No Insurance Should Not Be An Option

I once met a man who chose not to purchase health insurance. He said, I work out. I eat well. Thats my insurance.

I often wondered what he thought would happen if he tore an ACL playing touch football, or got hit by a drunk driver.

Unless youre extremely wealthy and can afford to pay for a medical catastrophe that comes your way, forgoing insurance altogether is not advised.

Even the most healthy among us fall and break their arms, get into car accidents, or come down with life-threatening diseases.

A visit to the emergency room for even a minor issue could leave you with thousands of dollars in medical bills.

The costs of surgery could run in the tens of thousands of dollars.

While the Affordable Care Act no longer has a tax penalty for not having coverage, insurance provides peace of mind.

Do You Need Supplementary Health Or Dental Insurance

If you are young and healthy, you might not need to buy supplementary health or dental coverage. It depends to an extent on what you are covered for under OHIP, a group plan or a parents group plan. For example, starting in January 2018, OHIP provides prescription drug coverage to youth 24 and under who are not covered by private benefits. Those children and youth are able to get more than 4,400 prescription medicines for free by showing their health card and prescription. Coverage is automatic, with no up-front costs. Read the news release to find out more. Check what you are covered for, take a look at your individual situation, and make a decision on whether what you have now is sufficient.

How Do I Find The Most Affordable Health Insurance

The first place to go for affordable health insurance is the exchange at HealthCare.gov. However, you can also go to an insurance broker to get a short- or long-term individual health insurance plan. There are more short-term policies outside of HealthCare.gov, Starr says.

If you need help comparing plans or finding health insurance that suits your budget and needs, you can seek help from a state navigator, Starr says.

Communities can also offer health insurance resources to residents. Sometimes, bodies of worship such as churches and temples have experts come in to help their communities, and a lot of hospital systems also have navigators to help you with insurance options, she says.

As you look for affordable health insurance, here are some key considerations:

- Find plans available in your area

- Research the network

- Check insurer ratings

Don’t Miss: Does My Health Insurance Cover Eye Exam

Farm Bureau Health Insurance

If youre healthy and dont qualify for Marketplace subsidies, Farm Bureau plans may be cheaper than other alternatives. Like short-term health plans, Farm Bureau health insurance may not cover pre-existing conditions or could have a waiting period before these conditions are covered. Your medical history is a factor when you apply, and could cause you to be denied coverage.

Though Farm Bureau plans can be relatively affordable, these cheap health insurance plans are not compliant with the Affordable Care Act regulation and dont have to cover the 10 essential health benefits. Coverage varies by state, but you can apply year-round if youre a Farm Bureau member, which comes with a separate annual membership cost.

More Help Before You Apply

-

Estimating your expected household income for 2023

- You can probably start with your households adjusted gross income and update it for expected changes.

- You may qualify to enroll in or change Marketplace coverage through a new Special Enrollment Period based on estimated household income. See if you may qualify.

- Learn more about estimating income, and see what to include.

Including the right people in your household

Don’t Miss: Can I Get Health Insurance After An Accident

Bronze Silver And Gold Plans: Understanding Metal Tiers

The different metal tiers in the Health Insurance Marketplace determine how health care costs are split between you and the insurance company. The more responsibility put on the insurance company, the higher your the cost of your premiums will be.

Some states also have a policy with a very high deductible called a Catastrophic health insurance plan. You can also get a Platinum plan in some states, which offers the lowest deductible but the highest monthly premium. A Catastrophic plan is best for the young and very healthy, while the Platinum plan is for those who expect very high medical bills.

How Do I Enroll In South Carolina Individual And Family Insurance

You can purchase insurance for yourself or your family through the marketplace or an insurance company in South Carolina. Whether youre choosing insurance for yourself or your family, youll need to ask yourself important questions:

- How healthy am I?

- How healthy is my family?

- How much can I afford to pay for a monthly premium?

- Will my income allow me to qualify for any subsidies on the ACA marketplace?

- How much can I afford to pay in out-of-pocket costs?

