan.

If you own a small business with fewer than 25 employees, you may also qualify for government subsidies, which can help pay for your employees’ health insurance.

You May Like: Will Health Insurance Pay For Wisdom Teeth Removal

Decide When To Use The Discount

When you have your discounted rate, you get to decide when to use it. You have three options:

Youll have to decide which option makes the most sense for your family. Youll have to reconcile your account when you file your tax return no matter which option you use.

How Much Money Can I Make And Get A Tax Credit

The amount of tax credit you are eligible for varies from year to year. You may be eligible for a tax credit if the amount of money you expect to make for all of 2020 is in the following income ranges:

- $13,590 to $54,360 for one adult

- $18,310 to $73,240 for a family of 2

- $23,030 to $101,120 for a family of 3

- $27,750 to $111,000 for a family of 4

The less money you make, the more financial aid you can get. These amounts change each year. The income amounts for people who live in Alaska and Hawaii are slightly different.

Read Also: How Does Employer Health Insurance Work

What Happens If My Family Size Or Income Changes During The Year

Life-changing events can impact your tax credit eligibility by either increasing or decreasing the amount that you are allowed to claim. Events that can affect your premium tax credits may include:

- Change in your household income

- Gaining or losing health insurance coverage

Since the marketplace determines your tax credit, it is important to report changes immediately so your health plan eligibility can be updated. And if you’re currently using the advance premium tax credit, then it is particularly important to report any life changes to the marketplace as soon as possible.

If you wait to report such changes, there may be discrepancies between what you paid and what you should pay. In this case, if you used more advance premium tax credits than you are allowed, you may have to pay back money when filing your federal income tax return. On the other hand, if you used less than allowed, you may get an added refund. This is known as “reconciling” your advance premium tax credits.

Other Health Care Tax Credits

The premium tax credit isnt the only credit available to help you save money on health insurance. The health coverage tax credit is another federal tax credit that helps reduce the cost of insurance for people aged 55 through 64 who receive benefits from the Pension Benefit Guaranty Corp or those who are eligible for Trade Adjustment Assistance allowances due to a qualifying job loss.

You may also qualify for the small business tax credit if you own a small business. You must enroll in a Small Business Health Options Program plan to claim it. There are additional eligibility requirements based on the size of your business and the number of employees you have.

You May Like: Does Health Insurance Cover Helicopter Transport

Is Hctc Available To My Family Members

Yes. For any month that you are eligible for HCTC, you can include premiums paid for a qualifying family member for that eligible coverage month. The qualifying family member must:

- Be enrolled in a qualified health plan for which you paid some or all of the premiums.NOTE: It does not have to be the same coverage as you.

- Be claimed as a dependent on your federal tax return.

- Not enrolled in Medicare.

The Aca’s Premium Tax Credit

Most people who are eligible for the premium tax credit subsidy choose to have it paid in advance directly to their health insurance company each month. This lowers the amount they have to pay for premiums each month. When enrollees choose this option, the subsidy is referred to as an advance premium tax credit, or APTC.

But enrollees also have the option to pay full price for a plan purchased through the health insurance exchange, and then receive the full amount of their premium tax credit from the IRS when they file their tax return. When tax filers take this option, the subsidy is simply called a premium tax credit, or PTC.

APTC and PTC both refer to the same thinga premium subsidy to offset the cost of health insurance obtained in the exchange. And either way, it’s a refundable tax credit, which means you get it even if it exceeds the amount you owe in federal taxes.

And regardless of whether you receive APTC or PTC, you have to complete Form 8962 with your tax return. This is how you reconcile the amount that was paid on your behalf during the year or claim the credit in full after the year is over.

You May Like: Can You Add Spouse To Health Insurance

Questions And Answers On The Premium Tax Credit

Q1. What is the premium tax credit?

A1. The premium tax credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased through the Health Insurance Marketplace, also known as the Exchange. The size of your premium tax credit is based on a sliding scale. Those who have a lower income get a larger credit to help cover the cost of their insurance. When you enroll in Marketplace insurance, you can choose to have the Marketplace compute an estimated credit that is paid to your insurance company to lower what you pay for your monthly premiums . Or, you can choose to get all of the benefit of the credit when you file your tax return for the year. If you choose to have advance payments of the premium tax credit made on your behalf, you will reconcile the amount paid in advance with the actual credit you compute when you file your tax return for the year. Either way, you will complete Form 8962, Premium Tax Credit and attach it to your tax return for the year.

Note: For tax year 2020 only, you are not required to attach Form 8962 with your 2020 tax return unless your PTC is more than the APTC paid on your behalf for 2020 and you are claiming net PTC. See link below for information specific to tax year 2020.

See the Coronavirus Tax Relief section on this page for information specific to tax year 2020.

Q2. What is the Health Insurance Marketplace?