What If I Lose My Job Outside Of Open Enrollment Open

The yearly period in the fall when people can enroll in a health insurance plan for the next calendar year. Open Enrollment for 2023 runs from November 1 through January 15, 2023.

In 2023, a job-based health plan is considered “affordable” if your share of the monthly premium in the lowest-cost plan offered by the employer is less than 9.12% of your household income.

A standard of minimum coverage that applies to job-based health plans. If your employerâs plan meets this standard and is considered âaffordable,â you wonât qualify for a premium tax credit if you buy a Marketplace insurance plan instead.

New Ways To Get Health Insurance When Youre Unemployed

When you lose your job, you usually lose your employerâs health insurance, too. You have several options for replacing that coverage, but until recently many of those choices were expensive and especially difficult to afford when your income is down. But the American Rescue Plan, the relief package that was signed on March 11, 2021, makes several of those options much more affordable.

Whether you just lost your job or are reassessing your options after losing your job in the past year, hereâs what you need to consider when choosing new health insurance coverage. With new subsidies and other assistance, the best choice may be totally different now than it had been in the past.

â New subsidy continues your employerâs coverage through COBRA.

â Sign up for coverage through your stateâs insurance marketplace.

â Choose between COBRA and marketplace coverage under the new rules.

â Join your spouseâs plan.

New Subsidy to Continue Your Employerâs Coverage Through COBRA

The downside has always been the cost: The premiums usually jump significantly because you have to pay both the employeeâs and the employerâs share of the cost, plus up to 2% in administrative costs. Employers generally pay about 75% of the premiums for their current employees.

The new subsidy only applies to people who lost their jobs involuntarily people who left on their own are not eligible for the subsidy. For them, COBRA coverage will continue to be very expensive.

The Factors That Life Insurance Companies Consider

If youre unemployed and applying for life insurance, one of the first things the insurer looks at is how long youve been out of work. Generally, long-term unemployment is when youve been out of work for six months, though that can extend a bit during times of economic hardship like recessions.If youve been unemployed for six months or less, and are actively searching for a job, many insurance companies may move forward with your application and consider your previous income level as a guide.If youve been unemployed for longer than that, the insurer will often want to know why. Depending on the situation for example, youre in graduate school or a stay-at-home parent the insurer will take those factors into consideration when deciding on coverage.Some people with disabilities dont work, sometimes because they cant due to their disability or a related illness. In this case, it can be harder to get coverage.

Recommended Reading: How To Get The Health Insurance

The Health Insurance Cover Commences:

- for persons receiving unemployment insurance benefit, as of the date of entitlement to benefit

- for persons receiving unemployment benefit, as of the date of entitlement to benefit

- for unemployed persons who do not receive unemployment benefit, as of the 31st day of registration as an unemployed

- for unemployed persons who do not receive unemployment benefit but participate in practical training, work practice or employment training lasting at least 80 hours, as of the first day of participation

- for non-employed persons who have participated in nuclear disaster relief, as of the date the application is filed.

Are There Free Health Insurance For Unemployed

Unemployment comes with a lot of financial difficulties especially when youve been unemployed for a long time. Because when youre unemployed, you would most likely be spending the money you have without making any.

Losing ones job or not even having any at all affects our health adversely. This is because, although youre not making any money, youd still have to spend on so many other things like shelter, feeding, and health.

All these are considered priorities and getting the right balance is difficult. The strain on financial commitments brought about by unemployment makes it somewhat impossible for the unemployed to get good healthcare insurance. And so the best, most suitable option is getting free healthcare coverage.

Most people ask the question Can I get free healthcare coverage if Im unemployed? Well, the answer is If you meet the requirements, why not?

There are several discounted and free plans available for unemployed individuals. These plans, however, have their requirements that must be met before the plan is issued.

So, rather than asking if there is a free healthcare coverage plan for the unemployed, your question should be What are the free healthcare coverage plans that my unemployed status can qualify for?

