How Is The Delivery System Organized And How Are Providers Paid

Physician education and workforce: Most medical schools are public. Median tuition fees in 2019 were $39,153 in public medical schools and $62,529 in private schools. Most students graduate with medical debt averaging $200,000 , an amount that includes pre-medical education.21 Several federal debt-reduction, loan-forgiveness, and scholarship programs are offered many target trainees for placement in underserved regions. Providers practicing in designated Health Professional Shortage Areas are eligible for a Medicare physician bonus payment.

Primary care: Roughly one-third of all professionally active doctors are primary care physicians, a category that encompasses specialists in family medicine, general practice, internal medicine, pediatrics, and, according to some, geriatrics. Approximately half of primary care doctors were in physician-owned practices in 2018 more commonly, these are general internists rather than family practitioners.22

Primary care physicians are paid through a combination of methods, including negotiated fees , capitation , and administratively set fees . The majority of primary care practice revenues come from fee-for-service payments.23 Since 2012, Medicare has been experimenting with alternative payment models for primary care and specialist providers.

Providers bill insurers by coding the services rendered. There are thousands of codes, making this process time-consuming providers typically hire coding and billing staff.

The 1930s: The Great Depression Social Security & Henry Kaiser

When the Great Depression hit in the ’30s, healthcare became a more heated debate, most especially for the unemployed and elderly. Even though The Blues were expanding across the country, the 32nd President of the United States, Franklin Delano Roosevelt , knew healthcare would grow to be a substantial problem, so he got to work on a health insurance bill that included the old age benefits desperately needed at the time.

However, the AMA once again fiercely opposed any plan for a national health system, causing FDR to drop the health insurance portion of the bill. The resulting Social Security Act of 1935 created the first real system of its kind to provide public support for the retired and elderly. It also allowed states to develop provisions for people who were either unemployed or disabled .

Around this time, Henry Kaiser, a leading industrialist of the day, contracted with Dr. Sidney Garfield to provide pre-paid healthcare to 6,500 of his employees working in a rather remote region on the largest construction site in history – the Grand Coulee Dam. The program was a big hit with Kaiser’s workers and their families, but as the dam neared completion in 1941, it seemed as if the program would fade away.

Health Insurance In The Mid

In the booming American economy following World War II, health insurance coverage expanded dramatically. By 1950, nearly 76.6 million Americans constituting half the American population had hospitalization insurance 54.2 million had surgical benefits, and 21.6 million had medical benefits. By 1965, when Medicare and Medicaid were adopted, private hospital insurance covered 138.7 million Americans, that is, approximately 71% of the American population.

As coverage expanded, it also became more comprehensive. In the early 1950s, commercial insurers began to offer major medical coverage that provided catastrophic coverage for hospital and medical care. Major medical policies usually supplemented basic hospital and surgical-medical coverage. Comprehensive coverage followed soon on its heels, bundling basic and major medical coverage into a package to provide the most complete coverage available. During the 1950s, Blue Cross and Blue Shield plans began to combine forces to offer similarly comprehensive coverage. Finally, during the 1960s and 1970s, insurance coverage began to expand to cover dental care and pharmaceuticals, with improved coverage for maternity care, mental health, and some preventive services within basic coverage.

Read Also: How To Apply For Public Health Insurance

Initial Healthcare Insurance Forms

Massachusetts Health Insurance of Boston offered early group policies with a relatively comprehensive list of benefits as early as 1847. The earliest forms of health insurance, howÂever, did not emerge until 1850, when the Franklin Health Assurance ComÂpany of Massachusetts began providing accident insurance, to cover injuries reÂlated to railroad and steamboat travel.

Individual accident insurance proved a successful venture, so these kinds of early plans began to evolve into more expansive programs that covered a broader range of illness and injury, including early versions of disability coverage by the end of the 19th century.

Trends In Private Coverage

The proportion of non-elderly individuals with employer-sponsored cover fell from 66% in 2000 to 56% in 2010, then stabilized following the passage of the Affordable Care Act. Employees who worked part-time were less likely to be offered coverage by their employer than were employees who worked full-time .

A major trend in employer sponsored coverage has been increasing premiums, deductibles, and co-payments for medical services, and increasing the costs of using out-of-network health providers rather than in-network providers.