Also Check: What Is The Difference Between Life Insurance And Health Insurance

Can I Combine Health Plans

You can try mixing indemnity insurance, designed to pay a set percentage of the health providerâs fee if youre hospitalized or in an accident, with a short-term medical plan that can let you go to the doctor a few times a year for more minor ailments.

In her former role as senior vice president of advisor services at Manning & Napier, Shelby George noticed people trying to rig these set-ups on their own, sometimes with poor results. They had to file every claim with all insurers so that every dollar could be recouped. That was complex, so the company rolled out combo plans with single insurers to make the claims process smoother.

Still, eHealthâs Nate Purpura notes that you have to take heed of two things when choosing health plans:

- Is the plan underwritten based on your health, or is it guaranteed issue, so it must enroll you regardless of your age, health status, or other factors?

- What does the plan cover if you have to be hospitalized?

Always make sure you know what youd get, before choosing a health plan.

Stick With Your Parents

Are you under age 26? If so, there may be no need to stress about shopping for insurance just yet.

Under the provisions of the Affordable Care Act, children can remain on their parents insurance until age 26.

This option is a huge benefit to young people who may still be in school or just entering the workforce.

If your parents agree to keep you on their policy, they will pay more in premium. You can offset this cost by paying them back.

Even if you pay them back for that difference, youll end up paying far less than if you were to seek insurance on the open market or healthcare exchanges.

Recommended Reading: How To Get Health Insurance For My Parents

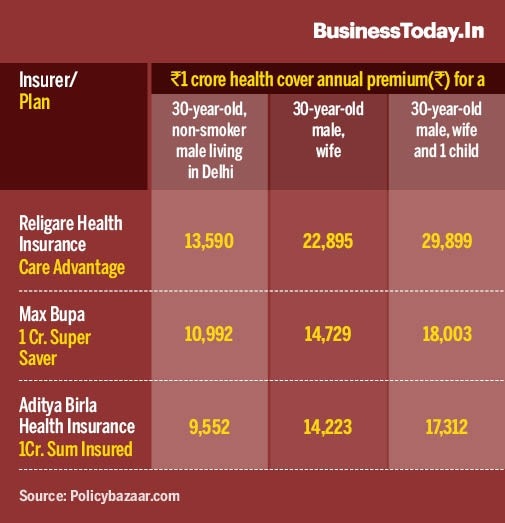

How Much Does Health Insurance Cost

A Bronze health insurance plan costs an average of $928 a month on the ACA health insurance marketplace at Healthcare.gov. The monthly average cost increases to $1,217 for a Silver plan and $1,336 for a Gold plan.

What you pay depends on your particular situationthe cost of health insurance can vary significantly. Some factors that affect the cost of health insurance include deductibles, copayments, coinsurance, monthly premiums and your out-of-pocket maximums, along with personal choices about the plan and coverage options.

Related: How much does health insurance cost?

How To Find Affordable Health Insurance

The cost of health insurance varies mainly based on a combination of monthly premiums and out-of-pocket costs. The more you’re willing to pay out of pocket for care, the lower those monthly rates will be.

That means the most inexpensive health insurance plans are those with higher deductibles, coinsurance, and copayments. That makes shopping for affordable healthcare a balancing act between what you pay every month and what you will have to pay if you need care.

Fortunately, there are programs and plans aimed at making affordable health insurance accessible.

You May Like: Does Burger King Offer Health Insurance

Affordable Health Insurance Texas

Medicaid is usually the best way to get comprehensive coverage at the lowest rates. However, most people dont qualify for Medicaid.

Medicaid is a federal/state health insurance program for low-income Americans. About five million Texans have either Medicaid coverage or a Childrens Health Insurance Program plan.

Eligibility is based on household income and each state has its own rules. Texas hasnt expanded Medicaid eligibility, which has happened in most states. That said, children and pregnant women have lower eligibility limits than everyone else in Texas, which makes them more likely eligible for Medicaid.

