What Benefits Will Be Covered In The Marketplace

Health insurance sold in the Marketplace must at least cover a set of essential health benefits. This includes doctors office visits emergency room services and hospitalization pregnancy and newborn care mental health and substance use disorder services prescription drugs rehabilitative services and devices laboratory services preventive services chronic disease management and childrens health services .

Recommended Reading: Does Starbucks Provide Health Insurance For Part Time Employees

When Can I Buy Private Health Insurance

Most types of health insurance have an open enrollment period during which you can sign up for private health insurance. This is true whether you buy insurance via the Affordable Care Act health insurance exchange in your state, sign up directly through the insurer, enroll in the plan that your employer offers, or sign up for Medicare.

Certain life events can trigger a special enrollment period, which will allow you to change your health insurance coverage outside of the normal enrollment period. These events include getting married or divorced, having a baby, losing your job-based health insurance, or moving out of your health plans service area.

Can I Buy Private Health Insurance At Any Time

Most health insurance plans typically have an Open Enrollment Period from November 1 to December 15, when you can apply for health insurance. Some qualifying life events, like losing your job or getting married, trigger a special enrollment period . An SEP allows you to get insurance in between open enrollments. You often have 60 days before or 60 days after the event to enroll.

You May Like: Where Can You Get Affordable Health Insurance

Private Vs Public Health Insurance

Whats the difference between private and public health insurance? Lets take a closer look.

- Public: Public health insurance is funded and supported by a federal or state government. In the U.S., the 2 most common public health insurance plans are Medicare and Medicaid. Its important to note that you may have to pay for public health insurance. For example, people with Medicare pay a premium for Part B.

- Private: Private health insurance is insurance that isnt offered by the federal or state government. You can purchase private health insurance through an employer, through your states Marketplace or directly from an insurance company.

Both types of health insurance have out-of-pocket costs.

Medicare Is Usually Cheaper

When you enroll in Medicare, youre getting the same quality coverage regardless of which insurance provider youre working with. This is because all Medicare plans offer the same types of coverage and provide the same types of protection. The only difference between policies is the provider you choose to work with and the prices they charge for coverage.

This means youll want to shop around and use this MedicareWire tool to compare plan coverage before you commit to an agreement.

Once you do, youll typically save money with a Medicare plan compared to what youd spend with private insurance. Your deductibles will usually be lower and your insurance will cover more treatment options.

When you enroll in a private insurance policy, youre subject to the terms of that policy. Its not backed by the government and its up to the insurance provider to determine your maximum out-of-pocket costs for your coverage. The quality of that coverage varies widely and youll often end up paying a higher premium rate for better quality coverage as long as youre enrolled.

Don’t Miss: Do Dermatologist Take Health Insurance

How Do I Get Health Insurance If I Am Self

If you own your own business, you can apply for health coverage through the Marketplace. Your income and household size may qualify you for premium tax credits and other insurance savings. There could also be free or low-cost coverage through CHIP or Medicaid programs in your state. Marketplace plans allow business-owners to insure their children and spouses. Healthcare savings is based on an estimate of net earnings in the year you apply, not the previous years income.

Also Check: How To Cancel Evolve Health Insurance

Why I Dropped Obamacare

When I left the corporate world by my own choosing at the end of 2014, I gained several things, including control over my own hours and assignments. But I lost something important: health insurance.

While I was only 33 years old at the time, Ive never been the kind to go without insurance especially when I could afford to have it. I left a steady paycheck behind, but within months I was consistently earning more as a freelance writer and journalist than I ever had in my office job.

To tide me through the first several months of smaller paychecks during the first half of 2015, I elected an insurance plan through the Affordable Care Act which is more well known as Obamacare.

Obamacare did provide me with reduced-cost health insurance that covered all of my basic needs , but the deductibles were through the roof!

I still ended up paying more than $180 per month on a healthcare plan that ordinarily cost $220 per month. And the plan didnt even include any of my usual doctors the ones I liked and had built a rapport with over the years.

As my income increased, my health insurance premiums grew, too, and quickly at that.

Before long, I was paying full price. But, because my income varied from month to month, I still had to report my income on a periodic basis.

Recommended Reading: Do Illegal Immigrants Get Health Insurance

What Are The Cost Differences

Private insurance premiums vary greatly, depending on the persons location, age, and chosen type of coverage. For example, high deductible plans often cost less per month than those that charge a low deductible. The reason for this is that the insurers cover their costs by having people contribute a higher amount toward their healthcare expenses before the company fund any treatment.

However, Medicare plans may cost more because they do not have an out-of-pocket limit, which is a requirement of all Medicare Advantage plans.

Recommended Reading: Does Medicare Part A Cover Doctors In Hospital

You Can Keep Your Employers Health Coverage

You and your dependents may be able to keep your existing health coverage even if you lose your group health benefits. These options are called continuation coverage.

If you lose your coverage, your employer must provide you with information on your options for continuing your existing coverage. You may see options with names like COBRA, Cal-COBRA, Conversion or insured. These. If you choose one of these options:

- You have to pay all of the premium.

- After you use up one kind of continuation coverage, you may be eligible for another kind of coverage.