Also Check: What Does Health Insurance Cost In Retirement

Public Health Care Coverage

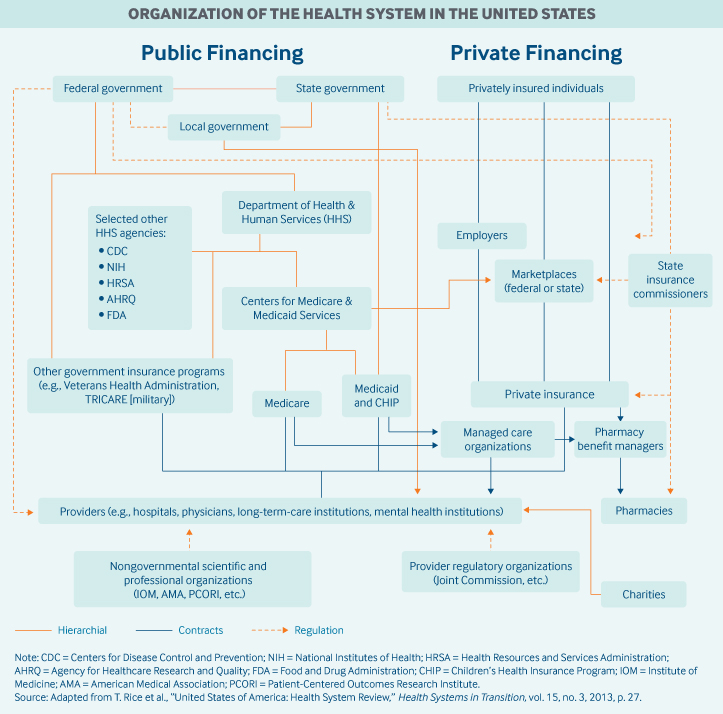

Public programs provide the primary source of coverage for most seniors and also low-income children and families who meet certain eligibility requirements. The primary public programs are Medicare, a federal social insurance program for seniors and certain disabled individuals Medicaid, funded jointly by the federal government and states but administered at the state level, which covers certain very low income children and their families and CHIP, also a federal-state partnership that serves certain children and families who do not qualify for Medicaid but who cannot afford private coverage. Other public programs include military health benefits provided through TRICARE and the Veterans Health Administration and benefits provided through the Indian Health Service. Some states have additional programs for low-income individuals. U.S. Census Bureau, “CPS Health Insurance Definitions”Archived May 5, 2010, at the Wayback Machine< /ref> In 2011, approximately 60 percent of stays were billed to Medicare and Medicaidâup from 52 percent in 1997.

There is some evidence that Medicare Advantage plans select patients with low risk of incurring major medical expenses to maximize profits at the expense of traditional Medicare.

Medicare Part D

Benjamin Franklin: Americas First Insurer

Property insurance was certainly not an unknown concept in the 18th century: Englands famed insurer Lloyds of London was established in 1688. But it took until the mid-1700s for the American colonies to become prosperous and sophisticated enough to adopt the concept. That happened in Philadelphia, which at 15,000 residents was one of the largest cities in North America at the time.

The city was haunted by a fear of fires. Much like London in the 1600s, houses at the time were made almost entirely out of wood. Worse yet, they were built close together. This was originally for security reasons, but as cities grew, developers built homes very close to each other for the same reasons they do todayto fit as many as possible on their plots of land. Although much of Philadelphia was built with wide streets and brick or stone structures, conflagrations were still a concern.

You May Like: Does Uber Have Health Insurance

Also Check: What Is Gateway Health Insurance

Is Your Prescription Insurance Right For You

When is the last time you went to the pharmacy? Did you use your health insurance to cover a portion of your prescription price, or did you end up paying for the whole thing out-of-pocket? If the latter is true, you may not be getting the most out of your prescription insurance. When youre spending

Development Of Modern Health Insurance

National health insurance proposal

Throughout the twentieth century, Progressive groups repeatedly called for national health insurance in the United States. The Progressive Party, also known informally as the Bull Moose Party, was formed in 1912 and nominated former President Theodore Roosevelt as its candidate for the presidential election. Its platform called for a National Health Service and public insurance for the elderly, unemployed, and disabled. The proposal for government health insurance was controversial and was opposed by influential organizations such as the American Federation of Labor, the American Medical Association, and fraternal organizations. Roosevelt finished second in the 1912 election, losing to Democratic candidate Woodrow Wilson. The Progressive Party performed poorly in the 1914 congressional elections and was dissolved in 1916 however, its idea of social insurance continued to influence reformers such as President Franklin Roosevelt.