Another route is to see if you can get a subsidized marketplace plan. The average annual cost for the cheapest Bronze plan in Texas is $3,672. The average annual cost of a Silver plan is $5,088 in the Lone Star State. Thats without subsidies.

You may pay much less if you qualify for subsidies. People with household incomes below 400% can be eligible for subsidies and tax credits to reduce the cost of ACA marketplace plans.

Texas also allows short-term health plans. Short-term plans offer limited coverage at low premiums. You can keep a short-term plan for a year and can request two annual extensions.

Short-term plans are meant as stopgaps between coverage and not a long-term health insurance solution.

Getting Help Paying For Obamacare In Texas Through Subsidies

![Average Health Insurance Premiums [INFOGRAPHIC] Average Health Insurance Premiums [INFOGRAPHIC]](https://www.healthinsurancedigest.com/wp-content/uploads/average-health-insurance-premiums-infographic.jpeg)

Some Texas residents may qualify for help paying for health insurance. People often call this help a “subsidy.” There are at least a couple of different kinds of subsidies you might qualify for in Texas: premium tax credits and out-of-pocket savings subsidies.

Premium tax credits

If your household income is below a certain amount, you can get a subsidy in the form of a “premium tax credit” to help pay for health insurance if you qualify. And if you do qualify, you get to decide whether to have the government help pay your monthly premium , or have the government give you the tax credit when you file your federal tax return.

Qualifying for a premium tax credit in Texas

Here’s how it works. First, you need to know your household income level. It might help to have your last federal tax return available.

To qualify, you must:

- Not be claimed as a dependent on anyone’s tax return

- Have an income of less than 400% of the Federal Poverty Level , but not less than 100% of the Federal Poverty Level.

- File a joint return, if you’re married

- Be enrolled in a plan through the health insurance Marketplace

- Not qualify for other minimum essential coverage

Out-of-pocket savings subsidies

Another kind of help that some people refer to as a subsidy is something the government calls out-of-pocket savings.

Do I qualify for a subsidy in Texas?

Want to find out if you might qualify for a subsidy? Just use eHealth’s subsidy calculator to get an estimate.

Also Check: What Is The Best Most Affordable Health Insurance

What If You Dont Qualify For Medicaid

Donât panic if you dont meet the rules for Medicaid. You do have other options. Health care expert Shelby George, CEO of PERKY, a firm that helps employers educate employees about benefits, warns to be cautious about signing up for a plan without first doing your research. Theres so much jargon, complexity, and misunderstanding in the health insurance world, she says. Its become just like shopping for a car. Spend the hours you need to know what youre getting for what youre paying.

Keep some key points in mind when you search for a health plan that you can afford.

-

Medicaid: Itâs free or very low-cost if you qualify

-

An IRS tax credit that can offset or even cover the cost of a plan

-

A cheap, short-term plan, because IRS rules changed to allow you to keep one of these for up to one year

-

Plans that claim to be low-cost but arenât

-

Income limits that could disqualify you from Medicaid

-

The limited coverage of short-term policies

-

The fine print: Plans often have complex rules and many exclude certain care

Recommended Reading: What Qualifies For Self Employed Health Insurance Deduction

Go Through Your Employer

This choice is a no-brainer for anyone who works for a sizable company.

If your employer subsidizes the cost of health insurance, youll usually get better coverage and pay less than if you were to try and purchase insurance on your own.

In most cases, employers will allow you to buy insurance for not just yourself, but your immediate family.

Employers will often give you a choice between a more robust plan with higher premiums and a lower-cost plan with less coverage or more restrictions.

Companies often will offer dental insurance and vision plans as well.

The Kaiser Family Foundation reported that about 156 million people receive employer-sponsored insurance.

On average, most workers contribute between 0% and 25% of the premium cost to get health insurance.

And workers who received employer-sponsored insurance contributed an average of $5,588 in premiums in 2020, while employers contributed $15,754 .