- There are deadlines and other requirements for each kind of continuation coverage.

If you have any questions about your options, contact the Consumer Hotline at the Department of Insurance 927-4357 for assistance.

Continuation Coverage or an Individual Policy?

If you lose your job or your hours are cut, you may have the choice to enroll in continuation coverage or buy an individual/family policy. Compare the price, benefits, and physician networks carefully when you make this choice. For example, an individual plan is often less expensive than continuation coverage, but the benefits may be different and you may not be able to see the same doctors.

Buying Individual Health Insurance on Your Own

People usually buy individual health insurance because they do not have group insurance through a job and they do not qualify for any public program.

Medi-Cal

Read Also: What Is A Ppo Health Insurance Plan

Can I Buy Health Insurance On My Own

Yes, individual health insurance plans are available for people who don’t have a health insurance plan through their employer. If they qualify for purchasing individual health insurance coverage, they can buy it on the open marketplace. Be sure to know your income limits and other requirements before you apply.

You may also be able to find an individual or family policy from another source such as an insurer that offers individual policies. As always, make sure you understand the terms of any offer before you sign up for anything.

How To Buy Health Insurance On Your Own

Ashlee, a former managing editor, insurance, at QuinStreet, is a journalist and business professional. She earned an MBA in 2014 with a concentration in finance. She has more than 15 years of hands-on experience in the finance industry.

Why you can trust Insure.com

Quality Verified

Most Americans get health insurance through their employer or Medicare. However, you can buy health insurance on your own.

The Affordable Care Act created exchanges that allow people to compare individual plans in their area. You can see each plans design and what you would pay in premiums and out-of-pocket costs. There are also individual insurance plans outside of the exchanges that offer even more choices.

Buying your own health insurance can seem daunting, but it can also open up more possibilities. Lets take a look at how to get your own health insurance.

Also Check: How Much Does Health Insurance Cost A Month

Should You Have Medicare And Private Insurance Or Should You Delay Medicare Enrollment

If youre eligible for Medicare and have private health insurance, there may be some situations when it may make sense to delay Medicare enrollment, especially in Medicare Part B. Part B is medical insurance So, you might find yourself paying two monthly premiums one for your plan and one for Part B for very similar coverage.

So, some people choose to keep the group health plan and delay enrollment in Part B. But it really depends on your situation. Before you decide to delay Part B enrollment, call your private insurance plan and ask them how your plan works with Medicare. You can also contact eHealth and ask one of our licensed insurance agents for more details about delaying Part B enrollment.

If you decide to delay Part B enrollment, make sure you sign up as soon as your private insurance coverage ends, so you can avoid a penalty for late enrollment in Part B.

The Aca Health Insurance Marketplace

The health insurance marketplace at Healthcare.gov provides insurance plans to individuals, families and small businesses. Through this online resource, you can learn more about health insurance, compare plans, enroll in a plan and figure out how much you can save through premium tax credits and subsidies.

You can purchase a health plan through the marketplace even if youre offered insurance by your employer however, you may not qualify for subsidies if you have access to employer-sponsored coverage.

To buy a policy through the marketplace, you must apply during open enrollment or special enrollment. Open enrollment for 2023 coverage begins Nov. 1, 2022, for the federal marketplace and runs until Jan. 15, 2023, in most states. To have your coverage start by Jan. 1, 2023, enroll in your plan by Dec. 15, 2022.

Some state exchanges may have slightly different open enrollment periods. If you miss open enrollment, you may qualify for a special enrollment period due to a major life change like moving, getting married, having a child or losing your existing health coverage.

To begin your search for insurance through the marketplace, head to Healthcare.gov during open enrollment or after you qualify for a special enrollment and enter your ZIP code. It will direct you to either your states exchange or to the federal marketplace where you can begin shopping.

Recommended Reading: How Much Is Health Insurance In West Virginia

If Your Company Cant Pay Its Claims

Guaranty associations pay claims for licensed insurance companies that go broke. There are separate guaranty associations for different lines of insurance. The Texas Life and Health Insurance Guaranty Association pays claims for health insurance. It will pay claims up to a dollar limit set by law.

It doesn’t pay claims for HMOs and some other types of plans. If an HMO cant pay its claims, the commissioner of insurance can assign the HMO’s members to another HMO in the area.

Where You Can Buy Health Insurance

There are four health insurance providers in Ireland, although there are other companies that provide health insurance schemes for some select groups.

You can start your comparison here by checking out these health insurance providers. Comparing providers helps you get the best private insurance available at a price you can afford.

Recommended Reading: How To Get Insurance Between Jobs

Also Check: Does South Carolina Require Health Insurance

How Much Will I Have To Pay

It can be hard to know how much you may owe. Call your insurance company and ask for an estimate before you get a costly service. Ask if you can compare the costs of different providers online.

Sometimes we have to make health care decisions without the best cost and quality information. Now you can use our California Healthcare Compare website, www.cahealthcarecompare.org to compare cost and quality for common services like knee replacements, diabetes treatment, and childbirth. In addition to asking your insurer, this tool can help you compare providers.