By 1920, 16 European countries had adopted public health insurance. In contrast, the United States rejected the European models and instead developed a system of private health insurance in which many employers provided plans to employees and their families. This system emerged in the late 1920s when hospitals began offering health plans to public school teachers.

Emergence of employer-sponsored insurance

Spread of employer-sponsored insurance and managed care

Also Check: How To Get Health Insurance For My Small Business

The 1700s: Colonial Times

Medicine was fairly rudimentary for the first few generations of colonists who landed in the new world, primarily because very few upper-class physicians emigrated to the colonies. Women played a major role in administering care in these early days, most especially when it came to childbirth.

Mortality in those early days was extremely high, most notably for infants and small children. Malaria was particularly brutal, as was diphtheria and yellow fever. Most of the sick were treated with folk remedies, though smallpox inoculation was introduced earn-on In these early days, there was virtually no government regulation or attention paid to public health.The first medical society was formed in Boston in 1735. Fifteen years later, in 1750, the first general hospital was established in Philadelphia.

In 1765, the Medical College of Philadelphia was founded. Two years later, the medical department of King’s College was established in New York and in 1770, they awarded the first American M.D. degree.

The Mid 1800s: The Civil War

As was common in the day, more soldiers died of disease than from fighting in the Civil War. The conditions in the Confederacy were particularly brutal, due to severe shortages of medical supplies and physicians. Lack of hygiene and cramped quarters brought about epidemics of childhood diseases like measles, mumps, chickenpox, and whooping cough. Diarrhea, dysentery, and typhoid fever ravaged the south, in particular.

The war did usher in a wave of progress in the form of surgical techniques, research, nursing methods, and care facilities. The Union built army hospitals in every state, and proactive medical organizers achieved considerable progress thanks to a well-funded United States Army Medical Department and the United States Sanitary Commission. Numerous other new health-related agencies were also formed during this time, raising public consciousness about healthcare.

In addition to the Federal government, states also started pouring money into healthcare. Following the particularly bloody battle of Shiloh in April of 1862, the state of Ohio sent boats to the scene, which they converted into floating hospitals. Similar actions in other states soon followed.

Recommended Reading: How Much Is Health Insurance For A Family Of 5

Us Health System In The 1980s

As frequently noted, the U.S. health care system suffers from rapid escalation of health costs, lack of universal access to insurance coverage, geographic maldistribution of providers, underutilization of primary care and preventive services, gaps in the continuity of care, and a high rate of inappropriate utilization of health services. These problems coexist with widely acknowledged strengths such as providing the vast majority of the population with state-of-the-art care, offering consumers freedom of choice among a variety of highly skilled providers using the latest technology, and promoting a vigorous biomedical research and development sector. There are sophisticated quality assurance and data systems, and virtually no queues for elective surgery for those with insurance.

Health care cost growth

Health care costs are perceived as reducing the international competitiveness of American business, however, there is debate on this issue. For example, Chrysler states that health care costs add $700 to the price of every American manufactured car. By comparison, health care costs add $350 to the cost of a car in Germany and France, or $225 in Japan . Others argue that the issue is the total labor compensation package, not fringe benefits alone .

Administrative costs

Medical malpractice

Inappropriate utilization

Delivery system under stress

Utilization review

Long-term care

Federal Government As Sponsor Of Employee Health Benefits Program

Because it has been both cited and criticized as a model for national health policy for the last two decades and because it is the country’s largest employment-based program, a note on the history of the Federal Employees Health Benefits Program is in order . FEHBP was established in 1959 so that the federal government could compete more effectively with private employers to recruit and retain a productive work force . Until that time, only a fraction of federal agencies sponsored health plans, although between 1947 and 1959 some 30 bills had proposed creation of a program.

The FEHBP program was unusual in that its congressional sponsors wanted to encourage competition and employee choice among health plans. It provided for three types of plans: governmentwide plans, including both a service plan and an plan employee organization plans and comprehensive medical plans such as prepaid group practices. By 1961, there were already 55 approved options, and there are over 300 today. Initially, the government paid 40 percent of a plan , subject to certain minimums and maximums. The formula was revised in 1971 so that the government contribution would equal 60 percent of the average of the premiums of the six big FEHBP high-option plans, not to exceed 75 percent of any specific plan premium.

Don’t Miss: Which Health Insurance Company Is The Best In Texas

To Make Health Insurance More Affordable

In order to make health insurance more affordable, the ACA included:

Premium tax credits

- Americans with household incomes below 400 percent of the federal poverty line qualify for premium tax credits which cap the cost of a qualifying households individual health insurance policy as a percentage of the households income.