This is because there are various free or greatly subsidized healthcare coverage plans for unemployed individuals, but the requirement will determine if youd get the plan.

Recommended Reading: Where Can I Go For Health Care Without Insurance

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.Limited time offer. Must file by 3/31.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund and seewhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Get The Cheapest Health Insurance When Unemployed

Find Cheap Health Insurance Quotes in Your Area

For most people who are unemployed, we recommend getting insurance through the Affordable Care Act health insurance marketplace.

Although there are several ways to get coverage, the most cost-effective option will be with a plan that reduces your health insurance costs based on your income, as ACA marketplace plans do. For example, a health insurance plan for someone who is recently unemployed can cost $47 per month. That assumes the person chooses a cheap Bronze plan and their total income for the year is $35,000, including the parts of the year when employed.

While Medicaid is even cheaper than the ACA marketplace, it’s only available for those who meet the income requirements, which can be less than $18,754 for individuals in many states. If you recently lost your job or your spouse is employed, it will be harder to qualify for Medicaid because other income sources, including unemployment income, are included when determining eligibility.

When shopping for coverage, watch out for short-term health insurance plans and their high deductibles. The cheap prices of these plans are attractive, but before the benefits kick in, you could have to pay thousands of dollars out of pocket for medical care.

| Provides the same coverage that you had through your job, but costs can be high. | Automatically eligible to continue your job-based insurance after you stop working. |

Read Also: What Is An Average Health Insurance Deductible

Options For Unemployed Individuals

If youre unemployed, you can get an affordable health insurance plan via KindHealth, which partners with Healthcare.gov and offers their same marketplace options. Your savings are based on your income and household size. You may also qualify for free or low-cost coverage through Medicaid or the Childrens Health Insurance Program .

If you had health insurance coverage at work, but you were then fired or let go, COBRA may be an option for you. COBRA is a continuation of your health coverage, established by a federal law that requires employers to let former employees continue their healthcare plan for up to 18 months after they lose their jobs. Although most states have similar plans for smaller employers, COBRA generally only applies to companies with 20 or more employees. With a COBRA plan, youll keep the same coverage and provider network as you once had. Under the law, you pay 35 percent of the health insurance plans premium cost, and your employer pays the rest meaning you pay only about one-third of the plans cost.

Dont Miss:

Choosing The Right Health Insurance When Youre Unemployed

Theres a lot to think about when looking for health insurance while unemployed. Youll need to consider your health care needs as well as your budget. In addition to premium costs, you should also assess deductibles, copayments and coinsurance, out-of-pocket maximums and any caps on coverage.

Once youve found the right health insurance plan, be sure to make your payments on time. Setting up automatic payments from your bank account or a can help to ensure you dont miss a payment. Late payments may negatively affect your and might even cost you the health insurance you worked so hard to get.

Also Check: What Health Insurance Do Veterans Have

Check Out Your States Health Insurance Marketplace

When it comes to shopping for health insurance, your first stop should be your states health insurance marketplace. Some states will have their own marketplace, like Minnesotas MNsure, while others go directly through the federal exchange at HealthCare.gov. There are several excellent reasons why you should point your web browser here before anywhere else:

- Wide selection of insurers and plans Whether its through your states marketplace or through the federal exchange, youll find a market with many insurers competing for your membership. Youll find local, regional and national companies offering many kinds of plans.