What Is The Affordable Care Act

The Affordable Care Act provides individuals and families greater access to affordable health insurance options including medical, dental, vision, and other types of health insurance that may not otherwise be available. Under the ACA:

-

You may be able to purchase health care coverage through a state or federal marketplace that offers a choice of plans.

-

Insurers can’t refuse coverage based on gender or a pre-existing condition.

-

There are no lifetime or annual limits on coverage.

-

Young adults can stay on their familys insurance plan until age 26.

-

Seniors who hit the Medicare Prescription Drug Plan coverage gap or “donut hole” can get a discount on medications.

Read the full text of the ACA and learn more about its provisions and relationship to patients, insurers, businesses, and families.

Read Also: What Is The Average Cost Of Self Employed Health Insurance

Enroll During The Annual Open Enrollment Period

Open enrollment for 2022 coverage began November 1, 2021. In most states, it ended on January 15, 2022 , although there are several state-run exchanges where the open enrollment period for 2022 coverage has been extended past January 15. The following state-run exchanges have later deadlines to sign up for 2022 coverage:

And Colorado is offering a special enrollment period through March 16, uninsured residents affected by the Omicron COVID surge or the Marshall Fire.

During open enrollment, individual/family health insurance can be purchased by nearly anyone. The enrollment window applies both on-exchange and off-exchange, although subsidies are only available to eligible applicants who enroll through the exchange. There is no requirement that you have a qualifying event or have maintained prior coverage. And as is always the case with ACA-compliant coverage, your medical history will not be taken into consideration when youre enrolling in a new plan or switching from one plan to another.

How To Get Health Coverage

You can get health care coverage through:

- A group coverage plan at your job or your spouse or partner’s job

- Your parents’ insurance plan, if you are under age 26

- A plan you purchase on your own directly from a health insurance company or through the Health Insurance Marketplace

- Government programs such as

You May Like: How To Get Health Insurance In Rhode Island

Other Types Of Coverage

These types of health insurance provide only limited coverage. Companies selling them can deny you coverage or charge you more if you have a preexisting condition. They also usually limit the amount they will pay for your care.

- Specified disease policies pay only if you have the illness named in the policy. For instance, a cancer policy will pay only if you have cancer. It wont pay if you have another disease.

- Short-term policies provide coverage for only a limited time, usually six to 12 months. People sometimes buy these policies while they’re between jobs or waiting for other coverage to start.

Learn more: Alternative health plans

How Can I Learn More About My Health Insurance

- Ask your insurance company or employer for a Summary of Benefits. This is a short list of your benefits and costs.

- Make sure you have a copy of your policy. This has more information about your costs and benefits. It also tells you the services that are not covered.

- Most health insurance companies have a phone number you can call with questions. Or ask your health insurance agent, insurance company, or employer to explain things.

Also Check: How Do I Get Health Insurance After Open Enrollment

How Much Does It Cost To Buy Health Insurance On Your Own

Generally, the less you pay out of pocket for the deductible, copays and coinsurance, the more you spend on premiums.

Platinum plans charge harmer premiums than the other three plans, but you wont pay as much if you need health care services. Bronze, meanwhile, has the lowest premiums but the highest out-of-pocket costs.

When deciding on the level, consider the medical services you used over the past year and what you expect next year. For instance, if you plan on starting a family, consider how much out-of-pocket costs youll have to pay if you go with a Bronze plan.

eHealth reported the average monthly premium by metal level:

- Platinum $732

Bronze and Silver are the most popular plans 42% have Bronze plans and 34% have Silver plans. Only 14% have Gold plans and 2% have Platinum plans.

How Do I Get Health Insurance

You can get it through:

- your job or your spouse’s job, if the employer offers it.

- your parent’s plan until you turn 26.

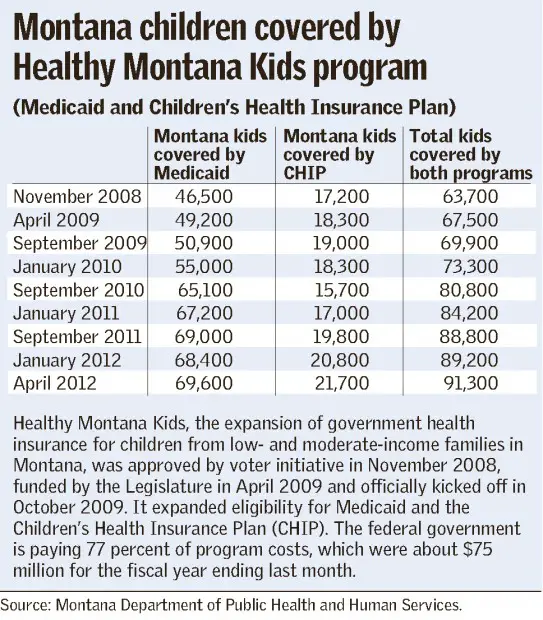

- a government program like CHIP, Medicaid, or Medicare.

- your college if they offer a student plan.

- a membership association, union, or church.

- an insurance company or agent.

- the federal health insurance marketplace.

Read Also: What Is The Best Health Insurance For Young Adults