Medicaid expansion

- States have the option of expanding Medicaid eligibility to citizens with household incomes up to 138 percent of FPL.

Individual mandate

- The individual mandate, which used to require all U.S. citizens to purchase health insurance or pay a tax penalty, was originally designed to diversify the risk pool with healthy participants in order to lower costs. This mandate has since been repealed, and today only certain states still enforce a penalty.

How Are Costs Contained

Annual per capita health expenditures in the United States are the highest in the world , with health care costs growing between 4.2 percent and 5.8 percent annually over the past five years.43

Private insurers have introduced several demand-side levers to control costs, including tiered provider pricing and increased patient cost-sharing . Other levers include price negotiations, selective provider contracting, risk-sharing payments, and utilization controls.

The federal government controls costs by:

-

setting provider rates for Medicare and the Veterans Health Administration

-

capitating payments to Medicaid and Medicare managed care organizations

-

capping annual out-of-pocket fees for beneficiaries enrolled in Medicare Advantage plans and individuals enrolled in marketplace/exchange plans

-

negotiating drug prices for the Veterans Health Administration.

However, since most Americans have private health insurance, there are limited options available to the federal government. The ACA introduced cost-control levers for private insurers offering marketplace coverage, requiring that insurers planning to significantly increase plan premiums submit their prospective rates to either the state or the federal government for review.

Attempts to contain pharmaceutical spending are limited to a few mechanisms:

You May Like: What Is The Worst Health Insurance Company

The Development Of Modern Health Insurance

Health insurance as a concept gained traction as the Great Depression took hold of the United States. It was nearly impossible for many Americans to meet everyday expenses, and paying the costs related to medical care for illnesses or accidents was a major hardship. The introduction of 1935s Social Security Act and unemployment compensation brought the need for comprehensive health insurance to the forefront for many legislators.

As World War II rolled in with the mid-1940s, employers and employees were facing the harsh realities of wage freezes. As a result, employers began developing benefits packages in lieu of wage increases that included group health insurance. As you could imagine, health insurance was a very desirable benefit.

In 1949, the United States Supreme Court would rule that, as part of the Taft-Hartley Act, employers would be required to bargain on welfare issues. This would lead to the spread of prepayment concepts and health insurance throughout the nation. As a result, Blue Cross and Blue Shield plans would spread rapidly throughout the nation as well.

The 1970s: A Push For National Health Insurance

By 1970, NHE accounted for 6.9 percent of GDP, due in part to unexpectedly high Medicare expenses. Because the U.S. had not formalized a health insurance system , they didnt really have any idea how much it would cost to provide healthcare for an entire group of people especially an older group who is more likely to have health problems. Nevertheless, this was quite a leap in a ten year time span, but it wouldnt be the last time wed see such jumps. This decade would mark another push for national health insurance this time from unexpected places.

Richard Nixon was elected the 37th President of the United States in 1968. As a teen, he watched two brothers die and saw his family struggle through the 1920s to care for them. To earn extra money for the household, he worked as a janitor. When it came time to apply for colleges, he had to turn Harvard down because his scholarship didnt include room and board.

Entering the White House as a Republican, many were surprised when he proposed new legislation that strayed from party lines in the healthcare debate. With Medicare still fresh in everyones minds, it wasnt a stretch to believe additional healthcare reform would come hot on its heels, so members of Congress were already working on a plan.

Recommended Reading: Does Health Insurance Cover Plastic Surgery

Enactment Of Medicare And Medicaid

The first nationwide hospital insurance bill was introduced in Congress in 1942, but failed to pass. Discussions of various forms of national health insurance over the next two decades culminated in the enactment of Medicare and Medicaid in 1965. Medicare and Medicaid were a compromise between those who wanted national health insurance for everyone, and those who wanted the private sector to continue to be the source of insurance coverage. The elderly and the poor were at high risk for health expenses beyond their means and were less likely than other population groups to have health insurance. The elderly were generally considered to be uninsurable or bad risks by the private insurance market. In 1963, 75 percent of adults under age 65 had hospital insurance compared with 56 percent of people 65 years of age or over. In 1966, following passage of Medicare, about 19 million elderly people, or 10 percent of the population, received health insurance coverage. This nearly doubled the number of insured 65 years of age or over. Medicare coverage was extended to the under age 65 population with disabilities or end stage renal disease, about 2 million new enrollees, in 1972 .