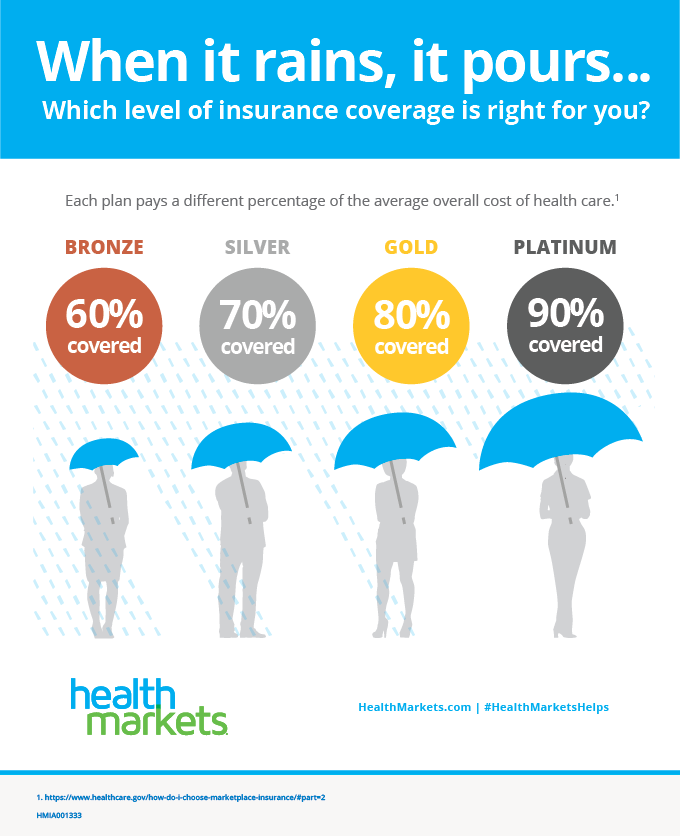

- Plans that are easy to compare These marketplaces classify plans into four different metal levels Bronze, Silver, Gold and Platinum. The higher up in the metal scale, the higher the plans cost and the higher the amount of care the plan covers. This makes comparing plans easier, giving you a true apples to apples way to stack plans up against each other.

- Save money with financial help This is the biggest reason why you should start with your states marketplace. You could be eligible for financial help that could lower the costs of what you will pay in premiums sometimes significantly. These are only available through the marketplaces, so its best to check your eligibility here first.

Discounts for Minnesota shoppers

Discounts for Wisconsin shoppers

Coronavirus Job Loss: How To Get Health Insurance When Unemployed

We hope youre all doing well and staying healthy at this difficult time. Having said that, we know that unemployment or the risk of imminent unemployment concerns a lot of you. While both the state and federal governments are taking steps to provide stimulus payments and unemployment benefits at this time, you might be wondering what to do about health insurance coverage.

Federal law does require employers to allow you to remain enrolled in your group healthcare plan when youre laid off. The COBRA law allows you to continue in the same plan, if you wish, but you have to pay the entire cost of the premiums . That might work for a few people, particularly those whose spouses are still employed and can cover the cost of the premiums, but for many unemployed people the cost of the entire premium simply is not feasible.

So, what else can you do about healthcare coverage if youve recently become unemployed?

First, know this: If youve lost your health insurance due to job loss, you qualify for a Special Enrollment Period. This means that you can enroll in a new healthcare plan outside of the usual Open Enrollment period .

If you elect to pursue coverage through Covered California, you might be eligible for a subsidy to help cover the cost of your premiums. Keep in mind that if youve applied in the past and didnt receive a subsidy, that is likely to change now since your income has changed.

Don’t Miss: Can I Get Health Insurance Outside Of The Marketplace

Best For People Who Want More Coverage: Kaiser Permanente

If youre unemployed but can pay a bit more each month, you can opt for a Gold plan, which covers more of your total health care costs and offers more protection. They cost more in premiums each month but have lower deductibles and out-of-pocket maximums, so you pay less as you use services. These plans make sense if you have significant health care needs and if you can afford the higher monthly tab.

MoneyGeeks pick for the best Gold plan provider on the Marketplace is Kaiser Permanente, whose average monthly premiums for Gold plans is $463.96. In contrast, the companys average Silver premium is $427.47 per month.

Kaiser Permanente

Kaiser Permanente is the highest-rated national health insurance provider, offering Gold plans on the Marketplace in nine states. Kaisers quality rating overall is 4.28 out of 5.00, the highest of all major national insurers. Its best-scoring category is prevention, where it scores 4.33 out of 5.00.

