How Much Does Health Insurance Cost For Employees

According to HR consultancy Willis Towers Watsons Best Practices in Health Care Survey, as reported by SHRM, the average annual premium cost for an employee in 2021 for employer-sponsored health coverage was $3,331, up from $3,269 in 2020. Another survey from Mercer projected premiums will increase by 4.4% in 2022. However, the data indicates many employers arent raising their employees share of the cost its expected workers will continue to contribute 22% of their health plan premiums cost, unchanged from 2021.

At the same time, some employers are looking to decrease their employees healthcare expenses by covering treatments or expanding what they offer. These services could be considered fringe benefits:

- Health and wellness promotions within the workplace

- Access to centers of excellence

- Working spouses surcharges

Bottom Line: Even as insurance premiums rise, costs wont necessarily increase for employees in 2022 if employers take on more of the financial burden and cover more services.

How Much Does It Cost To Offer Health Insurance To My Employees

You already know the benefits of offering a group health plan, but if youre here, you are understandably worried about the cost. While health insurance is the most sought-after benefit among workers, it is also the most expensive.

Complete Payroll Solutions designs health benefit plans for employers of all sizes and industries throughout the Northeast, specializing in finding affordable coverage. In this article, well explain the factors that impact the cost of health insurance so you can understand what will drive up your expenses as well as share potential ways to save.

After reading, youll understand what you can expect to pay for coverage so you can decide if offering a group plan will fit your needs and budget.

Is An Employer Required To Pay For Health Insurance

If you decide to offer health insurance to your team, in many cases, your responsibility doesnt end there. In the majority of states, carriers will require you to cover 50% of the premium cost for employees. This requirement, however, only applies to premiums for the employee, not their covered dependents. For other tiers of coverage, such as employee and spouse, employee and children, or family, the insurers want employers to pay 33%.

For 2020, the affordability threshold is 9.78% of an employees income.

Many employers even choose to contribute more than this amount. In fact, last year, on average, covered workers contributed only 17% of their premium for single coverage and 27% for family coverage. One reason for this, especially in companies with lower-wage workers, is that large employers covered by the ACA must offer affordable coverage or be penalized. For 2020, the affordability threshold is 9.78% of an employees income.

You May Like: Starbucks Health Insurance Cost

Employers Are Paying Too Little For Health Insurance

My second answer for how much do employers pay for health insurance is too little! Thats right! You might be thinking I am talking out of both sides of my mouth right now, but so are small businesses!

You see, out of all the complaining that is out there about health insurance, did you know that only 31% of companies that have less than 50 employees even offer any sort of health benefit to their teams? That means that 7 out of 10 small businesses are not doing anything to help their employees with healthcare. I dont blame them. I mean, when you look at the data above, it can feel like an insurmountable task to provide anything substantial, right?

It depends on your budget. Most organizations have something they can give. Its just that they dont realize there is a stair-step approach they can take to finally get into benefits maybe again, or maybe even for the first time. You can easily throttle in a brand new benefit to the team in a more flexible and accessible way than has ever been possible before.

