Coverage Options For Recent Graduates

Graduates may find themselves in insurance limbo following graduation. If they are not going directly into a job that offers health insurance benefits, or if there is a gap in time before they can become eligible to participate, they have to find an alternative source of coverage. They are no longer students, so if they had a student health insurance plan , they face the loss of coverage. However, there are some options for recent graduates to consider, and they must remember that everyone is now required to maintain health insurance or pay a penalty on their taxes:

Best For Budget: Kaiser Permanente

Kaiser Permanente

Why We Chose It: Kaiser Permanente is our overall budget choice because of its excellent ratings and industry strength coupled with economic coverage against worse case scenarios for low-income students.

-

Coordinated insurance and health care

-

Virtual care available

-

The policyholder must use Kaiser facilities

-

Coverage limited to eight states and the District of Columbia

Health industry leader Kaiser Permanente provides insurance solutions for college students with financial restrictions through its catastrophic plans. Kaiser took our top budget place with low monthly premiums and a range of no-fee covered services such as preventative care.

Non-profit Kaiser Permanente is a managed care organization with a network of 39 hospitals and 727 medical offices. Once you join a Kaiser plan, you can in some cases visit in-network specialists without a referral.

Students can get quotes online for catastrophic, bronze, silver, gold, and platinum policies. These plans have no exclusion for health conditions and are available to all ages, as they are ACA compliant. Some students may even qualify for government subsidies based on household income. These only apply to silver tier plans and above. With a discounted premium, the more comprehensive coverage could work out cheaper.

Recommended Reading: How Much Does Health Insurance Cost In Ct

Faq: Coverage For Recent College Grads

Graduating from college is an exciting time, so people may not necessarily be considering what they will do about their health insurance coverage during this stage of their life. However, it is still important for recent grads to make sure they have coverage in case the unexpected happens. This section answers some questions that people may have about getting health insurance after graduation.

Read Also: What Is Covered California Health Insurance

Why You Need It How To Get It

Under the Affordable Care Act, children can obtain coverage through their parents employer-sponsored or privately purchased insurance plan through the age of 26. Since this provision of the bill came into effect in 2013, the rate of uninsured nonelderly adults dropped from 20.5% to 12.2% in 2016. Even with all of this progress, young people remain the least insured age group in the U.S.

Consider the gamble young adults are taking by going uninsured:

- Motor Vehicle Accidents: A 2015 statistic from the Centers for Disease Control shows that while young people ages 15-19 represent only 7% of the U.S. population, they account for 11% of the total costs of motor vehicle injuries.

- Chronic Illness: According to WHO, up to 15% of young people aged 12 to 19 suffer from chronic condition.

- Mental Illness:The National Institutes of Mental Health , young adults aged 18 to 25 have the highest prevalence of mental illness among all age groups.

What are the consequences for these uninsured young adults? With the cost of medical care so high, they are at great financial risk should an unexpected medical event occur. This could put a college student deep in debt before ever entering the workforce. Significant debt from medical bills can damage a young persons credit, which in turn can affect their ability to qualify for housing, get student or car loans, or even travel. In the United States, medical debt is one of the leading causes of bankruptcies.

Navigating The Affordable Care Act

Health insurance can be confusing, especially for those who are getting coverage for the first time. This section explains what college students and recently grads can expect and the benefits that are still available to them through to the Affordable Care Act.

College students and recent graduates have a few choices for receiving health insurance. For those who are still in school, signing up for a student health plan through school is an affordable way to get the insurance they need. In addition, current students and recent graduates have the option to stay on their parents’ health care plans until they reach 26 years old. When people do this, they can either enroll in the insurance that their parents receive from their jobs or a plan parents purchase through the Health Insurance Marketplace. Marketplace plans are offered by the states and on the federal level if a state marketplace is not available.

Students and recent college graduates may be able to purchase their own coverage through the Health Insurance Marketplace. In order to find out what type of plans they are eligible for, people can visit HealthCare.gov and enter information about their income, the state they live in, and how many people live in their household. In addition, some people may qualify for a discount on their health insurance plans depending on their income, provided that they aren’t claimed as a dependent on their parents’ tax return.

Read Also: Do I Need Health Insurance With Medicare

Getting Your Own Individual Market Plan

You can also get your own plan in the exchange . Moving to a new location which includes moving to college is a qualifying event that will allow you to purchase an individual market health insurance plan outside of the annual open enrollment period .

Your eligibility for subsidies will depend on your household income and the cost of plans in your area. If your parents claim you on their tax return, your total household income will include their income . If you file your own tax return, your subsidy eligibility will be based on your own income.

And through the end of 2025, the American Rescue Plan and Inflation Reduction Act is making coverage for young adults more affordable than it used to be.

The Treasury Department clarified in 2013 that college and graduate students can qualify for subsidized insurance on an exchange even if theyre eligible for a student health plan offered by the university as long as they dont enroll in the universitys plan .