You May Like: How To Find Health Insurance In New York

What Can You Do If Youre Facing Unaffordable Premiums

Most Americans get coverage from a subsidized government-run program , an employer-sponsored plan that includes significant employer subsidies and tax breaks, or a subsidized individual market plan through the exchange.

So the people who have to pay full price for their coverage are sometimes lost in the shuffle. But if youâre faced with a premium bill that amounts to a substantial portion of your income, youâre not alone. Letâs take a look at what you can do in this situation.

First, understand why youâre not eligible for financial assistance with your premiums. In most cases, youâll be in one of the three scenarios described above.

Switch to the Exchange

If youâre enrolled in a plan outside the exchange/marketplace in your state, you canât receive a subsidy. Switching to the exchange might result in much more affordableand possibly more comprehensivecoverage. This is especially true now that the American Rescue Plan has been implemented. If youâre eligible for subsidies, you might be surprised to find out how affordable the coverage is.

You can switch to a plan in the exchange during open enrollment, which runs from November 1 through January 15 in most states .

Outside of open enrollment, youâll need a qualifying life event in order to switch plans.

Talk to Your Employer

Were Here To Help You Understand Health Insurance

I really appreciate you taking the time to help out and explain things to people who need it the most.

Thank you, Louise! This is extremely helpful and makes me feel better prepared to navigate my transition.

Louise, Thank you so much for the clear and very helpful response. Ive learned a lot from you on the subject.

Thank you, Louise for your detailed answer. Your first paragraph is exactly what we were looking for!

Thank you so much this is one of the clearest articles on the income limits and subsidy amounts.

Also Check: Do I Have To Offer My Employees Health Insurance

How We Rate Health Insurance Companies

Financial strength: The financial strength rating uses the insurance companys AM Best financial strength rating. AM Best is a credit rating agency specializing in the insurance industry, which rates an insurers ability to meet ongoing obligations.

Customer satisfaction: The customer satisfaction rating considers Kaiser Permanentes Better Business Bureau, National Committee for Quality Assurance, and Consumer Affairs ratings. These ratings use customer complaints and satisfaction ratings.

Value: The value rating calculates an insurers overall value based on monthly premium, annual deductible, office visit cost, ER visit cost, and annual maximum out-of-pocket cost.

Coverage: The coverage rating considers the insurers availability of coverages, plan types, and network size.

President Expands Special Enrollment Period For Low

The ACA marketplaces open enrollment is usually from in most states, but starting in 2022, low-income Americans will have more chances to get a marketplace plan.

People with income up to 150% of federal poverty level will be eligible for a special enrollment period each month. The Centers for Medicare and Medicaid Services estimates that about one-third of marketplace plan members will qualify.

Donât Miss: What Is Temporary Health Insurance

Don’t Miss: How Much Does Average Health Insurance Cost Per Month

Unitedhealthcare Individual & Family Aca Marketplace Plans

Looking for health care plans on the Affordable Care Act Marketplace? UnitedHealthcare Individual & Family ACA Marketplace plans offer affordable, reliable coverage options for you and your family.

As part of the American Rescue Plan Act of 2021 and Inflation Reduction Act of 2022, many individuals and families are now eligible for lower or in some cases $0 1 monthly premiums for ACA Marketplace health coverage.

Cheapest Health Insurance By State

A cheap individual health insurance plan costs about $336 per month for the most affordable Bronze plan in each state. But many people don’t have to pay full price.

Those with low incomes can either pay a discounted rate on marketplace plans with premium tax credits or get free or low-cost insurance through Medicaid. For example, a person earning $35,000 a year would pay an average of $47 per month for the cheapest Bronze plan in each state.

Health insurance policy availability and rates vary by location and other factors like age and income.

| State |

|---|

| Cigna | $560 |

When evaluating affordable health insurance policies, some companies will consistently offer lower rates than others. However, there is frequently a tradeoff when choosing a low-cost provider. For example, Kaiser Permanente health insurance has a limited network of doctors, and Ambetter has below-average customer service. These factors are important to evaluate when choosing the best policy for your family.

Don’t Miss: How Does Government Health Insurance Work