The average Kaiser premium for Gold plans is $463.96, which isnt the cheapest average rate available , but its close. Kaiser Permanente offers the best combination of quality and cost, though specific rates vary by market.

Getting Health Insurance For Unemployed Citizens

One thing about the modern healthcare insurance scheme is its versatility. Different individuals have different health needs, financial statuses, and requirements.

And knowing this, healthcare insurance has been made accessible by healthcare insurance companies by creating different plan categories and schemes for different individuals.

Most people ask, is there a healthcare insurance plan for the unemployed? Well, its quite tricky to answer this but, if it makes you feel any better, theres always a way around it and there might just be a plan for your unemployment status.

Also, although there are plans that might suit your unemployed status, these plans have other requirements aside from being unemployed.

So, the reason youve not qualified for a health plan might not be just because youre unemployed but because you didnt meet up with the requirements for your unemployed plan category.

One of the major considerations while getting a plan for an unemployed person is the cost-effectiveness and how cheap the plan is. Also, sometimes unemployed people seek free healthcare insurance plans, depending on how bad their financial status is.

Nevertheless, it is important to note the many other factors involved in healthcare insurance plans when looking for an unemployed health plan.

Your net worth or financial strength will always determine the category of unemployment health insurance plan youd get. The more money you have, the more expensive the plan will be.

Also Check: When Does Open Enrollment Start For Health Insurance

What Is The Healthcare System In Germany Like

First of all. There is one simple rule you must know about health care in Germany.

Everyone who moves to Germany is required to have health insurance.

Why?

Because there is a legal obligation for everyone to have health insurance in Germany.

You must have either public or private health insurance. If you stay in Germany permanently, travel health insurance is not sufficient.

About 85% of Germans are member of a public health insurance provider in Germany. In German you call this Gesetzliche Krankenkenversicherung .

The other 15% are member of a private health insurance.

Ok. Anything else I need to know?

Yes. You may be pleased to hear the following.

Germanys healthcare system is one of the best in the world.

Yes, waiting times for public health insurance members may be longer than for privately insured patients.

But the quality of the treatment you get as member of the German public health insurance is extremely good. Much better than in many other countries of the world.

Some people travel to Germany just to get medical treatment. Crazy, he?

Recommended Reading: How Do I Sign Up For Unemployment In Washington State

What Does Financial Support Look Like Under The Fast Forward Program

This program authorizes you to continue to receive EI from Service Canada while in training only.

You continue to receive EI Regular Benefits during the training program you are using your EI claim period to improve your skills and employability. The Fast Forward Program does not extend the length of time of your EI Regular Benefits. The scheduled end date of your EI claim does not change.

Support is linked to your EI claim. The amount of time you receive support and the date your support begins looks different for everyone. Here are some explanations of how support occurs depending on the timing of your application submission:

- If your application is received before the start date of your current term/semester and approved before that start date, support under the Fast Forward Program begins on the start date of your current term/semester.

- If your application is received before the start date of your current term/semester but is approved after that start date, support under the Fast Forward Program is backdated to the start date of your current term/semester.

- If your application is received after the start date of your current term/semester and if it is approved, support under the Fast Forward Program is backdated to the date your application was received by Employment Nova Scotia only.

Should you have difficulty funding your education once your EI payments have ended, Employment Nova Scotia cannot help you.

Recommended Reading: How Much Unemployment Will I Get In Nc

Recommended Reading: How Much Subsidy For Health Insurance

How We Chose The Best Health Insurance For The Unemployed

Our analysis looked at 30 health insurers nationwide to identify the best companies based on the benefits they offer to those facing unemployment. We chose insurers with widespread geographic representation who provide flexible policies geared toward individuals with short-term insurance needs. Since financial strain is a main concern during periods of unemployment, we weighed policy pricing heavily by comparing quotes from five sample markets. Finally, we evaluated accessibility to care, including the number of in-network providers and the availability of telehealth services.