Theres no one-size-fits-all solution for college students. If youre eligible for a subsidy in the exchange, it may be cost-effective to purchase an exchange plan instead of the student health plan from your university. Although depending on the size of your subsidy, you may find that the student health plan offered by your college still ends up being less expensive than the exchange plan, and might also have lower out-of-pocket costs.

What Is A Deductible In Health Insurance

A deductible is a set amount youll pay for covered health services before your plan begins to cover your care. Once youve met your deductible by paying for health services out-of-pocket, youll only pay a copayment or coinsurance when you need care. Some affordable health insurance plans also have separate deductibles for specific items, such as prescription drugs. However, unlike an auto insurance deductible, your health insurance deductible may not apply to all services. For example, many plans will pay for your annual checkup or for disease management before you meet your deductible.

You May Like: How Much Is Health Insurance For Kids

What Do You Mean Waive The Health Insurance

Most colleges will automatically place a health insurance charge on your college bill. This is important to know, as you could end up paying for the school’s health insurance without realizing it if you don’t closely review your college bill. You can let the Financial Aid or Student Billing Office know that you will continue to cover your child under your own insurance plan and instruct them to remove the health insurance charge from the bill. You may be able to easily do this online. There’s usually a deadline to making this request, so make sure that you’re proactive in doing so.

How Can Students Choose The Best Insurance For Their Health Care Needs

First, students should think about where they live and where they are going to get care. A student that stays on their parents’ plan and goes to school out-of-state could face higher costs when accessing care because they will be out-of-network for that local health coverage. On the other hand, if students want to keep their family doctor, staying on their parents plan and getting check-ups during breaks from school is an option. Find out if your parents’ plan has hospitals near your school for any needed emergency care.

SHIP plans are often a good option for full-time students because many SHIP plans allow the student to get care right on campus or with providers affiliated with the school. Four-year schools are more likely to offer SHIPs than two-year schools, and the coverage is often included in the regular schedule of tuition and fees students pay at the beginning of each semester. Most schools enroll students into their SHIP and require that students opt-out if they want to get coverage elsewhere.

Recommended Reading: Does Health Insurance Pay For Abortions

Where Can I Find The Health Insurance Charge Is It Included In Tuition

No. The health insurance will be listed separately from the tuition on your bill. If you see college costs listed on your financial aid offer, you may not see the health insurance charge, but it could still be included in your fall semester bill. Make sure you pay close attention to your bill when you receive it.

Make Sure You Have Health Insurance

First things first: students need health insurance coverage. There are a few options to find a plan:

- Stay on a Parents Plan: Students under 26 have the option to stay on their parents health insurance plan. If selecting this option, its a good idea to contact your Blue Cross Blue Shield company to get details about out-of-state coverage if you need it.

- Student Plans: Many schools also offer student coverage, which can be a good option for basic care. Contact your school for details.

- Health Insurance Marketplace: Another option is to purchase health insurance on the , which may allow you to qualify to receive financial help from the government to pay for your plan. You can also find out if you qualify for Medicaid.

You May Like: How Important Is Health Insurance

Am I Required To Be Insured

Probably. Most postsecondary institutions require incoming students to have some form of health coverage. Many schools will automatically enroll students in the school’s health insurance plan unless the student proactively opts out and provides proof that they have obtained coverage from another source.

Types Of Health Insurance Plans

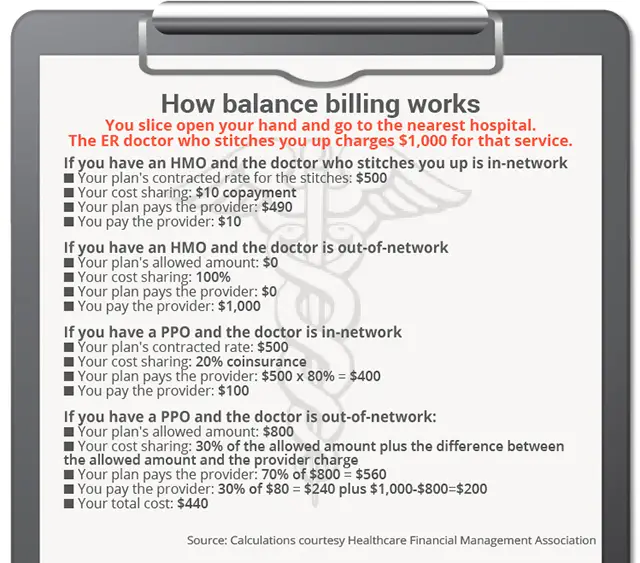

When purchasing health insurance, your choices typically fall into one of three categories:

- Traditional fee-for-service health insurance plans are usually the most expensive choice. They offer the most flexibility in choosing health care providers.

- Health maintenance organizations offer lower co-payments and cover the costs of more preventive care. Your choice of health care providers is limited to those who are part of the plan.

- Preferred provider organizations offer lower co-payments like HMOs but give you more options when selecting a provider.