Average Percentage Of Employer Contribution To Health Insurance

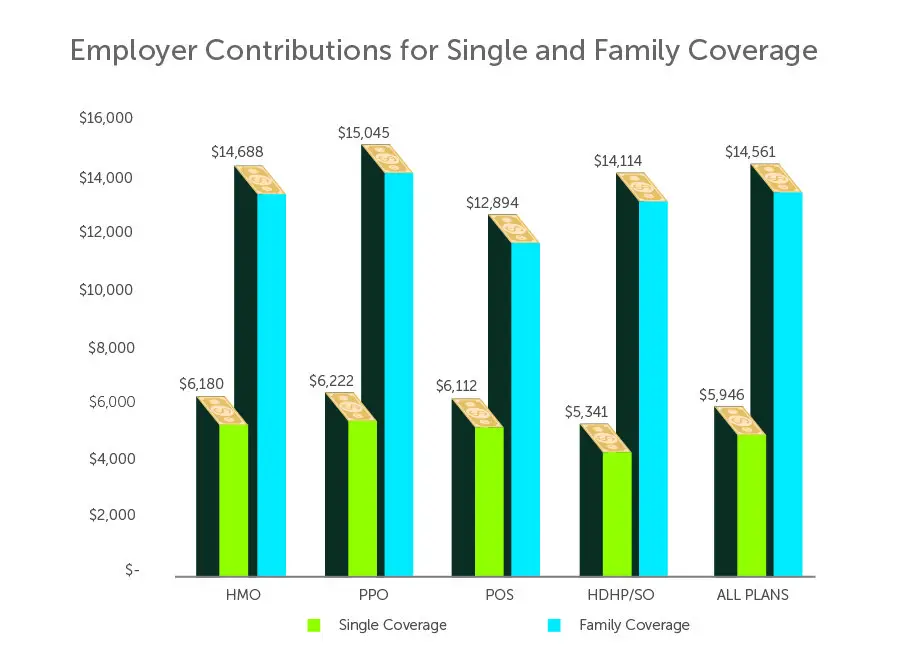

The numbers in the previous section give an overview of what the average employer contributes to health insurance premiums.

Youll notice that the average employer contribution for all plans held steady in terms of percentage from 2016 to 2017, so while insurance premiums are increasing everywhere for everyone, employers are still paying around the same share: 82 percent for individuals and 70 percent for family coverage.

If youre looking for a general place of comparison, these shares are a fairly good marker. Because actual premium price can vary so greatly across companies, percentage of premium is one of the best measuring tools. If your company is paying less as a percent of individual and family premiums, this could negatively affect your employee recruitment and retention efforts.

Read Also: Eligibility For Aarp

Can You Drop Your Employer

Unlike individual health insurance, there are specific rules governing the cancellation of job-based health insurance. It can only be canceled within the companys open enrollment period or both you and your employer may incur tax penalties in accordance with Section 125 of IRS code.

There is one exception. You may cancel your participation in an employer group health plan if you have a qualifying life event. This could be a change in hours or loss of a job, a new baby, marriage, or divorce.

You can also cancel coverage if you lose your job, but then you have to worry about alternate coverage. That is where COBRA insurance could help.

Why Is Health Insurance Important

Almost 2/3rds of bankruptcies in the United States were caused by medical bills. Health insurance is not just insuring your health it insures your wealth. Even after the passage of the Affordable Care Act, most people in the US receive their health care through their employer. Insurance can be difficult to obtain if you retire before youre eligible before Medicare. The ability to have access to any sort of coverage between retirement and Medicare is a huge benefit. Not just for federal employees, but also their spouses, and family members.

Recommended Reading: Starbucks Health Insurance Part-time

How To Ask An Employer For Health Insurance

Many employers offer details and paperwork regarding health insurance when you first start a job.

However, Carey recommends broaching the subject even earlier.

During the interview process, ask if the employer offers health insurance and find the details of what the benefits and cost are, he encourages. If an employee works at a company that does not offer it, speak to HR indicating how important those benefits are.

OnPay, a payroll and HR software, conducted an extensive 2020 study regarding employee benefits preferences. Elliott Brown, OnPays Director of Marketing, explains, According to the employees we surveyed, health insurance is the most important benefit by a long shot . However, only about half of small businesses offer health insurance. Given this disparity, its not hard to see why employees with health benefits are more engaged and less likely to look for a new job.

A 2020 Insure survey also found that health coverage plays a major influence in employee recruitment and retention. Seventy percent rated a companys health insurance as important when deciding on a job or staying with a company.

Necole Gibbs, licensed broker and insurance professional for TNG Insurance Agency, says employees of small companies may not have success in getting their employer to add health insurance.

If your employer doesnt offer health insurance, some effective ways to initiate that conversation and discuss other alternatives include:

Digging Deeper For Pricing Information

However, it’s not universally good news. For more details, we consulted the CMS’ 2020 Health Insurance Exchange Premium Landscape Issue Brief. It indicates that 27-year-olds buying silver plans saw their premiums increase by 10% or more in Indiana, Louisiana, and New Jersey.

More importantly, it reveals that the percentage changes don’t tell us much about what people are actually paying: “Some of the states with the largest decreases still have relatively high premiums and vice versa,” the brief states. “For example, while Nebraskas benchmark plan premium decreased 15% from PY19 to PY20, the average 27-year-old PY20 benchmark plan premium is $583. On the other hand, while Indianas average PY20 benchmark plan premium increased 13% from PY19, the average 27-year-old PY20 benchmark plan premium is $314.”

In 2021, that trend continues. The 2021 edition of the CMS Brief notes that, for example, while Wyomings average benchmark plan premium decreased 10% from PY20 to PY21, the average 27-year-old PY21 benchmark plan premium is $648the highest in the U.S. How many 27-year-olds can afford that kind of monthly premium? By contrast, New Hampshire’s benchmark plan premium for a 27-year-old is the lowest in the nation at $273.

Recommended Reading: Evolve Health Insurance

How Much Do Employers Pay For Health Insurance

Whether youre exploring cost-effective health plans for your organization, researching health reimbursement arrangements for the first time, or looking into health stipends, a common question business owners have is, how much does health insurance cost per employee?

Rising healthcare costs can make organizations second-guess offering an employer-sponsored health plan. However, the cost of losing employees by not offering health benefits can surpass the cost of supporting your employees well-being, so offering a comprehensive health benefit is vital.

This article will break down the average employer health insurance cost per employee and the average cost of employer-sponsored health insurance. Well also explain how you can use an HRA or health stipend to control your budget.

Use the table contents below to jump to a specific section:

How Much Does Group Health Insurance Cost For Employees

From the insurance plan your company chooses to your employees health conditions, many factors affect how much employees pay for health insurance.

Again looking at KFFs report, in 2021, group health insurance participation cost employees $5,969 annually, roughly 27% of the premium, for family coverage and $1,299, about 17%, for an individual. Employee costs are typically taken through a payroll deduction.

Premium costs with a group health insurance plan typically increase every year. In fact, employers expect the average total cost of healthcare to increase by 4.7% in 2022. To minimize or reduce fluctuation in premium amounts, and to control the cost of benefits from year to year, you can change contribution strategies or plan features.

You May Like: Does Insurance Cover Chiropractic

How Much Are Your Benefits Really Worth

Getty

Are you overlooking the real value of your benefits when you think about your compensation? Probably. According to the Bureau of Labor Statistics, benefits accounted for about 32% of employer costs of compensation for U.S. workers in June 2018, with salary making up the other 68%.

Thats an impressive number to start with, but when you look at it from the perspective of the employee, the impact is more striking. Employer-paid benefits improved wages for private industry workers by 46.6% . Did I mention that most of those employee benefits are not taxable to the employee?

Its a good time to practice some benefits appreciation.

While youre making decisions about your health insurance and other employee benefits for the upcoming year during this open enrollment season, I invite you to take some time to calculate and appreciate their value. Think of it this way: if you were self-employed, youd have to earn more than 50% more per hour to pay your own benefits costs plus the employers share of FICA taxes . Thats assuming you could get similar pricing on insurance, which is unlikely. While there are many advantages to being your own boss, lack of access to group insurance coverages and retirement planning contributions arent in the plus column.

How to estimate the financial value of your benefits

Whats your total?

Fehb And Medicare Parts A & B

You can enroll in Medicare part A when youre 65. Youre expected to enroll in Medicare Part B when you turn 65 if you are retired. If you do not enroll at age 65, you will be penalized if you try to enroll later. You should know that while you can continue your FEHB benefits for life, your FEHB insurance company expects you to enroll in Medicare Part B. Therefore, if you dont enroll in Medicare Part B at age 65 because you participate in the FEHB, you may find an unpleasant surprise in the form of the coverage gap when you visit a doctor.