Also Check: What Is A Health Insurance Plan

Individual Coverage Through Aca Marketplace

For uninsured students who have aged-out of their parents insurance, or for whom there was no opportunity to be added to parents insurance, purchase of an individual policy on the ACA marketplace might be the best answer. Most states have a good number of policies to choose from, and there are at least four price/coverage levels available.

- Coverage not dependant on student status

- Option to choose a plan that fits personal budgets

- Applicants within 100% to 400% of Federal Poverty Level are eligible for federal tax credits to cover insurance costs

Experience Lower Costs And Added Benefits

Student health plans can be a valuable solution for college students and their families. Not only can they cost less than other plans even less than staying on an employer-sponsored family plan they can also provide better benefits.

Here are some reasons to think about a student health plan .

- Lower cost deductibles and premiums.

- Comprehensive benefits, including added services not always found with other plans.

- Greater access to national and local networks of physicians and behavioral health specialists.

- Better coverage for school-sponsored, on-site health clinics and virtual visit services.

Student plans come with added benefits because theyre designed with students in mind. Lower rates are possible partly because theyre based on a younger, healthier population and provide coverage for a limited time . Families and students can save money and get high-quality coverage at the same time.

Recommended Reading: How Much Does Good Health Insurance Cost A Month

What Are Health Insurance Options For College Students

College students may have several health insurance options to choose from:

- Stay on a parents health insurance until age 26.

- Purchase a student health insurance plan available through the college or university.

- Get an individual policy or catastrophic health plan through the states health insurance marketplace.

- Receive health insurance coverage through a plan offered by the students employer .

- Buy a short-term medical plan offered by a private insurance company.

- The college student may qualify for Medicaid depending on income and state.

For many college students, the best option is to stay on a parents plan. The Affordable Care Act requires that health plans covering dependents must offer coverage to adult children until they turn 26.

Most college students qualify. Young adults dont have to live with their parents or be dependent for tax purposes to stay on a parents health plan.

Adding a child to a health plan may increase costs on the parents health insurance. However, if you already have a family plan, adding another dependent likely wont affect insurance premiums.

Some policies are priced as employee + 1 and employee +2, but others have either self-only vs. dependent coverage or employee plus children.

If the premiums are employee plus children, then its the same premiums for two or three children, says Wayne Sakamoto, an independent health insurance broker in Naples, Florida.

Heres how the different health plan options compare:

| Health Plan |

|---|

Best Health Insurance For College Students

Blue Cross Blue Shield is our pick for the best overall health insurance for college students based on a wide provider network and affordable rates.

Find Cheap Health Insurance Quotes in Your Area

As a college student, you may think you don’t need health insurance or that it’s too costly. But health care expenses can be high a surgery or hospital stay can run between $10,000 and $20,000 and without insurance, you risk paying the full cost on your own and damaging your financial well-being.

There are several ways to get health insurance for college students, and you may have questions about which option best fits your situation. You, as a student, may qualify for Medicaid or employer coverage, or you could have access to a college-sponsored health plan or your parents’ insurance. If none of these apply to you, you’ll need to look into an individual Affordable Care Act or short-term medical plan. To help you find the best insurance for your needs, we reviewed several health insurance companies and evaluated plans based on a range of factors.

You May Like: How Much Does It Cost For Health Insurance Per Month

Cobra: Expensive But Good For A Coverage Gap

Beneficiaries who are aging off of their parent’s insurance can stay on the same plan through the Consolidated Omnibus Budget Reconciliation Act .

Insurance through COBRA is usually very expensive because the parent’s employer is no longer paying for the young adult’s coverage. That’s why COBRA should only be used as a temporary measure, bridging short coverage gaps until beneficiaries transition on to more permanent health care plans.

For example, if you’ve already met the plan’s yearly deductible, you may want to use COBRA to stay on the same plan until the end of the policy year.

The Best Health Insurance For College Students

Ashlee, a former managing editor, insurance, at QuinStreet, is a journalist and business professional. She earned an MBA in 2014 with a concentration in finance. She has more than 15 years of hands-on experience in the finance industry.

Why you can trust Insure.com

Quality Verified

Insights:

The best health insurance for students depends on many factors, including whether they can stay on their parents health plan.

Even though college students tend to be young and healthy, they still need health insurance to protect against crushing costs if they get sick or have an accident and need expensive medical care. And many colleges require that students prove they have health insurance when they enroll.

One easy way to get coverage is through a parents health plan, but that coverage may not be effective if the child moves away to college.

Key Takeaways

Heres what you need to know about health insurance for college students.

Also Check: Where To Find Affordable Health Insurance

If No One Claims You As A Dependent

- And you live separately from your parents : You should fill out your own separate application. Your savings will be based on only your income, not your parent’s.

- And you live with your parents: You should apply on your own separate application. But if you’re under 21, you may need to provide information about your parents and their income to complete the application.

TIP