Also Check: Evolve Health Products

Myth : Employers Must Pay At Least 70 Percent Of Employees Health Insurance Premium Costs

Busted. Although the Affordable Care Act does not specify a set amount that employers are required to contribute, some insurance carriers or states require employers to cover at least 50 percent of the premium for employee-only coverage. Employers can choose to cover more as a strategy to attract and retain quality employees, and many do. In 2017, the average employer contribution was 82 percent for employee-only coverage.2

Group Or Individual Coverage Hras

Within a group or stand-alone coverage HRA, employers can offer HRA options that meet the legal requirements and offer financial relief to employees. The group coverage HRA targets small employers that offer a high-deductible health plan. Group coverage HRAs can be compatible with other group health insurance programs.

With group-affiliated HRAs, employers select a monthly benefit allowance of tax-free money to offer each enrolled employee. Employees then purchase what they need throughout the month, saving their receipts for the employer to review. Once the review process is complete and the expense is approved, the employer reimburses the employee up to the monthly cap theyve set.

Employers execute the stand-alone program the same way they would a group coverage HRA. The employee has a set amount of pretax money each month, and the employee submits receipts for their qualifying expenses. Also, there are no IRS-regulated contribution caps on stand-alone HRAs, so the employee can be reimbursed for any qualifying expense the IRS lists.

Recommended Reading: Starbucks Dental Insurance

Health Insurance Costs Can Vary Dramatically Based On The Plan You Choose Here’s What To Expect In 2022 And How To Select The Best Plan Financially For Your Business And Your Employees

Employee health insurance benefits are a must-have for many workers. Nearly 50% of Americans receive health insurance benefits through an employer, according to eHealth and the Kaiser Family Foundation . While people without employer-sponsored insurance have the option to find health benefits through health insurance marketplaces or federal programs, the cost of private health insurance has gone up, leaving many Americans without viable options. This means that the insurance benefits an employer offers as part of their compensation management program and how the costs of that insurance are shared with the employee, directly impact a businesss ability to hire and retain the right people.

Below, weve broken down the current state of health insurance costs in the U.S., including how to keep expenditures down and what health insurance prices in 2022 mean for employers.

What Is Employer Health Insurance

Employer health insurance refers to a group health insurance plan chosen and maintained by a company for its employees.

Although optional for smaller companies, the Affordable Care Act mandates that larger companies must offer health insurance to employees or they may face penalties. This applies to employers with a minimum of 50 full-time equivalent employees. Employers are responsible for paying at least 50% of their employees annual premiums.

There are incentives for small companies, too. When there are fewer than 25 full-time equivalent employees, companies could receive a tax credit when they offer employee health insurance.

Key Takeaways

- Larger companies must offer health insurance to employees or face penalties.

- Smaller companies also often provide health coverage for employees and are eligible for tax credits when they offer job-based insurance

- If youre eligible, you can enroll in health coverage when youre first hired and can make changes to health insurance during the open enrollment period.

- Businesses also allow you to make changes to your job-based plan if you have qualifying life events that lead to a special enrollment period.

- If you decline an employer-sponsored plan, you may not be eligible for tax credits if you buy a health insurance marketplace plan.

Recommended Reading: Starbucks Insurance For Part Time Employees

Providing Access To Telehealth And Lower

Some good news stemming from the pandemic and health plan costs is the growing acceptance of telehealth as a lower-cost care option. According to the Mercer survey, employers had positive feedback about telemedicine during the pandemic, with 74% saying they were very satisfied or satisfied. Whats more, 80% of employers said telemedicine will play a larger role in their benefits offerings, with 28% planning to add, expand or incentivize telemedicine and related virtual health options.

A key value of lower-cost options is that it helps employees get the right level of care based on their specific need. When lower-cost health care is an option and employees are healthier, they are more likely to opt for a high-deductible plan which means lower premiums for you and them.

HealthPartners health plans have robust support for telehealth options and other low-cost services such as Virtuwell and Doctor on Demand.

How To Reduce Costs

The amount and the speed at which premiums for health insurance in Canada are rising have individuals and families looking for ways to reduce their costs. While some may be tempted to drop their private insurance and just rely on their provincial plan, most people do recognize the benefits of health insurance.

If youve been looking for a way to reduce your costs, you should read Insurdinarys article on how to tell which insurance company is the best for you.

You May Like: Starbucks Health Insurance Part Time